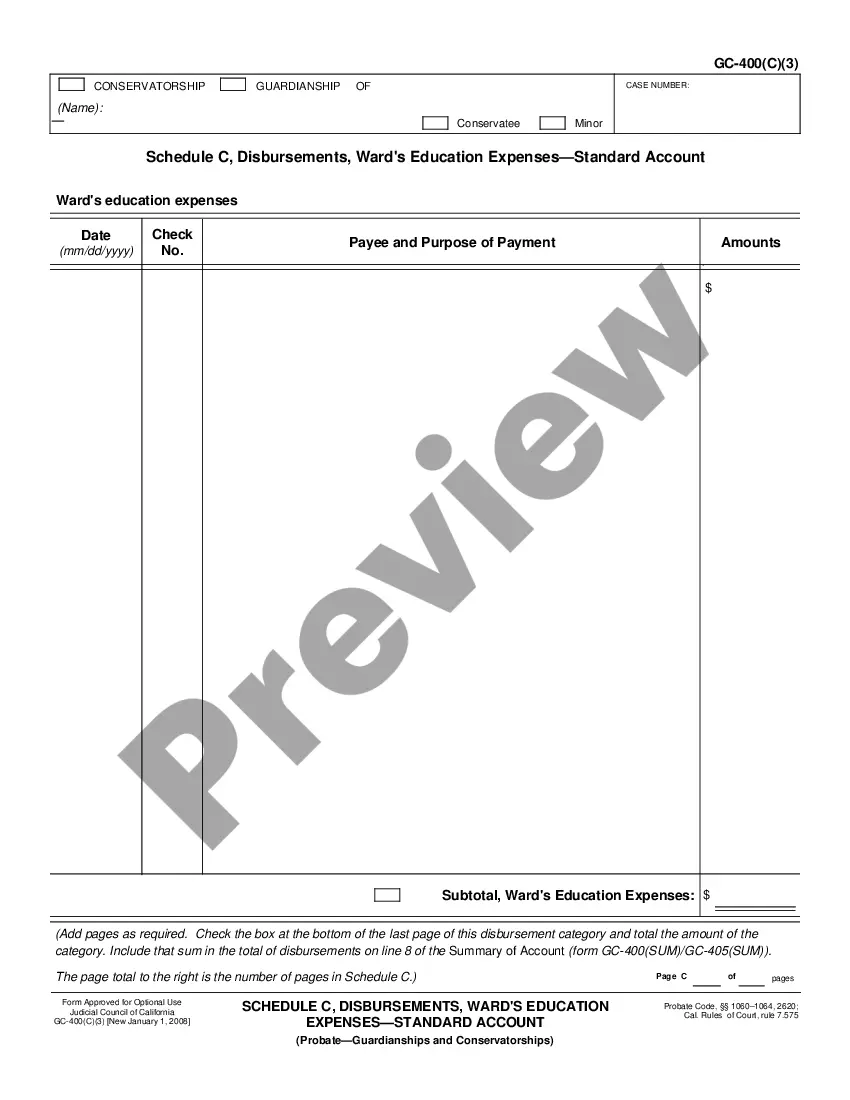

This form is a generic example that may be referred to when preparing such a form.

A Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines a financial agreement between a lender and a borrower in the city of Moreno Valley, California. This type of promissory note sets forth specific terms and conditions regarding the repayment of borrowed funds. Keywords: Moreno Valley California, promissory note, payment due until maturity, interest, compound annually. This specific type of promissory note allows borrowers to defer making any payments towards the principal amount and accrued interest until the maturity date specified in the agreement. Instead of making regular installment payments, the borrowed funds remain outstanding until the maturity date arrives. One of the key features of this promissory note is that the interest is compounded annually. This means that the interest payments on the loan are calculated based on the principal amount, and then added to the principal at the end of each year. This compounding interest increases the total repayment amount over time. While this article primarily focuses on the Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it's important to note that there may be variations or alternative types of promissory notes available in the region. These variations could include promissory notes with payment due dates before maturity, different interest rate structures, or other terms specific to the borrower's and lender's preferences. The key takeaway is that a Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually allows borrowers to defer payment obligations until the maturity date, while the interest on the loan accumulates and compounds annually. It is important for both borrowers and lenders to carefully review and understand the terms and conditions outlined in the promissory note before entering into any financial agreements. Seeking legal advice or consulting a financial professional can help ensure that all parties involved are fully informed and protected.A Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines a financial agreement between a lender and a borrower in the city of Moreno Valley, California. This type of promissory note sets forth specific terms and conditions regarding the repayment of borrowed funds. Keywords: Moreno Valley California, promissory note, payment due until maturity, interest, compound annually. This specific type of promissory note allows borrowers to defer making any payments towards the principal amount and accrued interest until the maturity date specified in the agreement. Instead of making regular installment payments, the borrowed funds remain outstanding until the maturity date arrives. One of the key features of this promissory note is that the interest is compounded annually. This means that the interest payments on the loan are calculated based on the principal amount, and then added to the principal at the end of each year. This compounding interest increases the total repayment amount over time. While this article primarily focuses on the Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it's important to note that there may be variations or alternative types of promissory notes available in the region. These variations could include promissory notes with payment due dates before maturity, different interest rate structures, or other terms specific to the borrower's and lender's preferences. The key takeaway is that a Moreno Valley California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually allows borrowers to defer payment obligations until the maturity date, while the interest on the loan accumulates and compounds annually. It is important for both borrowers and lenders to carefully review and understand the terms and conditions outlined in the promissory note before entering into any financial agreements. Seeking legal advice or consulting a financial professional can help ensure that all parties involved are fully informed and protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.