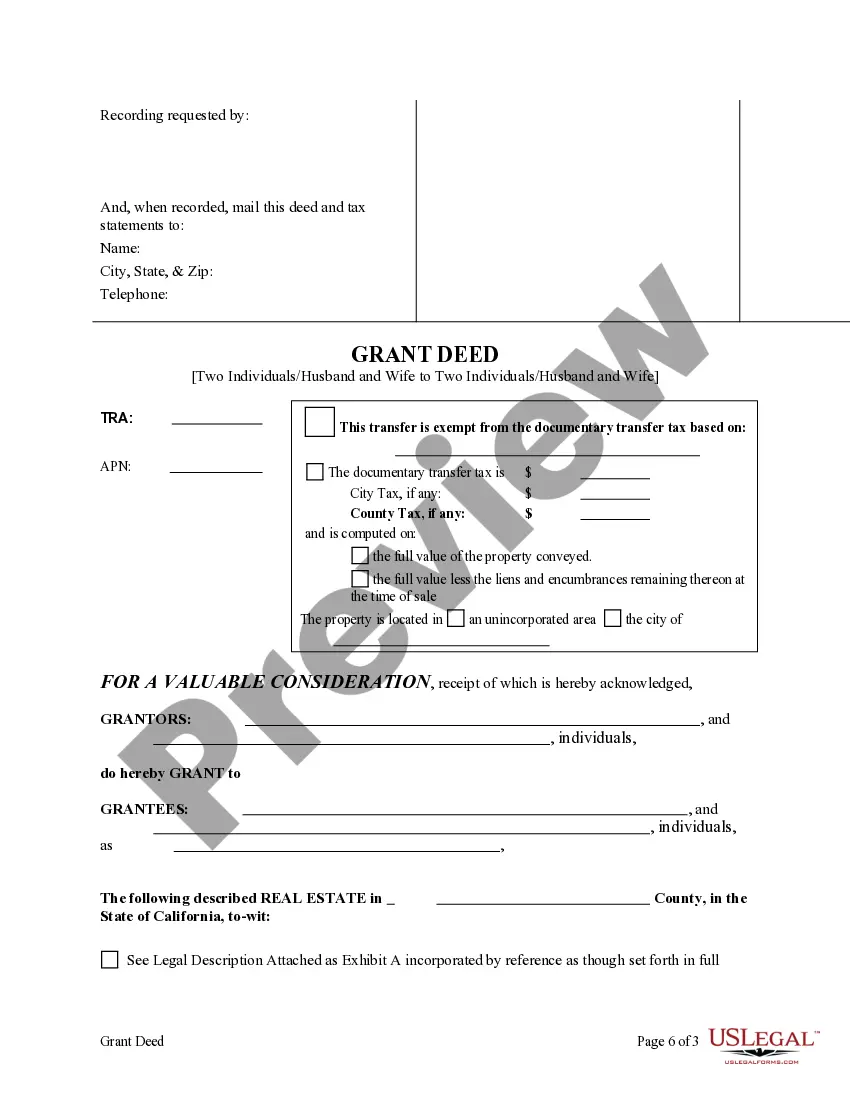

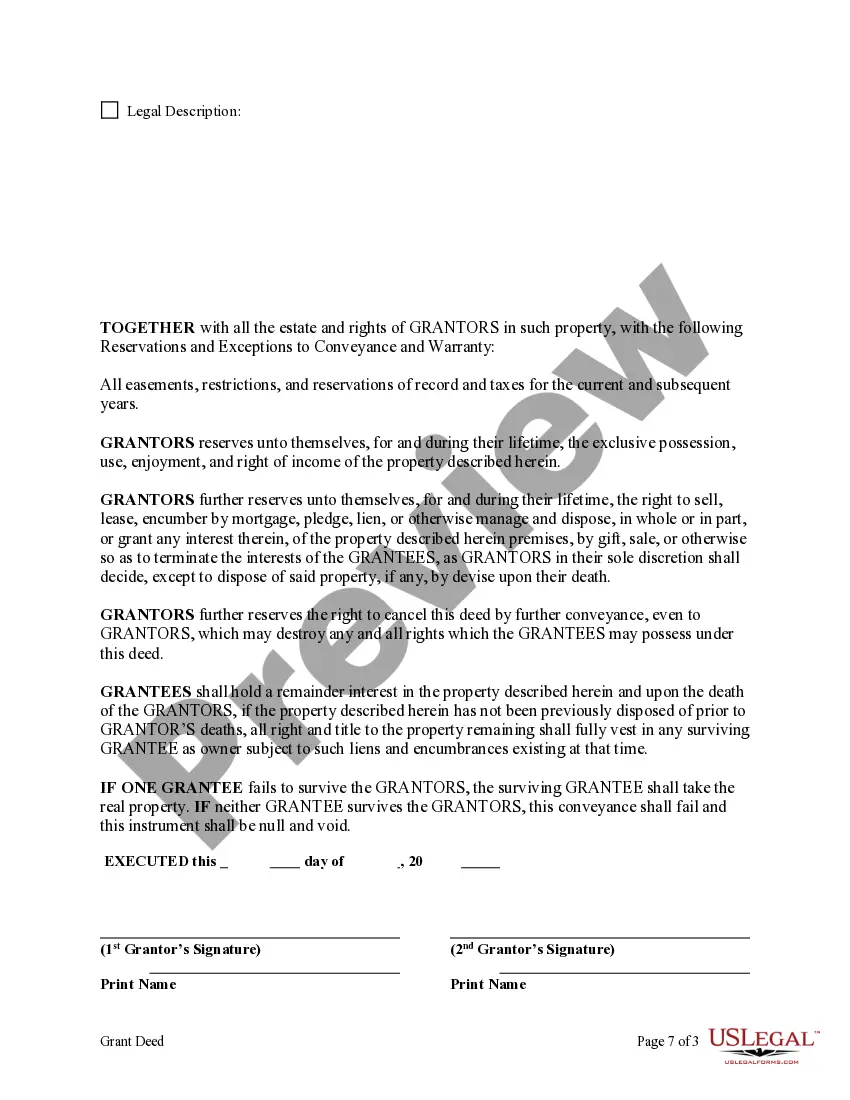

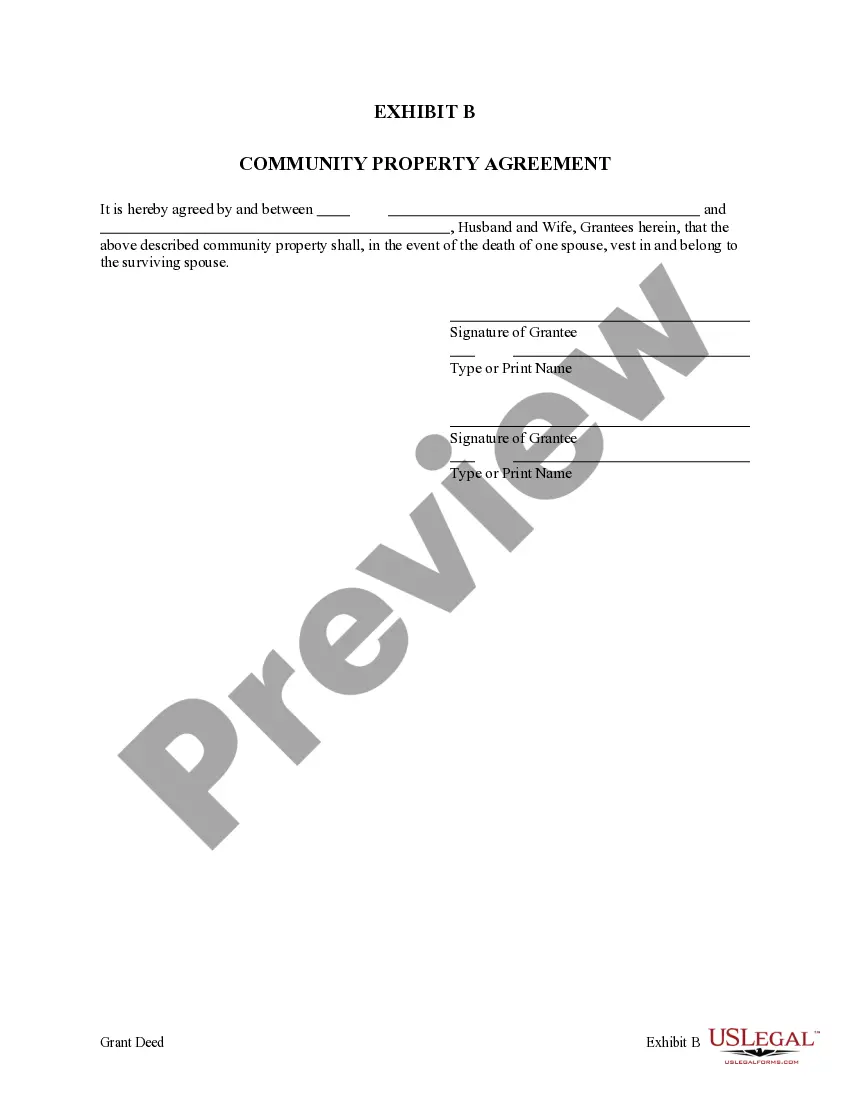

This form is a Grant Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

The Escondido California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to Two Individuals, or Husband and Wife, is a legal document that facilitates the transfer of property ownership while allowing the original owners to retain certain rights and benefits during their lifetime. This type of deed is designed to provide flexibility and protection for all parties involved. With an Enhanced Life Estate or Lady Bird Grant Deed, a married couple (or two individuals) can transfer their property to another married couple (or two individuals), while still maintaining their right to live in and use the property throughout their lives. This deed offers several advantages, such as avoiding probate, protecting the property from creditors, and ensuring a seamless transfer of ownership upon the original owners' passing. There are different variations of the Enhanced Life Estate or Lady Bird Grant Deed available in Escondido, California, each tailored to specific circumstances and preferences. One variation is the Traditional Enhanced Life Estate, which grants the original owners the right to live on the property until their death or decision to move. Another type is the Stepped-Up Basis Enhanced Life Estate, which allows for a tax advantage by preserving the stepped-up basis of the property for the remainder beneficiaries upon the original owners' passing. The Escondido California Enhanced Life Estate or Lady Bird Grant Deed is a popular estate planning tool that offers flexibility and peace of mind for property owners. It is important to consult with a qualified attorney or real estate professional to understand the specific requirements and implications of this deed, as it involves legal and financial considerations. Implementing this deed can help ensure a smooth and efficient transfer of property ownership, reducing the burden on loved ones and preserving the intended beneficiaries' interests.The Escondido California Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to Two Individuals, or Husband and Wife, is a legal document that facilitates the transfer of property ownership while allowing the original owners to retain certain rights and benefits during their lifetime. This type of deed is designed to provide flexibility and protection for all parties involved. With an Enhanced Life Estate or Lady Bird Grant Deed, a married couple (or two individuals) can transfer their property to another married couple (or two individuals), while still maintaining their right to live in and use the property throughout their lives. This deed offers several advantages, such as avoiding probate, protecting the property from creditors, and ensuring a seamless transfer of ownership upon the original owners' passing. There are different variations of the Enhanced Life Estate or Lady Bird Grant Deed available in Escondido, California, each tailored to specific circumstances and preferences. One variation is the Traditional Enhanced Life Estate, which grants the original owners the right to live on the property until their death or decision to move. Another type is the Stepped-Up Basis Enhanced Life Estate, which allows for a tax advantage by preserving the stepped-up basis of the property for the remainder beneficiaries upon the original owners' passing. The Escondido California Enhanced Life Estate or Lady Bird Grant Deed is a popular estate planning tool that offers flexibility and peace of mind for property owners. It is important to consult with a qualified attorney or real estate professional to understand the specific requirements and implications of this deed, as it involves legal and financial considerations. Implementing this deed can help ensure a smooth and efficient transfer of property ownership, reducing the burden on loved ones and preserving the intended beneficiaries' interests.