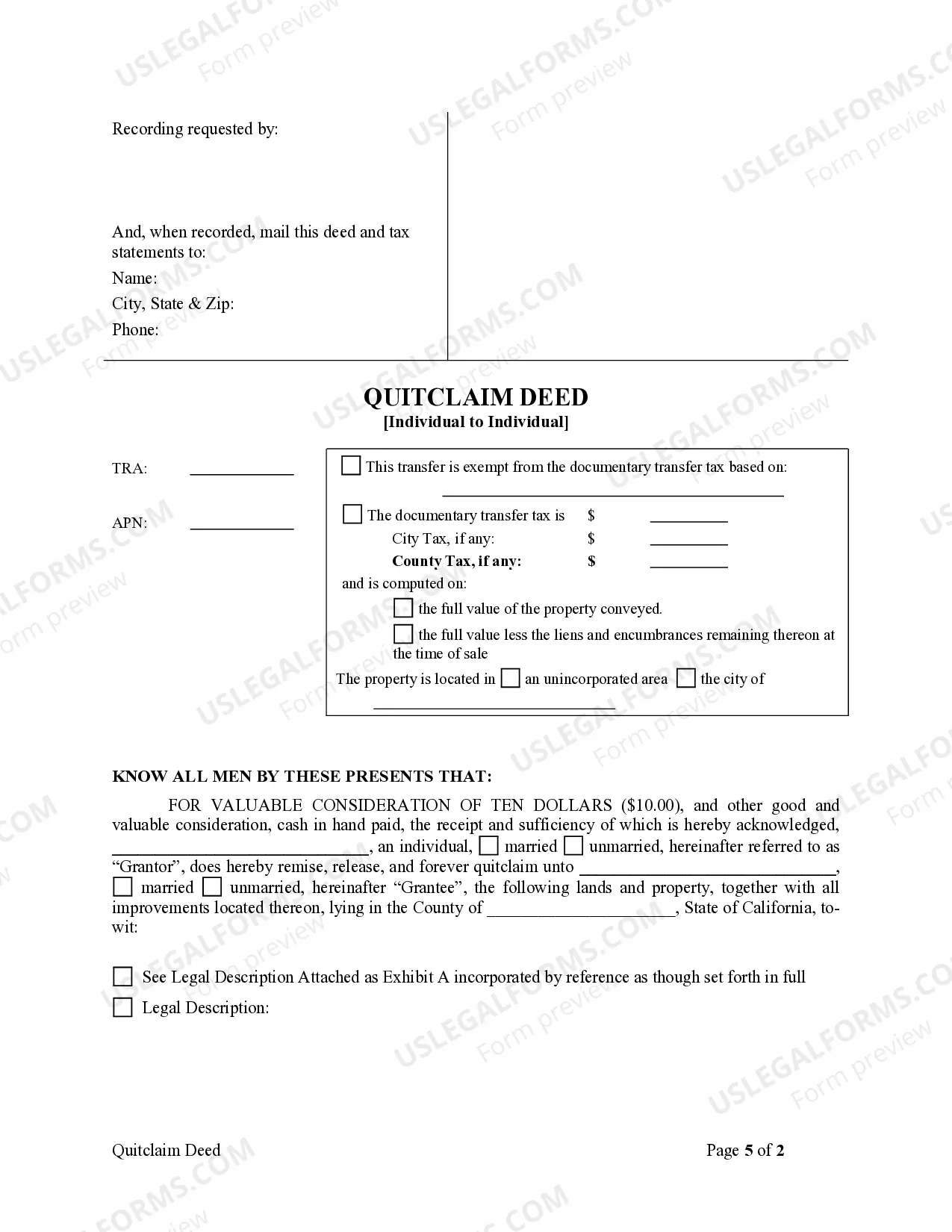

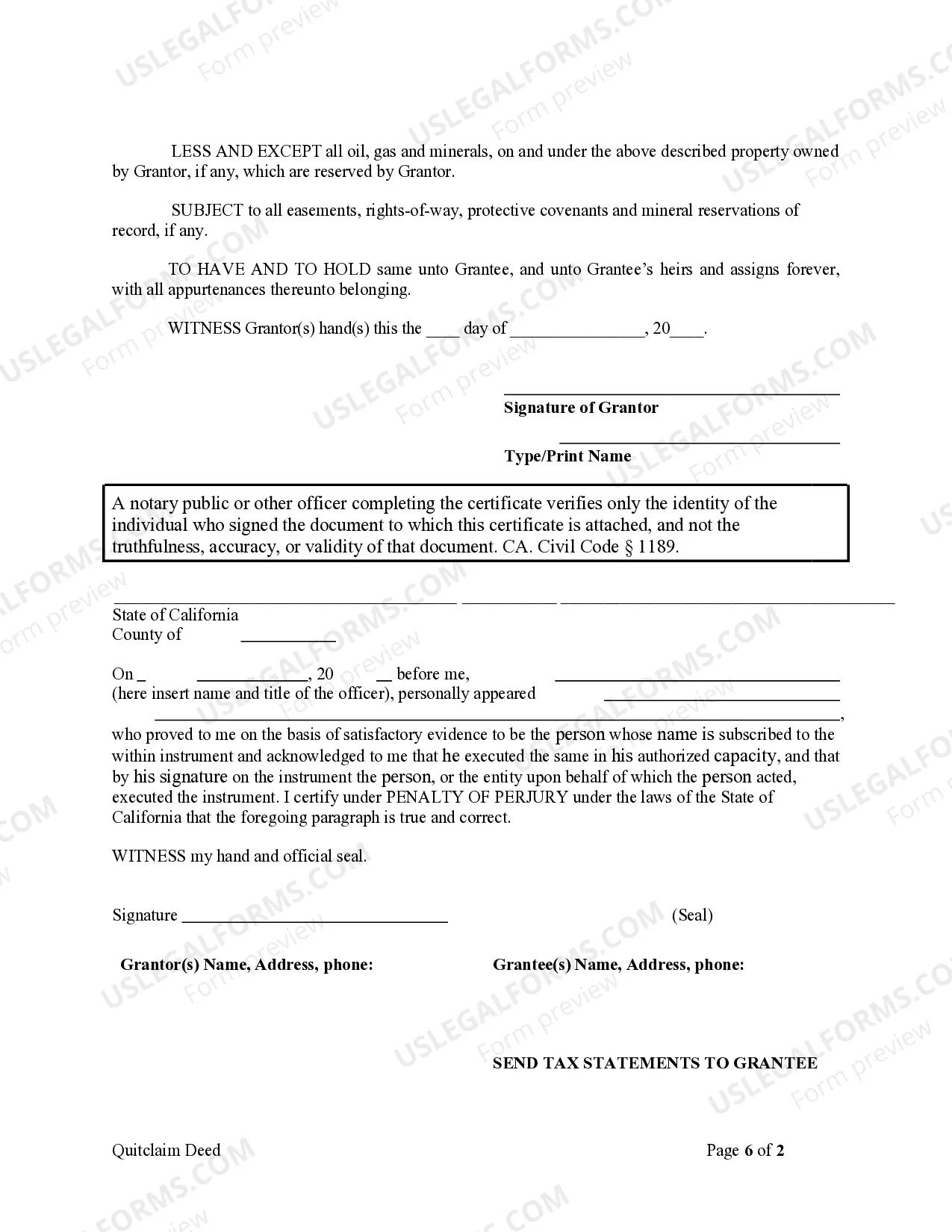

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Vallejo California Quitclaim Deed from Individual to Individual is a legal document commonly used in real estate transactions to transfer ownership of a property from one person (granter) to another (grantee). This type of deed is different from other types of property transfers as it makes no guarantees or warranties regarding the property's title. Keywords: Vallejo California, Quitclaim Deed, Individual to Individual, property transfer, ownership, real estate transactions, granter, grantee The Vallejo California Quitclaim Deed from Individual to Individual can be further categorized into several types based on specific circumstances. These include: 1. Interfamily Transfer Quitclaim Deed: This type of quitclaim deed is used when an individual transfers a property to a family member, such as a spouse, child, or parent. 2. Divorce Quitclaim Deed: In cases of divorce or legal separation, a quitclaim deed may be utilized to transfer one party's interest in a property to the other. 3. Gift Quitclaim Deed: When a property is gifted by one individual to another without any monetary exchange, a gift quitclaim deed is commonly employed. 4. Transfer on Death Quitclaim Deed: This type of quitclaim deed allows an individual to designate a beneficiary who will automatically assume ownership of the property upon the granter's death, bypassing the need for probate. 5. Trust Quitclaim Deed: A trust quitclaim deed is used when a property owner wants to transfer the property's ownership into a trust, often for estate planning or asset protection purposes. It is essential to consult with a qualified real estate attorney or legal professional to ensure the proper completion and recording of the Vallejo California Quitclaim Deed from Individual to Individual, as well as to understand any potential legal consequences or tax implications associated with the property transfer.A Vallejo California Quitclaim Deed from Individual to Individual is a legal document commonly used in real estate transactions to transfer ownership of a property from one person (granter) to another (grantee). This type of deed is different from other types of property transfers as it makes no guarantees or warranties regarding the property's title. Keywords: Vallejo California, Quitclaim Deed, Individual to Individual, property transfer, ownership, real estate transactions, granter, grantee The Vallejo California Quitclaim Deed from Individual to Individual can be further categorized into several types based on specific circumstances. These include: 1. Interfamily Transfer Quitclaim Deed: This type of quitclaim deed is used when an individual transfers a property to a family member, such as a spouse, child, or parent. 2. Divorce Quitclaim Deed: In cases of divorce or legal separation, a quitclaim deed may be utilized to transfer one party's interest in a property to the other. 3. Gift Quitclaim Deed: When a property is gifted by one individual to another without any monetary exchange, a gift quitclaim deed is commonly employed. 4. Transfer on Death Quitclaim Deed: This type of quitclaim deed allows an individual to designate a beneficiary who will automatically assume ownership of the property upon the granter's death, bypassing the need for probate. 5. Trust Quitclaim Deed: A trust quitclaim deed is used when a property owner wants to transfer the property's ownership into a trust, often for estate planning or asset protection purposes. It is essential to consult with a qualified real estate attorney or legal professional to ensure the proper completion and recording of the Vallejo California Quitclaim Deed from Individual to Individual, as well as to understand any potential legal consequences or tax implications associated with the property transfer.