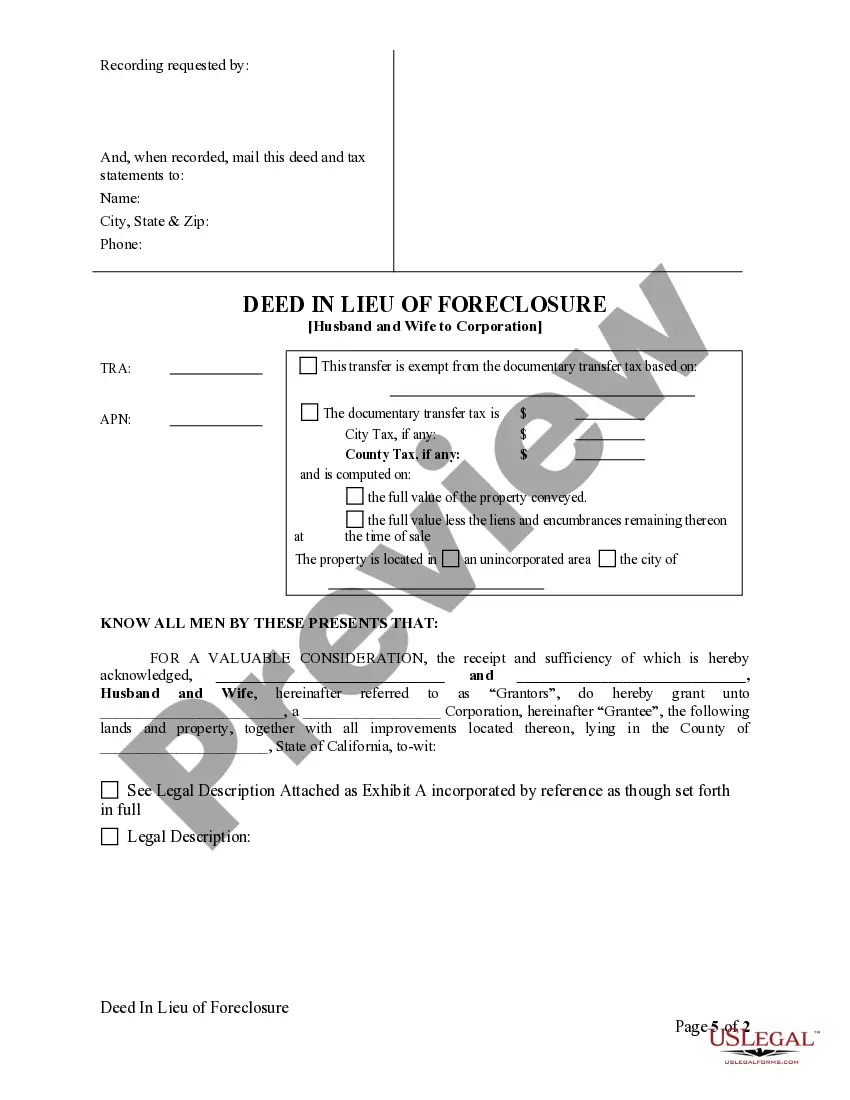

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Downey California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: A Comprehensive Overview In Downey, California, the Deed in Lieu of Foreclosure process enables homeowners who are facing financial hardship to voluntarily transfer their property to a corporation, resolving mortgage debts and avoiding foreclosure. This legal arrangement involves a husband and wife willingly transferring the property title to the corporation, relieving themselves from mortgage obligations and allowing the corporation to assume ownership. Keywords: Downey California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation, transfer, property title, mortgage debts, financial hardship. Types of Downey California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Traditional Deed in Lieu of Foreclosure: In this type, a husband and wife facing financial difficulties voluntarily transfer ownership of their property to a corporation in order to satisfy their outstanding mortgage debt. By completing this transaction, they avoid undergoing the foreclosure process while relinquishing any rights or claims to the property. 2. Cooperative Deed in Lieu of Foreclosure: In certain cases, homeowners in Downey, California, opt for a cooperative agreement with a corporation to transfer their property. This collaborative arrangement involves the corporation working closely with the homeowners to navigate the Deed in Lieu of Foreclosure process amicably, ensuring swift resolution of mortgage debts. 3. Strategic Deed in Lieu of Foreclosure: Sometimes homeowners who are unable to maintain mortgage payments and anticipate future financial difficulties proactively choose strategic deed in lieu of foreclosure. This enables them to transfer the property to a corporation before the situation worsens, avoiding extensive legal proceedings and potential long-term financial consequences. 4. Corporate Assistance Deed in Lieu of Foreclosure: Under this specialized arrangement, a corporation actively assists husband and wife in completing the Deed in Lieu of Foreclosure process. The established corporation may provide resources, guidance, and potentially financial aid to facilitate the transfer of ownership, thereby relieving the homeowners of their burdensome mortgage obligations. 5. IRS Pre-Foreclosure Sale Deed in Lieu of Foreclosure: In some cases, homeowners facing foreclosure in Downey, California, who meet specific Internal Revenue Service (IRS) criteria, may qualify for a Pre-Foreclosure Sale Deed in Lieu of Foreclosure. This allows them to transfer the property to a corporation as part of a pre-approved arrangement, reducing potential tax consequences and potentially obtaining additional benefits. Navigating the Deed in Lieu of Foreclosure process can be complex, and seeking professional guidance from experienced attorneys and real estate professionals is highly recommended. Always consult legal and financial experts to fully understand the implications and specific options available in Downey, California, for your unique situation.Downey California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: A Comprehensive Overview In Downey, California, the Deed in Lieu of Foreclosure process enables homeowners who are facing financial hardship to voluntarily transfer their property to a corporation, resolving mortgage debts and avoiding foreclosure. This legal arrangement involves a husband and wife willingly transferring the property title to the corporation, relieving themselves from mortgage obligations and allowing the corporation to assume ownership. Keywords: Downey California, Deed in Lieu of Foreclosure, Husband and Wife, Corporation, transfer, property title, mortgage debts, financial hardship. Types of Downey California Deed in Lieu of Foreclosure — Husband and Wife to Corporation: 1. Traditional Deed in Lieu of Foreclosure: In this type, a husband and wife facing financial difficulties voluntarily transfer ownership of their property to a corporation in order to satisfy their outstanding mortgage debt. By completing this transaction, they avoid undergoing the foreclosure process while relinquishing any rights or claims to the property. 2. Cooperative Deed in Lieu of Foreclosure: In certain cases, homeowners in Downey, California, opt for a cooperative agreement with a corporation to transfer their property. This collaborative arrangement involves the corporation working closely with the homeowners to navigate the Deed in Lieu of Foreclosure process amicably, ensuring swift resolution of mortgage debts. 3. Strategic Deed in Lieu of Foreclosure: Sometimes homeowners who are unable to maintain mortgage payments and anticipate future financial difficulties proactively choose strategic deed in lieu of foreclosure. This enables them to transfer the property to a corporation before the situation worsens, avoiding extensive legal proceedings and potential long-term financial consequences. 4. Corporate Assistance Deed in Lieu of Foreclosure: Under this specialized arrangement, a corporation actively assists husband and wife in completing the Deed in Lieu of Foreclosure process. The established corporation may provide resources, guidance, and potentially financial aid to facilitate the transfer of ownership, thereby relieving the homeowners of their burdensome mortgage obligations. 5. IRS Pre-Foreclosure Sale Deed in Lieu of Foreclosure: In some cases, homeowners facing foreclosure in Downey, California, who meet specific Internal Revenue Service (IRS) criteria, may qualify for a Pre-Foreclosure Sale Deed in Lieu of Foreclosure. This allows them to transfer the property to a corporation as part of a pre-approved arrangement, reducing potential tax consequences and potentially obtaining additional benefits. Navigating the Deed in Lieu of Foreclosure process can be complex, and seeking professional guidance from experienced attorneys and real estate professionals is highly recommended. Always consult legal and financial experts to fully understand the implications and specific options available in Downey, California, for your unique situation.