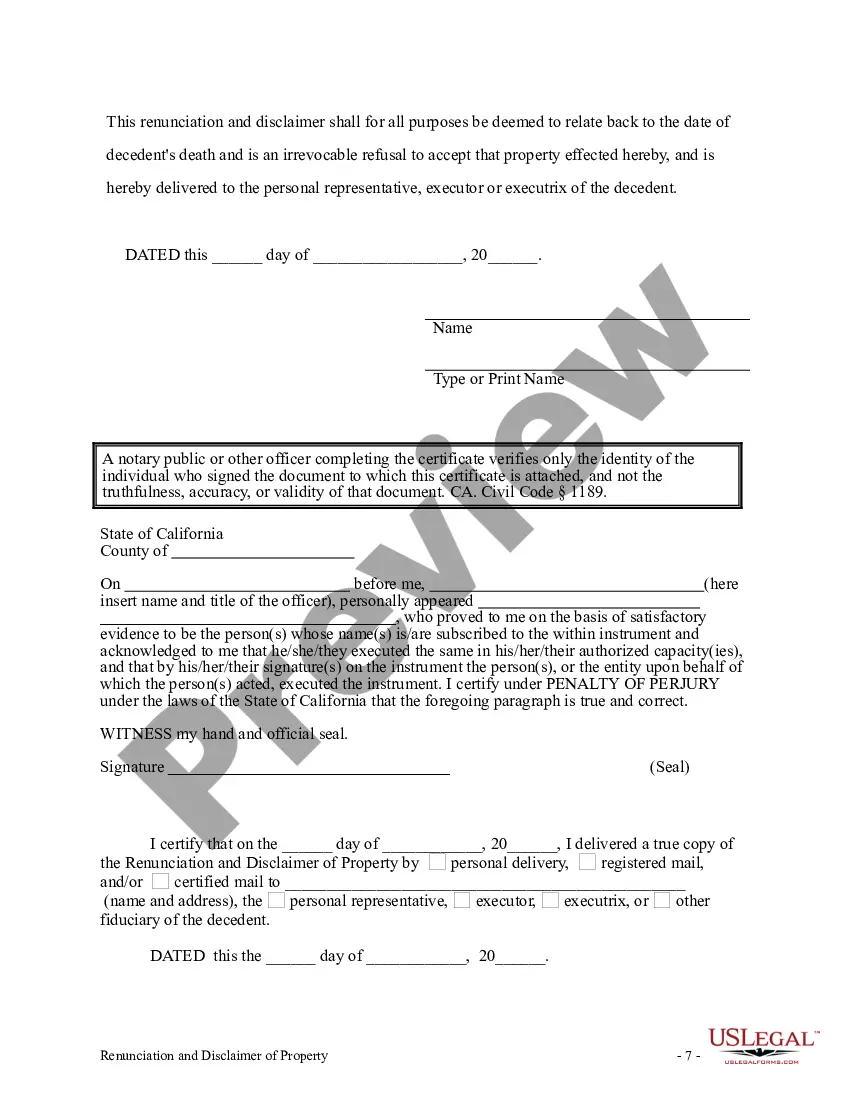

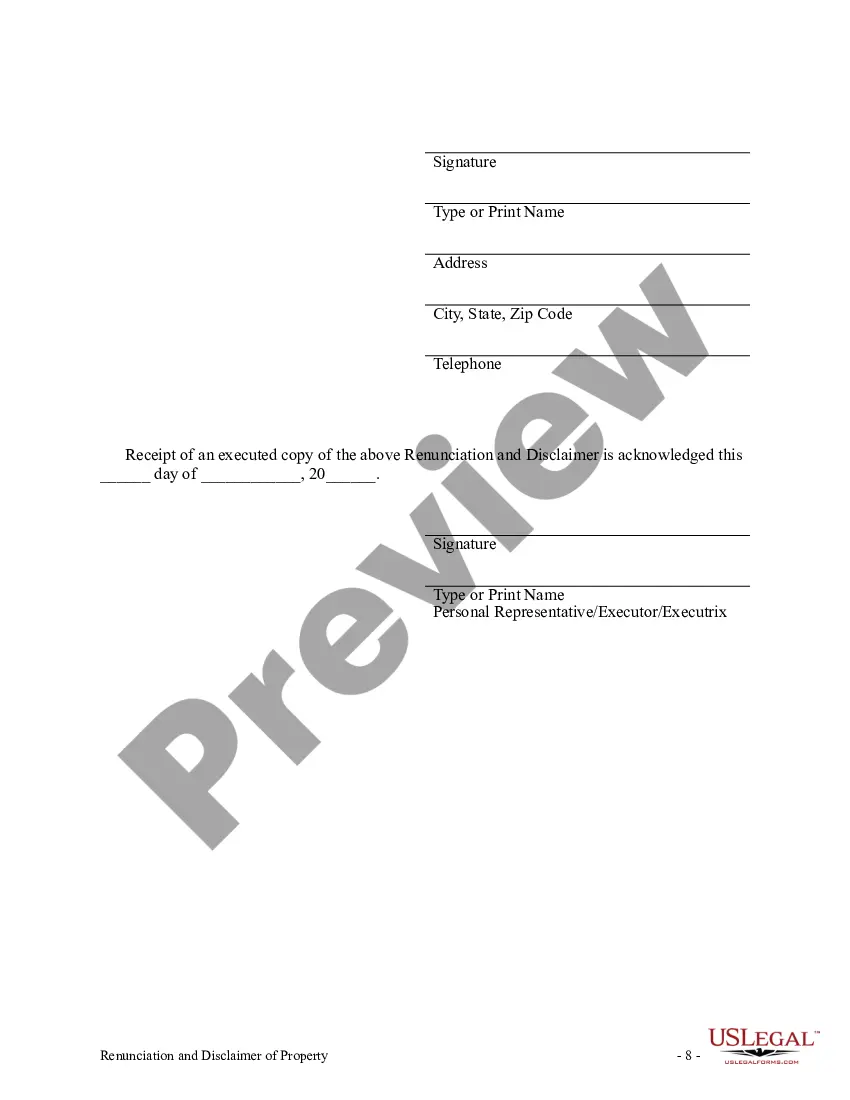

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond In Santa Clara, California, individuals have the option to renounce or disclaim their Individual Retirement Account (IRA), annuity, or bond. This legal process allows individuals to officially forgo their rights or interests in these financial assets. Renunciation and disclaimer can be crucial in certain situations, such as when someone inherits an IRA, annuity, or bond but does not wish to accept or be responsible for them. There are various types of Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: 1. IRA Renunciation and Disclaimer: This type applies specifically to Individual Retirement Accounts. By renouncing or disclaiming an IRA, individuals inform the financial institution or custodian holding the account that they do not wish to accept the assets passed on to them. It allows them to avoid potential tax liabilities and responsibilities associated with managing the account. 2. Annuity Renunciation and Disclaimer: Individuals who inherit annuity contracts can choose to renounce or disclaim their rights to the annuity. These reliefs them from any obligations, such as paying premiums or managing the annuity. By renouncing or disclaiming, they pass the annuity to the next eligible beneficiary or dispose of it according to the terms and conditions outlined by the issuing company. 3. Bond Renunciation and Disclaimer: Bond renunciation and disclaimer apply to individuals who are named as beneficiaries of bonds. By executing the renunciation or disclaimer process, they decline any ownership or interest in the bond. This allows the bond issuer to proceed with the distribution to alternate beneficiaries or follow the predetermined course of action as per the bond's terms. Renouncing or disclaiming an IRA, annuity, or bond in Santa Clara, California requires careful consideration and adherence to legal procedures. It is advisable for individuals contemplating renunciation or disclaimer to consult with a qualified attorney or financial advisor to understand the implications, potential tax consequences, and available alternatives. It is important to note that individuals should not renounce or disclaim without evaluating the specific circumstances and seeking professional guidance for their unique situation. In conclusion, Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond provides individuals the means to decline or relinquish their rights and interests in these financial assets. By executing the renunciation or disclaimer process, individuals can alleviate themselves from potential tax liabilities and responsibilities associated with managing these accounts. Consulting professionals is highly recommended navigating the legal and financial intricacies involved.Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond In Santa Clara, California, individuals have the option to renounce or disclaim their Individual Retirement Account (IRA), annuity, or bond. This legal process allows individuals to officially forgo their rights or interests in these financial assets. Renunciation and disclaimer can be crucial in certain situations, such as when someone inherits an IRA, annuity, or bond but does not wish to accept or be responsible for them. There are various types of Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: 1. IRA Renunciation and Disclaimer: This type applies specifically to Individual Retirement Accounts. By renouncing or disclaiming an IRA, individuals inform the financial institution or custodian holding the account that they do not wish to accept the assets passed on to them. It allows them to avoid potential tax liabilities and responsibilities associated with managing the account. 2. Annuity Renunciation and Disclaimer: Individuals who inherit annuity contracts can choose to renounce or disclaim their rights to the annuity. These reliefs them from any obligations, such as paying premiums or managing the annuity. By renouncing or disclaiming, they pass the annuity to the next eligible beneficiary or dispose of it according to the terms and conditions outlined by the issuing company. 3. Bond Renunciation and Disclaimer: Bond renunciation and disclaimer apply to individuals who are named as beneficiaries of bonds. By executing the renunciation or disclaimer process, they decline any ownership or interest in the bond. This allows the bond issuer to proceed with the distribution to alternate beneficiaries or follow the predetermined course of action as per the bond's terms. Renouncing or disclaiming an IRA, annuity, or bond in Santa Clara, California requires careful consideration and adherence to legal procedures. It is advisable for individuals contemplating renunciation or disclaimer to consult with a qualified attorney or financial advisor to understand the implications, potential tax consequences, and available alternatives. It is important to note that individuals should not renounce or disclaim without evaluating the specific circumstances and seeking professional guidance for their unique situation. In conclusion, Santa Clara California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond provides individuals the means to decline or relinquish their rights and interests in these financial assets. By executing the renunciation or disclaimer process, individuals can alleviate themselves from potential tax liabilities and responsibilities associated with managing these accounts. Consulting professionals is highly recommended navigating the legal and financial intricacies involved.