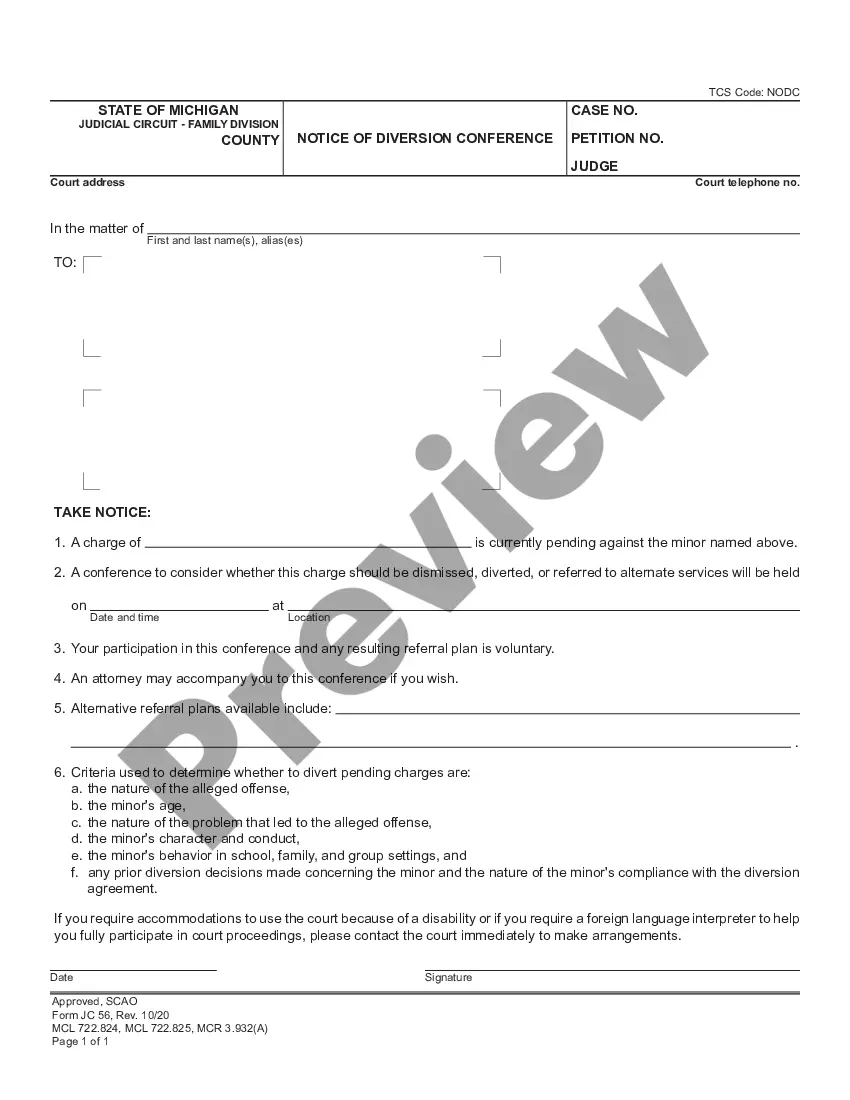

This form is a generic example that may be referred to when preparing such a form.

A Santa Maria California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan between a lender and a borrower, specifically in the city of Santa Maria, California. This type of promissory note stands out as it allows the borrower to defer making any payments until the maturity date specified in the agreement. The key feature of this particular promissory note is the annual compound interest, which means that interest will be added to the principal amount on a yearly basis. This ensures that the interest grows over time, potentially resulting in a higher overall repayment amount for the borrower. In Santa Maria, California, there may be variations or subtypes of this promissory note, each with its own unique features catering to specific needs and situations. Some potential variations could include: 1. Santa Maria California Promissory Note with Variable Interest Rate: This type of promissory note allows the interest rate to fluctuate based on certain market indicators, offering the opportunity for the borrower to benefit from potentially lower interest rates over time. 2. Santa Maria California Promissory Note with Balloon Payment: Unlike the original promissory note, this variation includes a larger payment known as a balloon payment, due at the end of the loan term. This type of promissory note may appeal to borrowers who expect to have a significant lump sum available at the maturity date. 3. Santa Maria California Secured Promissory Note: In this case, the lender may require the borrower to provide collateral to secure the loan. This collateral could be in the form of a property, vehicle, or any other valuable asset that can be liquidated in case of default. 4. Santa Maria California Unsecured Promissory Note: This type of promissory note does not involve any collateral, relying solely on the borrower's creditworthiness and trustworthiness to repay the loan. When drafting or entering into a Santa Maria California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it is crucial for both parties to seek legal advice to ensure the agreement aligns with their financial goals and protects their interests.A Santa Maria California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms of a loan between a lender and a borrower, specifically in the city of Santa Maria, California. This type of promissory note stands out as it allows the borrower to defer making any payments until the maturity date specified in the agreement. The key feature of this particular promissory note is the annual compound interest, which means that interest will be added to the principal amount on a yearly basis. This ensures that the interest grows over time, potentially resulting in a higher overall repayment amount for the borrower. In Santa Maria, California, there may be variations or subtypes of this promissory note, each with its own unique features catering to specific needs and situations. Some potential variations could include: 1. Santa Maria California Promissory Note with Variable Interest Rate: This type of promissory note allows the interest rate to fluctuate based on certain market indicators, offering the opportunity for the borrower to benefit from potentially lower interest rates over time. 2. Santa Maria California Promissory Note with Balloon Payment: Unlike the original promissory note, this variation includes a larger payment known as a balloon payment, due at the end of the loan term. This type of promissory note may appeal to borrowers who expect to have a significant lump sum available at the maturity date. 3. Santa Maria California Secured Promissory Note: In this case, the lender may require the borrower to provide collateral to secure the loan. This collateral could be in the form of a property, vehicle, or any other valuable asset that can be liquidated in case of default. 4. Santa Maria California Unsecured Promissory Note: This type of promissory note does not involve any collateral, relying solely on the borrower's creditworthiness and trustworthiness to repay the loan. When drafting or entering into a Santa Maria California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it is crucial for both parties to seek legal advice to ensure the agreement aligns with their financial goals and protects their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.