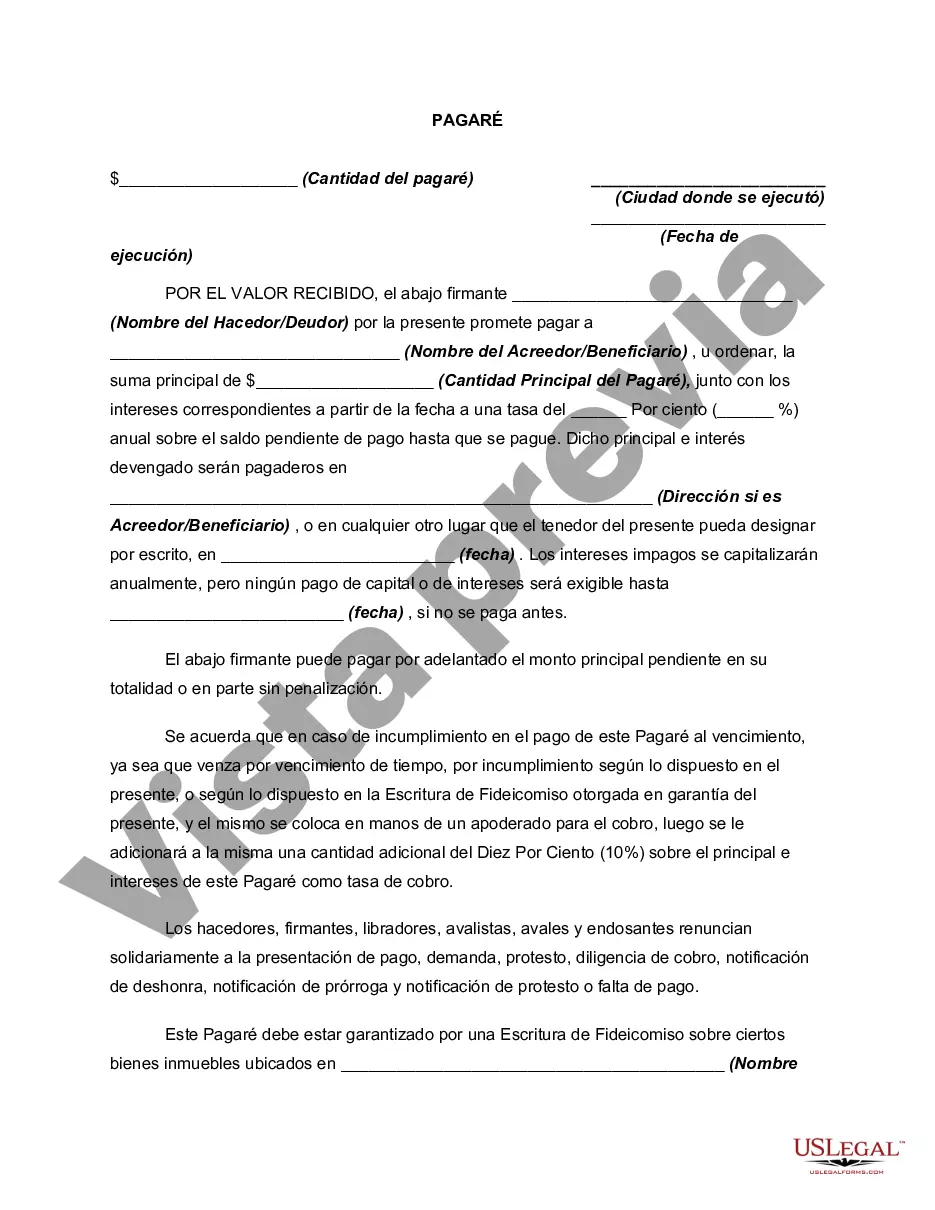

This form is a generic example that may be referred to when preparing such a form.

The Roseville California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan between a lender and a borrower in Roseville, California. This particular type of promissory note is unique in that it allows the borrower to defer making any payments towards the loan until the maturity date. The promissory note also stipulates that the interest on the loan will compound annually. This means that the interest that accrues on the loan will be added to the principal amount, and future interest calculations will be based on the new total. This compounding effect can significantly increase the overall amount owed over time. One of the key benefits of this type of promissory note is that it provides flexibility for the borrower. By deferring payment until maturity, the borrower has the opportunity to invest the loan funds or generate income elsewhere, potentially allowing them to make a larger payment at the end of the loan term. It is important to note that while this type of promissory note may be advantageous for some borrowers, it also carries inherent risks. The borrower must carefully consider their ability to repay the loan at maturity and account for the potential increase in the total amount owed due to the compounding interest. There are several variations of the Roseville California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. These include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan, which remains constant throughout the loan term. It provides predictability for both the lender and borrower. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate variant, this promissory note allows for periodic adjustments to the interest rate based on market conditions. The adjustment frequency and basis are specified in the note. 3. Secured Promissory Note: This version of the promissory note includes collateral pledged by the borrower as security for the loan. If the borrower defaults, the lender has the right to seize the collateral to satisfy the outstanding debt. 4. Unsecured Promissory Note: In contrast to the secured promissory note, this variant does not require any collateral. The lender relies solely on the borrower's promise to repay the loan. 5. Demand Promissory Note: This type of promissory note gives the lender the option to demand repayment of the loan at any time, rather than having a fixed maturity date. However, the interest will continue to compound annually until repayment is made. It is crucial for both parties involved in the loan transaction to carefully review and understand the terms of any promissory note before signing. Consulting with legal and financial professionals in Roseville, California would also provide valuable guidance to ensure compliance with state-specific regulations and protections.The Roseville California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan between a lender and a borrower in Roseville, California. This particular type of promissory note is unique in that it allows the borrower to defer making any payments towards the loan until the maturity date. The promissory note also stipulates that the interest on the loan will compound annually. This means that the interest that accrues on the loan will be added to the principal amount, and future interest calculations will be based on the new total. This compounding effect can significantly increase the overall amount owed over time. One of the key benefits of this type of promissory note is that it provides flexibility for the borrower. By deferring payment until maturity, the borrower has the opportunity to invest the loan funds or generate income elsewhere, potentially allowing them to make a larger payment at the end of the loan term. It is important to note that while this type of promissory note may be advantageous for some borrowers, it also carries inherent risks. The borrower must carefully consider their ability to repay the loan at maturity and account for the potential increase in the total amount owed due to the compounding interest. There are several variations of the Roseville California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. These include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan, which remains constant throughout the loan term. It provides predictability for both the lender and borrower. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate variant, this promissory note allows for periodic adjustments to the interest rate based on market conditions. The adjustment frequency and basis are specified in the note. 3. Secured Promissory Note: This version of the promissory note includes collateral pledged by the borrower as security for the loan. If the borrower defaults, the lender has the right to seize the collateral to satisfy the outstanding debt. 4. Unsecured Promissory Note: In contrast to the secured promissory note, this variant does not require any collateral. The lender relies solely on the borrower's promise to repay the loan. 5. Demand Promissory Note: This type of promissory note gives the lender the option to demand repayment of the loan at any time, rather than having a fixed maturity date. However, the interest will continue to compound annually until repayment is made. It is crucial for both parties involved in the loan transaction to carefully review and understand the terms of any promissory note before signing. Consulting with legal and financial professionals in Roseville, California would also provide valuable guidance to ensure compliance with state-specific regulations and protections.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.