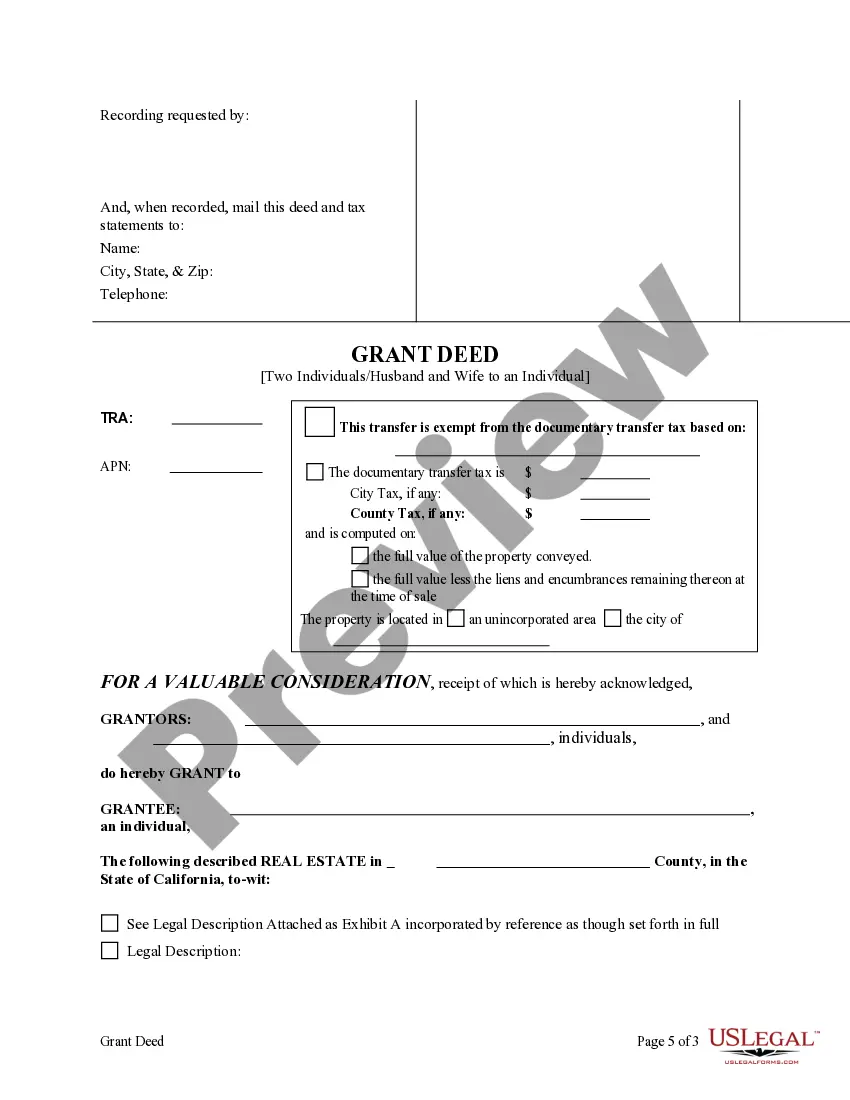

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Simi Valley California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual: Explained In Simi Valley, California, the Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual is a legally binding document that allows property owners to transfer their real estate interests to another person while retaining full control and benefits during their lifetime. This type of deed is commonly used for estate planning purposes, as it offers various advantages for both the granters (property owners) and the grantees (individual receiving the property). When utilizing this deed, the granters, who can either be two individuals or a husband and wife, transfer the property to an individual, who becomes the remainder man. Although the granters retain a life estate, meaning they can live in or use the property during their lifetime, the remainder man gains certain rights and benefits that differ from a traditional life estate deed. One key aspect of the Enhanced Life Estate or Lady Bird Grant Deed is that the granters have the power to revoke or change the deed at any time without requiring the consent of the remainder man. This feature allows them flexible control and the ability to maintain the property as they see fit throughout their lives. Another significant advantage of this type of deed is that the remainder man's interest in the property is protected from the granters' debts or liabilities. Therefore, creditors of the granters cannot make claims against the property during their lifetime, providing added security for the remainder man. Furthermore, upon the granters' passing, the property automatically transfers to the remainder man without going through probate. This means that it bypasses the potentially costly and time-consuming probate process, allowing for a smoother transition of ownership. It is important to note that while the Enhanced Life Estate or Lady Bird Grant Deed is commonly known by these names, there may be variations in their terminology or specific requirements based on local laws and regulations. It is essential to consult with a qualified attorney in Simi Valley or the state of California to ensure compliance with all legal requirements and to fully understand the implications of utilizing this type of deed. In conclusion, the Simi Valley California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual provides a unique estate planning tool that allows property owners to transfer their assets to a designated individual while maintaining control and benefits during their lifetime. Considered for its flexibility, creditor protection, and probate avoidance, this deed offers a versatile solution for property owners seeking to secure their future and that of their chosen beneficiaries.Simi Valley California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual: Explained In Simi Valley, California, the Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual is a legally binding document that allows property owners to transfer their real estate interests to another person while retaining full control and benefits during their lifetime. This type of deed is commonly used for estate planning purposes, as it offers various advantages for both the granters (property owners) and the grantees (individual receiving the property). When utilizing this deed, the granters, who can either be two individuals or a husband and wife, transfer the property to an individual, who becomes the remainder man. Although the granters retain a life estate, meaning they can live in or use the property during their lifetime, the remainder man gains certain rights and benefits that differ from a traditional life estate deed. One key aspect of the Enhanced Life Estate or Lady Bird Grant Deed is that the granters have the power to revoke or change the deed at any time without requiring the consent of the remainder man. This feature allows them flexible control and the ability to maintain the property as they see fit throughout their lives. Another significant advantage of this type of deed is that the remainder man's interest in the property is protected from the granters' debts or liabilities. Therefore, creditors of the granters cannot make claims against the property during their lifetime, providing added security for the remainder man. Furthermore, upon the granters' passing, the property automatically transfers to the remainder man without going through probate. This means that it bypasses the potentially costly and time-consuming probate process, allowing for a smoother transition of ownership. It is important to note that while the Enhanced Life Estate or Lady Bird Grant Deed is commonly known by these names, there may be variations in their terminology or specific requirements based on local laws and regulations. It is essential to consult with a qualified attorney in Simi Valley or the state of California to ensure compliance with all legal requirements and to fully understand the implications of utilizing this type of deed. In conclusion, the Simi Valley California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual provides a unique estate planning tool that allows property owners to transfer their assets to a designated individual while maintaining control and benefits during their lifetime. Considered for its flexibility, creditor protection, and probate avoidance, this deed offers a versatile solution for property owners seeking to secure their future and that of their chosen beneficiaries.