An estoppel affidavit enables a property owner, the grantor, to convey complete title of his property to the grantee so that the grantee assumes all obligations of the grantor. It can also act as a certificate in which a borrower certifies the amount owed on a mortgage loan and the rate of interest.

Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure

Description

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

Finding validated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms database.

It's an online repository of over 85,000 legal documents for both personal and business requirements and various real-life scenarios.

All the papers are well-organized by area of application and jurisdiction categories, making it as straightforward as ABC to search for the Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure.

Maintaining paperwork organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates for any requirements readily available!

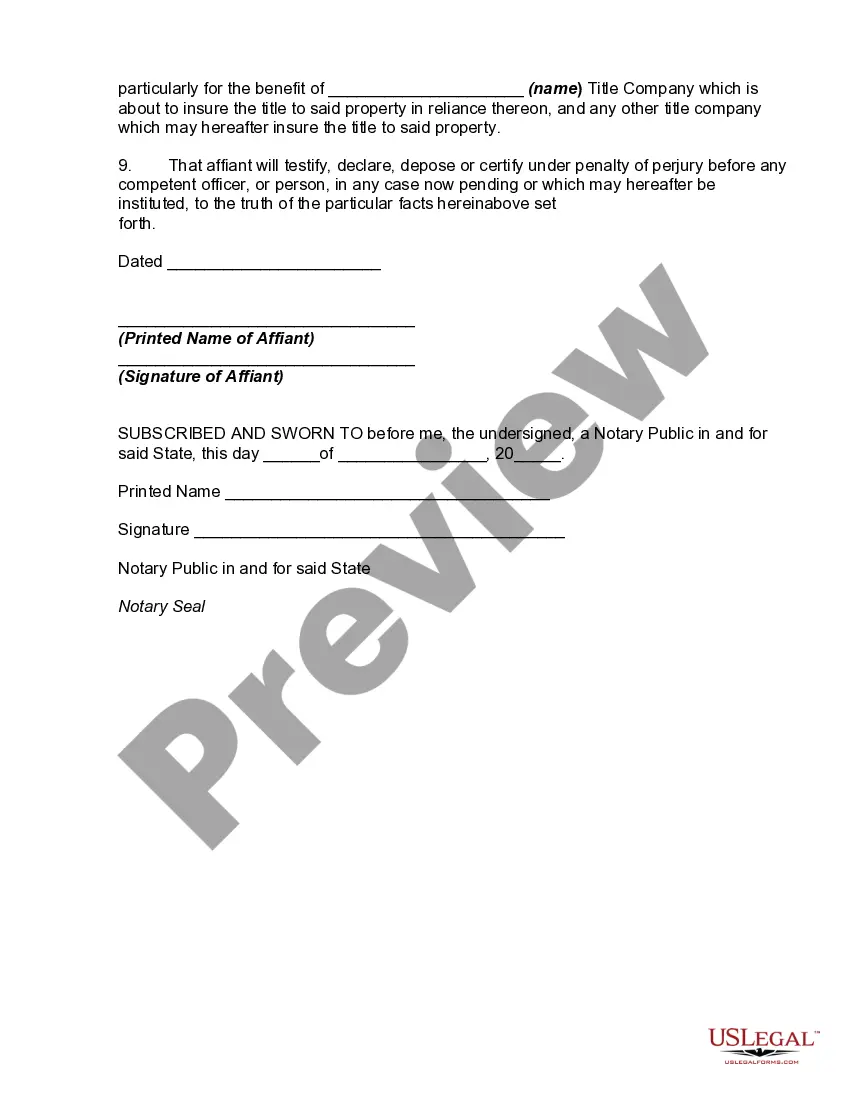

- Review the Preview mode and form description.

- Ensure you’ve chosen the right one that satisfies your needs and completely aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- Once you spot any discrepancy, utilize the Search tab above to find the right one. If it fits your needs, move on to the next step.

- Purchase the document.

Form popularity

FAQ

One significant disadvantage of a deed in lieu foreclosure is the potential impact on your credit score. While it may affect your credit less severely than a full foreclosure, it still represents a financial struggle and can make future borrowing more challenging. Additionally, lenders may require you to sign a Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which confirms your understanding of the process and its implications. To navigate these complexities, you might consider utilizing our platform at US Legal Forms, where you can find resources and documentation to assist you.

A lender is not obligated to accept a deed in lieu of foreclosure; they have the discretion to approve or deny your request. However, demonstrating your willingness to cooperate and providing necessary documentation can improve your chances. Using the Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can serve as a helpful tool in negotiations with your lender.

To file a deed in lieu of foreclosure, begin by contacting your lender to express your interest in this option. You will need to complete necessary paperwork, including the Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure. It’s advisable to obtain guidance from professionals or platforms like US Legal Forms to ensure all documents are filed correctly.

Obtaining a deed in lieu of foreclosure usually requires a few steps, including negotiations with your lender. Generally, you can expect to receive the final deed within a few weeks after the application is approved. For assistance, consider utilizing services like US Legal Forms to streamline the Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure process.

The process for a deed in lieu of foreclosure can vary, but typically it takes several weeks to a few months to complete. Once both parties agree, the lender will review your financial situation and the property condition. It’s crucial to engage in discussions with your lender about Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure to expedite the process.

Yes, purchasing a house after a deed in lieu of foreclosure is possible, but it comes with challenges. Most lenders will require a waiting period of several years before approving a new mortgage. During this time, rebuilding your credit score and demonstrating financial responsibility becomes essential. A Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can aid in smoothing your recovery process, providing documentation of your situation.

A key disadvantage of a deed in lieu of foreclosure is the potential impact on your credit score. This can affect your ability to secure financing in the future. Additionally, the lender may not accept the agreement if your property has liens or additional obligations attached. By utilizing a Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, you can help clarify your position and mitigate some risks.

Processing a deed in lieu of foreclosure involves several steps. First, communicate with your lender to express your intent and gather required documentation. Next, complete the necessary forms, including the Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which clarifies your agreement terms. Finally, ensure you understand all implications and finalize the transfer of ownership with your lender.

Despite its potential benefits, a deed in lieu of foreclosure has some drawbacks. Homeowners face potential tax implications on forgiven debt, which can complicate financial recovery. Furthermore, lenders may require a thorough evaluation of your circumstances, leading to delays. Understanding these factors is essential, and a Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can assist in protecting your rights.

Considering a deed in lieu of foreclosure in Sunnyvale, California, can be beneficial for those seeking a fresh start. It allows homeowners to hand over the property to the lender, potentially avoiding the lengthy foreclosure process. However, assessing your financial situation and consulting with a legal expert is crucial. Additionally, using a Sunnyvale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can provide clarity on your obligations.