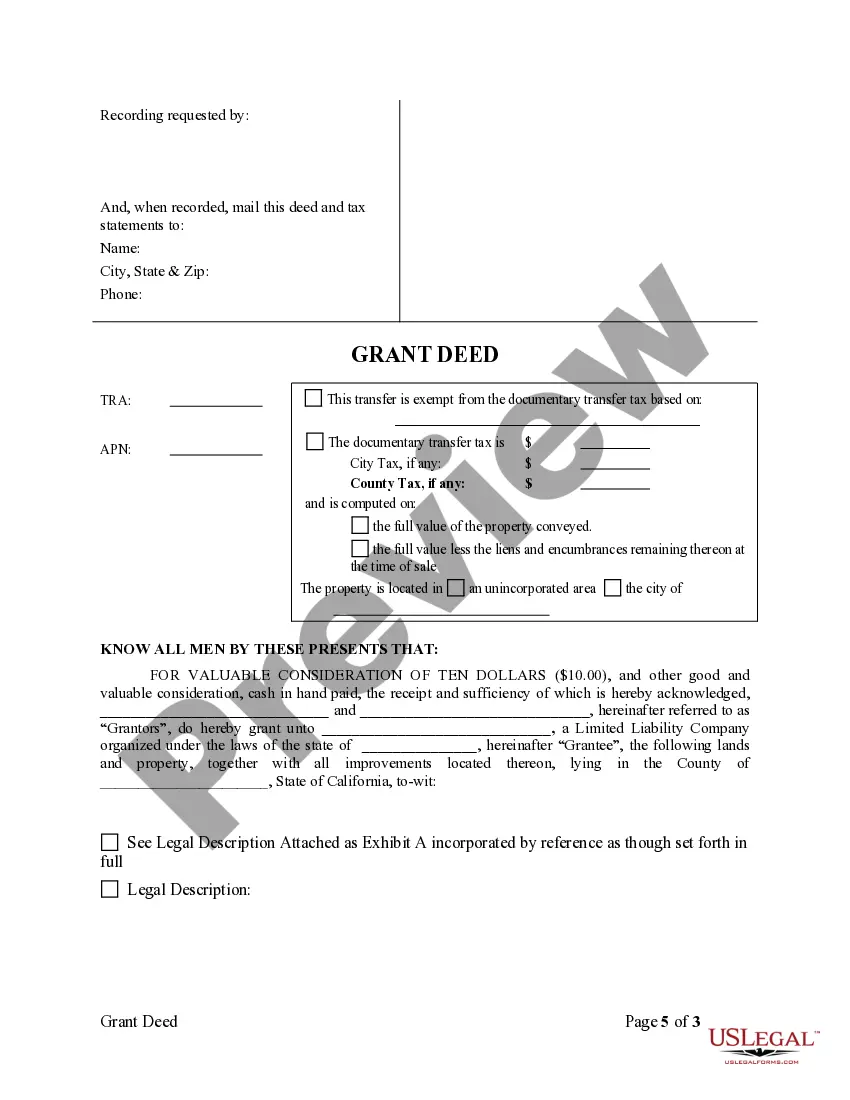

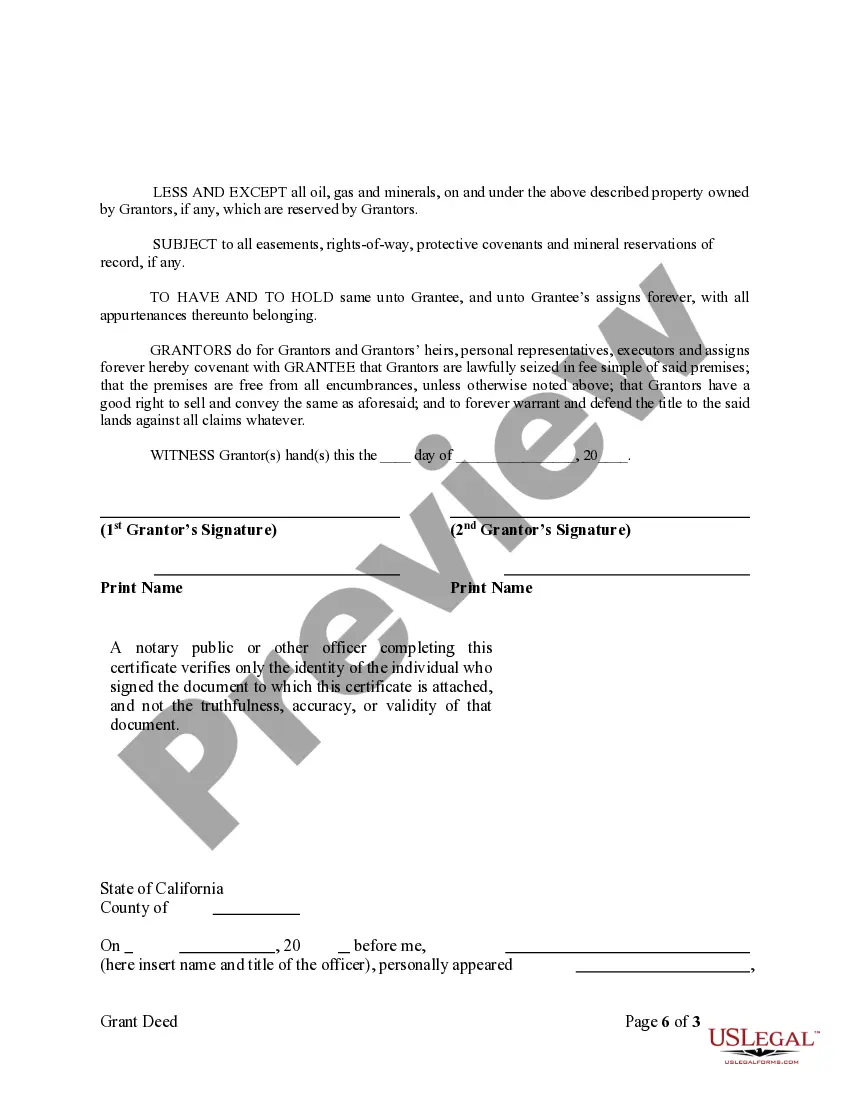

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

San Diego California Grant Deed from Two Individuals to LLC

Description

How to fill out California Grant Deed From Two Individuals To LLC?

If you have previously utilized our service, sign in to your account and download the San Diego California Grant Deed from Two Individuals to LLC onto your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it based on your payment plan.

If this is your initial use of our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: you can find them in your profile within the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business needs!

- Ensure you've found a relevant document. Review the description and utilize the Preview option, if available, to determine if it satisfies your needs. If it does not, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your San Diego California Grant Deed from Two Individuals to LLC. Select the file type for your document and save it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In California, removing a name from a deed can be achieved by executing a new grant deed that specifies the new owner. The document must be signed by all current owners and recorded at the county recorder's office. This crucial step helps clarify ownership, especially when transitioning assets from two individuals to an LLC, aligning with your estate planning goals.

To remove someone from a grant deed in San Diego, you will typically need to prepare a new grant deed that excludes the individual you want to remove. Both parties must sign the new deed, and then you must record it with the county. This process ensures that the property is legally transferred from two individuals to the LLC, maintaining the original intent of ownership.

People often place property in an LLC to gain liability protection and simplify tax reporting. An LLC can separate personal assets from business liabilities, minimizing risk for property owners. Additionally, when managing a San Diego California Grant Deed from Two Individuals to LLC, individuals may find it easier to manage multiple properties or investments under one legal entity.

Yes, you can add someone to a deed without hiring a lawyer by completing the necessary paperwork yourself. This involves drafting a new grant deed and ensuring it meets state requirements. However, navigating the specifics of a San Diego California Grant Deed from Two Individuals to LLC can be tricky, so seeking resources from platforms like uslegalforms can provide valuable guidance.

To transfer property from personal ownership to an LLC, start by drafting a grant deed that outlines the new ownership. Both the individual and the LLC must sign this deed to make the transfer valid. It's crucial to follow local regulations closely when executing a San Diego California Grant Deed from Two Individuals to LLC, ensuring proper documentation and filing.

To add someone to a grant deed in California, you need to prepare a new grant deed reflecting the changes. You must have the current property owners sign the new deed, and then submit it to the county recorder’s office for recording. This process is essential, especially when handling a San Diego California Grant Deed from Two Individuals to LLC.

One primary disadvantage of placing property in an LLC is the potential for increased costs. You may incur various fees, including setup, maintenance, and tax liabilities, in managing the LLC. Furthermore, transferring property can involve a complex process, especially when dealing with a San Diego California Grant Deed from Two Individuals to LLC, which could lead to legal hurdles.

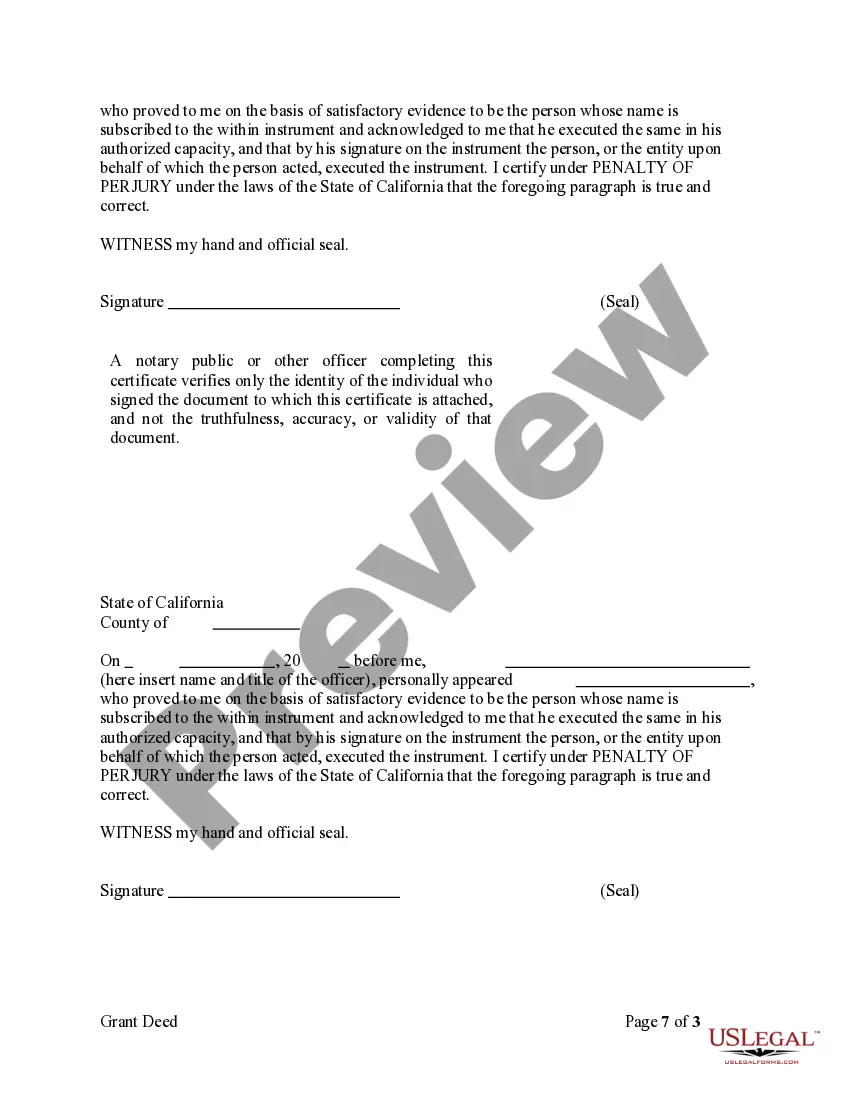

Amending a grant deed in California involves creating a new deed that includes the necessary changes. You will need to prepare the amended grant deed, sign it in front of a notary, and then file it with the county recorder's office. This process is critical for ensuring the official documentation reflects the current ownership. Utilizing services like uslegalforms can provide clarity and assistance, particularly in a San Diego California Grant Deed from Two Individuals to LLC context.

To remove someone from a grant deed in California, you must create a new grant deed that reflects the remaining owner's name. This deed must be signed by the person being removed and notarized. Subsequently, you need to file the new deed with the county recorder's office to update the public records. Ensuring you handle this correctly is important for any San Diego California Grant Deed from Two Individuals to LLC scenarios.

To transfer a deed from an individual to an LLC, you will need to create a new grant deed that specifies the LLC as the new owner. This process requires you to complete the grant deed form, sign it before a notary, and file it with the local county recorder’s office. Using resources like uslegalforms can simplify this process and ensure you fulfill all legal obligations. Such a transfer is common in a San Diego California Grant Deed from Two Individuals to LLC transaction.