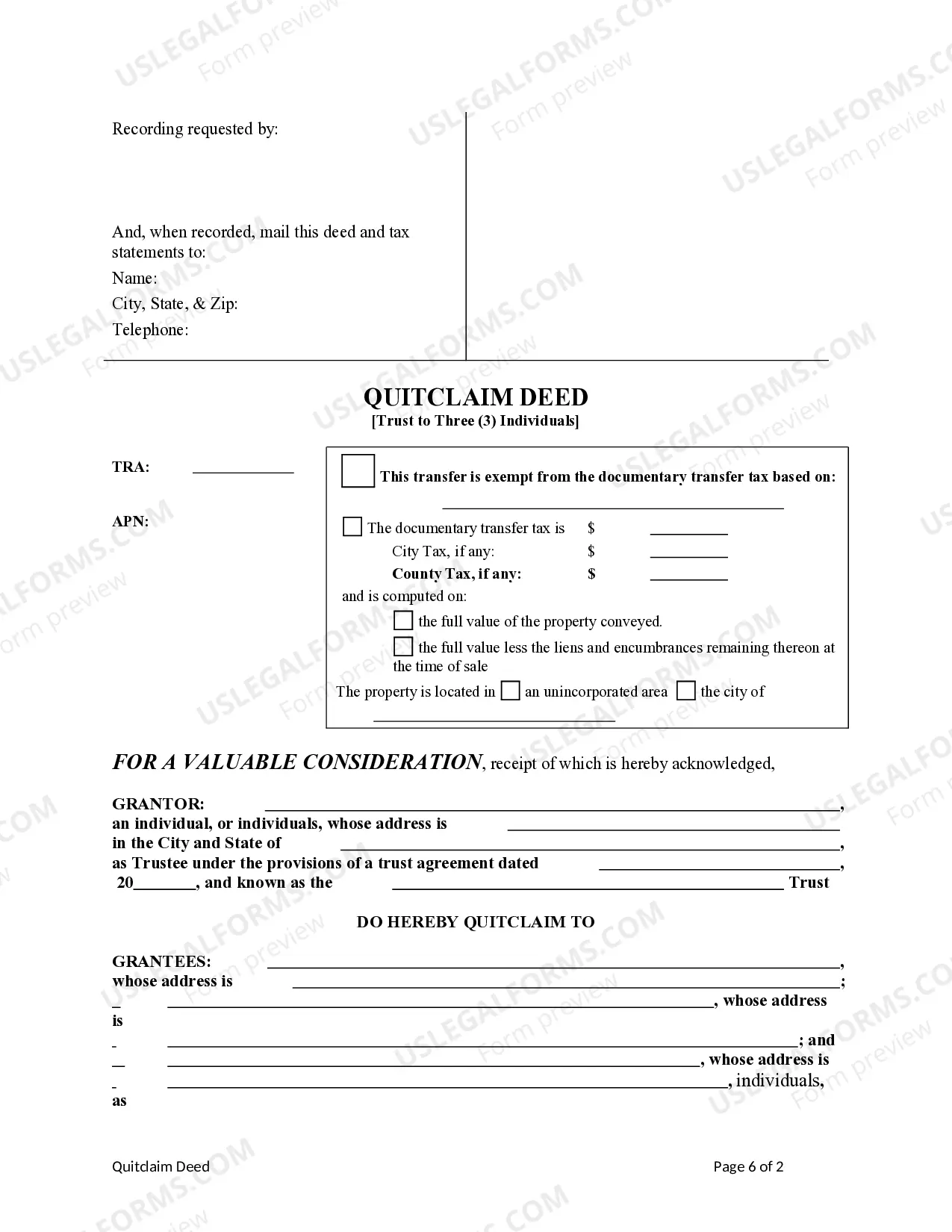

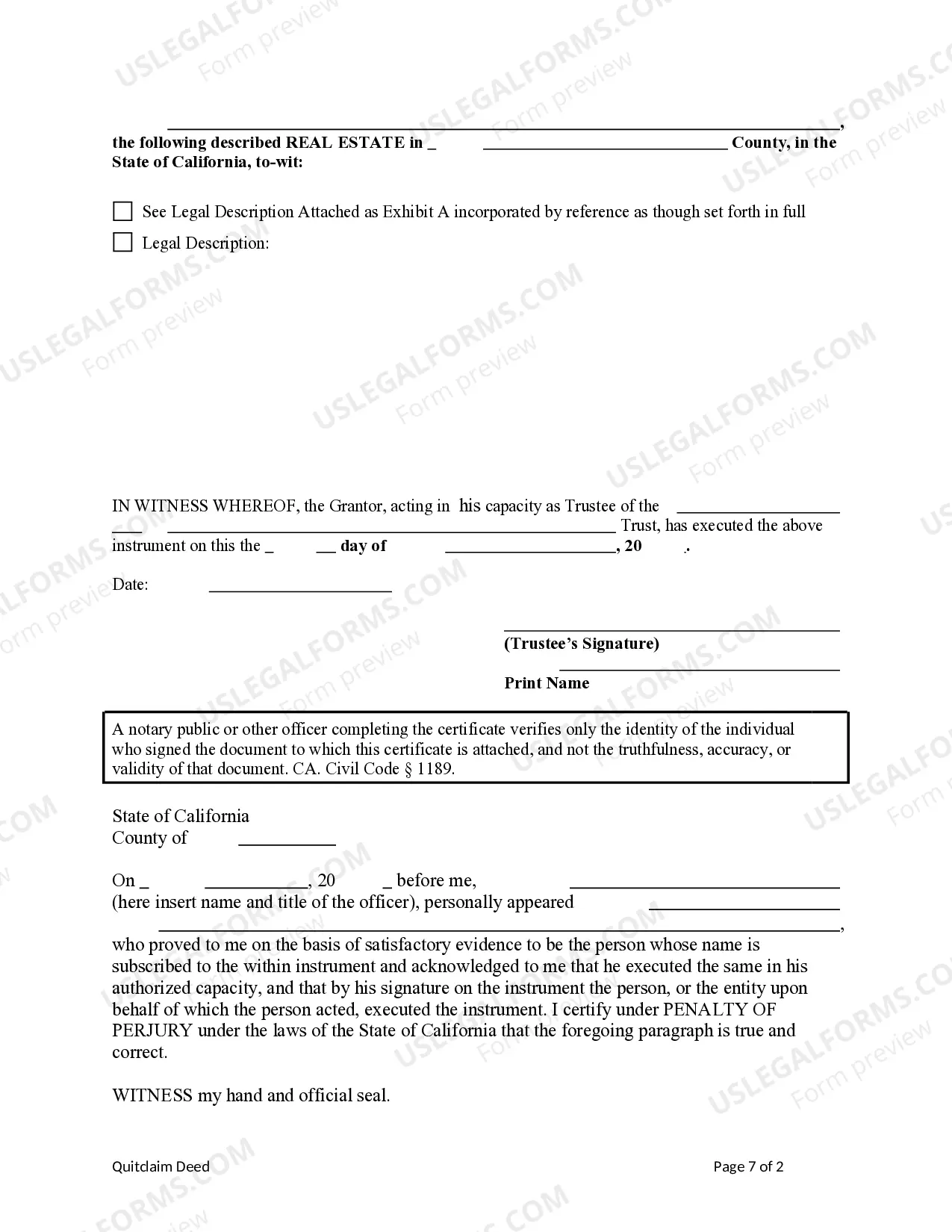

This form is a Quitclaim Deed where the Grantor is a trust and the Grantees are three (3) individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

A Salinas California Quitclaim Deed — Trust to Three Individuals is a legal document that transfers property ownership from one party to three specified individuals. This type of deed is commonly used in real estate transactions involving multiple beneficiaries or family members. Keywords: Salinas California, Quitclaim Deed, Trust, Three Individuals, property ownership, real estate transactions, beneficiaries, family members. Different Types of Salinas California Quitclaim Deed — Trust to Three Individuals: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows the three individuals to hold equal shares in the property. In the event of someone's passing, their share automatically transfers to the surviving owners. 2. Tenants in Common: Under this type of deed, each individual can have a different ownership percentage, as specified in the trust. Unlike joint tenancy, the shares do not automatically transfer to the surviving owners, but instead can be bequeathed to heirs. 3. Revocable Living Trust: This type of trust allows the individuals named in the quitclaim deed to retain control over the property during their lifetime. They can modify or revoke the trust at any time, giving them the flexibility to change the beneficiaries or terms as needed. 4. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked once it is established. This type of trust provides individuals with more tax benefits and asset protection but limits their control over the property. In summary, a Salinas California Quitclaim Deed — Trust to Three Individuals is a legal mechanism that enables the transfer of property ownership to three specified individuals. The various types of deeds, such as joint tenancy, tenants in common, revocable living trust, and irrevocable trust, offer different benefits and control over the property. It is crucial to consult with a qualified attorney or real estate professional to determine which type of deed and trust would best suit your specific needs and circumstances.A Salinas California Quitclaim Deed — Trust to Three Individuals is a legal document that transfers property ownership from one party to three specified individuals. This type of deed is commonly used in real estate transactions involving multiple beneficiaries or family members. Keywords: Salinas California, Quitclaim Deed, Trust, Three Individuals, property ownership, real estate transactions, beneficiaries, family members. Different Types of Salinas California Quitclaim Deed — Trust to Three Individuals: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows the three individuals to hold equal shares in the property. In the event of someone's passing, their share automatically transfers to the surviving owners. 2. Tenants in Common: Under this type of deed, each individual can have a different ownership percentage, as specified in the trust. Unlike joint tenancy, the shares do not automatically transfer to the surviving owners, but instead can be bequeathed to heirs. 3. Revocable Living Trust: This type of trust allows the individuals named in the quitclaim deed to retain control over the property during their lifetime. They can modify or revoke the trust at any time, giving them the flexibility to change the beneficiaries or terms as needed. 4. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked once it is established. This type of trust provides individuals with more tax benefits and asset protection but limits their control over the property. In summary, a Salinas California Quitclaim Deed — Trust to Three Individuals is a legal mechanism that enables the transfer of property ownership to three specified individuals. The various types of deeds, such as joint tenancy, tenants in common, revocable living trust, and irrevocable trust, offer different benefits and control over the property. It is crucial to consult with a qualified attorney or real estate professional to determine which type of deed and trust would best suit your specific needs and circumstances.