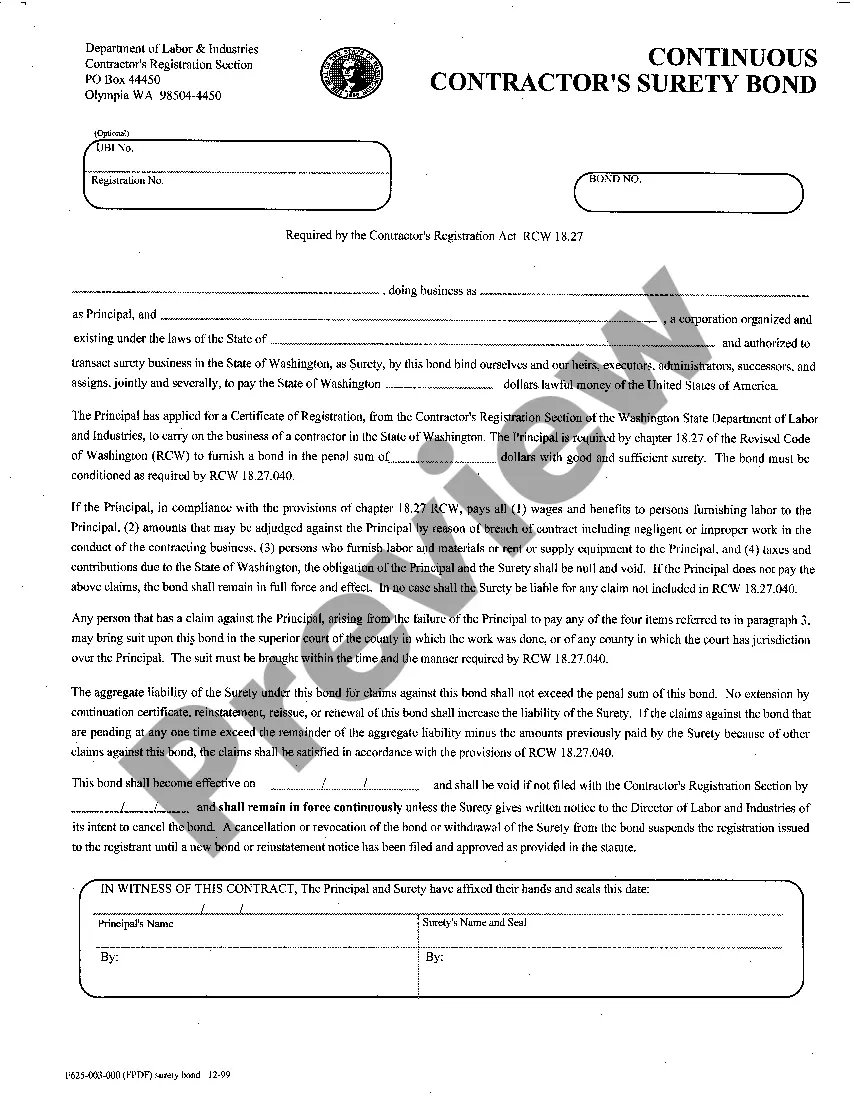

This form is a generic example that may be referred to when preparing such a form.

When it comes to financing real estate transactions in Temecula, California, one popular option is the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This type of agreement offers flexibility and convenience for both the borrower and the lender. Let's delve into the details of this arrangement, exploring its key features and benefits. A Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is essentially a loan agreement secured by a deed of trust. It involves three main parties: the borrower, the lender, and the trustee. The borrower is the party seeking financing, while the lender provides the funds. The trustee holds the property's title and acts as a neutral third party. In this type of deed of trust, there are no ongoing monthly payments required until the maturity date of the loan. Instead, all interest and principal are due at the end of the loan term. However, interest accumulates annually and compounds to the outstanding balance. This arrangement provides several advantages for both parties involved. For the borrower, it allows for greater financial flexibility during the term of the loan, as they are not burdened with monthly payments. Instead, they can use their resources more efficiently, focusing on other investments or expenses. For lenders, this type of deed of trust offers a potentially higher return on investment. The interest compound annually, allowing the lender to earn more on their funds over the loan term. Moreover, lenders have the added security of a deed of trust, which acts as collateral. If the borrower defaults, the lender can initiate foreclosure proceedings to recover their investment. It's important to note that there may be different variations of the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. These variations could include specific terms and conditions tailored to the needs of the parties involved. Some potential variations might include adjustable interest rates, wherein the interest rate may fluctuate over time, or even interest-only periods at the beginning of the loan term. Each variation addresses the unique requirements and preferences of the borrower and the lender. In conclusion, the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a favorable financing option for real estate transactions in Temecula. It provides borrowers with financial flexibility and enables lenders to earn potentially higher returns. The various types and variations of this deed of trust cater to the specific needs and preferences of the parties involved, ensuring a mutually beneficial agreement.When it comes to financing real estate transactions in Temecula, California, one popular option is the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This type of agreement offers flexibility and convenience for both the borrower and the lender. Let's delve into the details of this arrangement, exploring its key features and benefits. A Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is essentially a loan agreement secured by a deed of trust. It involves three main parties: the borrower, the lender, and the trustee. The borrower is the party seeking financing, while the lender provides the funds. The trustee holds the property's title and acts as a neutral third party. In this type of deed of trust, there are no ongoing monthly payments required until the maturity date of the loan. Instead, all interest and principal are due at the end of the loan term. However, interest accumulates annually and compounds to the outstanding balance. This arrangement provides several advantages for both parties involved. For the borrower, it allows for greater financial flexibility during the term of the loan, as they are not burdened with monthly payments. Instead, they can use their resources more efficiently, focusing on other investments or expenses. For lenders, this type of deed of trust offers a potentially higher return on investment. The interest compound annually, allowing the lender to earn more on their funds over the loan term. Moreover, lenders have the added security of a deed of trust, which acts as collateral. If the borrower defaults, the lender can initiate foreclosure proceedings to recover their investment. It's important to note that there may be different variations of the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. These variations could include specific terms and conditions tailored to the needs of the parties involved. Some potential variations might include adjustable interest rates, wherein the interest rate may fluctuate over time, or even interest-only periods at the beginning of the loan term. Each variation addresses the unique requirements and preferences of the borrower and the lender. In conclusion, the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a favorable financing option for real estate transactions in Temecula. It provides borrowers with financial flexibility and enables lenders to earn potentially higher returns. The various types and variations of this deed of trust cater to the specific needs and preferences of the parties involved, ensuring a mutually beneficial agreement.