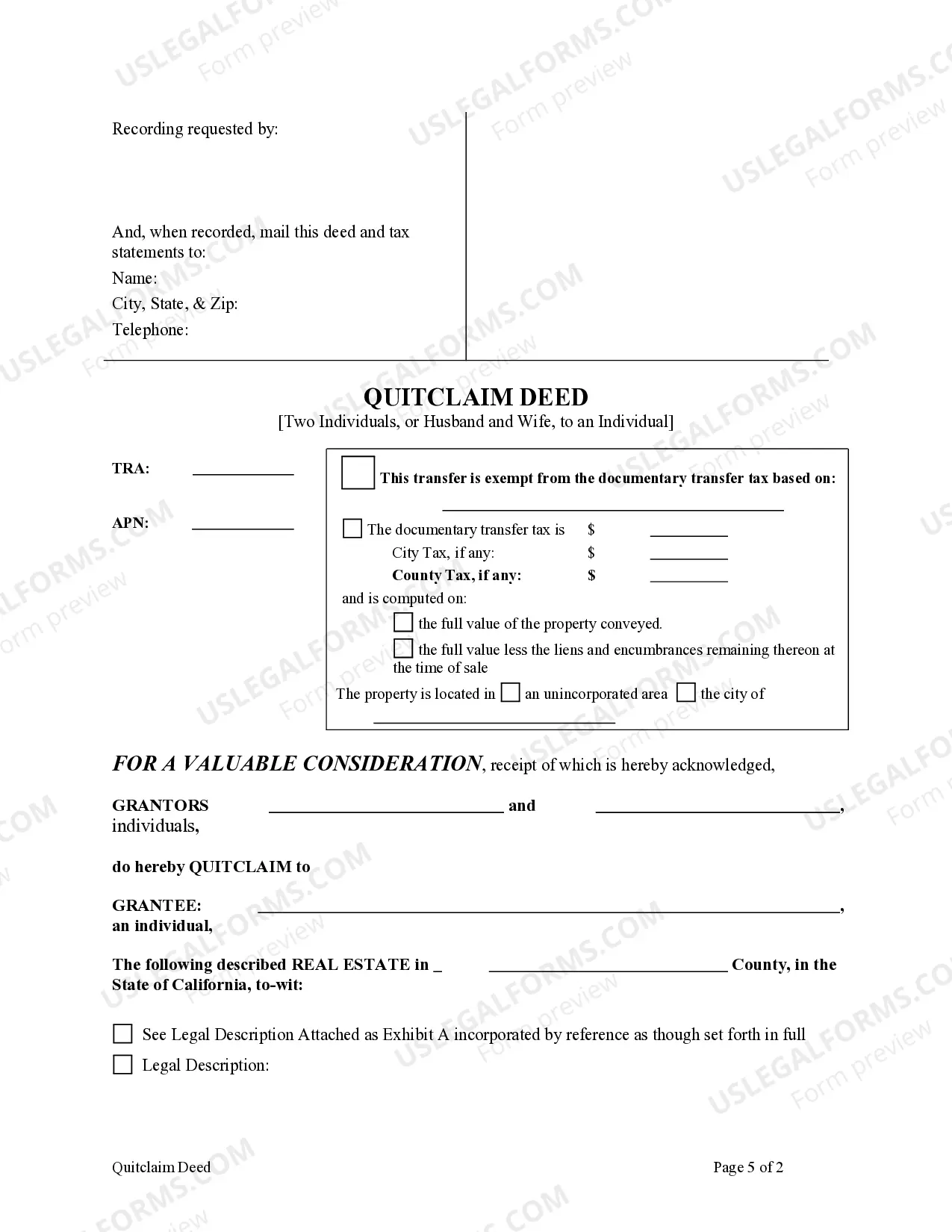

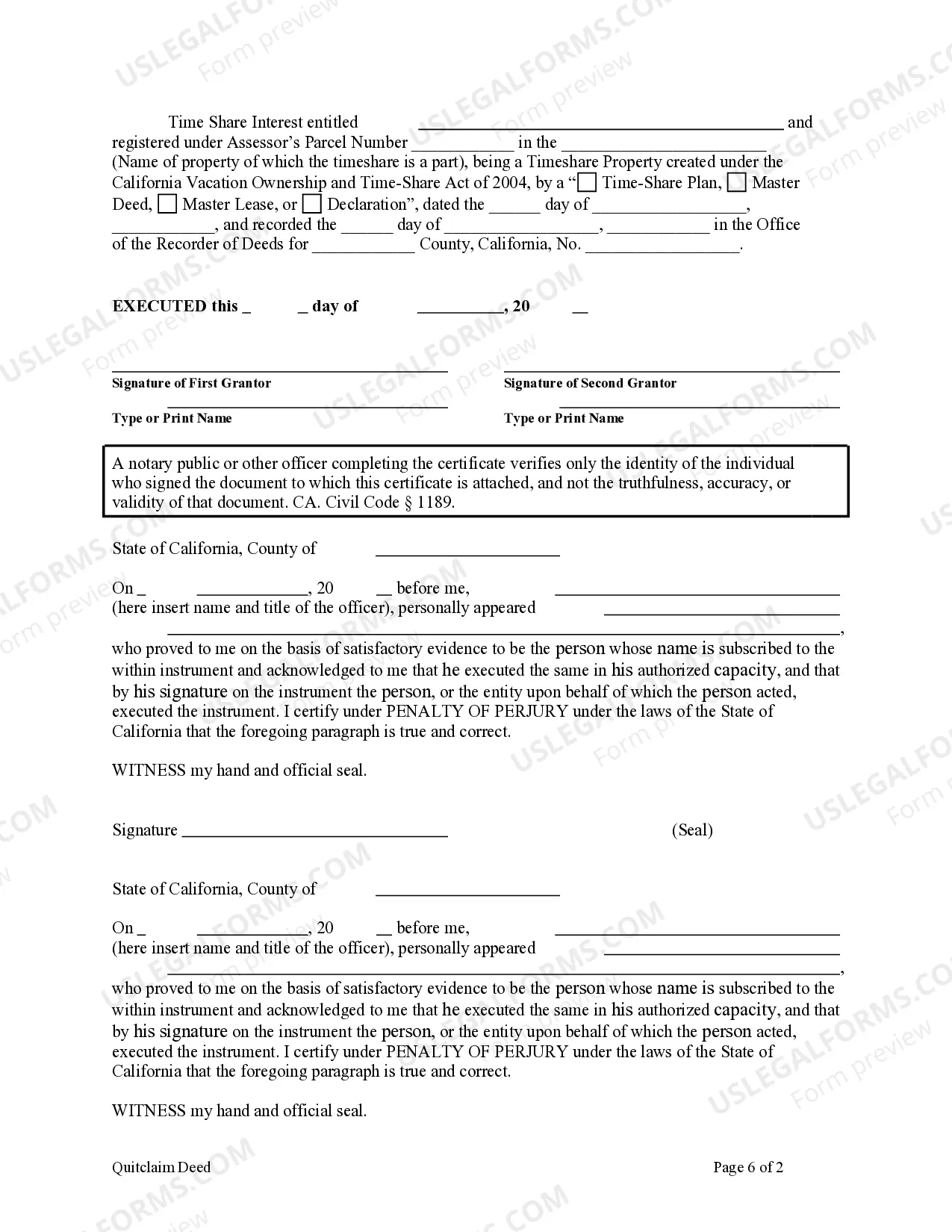

This form is a Quitclaim Deed for a Time Share where the grantors are husband and wife, or two individuals, and the grantee is an individual. Grantors convey and quitclaim any interest they might have in the described property to grantee. This deed complies with all state statutory laws.

A Salinas California Quitclaim Deed for a Time Share — Two Individuals, or Husband and Wife, to One Individual is a legal document used to transfer the ownership of a timeshare property from a couple or two individuals to a single individual. This type of deed is commonly used when one party in a married couple or partnership wants to take sole ownership of the timeshare property. In Salinas, California, there are a few variations of Quitclaim Deeds for a Time Share — Two Individuals, or Husband and Wife, to One Individual. These include: 1. Salinas Joint Tenancy Quitclaim Deed for a Time Share: This deed type allows a married couple or two individuals to transfer their joint ownership interest in a timeshare property to only one individual. It confirms the intention to sever the joint tenancy, resulting in the remaining individual becoming the sole owner. 2. Salinas Tenancy in Common Quitclaim Deed for a Time Share: This type of quitclaim deed is used when a couple or two individuals who own a timeshare property as tenants in common wish to transfer their ownership interest to a single individual. The deed clarifies that the remaining individual will now hold full ownership rights to the timeshare property. 3. Salinas Community Property Quitclaim Deed for a Time Share: This deed is commonly used by married couples who own a timeshare property as community property. It allows one spouse to relinquish their ownership rights, transferring them to the other spouse as a sole owner. The Salinas California Quitclaim Deed for a Time Share — Two Individuals, or Husband and Wife, to One Individual is an essential legal document that ensures the legal transfer of ownership rights from multiple individuals to a single individual. It should be prepared and executed according to California state laws and regulations, and it is advisable to consult with a qualified real estate attorney or professional to ensure a smooth and legally sound transfer process.A Salinas California Quitclaim Deed for a Time Share — Two Individuals, or Husband and Wife, to One Individual is a legal document used to transfer the ownership of a timeshare property from a couple or two individuals to a single individual. This type of deed is commonly used when one party in a married couple or partnership wants to take sole ownership of the timeshare property. In Salinas, California, there are a few variations of Quitclaim Deeds for a Time Share — Two Individuals, or Husband and Wife, to One Individual. These include: 1. Salinas Joint Tenancy Quitclaim Deed for a Time Share: This deed type allows a married couple or two individuals to transfer their joint ownership interest in a timeshare property to only one individual. It confirms the intention to sever the joint tenancy, resulting in the remaining individual becoming the sole owner. 2. Salinas Tenancy in Common Quitclaim Deed for a Time Share: This type of quitclaim deed is used when a couple or two individuals who own a timeshare property as tenants in common wish to transfer their ownership interest to a single individual. The deed clarifies that the remaining individual will now hold full ownership rights to the timeshare property. 3. Salinas Community Property Quitclaim Deed for a Time Share: This deed is commonly used by married couples who own a timeshare property as community property. It allows one spouse to relinquish their ownership rights, transferring them to the other spouse as a sole owner. The Salinas California Quitclaim Deed for a Time Share — Two Individuals, or Husband and Wife, to One Individual is an essential legal document that ensures the legal transfer of ownership rights from multiple individuals to a single individual. It should be prepared and executed according to California state laws and regulations, and it is advisable to consult with a qualified real estate attorney or professional to ensure a smooth and legally sound transfer process.