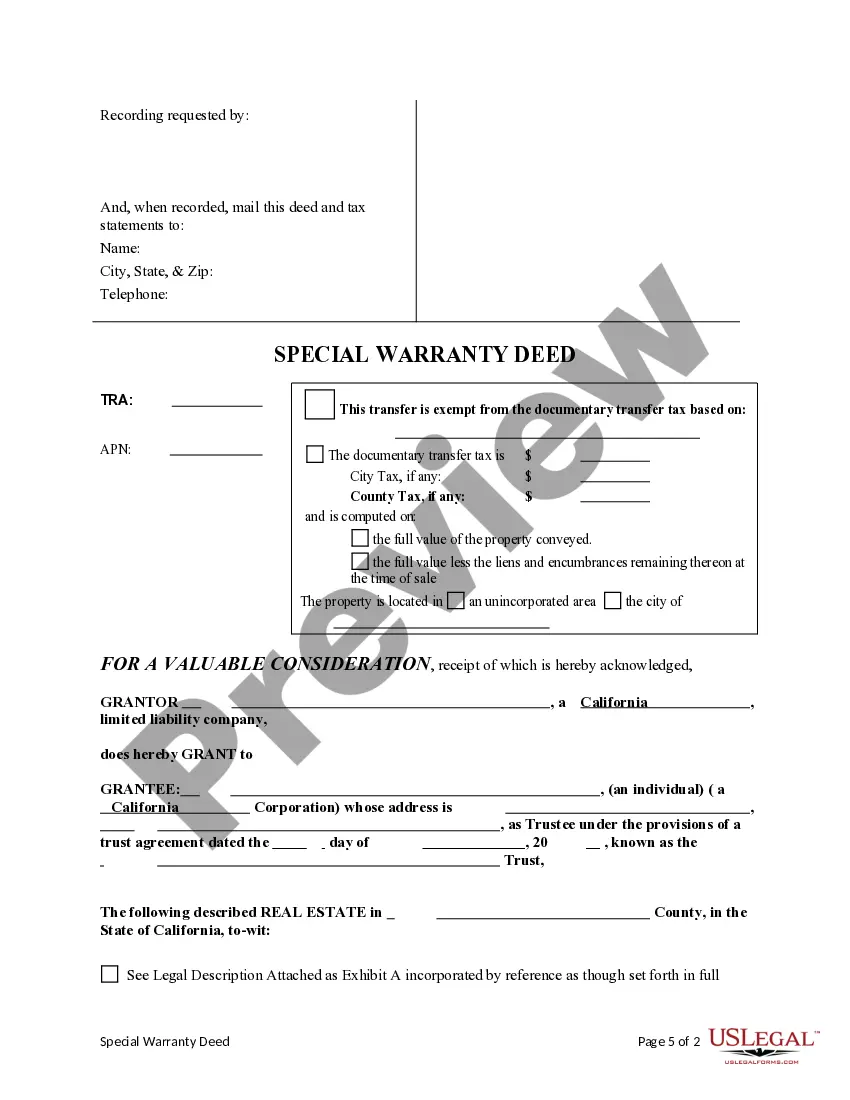

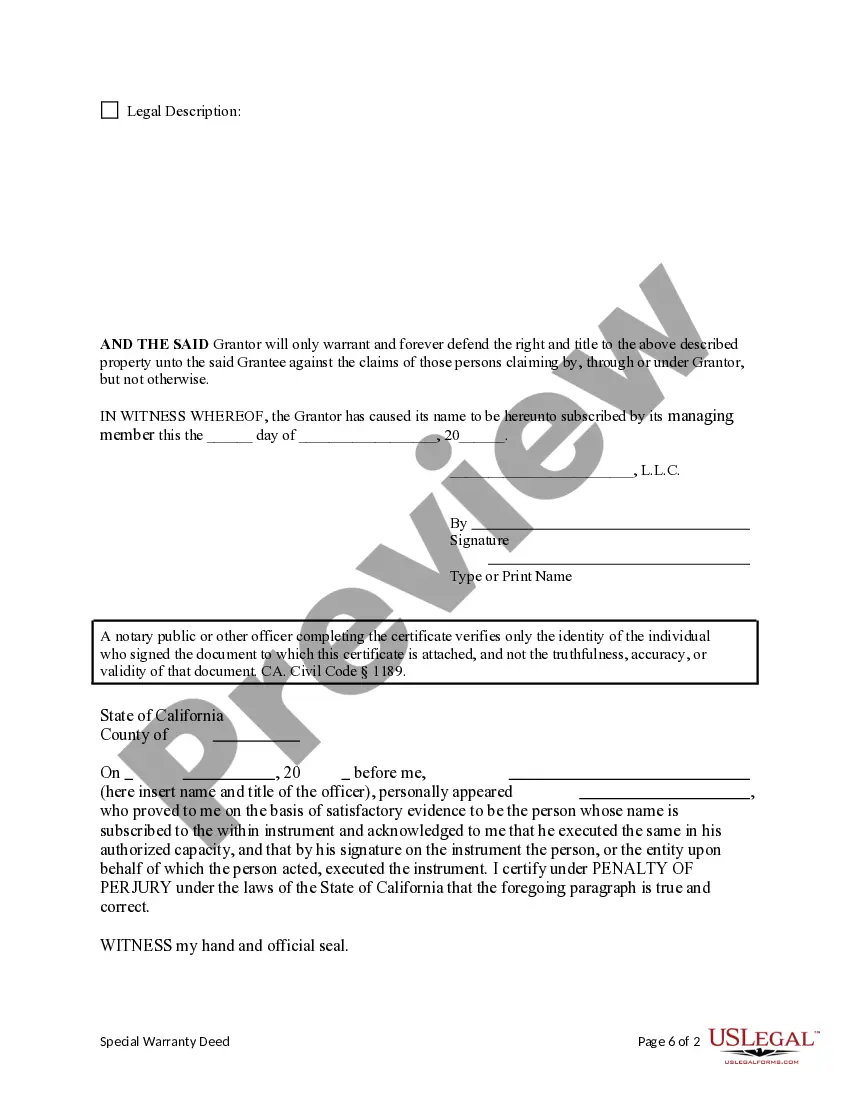

This form is a Special Warranty Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Inglewood, California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that facilitates the transfer of ownership from an LLC to a trust for a property located in Inglewood, California. This type of deed ensures that the LLC holds some liability protection while transferring the property to a trust. It is beneficial for individuals or entities who want to protect their assets and estate planning purposes. The Inglewood California Special Warranty Deed — Limited Liability Company to a Trust is specifically designed for real estate transactions taking place in Inglewood, California. It enables the LLC to transfer ownership rights and title of a property to a trust. The Special Warranty Deed guarantees that the LLC, as the granter, holds a clear title to the property, but only warrants against any issues that arose during the time the LLC held ownership. This means that the grantee, in this case, the trust, receives the property with limited warranty protection. There can be variations of the Inglewood California Special Warranty Deed — Limited Liability Company to a Trust, depending on the specific requirements and agreements between the parties involved. These variations may include: 1. Inglewood California Special Warranty Deed — Limited Liability Company to a revocable living trust: This type of deed allows the LLC to transfer the property to a revocable living trust. A revocable living trust is a popular choice for estate planning, as it offers flexibility and allows the granter to retain control over their assets during their lifetime. 2. Inglewood California Special Warranty Deed — Limited Liability Company to an irrevocable trust: This variation involves transferring the property to an irrevocable trust. Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked once established. This type of trust offers additional asset protection and tax planning benefits. 3. Inglewood California Special Warranty Deed — Limited Liability Company to a charitable trust: In some cases, an LLC may transfer the property to a charitable trust. This type of trust is established for charitable purposes, and the ownership transfer can potentially result in tax benefits for the granter. It is essential to consult with legal professionals familiar with California state laws and real estate regulations when considering the use of Inglewood California Special Warranty Deed — Limited Liability Company to a Trust. They can provide guidance and ensure compliance with all legal requirements to protect the interests of both the LLC as the granter and the trust as the grantee.Inglewood, California Special Warranty Deed — Limited Liability Company to a Trust is a legal document that facilitates the transfer of ownership from an LLC to a trust for a property located in Inglewood, California. This type of deed ensures that the LLC holds some liability protection while transferring the property to a trust. It is beneficial for individuals or entities who want to protect their assets and estate planning purposes. The Inglewood California Special Warranty Deed — Limited Liability Company to a Trust is specifically designed for real estate transactions taking place in Inglewood, California. It enables the LLC to transfer ownership rights and title of a property to a trust. The Special Warranty Deed guarantees that the LLC, as the granter, holds a clear title to the property, but only warrants against any issues that arose during the time the LLC held ownership. This means that the grantee, in this case, the trust, receives the property with limited warranty protection. There can be variations of the Inglewood California Special Warranty Deed — Limited Liability Company to a Trust, depending on the specific requirements and agreements between the parties involved. These variations may include: 1. Inglewood California Special Warranty Deed — Limited Liability Company to a revocable living trust: This type of deed allows the LLC to transfer the property to a revocable living trust. A revocable living trust is a popular choice for estate planning, as it offers flexibility and allows the granter to retain control over their assets during their lifetime. 2. Inglewood California Special Warranty Deed — Limited Liability Company to an irrevocable trust: This variation involves transferring the property to an irrevocable trust. Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked once established. This type of trust offers additional asset protection and tax planning benefits. 3. Inglewood California Special Warranty Deed — Limited Liability Company to a charitable trust: In some cases, an LLC may transfer the property to a charitable trust. This type of trust is established for charitable purposes, and the ownership transfer can potentially result in tax benefits for the granter. It is essential to consult with legal professionals familiar with California state laws and real estate regulations when considering the use of Inglewood California Special Warranty Deed — Limited Liability Company to a Trust. They can provide guidance and ensure compliance with all legal requirements to protect the interests of both the LLC as the granter and the trust as the grantee.