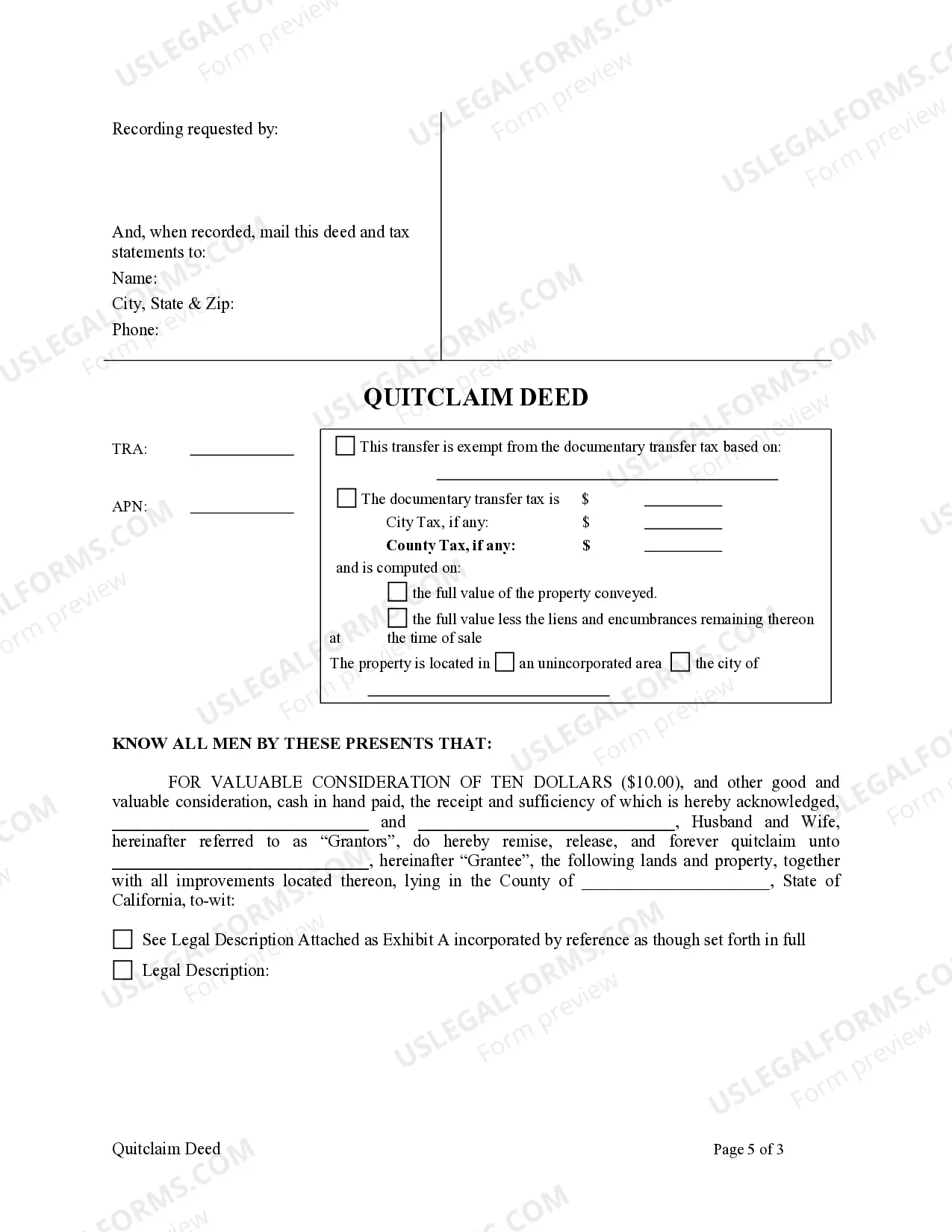

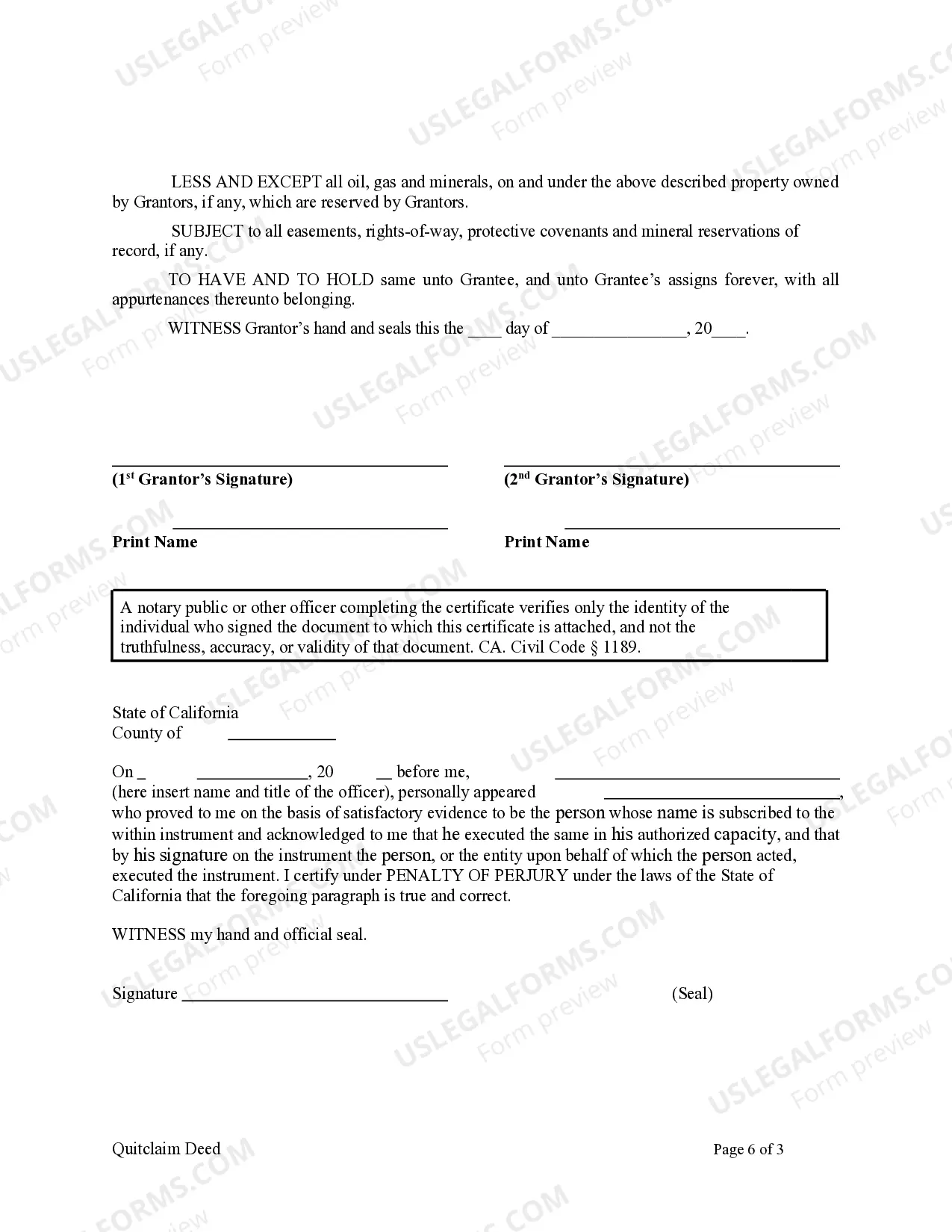

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Understanding Modesto California Quitclaim Deed from Husband and Wife to an Individual: Types and Process Explained Introduction: A Modesto California Quitclaim Deed from Husband and Wife to an Individual is a legal document that allows a married couple to transfer property ownership rights to a specific person without making any guarantees about the property's title. This article explores the different types of Modesto California Quitclaim Deeds from Husband and Wife to an Individual and breaks down their essential components. 1. Basic Definition: A Quitclaim Deed is a legal instrument used to transfer real estate ownership interests. When a married couple, as joint owners, decide to transfer their property to an individual, this deed type becomes essential. 2. Standard Modesto California Quitclaim Deed from Husband and Wife to an Individual: The standard type of Modesto California Quitclaim Deed from Husband and Wife to an Individual involves the transfer of property ownership without any warranties or guarantees. This deed typically provides a description of the property being transferred, identifies the couple as the granters, and the individual as the grantee. 3. Modesto California Enhanced Life Estate Deed (Lady Bird Deed): An alternative type of Quitclaim Deed commonly used in California is the Enhanced Life Estate Deed or Lady Bird Deed. Unlike a standard Quitclaim Deed, this type allows the granters (husband and wife) to retain control and use of the property for their lifetime, while still transferring it to an individual upon their death. This type of deed can help avoid probate and potentially reduce property tax reassessment. 4. Process of Creating a Modesto California Quitclaim Deed from Husband and Wife to an Individual: To create a Modesto California Quitclaim Deed from Husband and Wife to an Individual, follow these general steps: a. Prepare the deed form: Gather necessary information such as property description, granters' and grantee's details, and any special instructions. b. Consult an attorney: Seek legal advice to ensure compliance with California laws and to address any specific concerns. c. Execute the deed: The husband and wife, as granters, must sign the deed in the presence of a notary public. d. Record the deed: File the executed deed with the appropriate county recording office in Modesto, California, to make the transfer of ownership official and public. Conclusion: A Modesto California Quitclaim Deed from Husband and Wife to an Individual is a legal instrument used to transfer property ownership rights from a married couple to a specified individual. Various types of quitclaim deeds, including the standard version and the Enhanced Life Estate Deed (Lady Bird Deed), offer flexibility in transferring property interests. It is crucial to understand the differences between these deeds and consult an attorney to ensure a smooth and legal transfer of ownership.Title: Understanding Modesto California Quitclaim Deed from Husband and Wife to an Individual: Types and Process Explained Introduction: A Modesto California Quitclaim Deed from Husband and Wife to an Individual is a legal document that allows a married couple to transfer property ownership rights to a specific person without making any guarantees about the property's title. This article explores the different types of Modesto California Quitclaim Deeds from Husband and Wife to an Individual and breaks down their essential components. 1. Basic Definition: A Quitclaim Deed is a legal instrument used to transfer real estate ownership interests. When a married couple, as joint owners, decide to transfer their property to an individual, this deed type becomes essential. 2. Standard Modesto California Quitclaim Deed from Husband and Wife to an Individual: The standard type of Modesto California Quitclaim Deed from Husband and Wife to an Individual involves the transfer of property ownership without any warranties or guarantees. This deed typically provides a description of the property being transferred, identifies the couple as the granters, and the individual as the grantee. 3. Modesto California Enhanced Life Estate Deed (Lady Bird Deed): An alternative type of Quitclaim Deed commonly used in California is the Enhanced Life Estate Deed or Lady Bird Deed. Unlike a standard Quitclaim Deed, this type allows the granters (husband and wife) to retain control and use of the property for their lifetime, while still transferring it to an individual upon their death. This type of deed can help avoid probate and potentially reduce property tax reassessment. 4. Process of Creating a Modesto California Quitclaim Deed from Husband and Wife to an Individual: To create a Modesto California Quitclaim Deed from Husband and Wife to an Individual, follow these general steps: a. Prepare the deed form: Gather necessary information such as property description, granters' and grantee's details, and any special instructions. b. Consult an attorney: Seek legal advice to ensure compliance with California laws and to address any specific concerns. c. Execute the deed: The husband and wife, as granters, must sign the deed in the presence of a notary public. d. Record the deed: File the executed deed with the appropriate county recording office in Modesto, California, to make the transfer of ownership official and public. Conclusion: A Modesto California Quitclaim Deed from Husband and Wife to an Individual is a legal instrument used to transfer property ownership rights from a married couple to a specified individual. Various types of quitclaim deeds, including the standard version and the Enhanced Life Estate Deed (Lady Bird Deed), offer flexibility in transferring property interests. It is crucial to understand the differences between these deeds and consult an attorney to ensure a smooth and legal transfer of ownership.