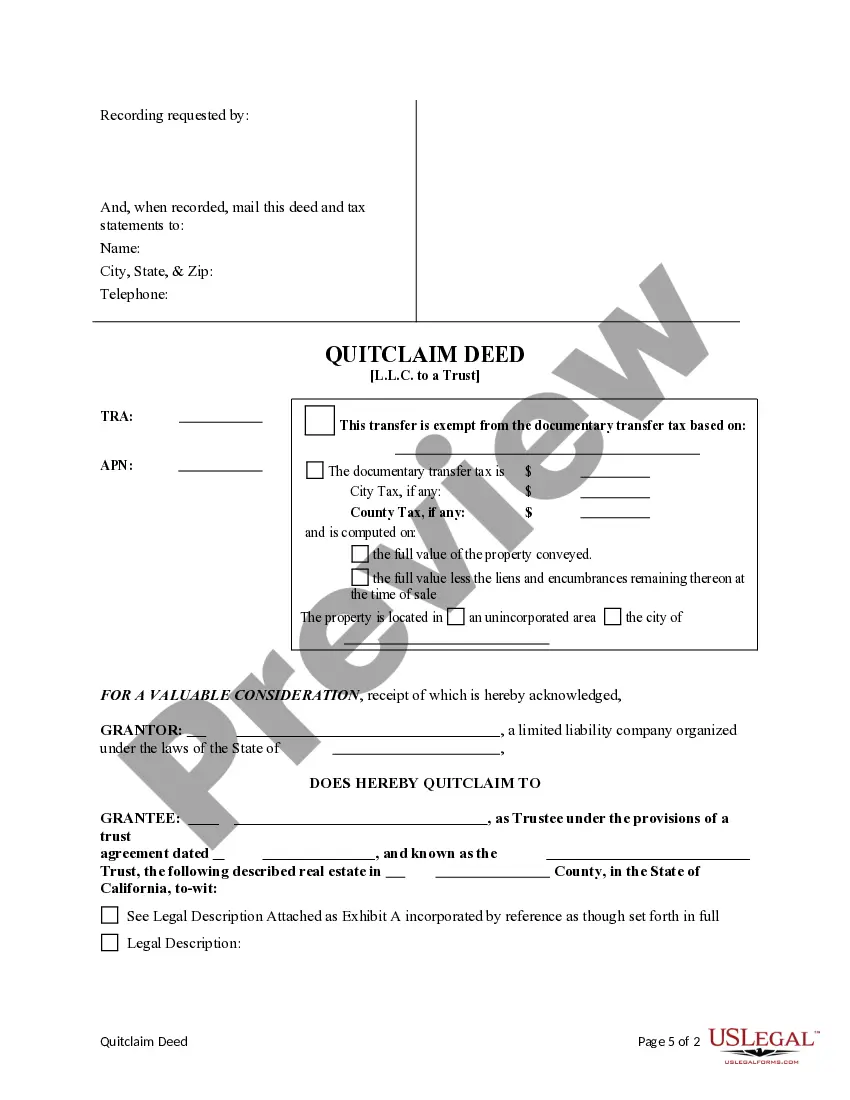

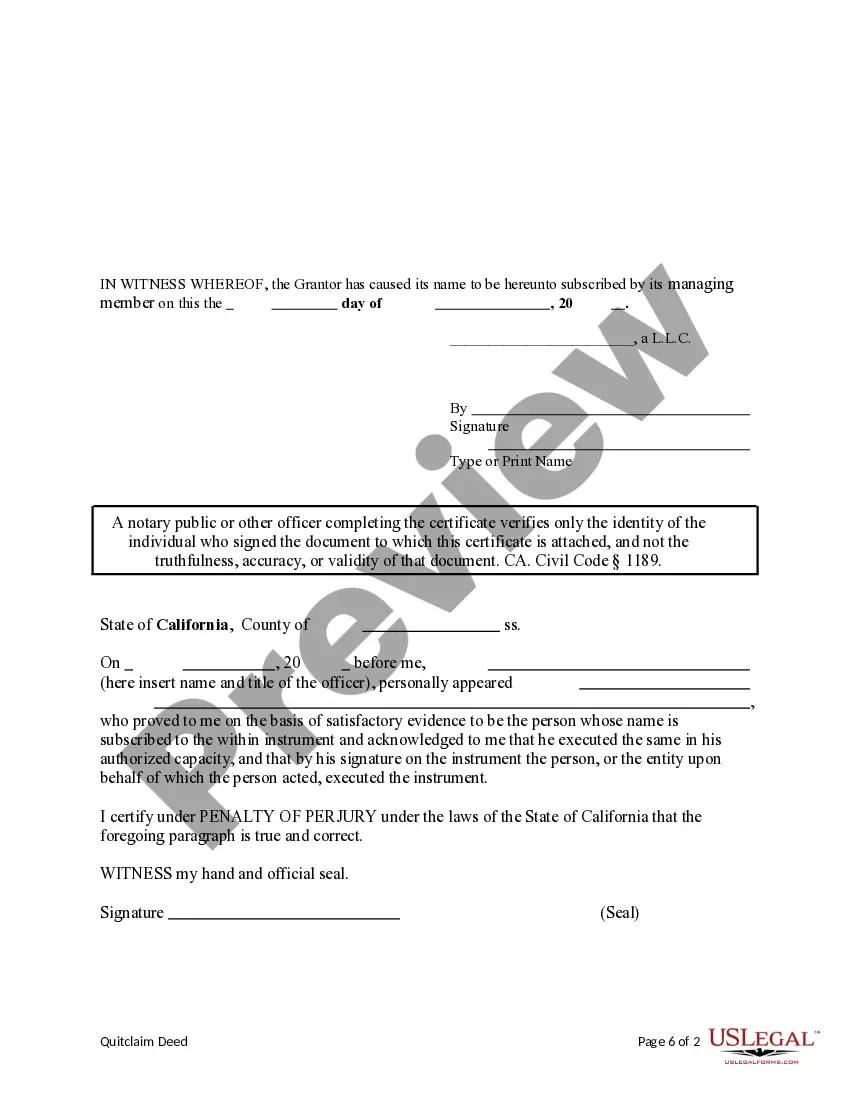

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Simi Valley California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document used to transfer ownership of real property from an LLC to a trust. This type of deed is often utilized in estate planning, business restructuring, or asset protection strategies. A quitclaim deed conveys the interest or claim that an entity, in this case, an LLC, holds in a property. It does not guarantee or warrant that the LLC has a clear title to the property. Instead, it transfers whatever interest the LLC has to the trust without any warranty or guarantee of ownership. By transferring the property to a trust, the LLC's ownership is effectively bypassed, and the property becomes an asset of the trust. A trust is a legal entity established to hold and manage assets for the benefit of one or more beneficiaries. The trust agreement dictates how the property will be managed and distributed. There are different variations of Simi Valley California Quitclaim Deeds from a Limited Liability Company to a Trust, which include: 1. Revocable Living Trust Quitclaim Deed: This type of deed transfers ownership from an LLC to a revocable living trust. The trust can be modified or revoked by the granter (the individual who created the trust) during their lifetime, allowing flexibility in managing the property. 2. Irrevocable Trust Quitclaim Deed: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked by the granter once it is established. The LLC transfers ownership of the property to an irrevocable trust, ensuring that it cannot be easily unwound or modified. This type of trust is often used for long-term asset protection or estate tax planning. 3. Family Trust Quitclaim Deed: A family trust is created to hold and distribute assets to family members as specified in the trust agreement. The LLC transfers ownership to a family trust, allowing for seamless management and distribution of the property within the family. 4. Special Needs Trust Quitclaim Deed: This type of trust is designed to provide for individuals with special needs or disabilities while preserving their eligibility for government benefits. The LLC transfers ownership of the property to a special needs trust, ensuring that the individual's needs are met without jeopardizing their access to essential programs. 5. Charitable Trust Quitclaim Deed: A charitable trust is established to benefit a charitable organization or cause. By transferring property to a charitable trust, the LLC can potentially receive tax benefits while supporting a charitable mission. In all cases, it is crucial to consult with legal professionals experienced in real estate transactions and trust law to ensure the proper execution and consideration of any tax or legal implications associated with the transfer of ownership from an LLC to a trust.A Simi Valley California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document used to transfer ownership of real property from an LLC to a trust. This type of deed is often utilized in estate planning, business restructuring, or asset protection strategies. A quitclaim deed conveys the interest or claim that an entity, in this case, an LLC, holds in a property. It does not guarantee or warrant that the LLC has a clear title to the property. Instead, it transfers whatever interest the LLC has to the trust without any warranty or guarantee of ownership. By transferring the property to a trust, the LLC's ownership is effectively bypassed, and the property becomes an asset of the trust. A trust is a legal entity established to hold and manage assets for the benefit of one or more beneficiaries. The trust agreement dictates how the property will be managed and distributed. There are different variations of Simi Valley California Quitclaim Deeds from a Limited Liability Company to a Trust, which include: 1. Revocable Living Trust Quitclaim Deed: This type of deed transfers ownership from an LLC to a revocable living trust. The trust can be modified or revoked by the granter (the individual who created the trust) during their lifetime, allowing flexibility in managing the property. 2. Irrevocable Trust Quitclaim Deed: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked by the granter once it is established. The LLC transfers ownership of the property to an irrevocable trust, ensuring that it cannot be easily unwound or modified. This type of trust is often used for long-term asset protection or estate tax planning. 3. Family Trust Quitclaim Deed: A family trust is created to hold and distribute assets to family members as specified in the trust agreement. The LLC transfers ownership to a family trust, allowing for seamless management and distribution of the property within the family. 4. Special Needs Trust Quitclaim Deed: This type of trust is designed to provide for individuals with special needs or disabilities while preserving their eligibility for government benefits. The LLC transfers ownership of the property to a special needs trust, ensuring that the individual's needs are met without jeopardizing their access to essential programs. 5. Charitable Trust Quitclaim Deed: A charitable trust is established to benefit a charitable organization or cause. By transferring property to a charitable trust, the LLC can potentially receive tax benefits while supporting a charitable mission. In all cases, it is crucial to consult with legal professionals experienced in real estate transactions and trust law to ensure the proper execution and consideration of any tax or legal implications associated with the transfer of ownership from an LLC to a trust.