This form is a generic example that may be referred to when preparing such a form.

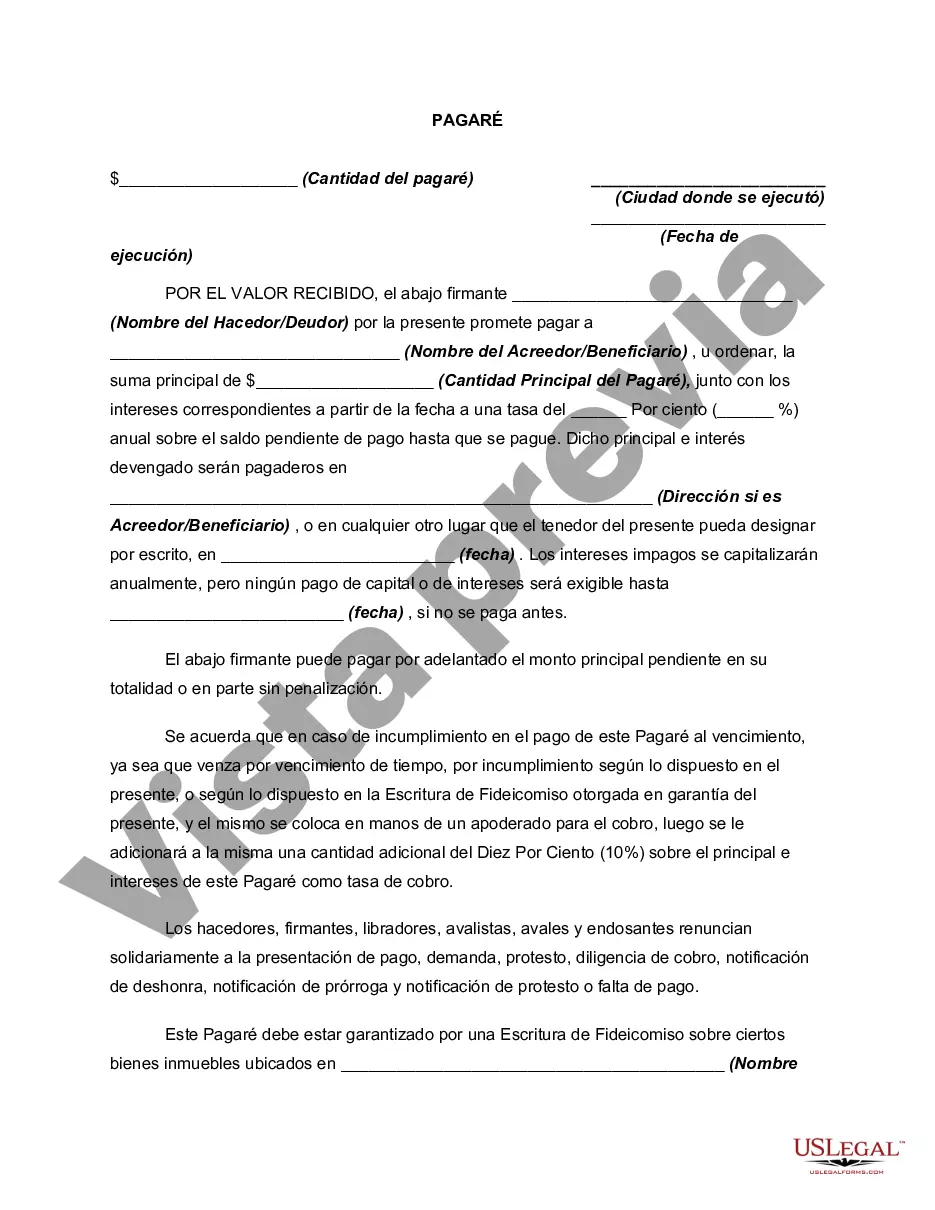

A Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used when both parties agree to delay any required payments until the maturity date of the loan. One specific type of Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is the Fixed-Rate Promissory Note. This note sets a predetermined interest rate at the time of signing the agreement, which remains fixed throughout the loan term. Such notes provide stability for both the lender and the borrower, as they can accurately predict the interest costs and plan their finances accordingly. Another type is the Variable-Rate Promissory Note which has an interest rate that fluctuates periodically based on various market conditions. This type of note allows the interest to compound annually, providing potential savings or increased costs depending on the market rates. Borrowers opting for this type of promissory note have the opportunity to benefit from lower interest rates if the market is favorable. When drafting a Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it is important to include specific details, such as: 1. The names and contact information of both the lender and the borrower. 2. The loan amount and the purpose of the loan. 3. The maturity date, which indicates the date by which the borrower must repay the entire loan amount. 4. The interest rate, which is set at a fixed or variable rate and compounded annually. 5. Any late payment penalties or default clauses, which outline the consequences in case of failure to meet the obligations. 6. A repayment schedule, providing flexibility to the lender and allowing the borrower to repay the loan in full on or before the maturity date. 7. Signatures of both parties, indicating their agreement and acceptance of the terms and conditions stated in the promissory note. It is crucial for both the lender and the borrower to thoroughly understand and agree to the terms of the promissory note before signing it. Additionally, seeking legal advice from an attorney experienced in financial agreements can ensure compliance with the regulations specific to Los Angeles, California.A Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used when both parties agree to delay any required payments until the maturity date of the loan. One specific type of Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is the Fixed-Rate Promissory Note. This note sets a predetermined interest rate at the time of signing the agreement, which remains fixed throughout the loan term. Such notes provide stability for both the lender and the borrower, as they can accurately predict the interest costs and plan their finances accordingly. Another type is the Variable-Rate Promissory Note which has an interest rate that fluctuates periodically based on various market conditions. This type of note allows the interest to compound annually, providing potential savings or increased costs depending on the market rates. Borrowers opting for this type of promissory note have the opportunity to benefit from lower interest rates if the market is favorable. When drafting a Los Angeles California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it is important to include specific details, such as: 1. The names and contact information of both the lender and the borrower. 2. The loan amount and the purpose of the loan. 3. The maturity date, which indicates the date by which the borrower must repay the entire loan amount. 4. The interest rate, which is set at a fixed or variable rate and compounded annually. 5. Any late payment penalties or default clauses, which outline the consequences in case of failure to meet the obligations. 6. A repayment schedule, providing flexibility to the lender and allowing the borrower to repay the loan in full on or before the maturity date. 7. Signatures of both parties, indicating their agreement and acceptance of the terms and conditions stated in the promissory note. It is crucial for both the lender and the borrower to thoroughly understand and agree to the terms of the promissory note before signing it. Additionally, seeking legal advice from an attorney experienced in financial agreements can ensure compliance with the regulations specific to Los Angeles, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.