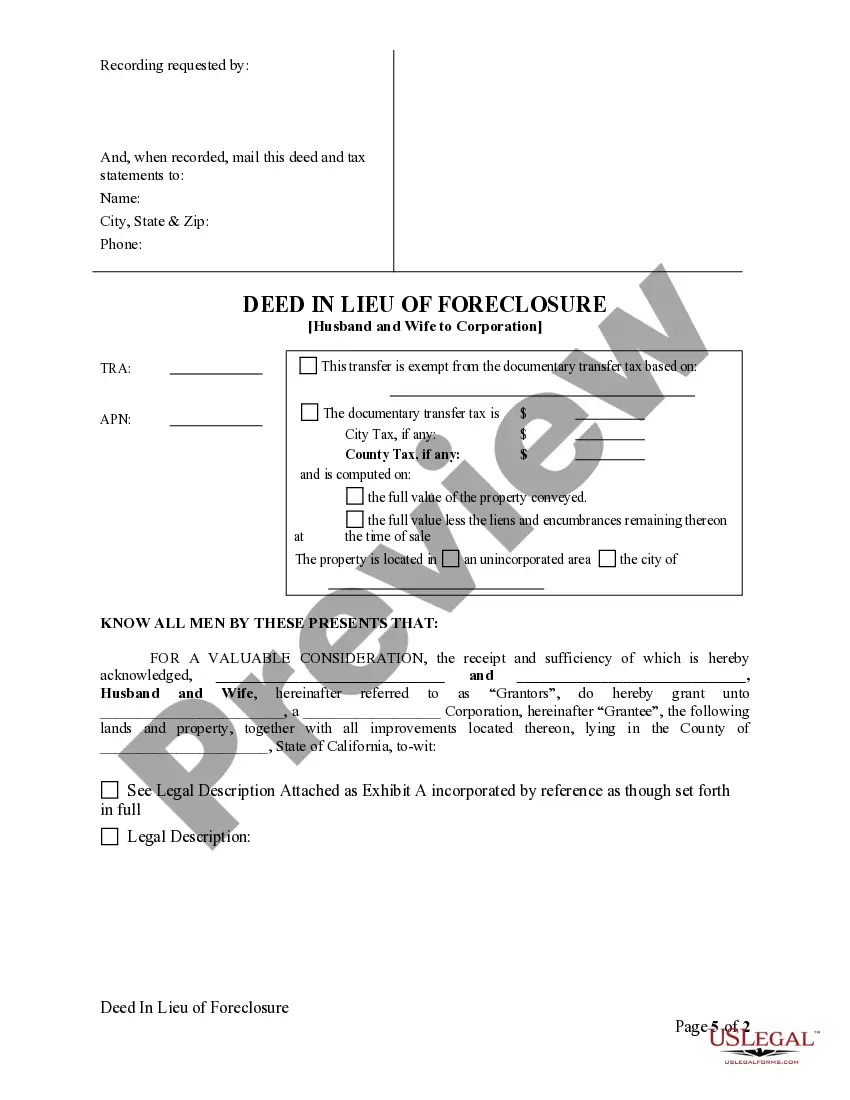

This form is a Deed in Lieu of Foreclosure from a Husband and Wife Grantors to a Corporation as Grantee. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process in which a couple facing foreclosure on their property voluntarily transfers ownership to a corporation to avoid the negative impacts of a traditional foreclosure. This article will provide a comprehensive overview of this particular type of deed in lieu of foreclosure in Simi Valley, California, explaining the process, benefits, requirements, and potential variations. A deed in lieu of foreclosure is a solution often considered by homeowners when they are unable to meet their mortgage obligations and wish to avoid going through the stressful and time-consuming foreclosure process. In this case, the property owners, who are a husband and wife, transfer the ownership of their property to a corporation instead of the lending institution foreclosing it. Simi Valley, located in California's Ventura County, has its own specific laws and regulations regarding deeds in lieu of foreclosure. The process usually involves several essential steps, including negotiation and agreement between the homeowners, the corporation, and the lender, followed by the preparation and execution of legal documents. One significant advantage of a Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is that it allows the couple to protect their credit rating to a certain extent, as the deed in lieu may have less severe impacts on their credit history compared to a foreclosure. Additionally, this option allows the homeowners to gracefully exit the burden of an unaffordable mortgage while avoiding the financial and emotional stress associated with foreclosure proceedings. It's important to note that there might be different types or variations of this particular deed in lieu of foreclosure in Simi Valley, California. These variations could include the involvement of multiple corporations, such as real estate investment companies or special purpose entities, each serving a specific purpose in the transaction. Other types might involve the transfer of property to a corporation owned by the homeowners themselves, enabling them to retain some control or potential benefits from the property in the future. To qualify for a Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, homeowners generally need to demonstrate financial hardship and prove that they are unable to fulfill their mortgage obligations. They must also obtain consent from the lender, who will assess whether accepting the deed in lieu of foreclosure is a viable alternative compared to pursuing a foreclosure sale. In conclusion, Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation provides homeowners in financial distress with a potential solution to mitigate the negative consequences of foreclosure. By voluntarily transferring ownership to a corporation, the couple can protect their credit rating and avoid the lengthy and unpredictable foreclosure process. It is crucial for homeowners considering this option to consult with legal professionals and understand the specific requirements and variations that may exist in Simi Valley.Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is a legal process in which a couple facing foreclosure on their property voluntarily transfers ownership to a corporation to avoid the negative impacts of a traditional foreclosure. This article will provide a comprehensive overview of this particular type of deed in lieu of foreclosure in Simi Valley, California, explaining the process, benefits, requirements, and potential variations. A deed in lieu of foreclosure is a solution often considered by homeowners when they are unable to meet their mortgage obligations and wish to avoid going through the stressful and time-consuming foreclosure process. In this case, the property owners, who are a husband and wife, transfer the ownership of their property to a corporation instead of the lending institution foreclosing it. Simi Valley, located in California's Ventura County, has its own specific laws and regulations regarding deeds in lieu of foreclosure. The process usually involves several essential steps, including negotiation and agreement between the homeowners, the corporation, and the lender, followed by the preparation and execution of legal documents. One significant advantage of a Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation is that it allows the couple to protect their credit rating to a certain extent, as the deed in lieu may have less severe impacts on their credit history compared to a foreclosure. Additionally, this option allows the homeowners to gracefully exit the burden of an unaffordable mortgage while avoiding the financial and emotional stress associated with foreclosure proceedings. It's important to note that there might be different types or variations of this particular deed in lieu of foreclosure in Simi Valley, California. These variations could include the involvement of multiple corporations, such as real estate investment companies or special purpose entities, each serving a specific purpose in the transaction. Other types might involve the transfer of property to a corporation owned by the homeowners themselves, enabling them to retain some control or potential benefits from the property in the future. To qualify for a Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation, homeowners generally need to demonstrate financial hardship and prove that they are unable to fulfill their mortgage obligations. They must also obtain consent from the lender, who will assess whether accepting the deed in lieu of foreclosure is a viable alternative compared to pursuing a foreclosure sale. In conclusion, Simi Valley California Deed in Lieu of Foreclosure — Husband and Wife to Corporation provides homeowners in financial distress with a potential solution to mitigate the negative consequences of foreclosure. By voluntarily transferring ownership to a corporation, the couple can protect their credit rating and avoid the lengthy and unpredictable foreclosure process. It is crucial for homeowners considering this option to consult with legal professionals and understand the specific requirements and variations that may exist in Simi Valley.