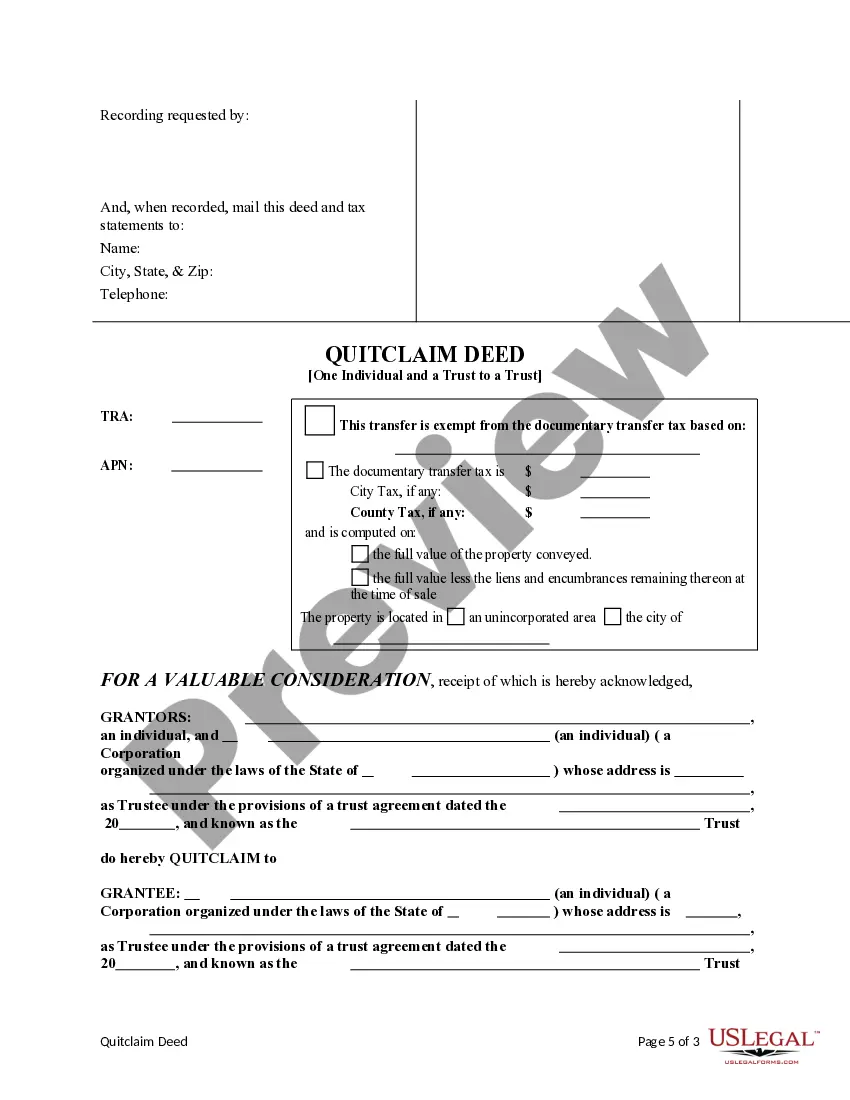

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

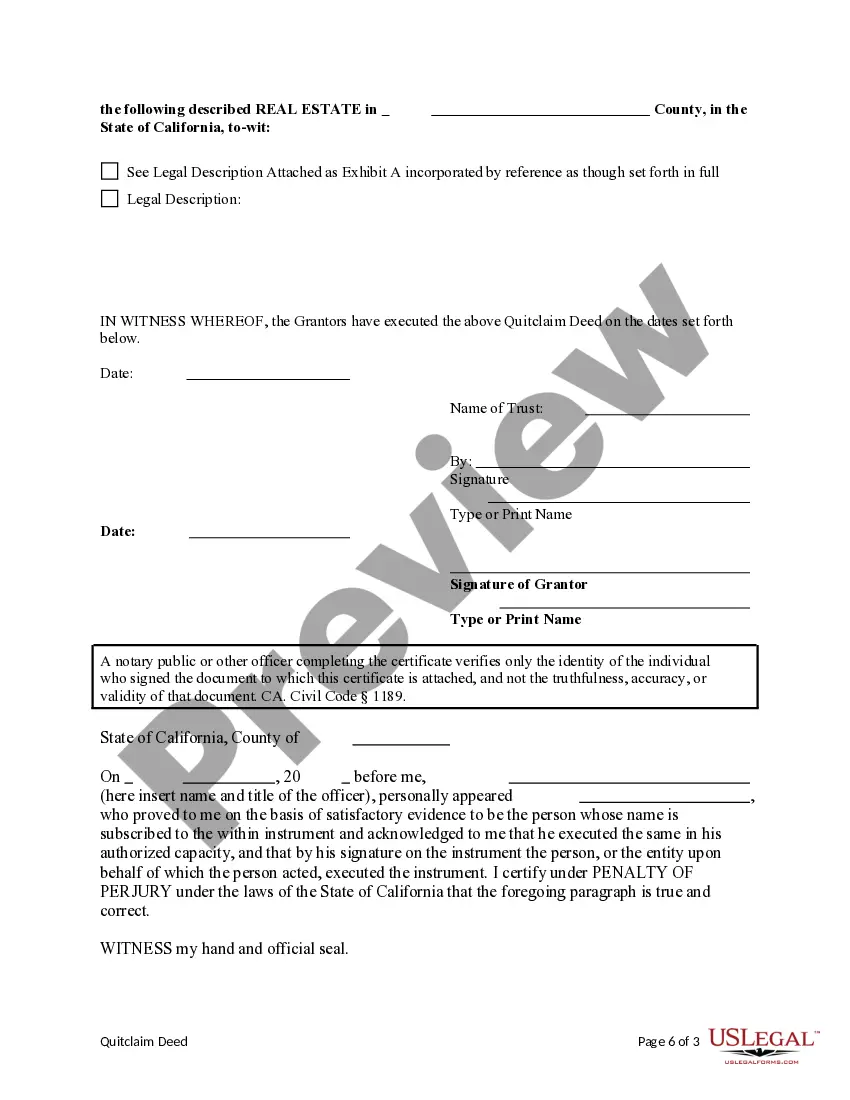

Title: Unveiling the Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: Types and Detailed Overview Introduction: If you are considering transferring property ownership in Thousand Oaks, California, a quitclaim deed can be an essential legal document to streamline the process. This article aims to provide a comprehensive understanding of a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust, exploring its main features, process, and various types that exist within this context. 1. What is a Quitclaim Deed? A quitclaim deed is a legal instrument used to transfer property ownership rights from one party (granter) to another (grantee) without making any guarantees or warranties regarding the property's title. Instead, it addresses any potential claims only from the granter's side. This deed facilitates seamless property transfers between individuals and entities, with its popularity stemming from its simplicity and efficiency. 2. Understanding the Role of Trusts in Quitclaim Deeds: In Thousand Oaks, California, individuals and trusts often utilize quitclaim deeds when transferring property interests to trusts, making the trust the new property holder. Trusts offer several benefits, including asset protection, avoiding probate, and facilitating efficient management of real estate assets. By utilizing a quitclaim deed, individuals and trusts can swiftly execute these property transfers. 3. Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: a. Individual to Trust: This type of quitclaim deed involves transferring property ownership from an individual to a trust. It typically occurs when an individual intends to place their property into a trust, gaining the benefits and protection that trusts provide. b. Trust to Trust: This type of quitclaim deed involves transferring property ownership from one trust to another. Such transfers mainly occur when there is a restructuring of trust assets or a merger of trusts while maintaining property interests. 4. Key Steps Involved in Executing Quitclaim Deeds: To ensure a smooth and legally valid transfer of property ownership, it is important to follow these essential steps when executing a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: a. Prepare the quitclaim deed document: This involves consulting with a qualified attorney or utilizing a reliable legal document preparation service to draft the quitclaim deed. b. Fill in the necessary details: Carefully fill out the names, addresses, and legal descriptions of the property involved, as well as the specific trust(s) and parties involved in the transfer. c. Notarize the document: The granter(s) must sign the quitclaim deed in the presence of a notary public, who will validate their identities and witness the signatures. d. Record the quitclaim deed: File the executed quitclaim deed at the Ventura County Clerk-Recorder's Office or the appropriate authority in Thousand Oaks to make the transfer legally binding. Conclusion: Executing a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust can be a practical legal tool for transferring property ownership. Whether individuals are transferring their property to a trust or trusts are transferring property to another trust, understanding the different types of deeds and following the necessary steps ensures a successful and legally compliant transfer process. Seek professional advice to navigate this process with precision and convenience.Title: Unveiling the Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: Types and Detailed Overview Introduction: If you are considering transferring property ownership in Thousand Oaks, California, a quitclaim deed can be an essential legal document to streamline the process. This article aims to provide a comprehensive understanding of a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust, exploring its main features, process, and various types that exist within this context. 1. What is a Quitclaim Deed? A quitclaim deed is a legal instrument used to transfer property ownership rights from one party (granter) to another (grantee) without making any guarantees or warranties regarding the property's title. Instead, it addresses any potential claims only from the granter's side. This deed facilitates seamless property transfers between individuals and entities, with its popularity stemming from its simplicity and efficiency. 2. Understanding the Role of Trusts in Quitclaim Deeds: In Thousand Oaks, California, individuals and trusts often utilize quitclaim deeds when transferring property interests to trusts, making the trust the new property holder. Trusts offer several benefits, including asset protection, avoiding probate, and facilitating efficient management of real estate assets. By utilizing a quitclaim deed, individuals and trusts can swiftly execute these property transfers. 3. Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: a. Individual to Trust: This type of quitclaim deed involves transferring property ownership from an individual to a trust. It typically occurs when an individual intends to place their property into a trust, gaining the benefits and protection that trusts provide. b. Trust to Trust: This type of quitclaim deed involves transferring property ownership from one trust to another. Such transfers mainly occur when there is a restructuring of trust assets or a merger of trusts while maintaining property interests. 4. Key Steps Involved in Executing Quitclaim Deeds: To ensure a smooth and legally valid transfer of property ownership, it is important to follow these essential steps when executing a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust: a. Prepare the quitclaim deed document: This involves consulting with a qualified attorney or utilizing a reliable legal document preparation service to draft the quitclaim deed. b. Fill in the necessary details: Carefully fill out the names, addresses, and legal descriptions of the property involved, as well as the specific trust(s) and parties involved in the transfer. c. Notarize the document: The granter(s) must sign the quitclaim deed in the presence of a notary public, who will validate their identities and witness the signatures. d. Record the quitclaim deed: File the executed quitclaim deed at the Ventura County Clerk-Recorder's Office or the appropriate authority in Thousand Oaks to make the transfer legally binding. Conclusion: Executing a Thousand Oaks California Quitclaim Deed from an Individual and a Trust to a Trust can be a practical legal tool for transferring property ownership. Whether individuals are transferring their property to a trust or trusts are transferring property to another trust, understanding the different types of deeds and following the necessary steps ensures a successful and legally compliant transfer process. Seek professional advice to navigate this process with precision and convenience.