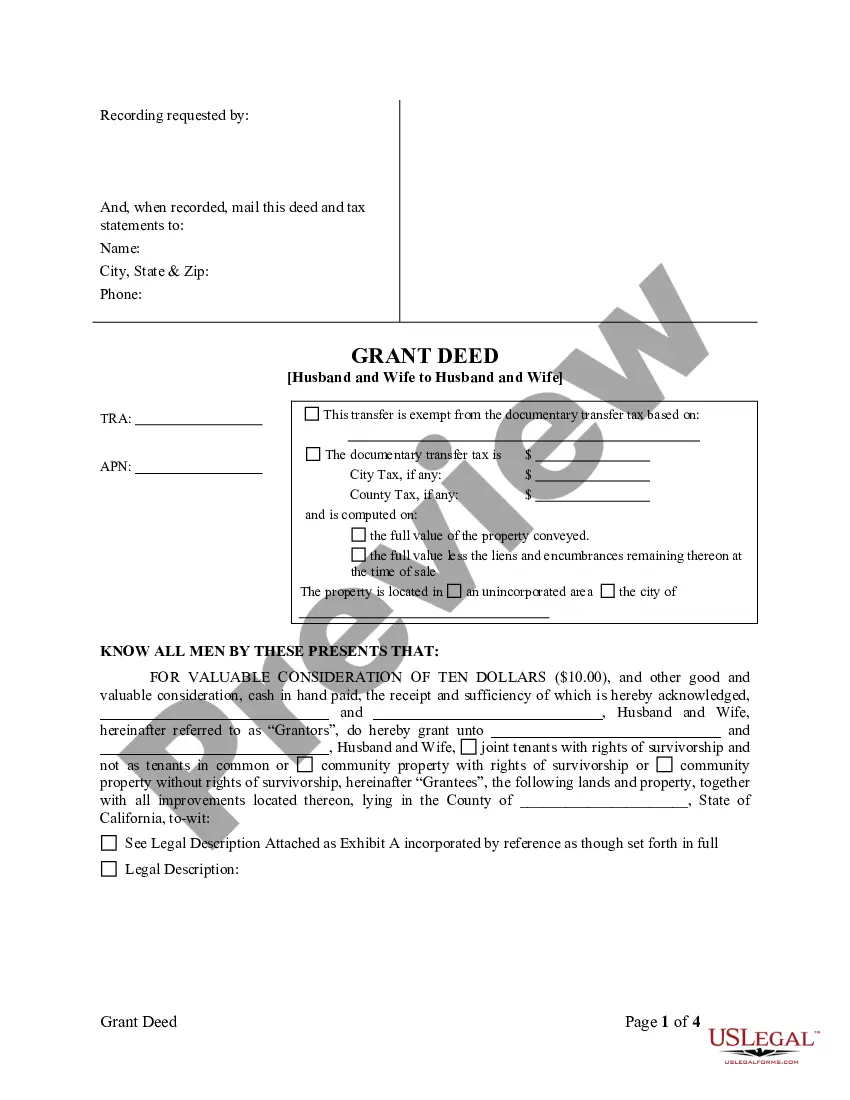

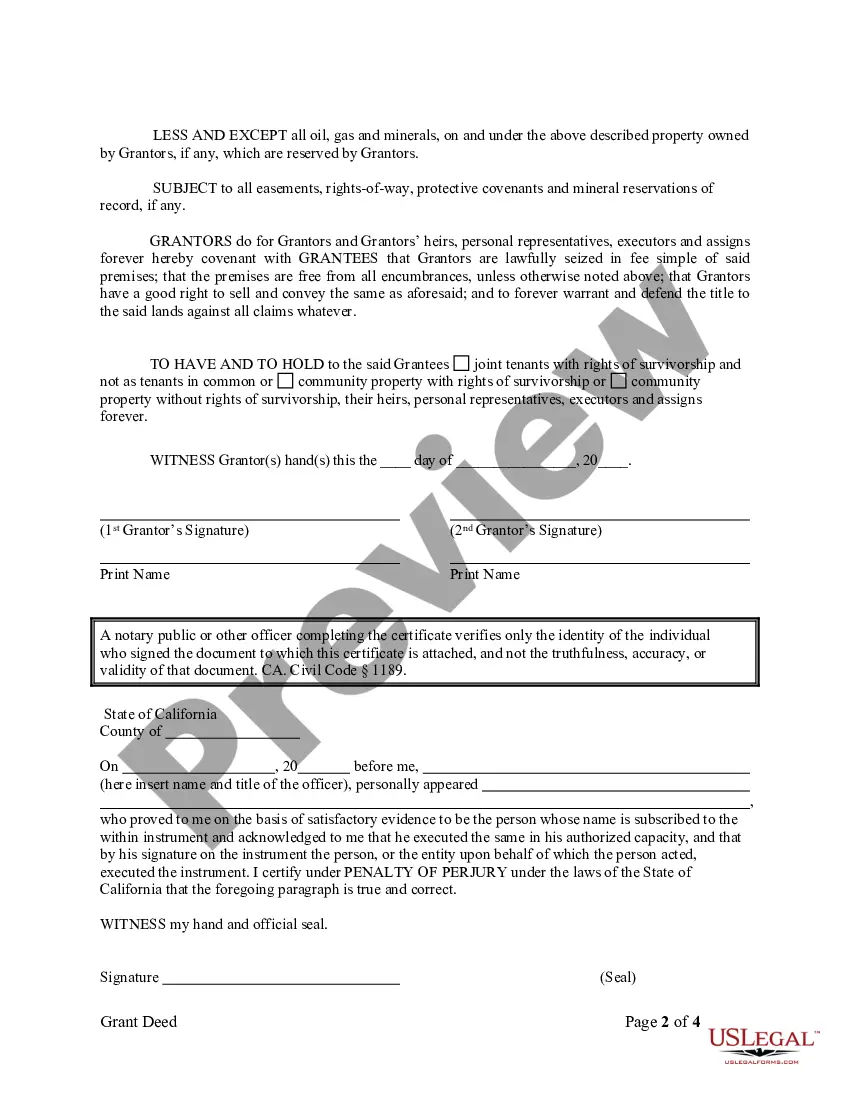

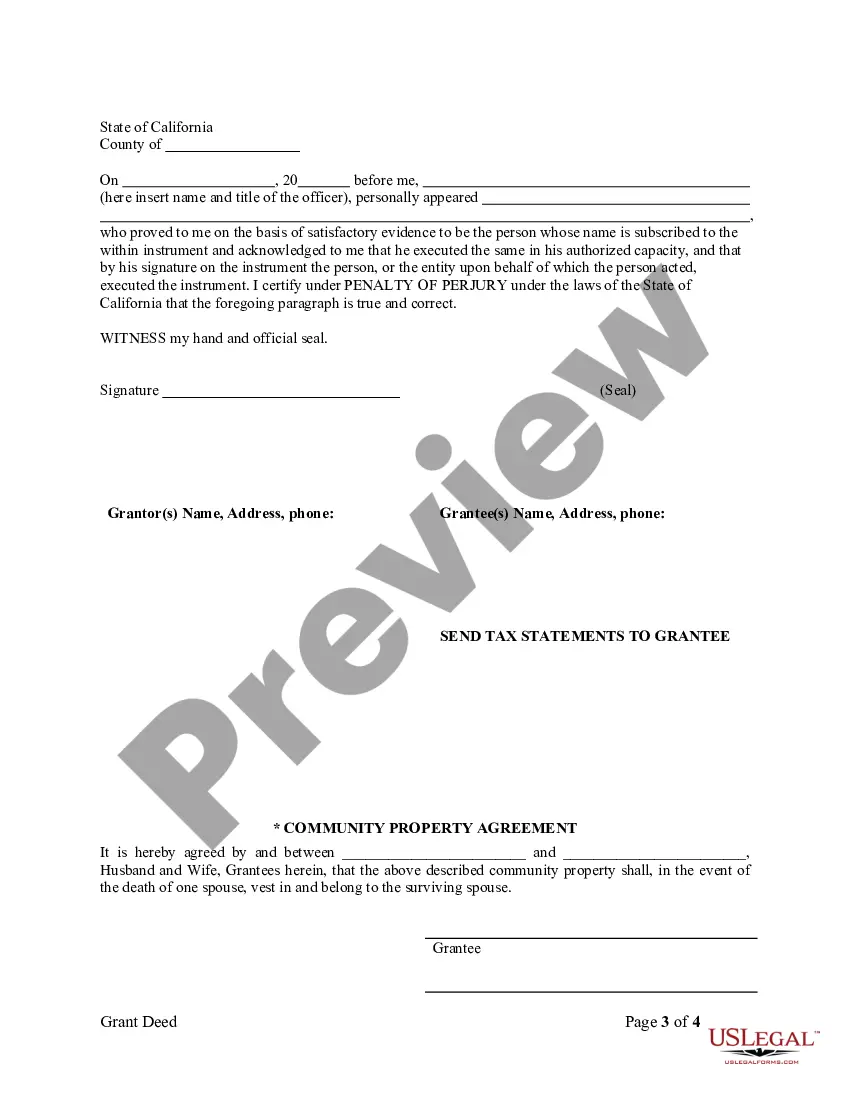

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

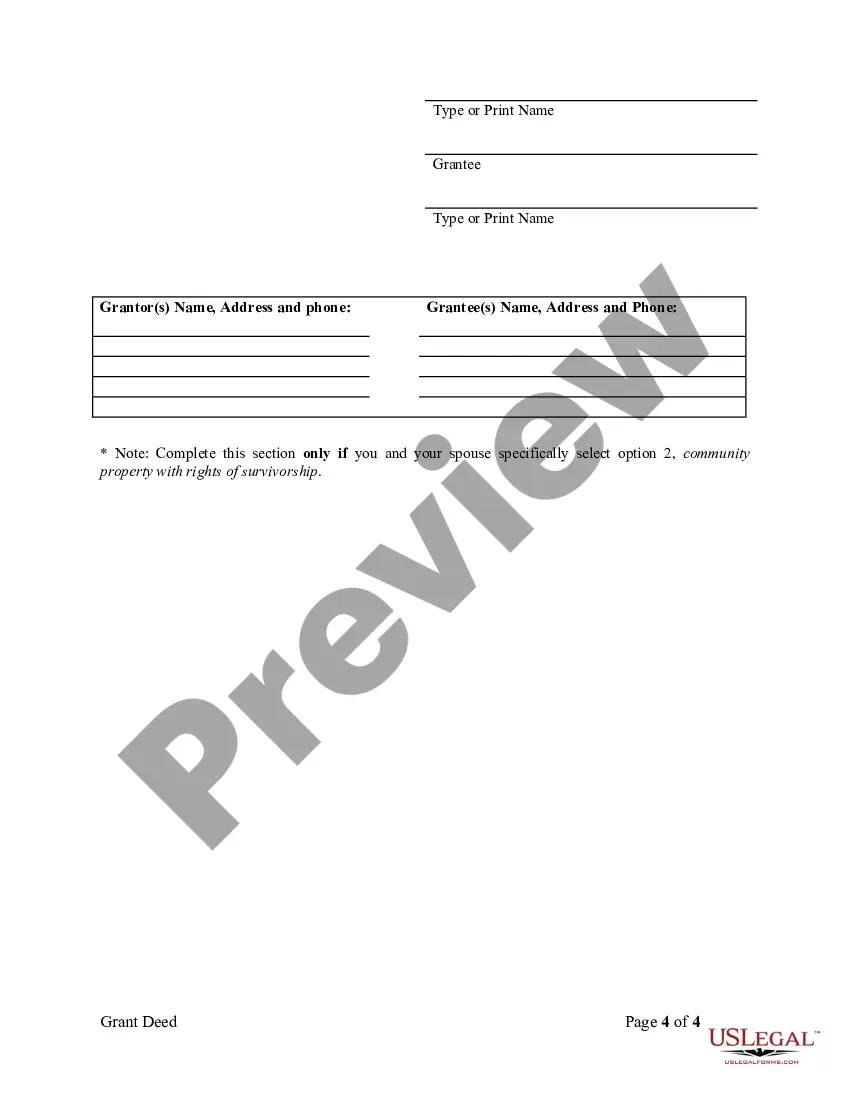

A Riverside California Grant Deed from Husband and Wife to Husband and Wife is a legal document used in the transfer of property ownership between spouses. This type of deed is executed when both parties involved in the marriage (husband and wife) wish to transfer their joint ownership of a property to themselves as individuals. In Riverside, California, there are generally two types of Grant Deeds that can be used in such a scenario: 1. Interspousal Transfer Grant Deed: This is commonly used when transferring property between spouses only. It allows for the seamless transfer of property rights without the need for the property to undergo reappraisal for property tax reassessment purposes. 2. Community Property with Right of Survivorship Grant Deed: This grant deed option allows for the ownership of property as a community property with a right of survivorship. In essence, both spouses own equal shares of the property, and in the event of one spouse's death, the surviving spouse automatically becomes the sole owner. To execute a Riverside California Grant Deed from Husband and Wife to Husband and Wife, the following steps are typically involved: 1. Obtain the correct grant deed form: Seek the assistance of a real estate attorney or visit the Riverside County Assessor-County Clerk-Recorder's office website to obtain the appropriate grant deed form. 2. Fill out the deed form: Provide accurate information regarding the property being transferred, including its legal description, the names of both spouses, and their marital status. 3. Prepare the necessary documents: Gather any additional documents required by Riverside County, such as preliminary change of ownership reports, transfer tax exemption documents, or property tax reassessment forms. 4. Get the deed notarized: Both spouses must sign the grant deed in the presence of a notary public, who will then notarize the document to verify the authenticity of the signatures. 5. Record the grant deed: Submit the grant deed to the Riverside County Assessor-County Clerk-Recorder's office for recording. Pay any associated fees, taxes, or assessment charges at this time. 6. Receive recorded grant deed: After recording, the original grant deed will be returned to the person named for the return of the document. Keep this deed in a safe place, as it serves as proof of property ownership. Note that the information provided here is for general informational purposes only and should not be considered legal advice. It is highly recommended consulting with a qualified real estate attorney or legal professional for specific guidance regarding your unique circumstances when preparing a Riverside California Grant Deed from Husband and Wife to Husband and Wife.A Riverside California Grant Deed from Husband and Wife to Husband and Wife is a legal document used in the transfer of property ownership between spouses. This type of deed is executed when both parties involved in the marriage (husband and wife) wish to transfer their joint ownership of a property to themselves as individuals. In Riverside, California, there are generally two types of Grant Deeds that can be used in such a scenario: 1. Interspousal Transfer Grant Deed: This is commonly used when transferring property between spouses only. It allows for the seamless transfer of property rights without the need for the property to undergo reappraisal for property tax reassessment purposes. 2. Community Property with Right of Survivorship Grant Deed: This grant deed option allows for the ownership of property as a community property with a right of survivorship. In essence, both spouses own equal shares of the property, and in the event of one spouse's death, the surviving spouse automatically becomes the sole owner. To execute a Riverside California Grant Deed from Husband and Wife to Husband and Wife, the following steps are typically involved: 1. Obtain the correct grant deed form: Seek the assistance of a real estate attorney or visit the Riverside County Assessor-County Clerk-Recorder's office website to obtain the appropriate grant deed form. 2. Fill out the deed form: Provide accurate information regarding the property being transferred, including its legal description, the names of both spouses, and their marital status. 3. Prepare the necessary documents: Gather any additional documents required by Riverside County, such as preliminary change of ownership reports, transfer tax exemption documents, or property tax reassessment forms. 4. Get the deed notarized: Both spouses must sign the grant deed in the presence of a notary public, who will then notarize the document to verify the authenticity of the signatures. 5. Record the grant deed: Submit the grant deed to the Riverside County Assessor-County Clerk-Recorder's office for recording. Pay any associated fees, taxes, or assessment charges at this time. 6. Receive recorded grant deed: After recording, the original grant deed will be returned to the person named for the return of the document. Keep this deed in a safe place, as it serves as proof of property ownership. Note that the information provided here is for general informational purposes only and should not be considered legal advice. It is highly recommended consulting with a qualified real estate attorney or legal professional for specific guidance regarding your unique circumstances when preparing a Riverside California Grant Deed from Husband and Wife to Husband and Wife.