An amendment to a document is a change in a legal document made by adding, altering, or omitting a certain part or term. Amended documents, when properly executed (signed by all parties concerned), retain the legal validity of the original document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rialto California Pagaré Modificado y Reexpresado - California Amended and Restated Promissory Note

State:

California

City:

Rialto

Control #:

CA-02625BG

Format:

Word

Instant download

Description

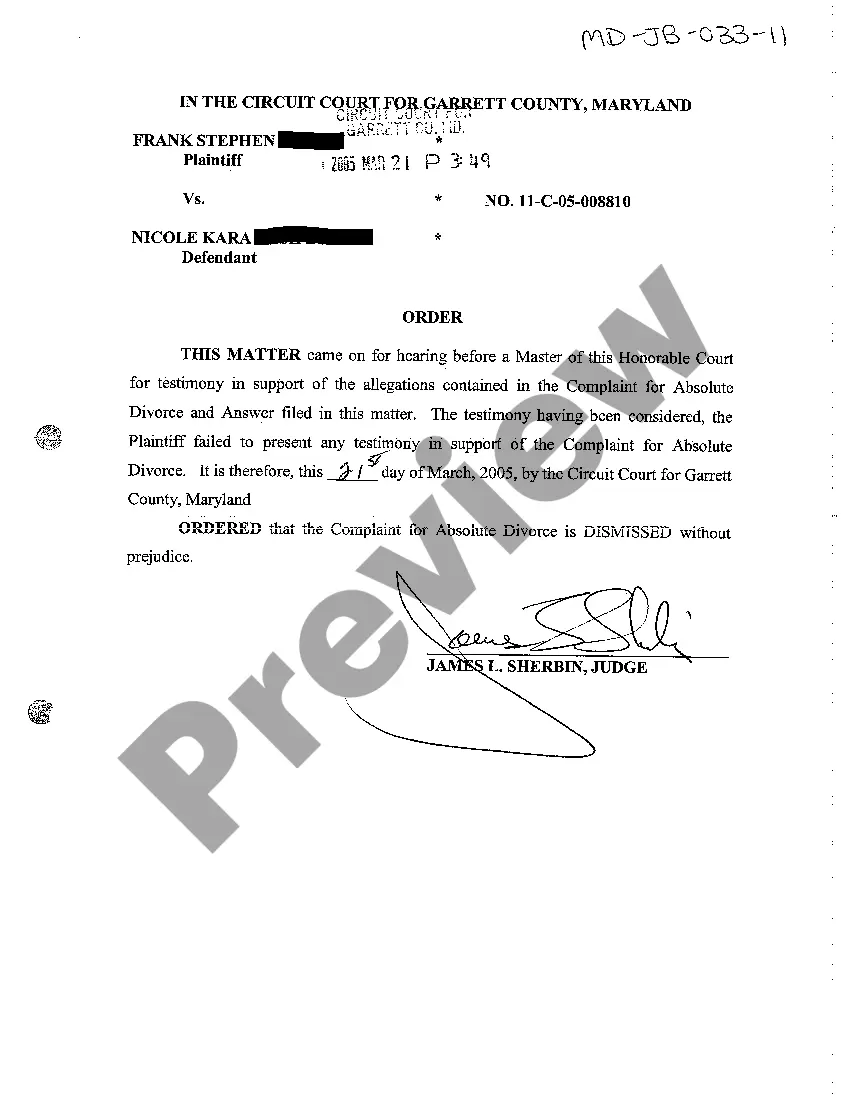

Free preview

How to fill out California Pagaré Modificado Y Reexpresado?

If you are looking for an appropriate form, it’s hard to find a superior platform than the US Legal Forms website – one of the largest collections available online.

Here you can obtain a vast array of form examples for both organizational and personal needs categorized by type and region, or by specific keywords.

With the enhanced search feature, acquiring the latest Rialto California Amended and Restated Promissory Note is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the file format and download it to your device. Edit. Fill out, modify, print, and sign the obtained Rialto California Amended and Restated Promissory Note.

- Furthermore, the relevance of each document is validated by a team of experienced attorneys who regularly assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our service and have an account, all that is required to obtain the Rialto California Amended and Restated Promissory Note is to Log In to your account and click the Download option.

- If this is your first time using US Legal Forms, simply follow the instructions outlined below.

- Ensure you have selected the form you need. Review its description and use the Preview feature to examine its contents. If it does not satisfy your needs, use the Search function at the top of the page to locate the desired document.

- Verify your selection. Click on the Buy now option. Then, choose the preferred payment plan and provide information to create an account.