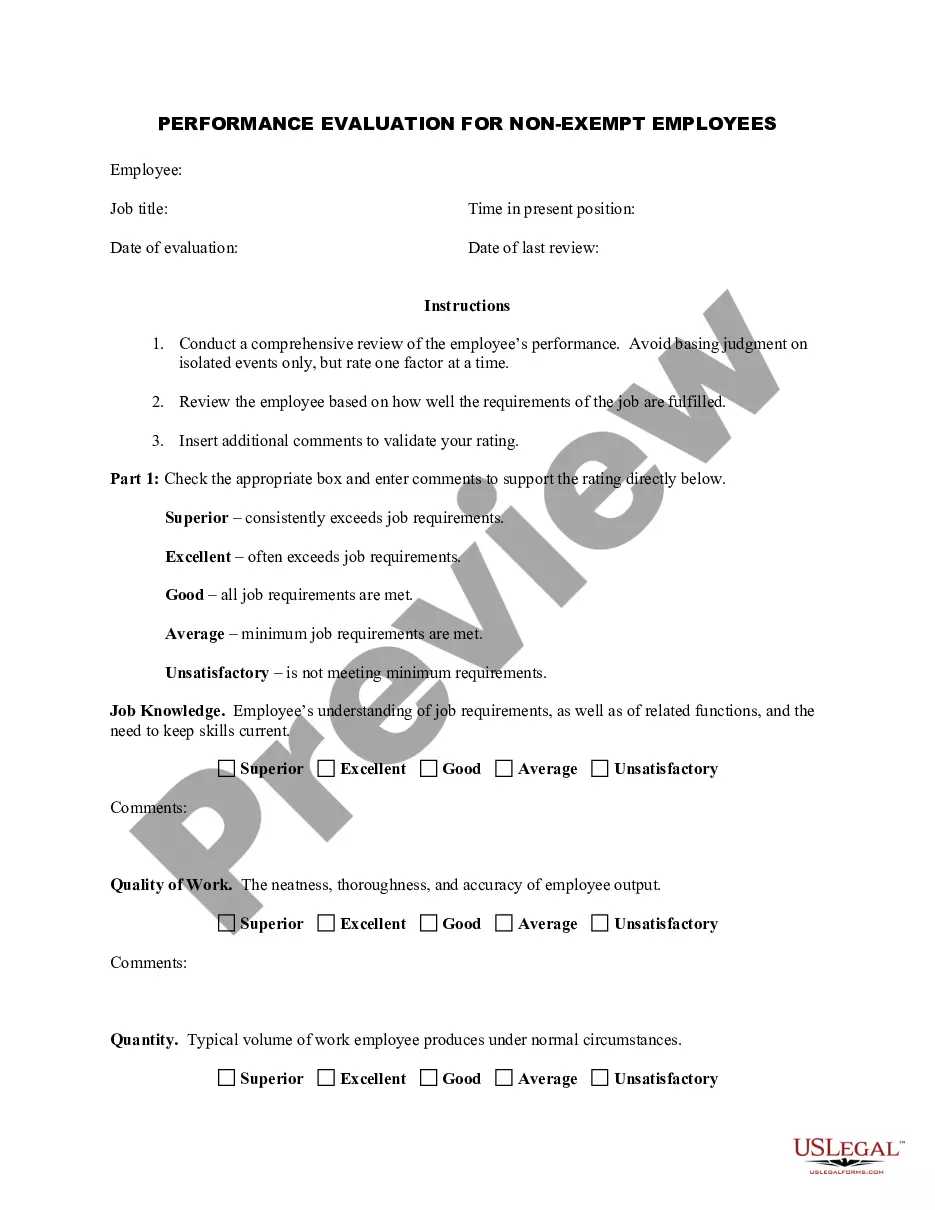

This form is a generic example that may be referred to when preparing such a form.

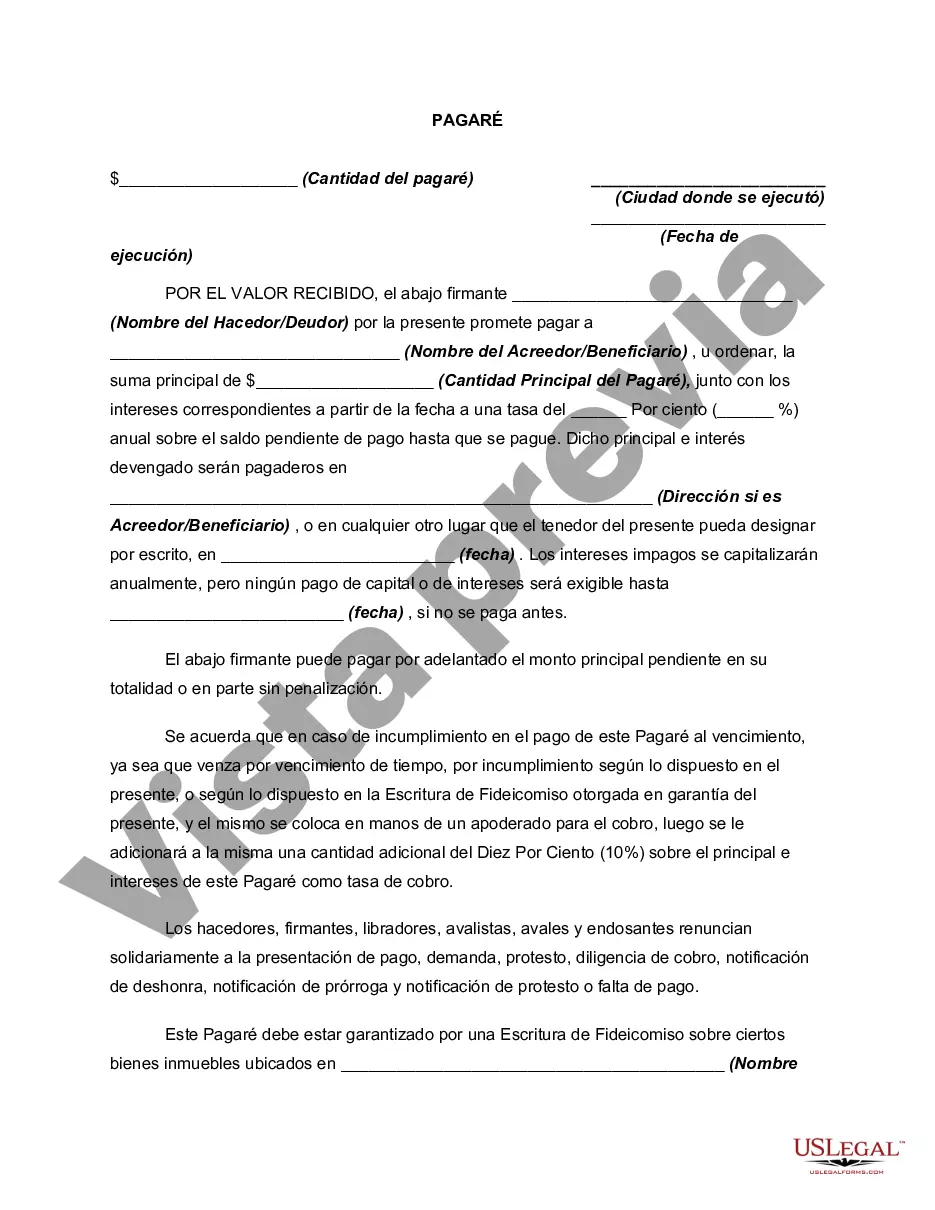

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Temecula California Pagaré sin pago vencido hasta el vencimiento e interés para capitalizar anualmente - California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually

State:

California

City:

Temecula

Control #:

CA-01700BG

Format:

Word

Instant download

Description

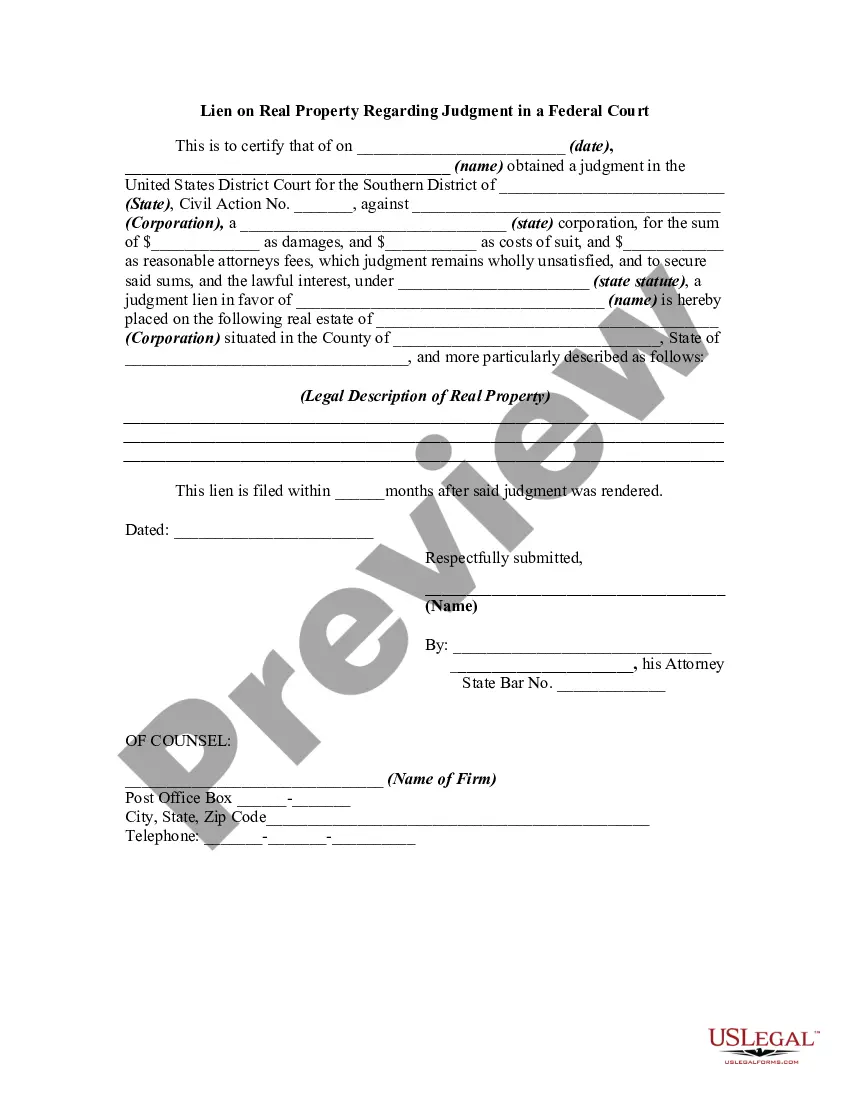

Free preview

How to fill out California Pagaré Sin Pago Vencido Hasta El Vencimiento E Interés Para Capitalizar Anualmente?

Acquiring authenticated templates that conform to your regional regulations can be challenging unless you access the US Legal Forms library.

This is an online repository containing over 85,000 legal documents catering to both individual and business requirements and various real-life scenarios.

All the forms are accurately categorized by area of application and jurisdiction, making the search for the Temecula California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually as straightforward as possible.

Complete your payment by entering your credit card information or using your PayPal account to settle for the service.

- Review the Preview mode and document description.

- Ensure you’ve selected the correct one that aligns with your needs and completely meets your local jurisdiction criteria.

- Look for another template, if required.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your criteria, proceed to the next step.

- Purchase the document.