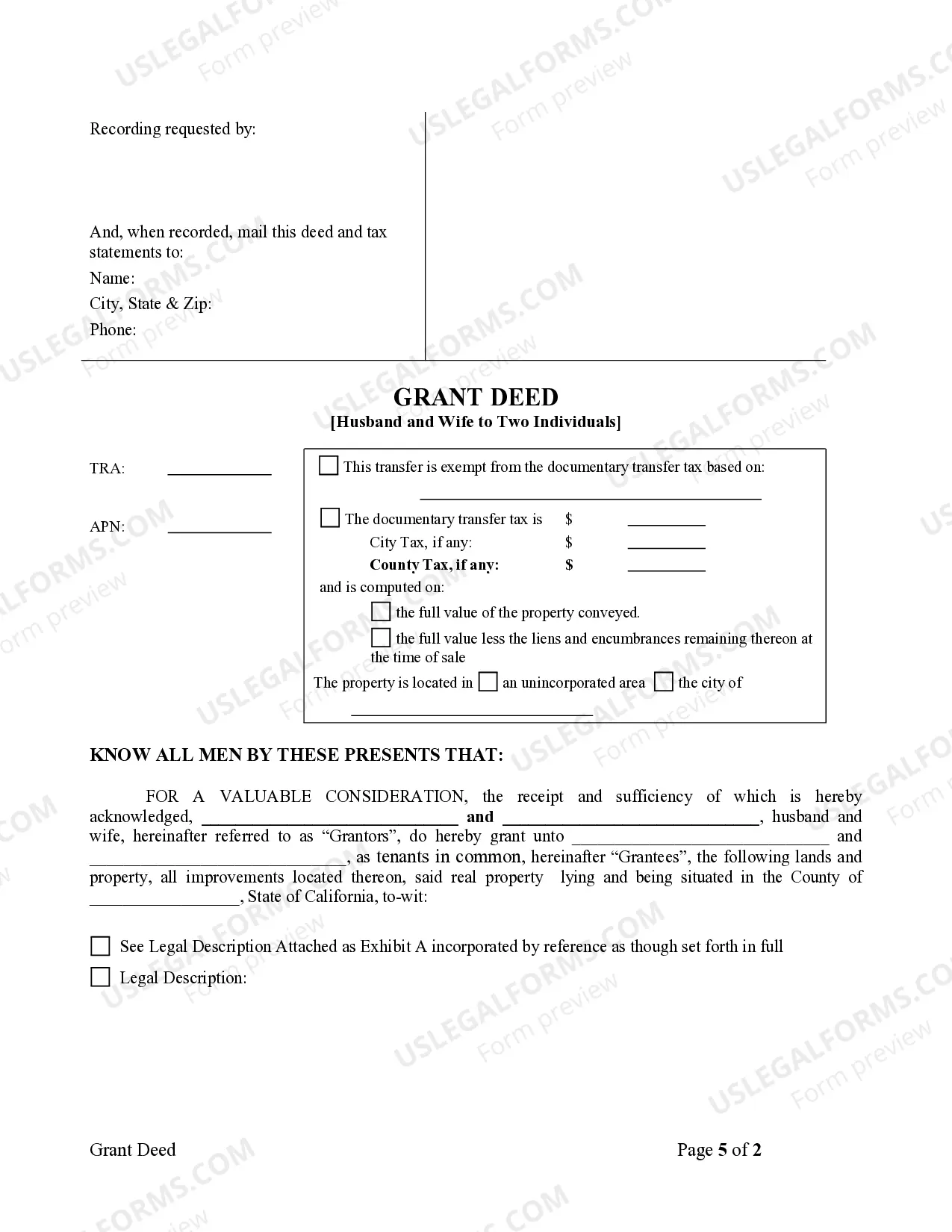

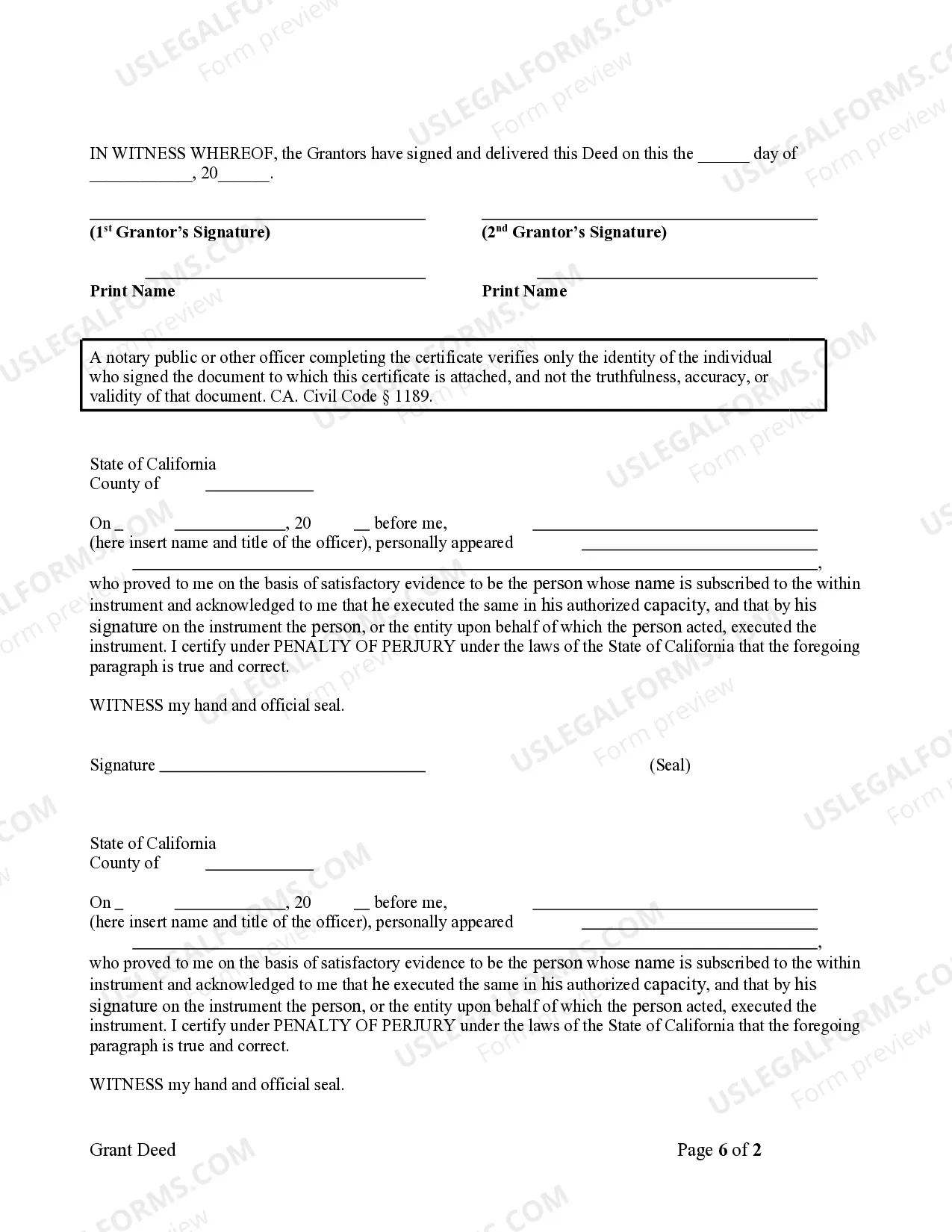

This form is a Grant Deed where the grantors are husband and wife and the grantees are two individuals. Grantors convey and grant the described property to the grantees. The grantees take the property as joint tenants with a right of survivorship or as tenants in common. This deed complies with all state statutory laws.

A Corona California Grant Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real estate from a married couple to two other individuals. This deed is commonly used when a husband and wife want to transfer property to both individuals equally or in specified shares. The grant deed serves as proof of the transfer and ensures that the new owners have clear legal ownership of the property. There are different types of Corona California Grant Deed — Husband and Wife to Two Individuals based on the specific arrangements and conditions of the transfer: 1. Joint Tenancy: In this type of grant deed, the property is transferred to the two individuals as joint tenants. This means that both individuals have equal ownership rights and share an undivided interest in the property. If one joint tenant passes away, their share automatically transfers to the other joint tenant. 2. Tenants in Common: With this type of grant deed, the property is transferred to two individuals as tenants in common. Each individual has a specified share of ownership, which does not have to be equal. Unlike joint tenancy, if one tenant in common passes away, their share does not automatically transfer to the other tenant. Instead, it becomes part of their estate and is distributed according to their will or state laws of inheritance. 3. Community Property with Right of Survivorship: This type of grant deed is specific to married couples in community property states like California. It allows the husband and wife to transfer the property to the two individuals with the right of survivorship. This means that upon the death of one spouse, their share automatically transfers to the surviving spouse, ensuring the property stays within the family. 4. Community Property: In this type of grant deed, the property is transferred to two individuals as community property. Community property refers to assets acquired during the marriage, which are considered owned equally by both spouses. However, unlike community property with right of survivorship, each spouse's share is not automatically transferred to the other upon death. Instead, it is distributed according to their will or state laws of inheritance. Overall, a Corona California Grant Deed — Husband and Wife to Two Individuals provides a legal framework for the transfer of property ownership between a married couple and two other individuals, ensuring clear title and rights are established. It is advisable to consult with a real estate attorney or professional to understand the specific type of grant deed that best suits your needs and to navigate the legal requirements of the transfer process.A Corona California Grant Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real estate from a married couple to two other individuals. This deed is commonly used when a husband and wife want to transfer property to both individuals equally or in specified shares. The grant deed serves as proof of the transfer and ensures that the new owners have clear legal ownership of the property. There are different types of Corona California Grant Deed — Husband and Wife to Two Individuals based on the specific arrangements and conditions of the transfer: 1. Joint Tenancy: In this type of grant deed, the property is transferred to the two individuals as joint tenants. This means that both individuals have equal ownership rights and share an undivided interest in the property. If one joint tenant passes away, their share automatically transfers to the other joint tenant. 2. Tenants in Common: With this type of grant deed, the property is transferred to two individuals as tenants in common. Each individual has a specified share of ownership, which does not have to be equal. Unlike joint tenancy, if one tenant in common passes away, their share does not automatically transfer to the other tenant. Instead, it becomes part of their estate and is distributed according to their will or state laws of inheritance. 3. Community Property with Right of Survivorship: This type of grant deed is specific to married couples in community property states like California. It allows the husband and wife to transfer the property to the two individuals with the right of survivorship. This means that upon the death of one spouse, their share automatically transfers to the surviving spouse, ensuring the property stays within the family. 4. Community Property: In this type of grant deed, the property is transferred to two individuals as community property. Community property refers to assets acquired during the marriage, which are considered owned equally by both spouses. However, unlike community property with right of survivorship, each spouse's share is not automatically transferred to the other upon death. Instead, it is distributed according to their will or state laws of inheritance. Overall, a Corona California Grant Deed — Husband and Wife to Two Individuals provides a legal framework for the transfer of property ownership between a married couple and two other individuals, ensuring clear title and rights are established. It is advisable to consult with a real estate attorney or professional to understand the specific type of grant deed that best suits your needs and to navigate the legal requirements of the transfer process.