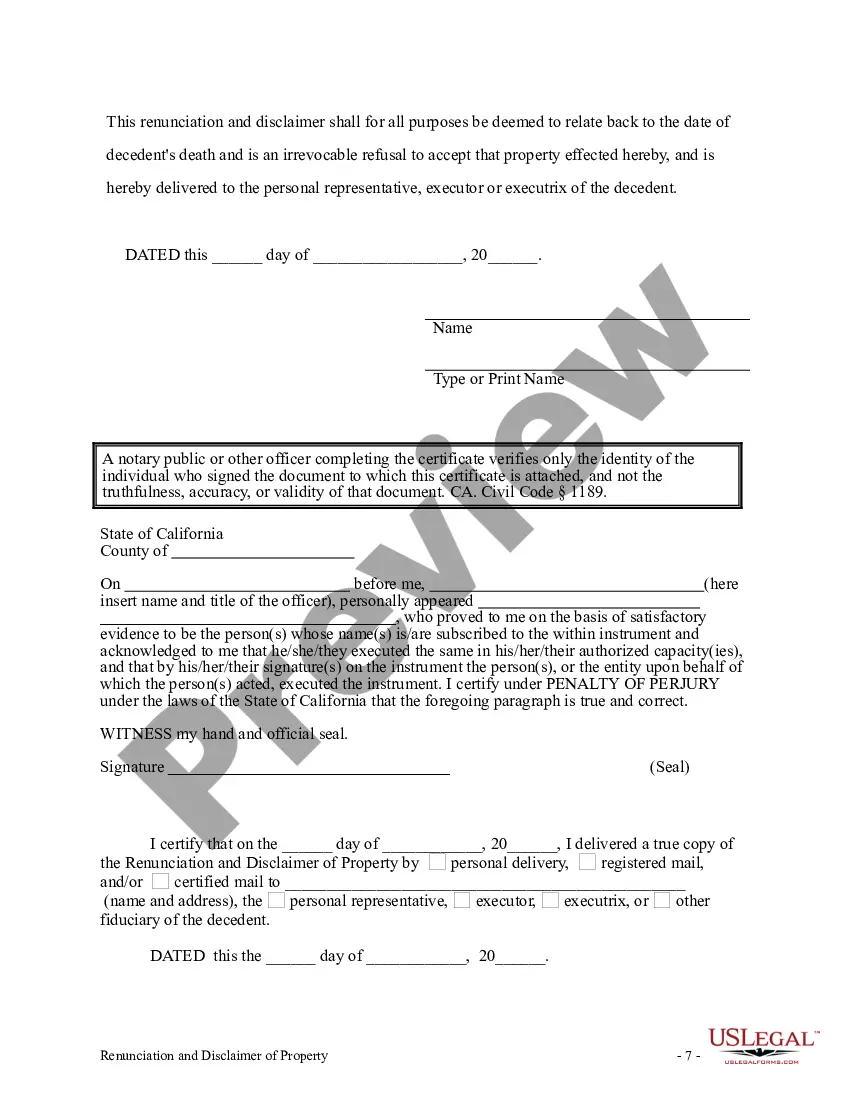

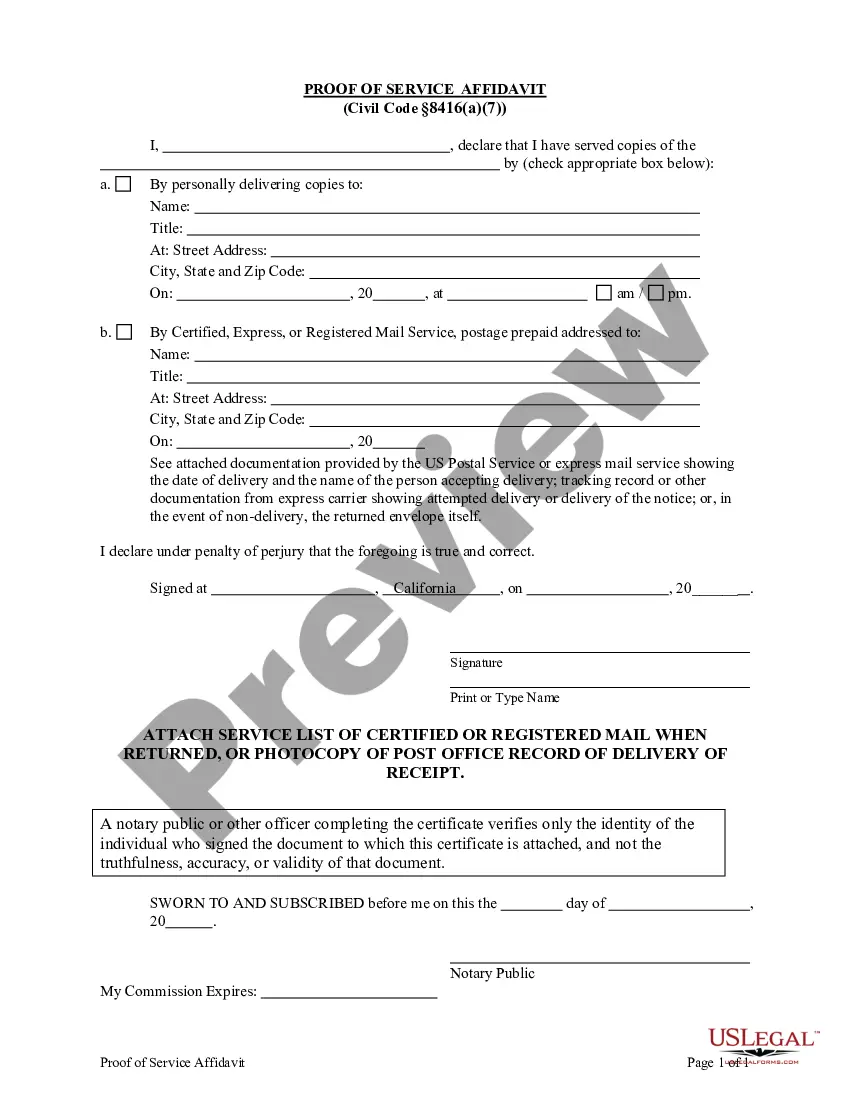

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: Overview and Types Introduction: Simi Valley, California, offers residents a range of financial planning tools and options to manage their retirement savings effectively. One such tool is the Renunciation and Disclaimer of Individual Retirement Account (IRA), Annuity, or Bond. This comprehensive description will delve into the concept, benefits, and various types of Renunciation and Disclaimer in Simi Valley, California, providing essential information to empower residents seeking to optimize their financial future. What is Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond? The Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond in Simi Valley refers to a legal mechanism that allows an individual, typically the beneficiary, to relinquish their claim or interest in an IRA, annuity, or bond. This renunciation cancels the potential rights that the beneficiary may have had and allows the assets to pass to an alternative beneficiary or be redistributed as per the provisions outlined in the original financial instrument. Types of Simi Valley California Renunciation and Disclaimer: 1. IRA Renunciation: Simi Valley residents may choose to renounce their inherited IRA, which typically involves disclaiming their right to receive distributions from the IRA account. By doing so, the assets held within the IRA can be directed to alternate beneficiaries, such as other family members, charities, or trusts, thereby optimizing the estate planning process. 2. Annuity Renunciation: In cases where an individual has been named as a beneficiary of an annuity, they may choose to renounce their interest in it. By renouncing their rights, the annuity can then pass on to an alternative beneficiary, ensuring that the funds are managed in line with the original account holder's intentions. 3. Bond Renunciation: Renunciation of bonds occurs when an individual refuses their claim to receive future interest payments and principal amount associated with a bond instrument. This decision allows the bond to be reassigned to another designated beneficiary or managed by the executor as part of the estate planning process. Benefits of Simi Valley California Renunciation and Disclaimer: 1. Flexibility in Estate Planning: Renunciation provides individuals with the means to ensure their assets are distributed in a manner consistent with their needs and goals for their estate. 2. Tax Efficiency and Minimization: By renouncing a financial instrument, the renounced can potentially minimize tax implications on the proceeds or prevent unintended tax burdens resulting from distributions. 3. Preservation of Family Wealth: Renunciation allows assets to be redirected to specific beneficiaries, ensuring wealth preservation and alignment with the family's long-term financial objectives. 4. Charitable Contributions: The renunciation of an asset like an IRA or annuity can allow individuals to direct funds to charitable organizations, enabling them to support causes close to their hearts while potentially gaining tax benefits. Conclusion: Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond empower individuals to make informed decisions about their financial futures. Understanding the various types of renunciation and the associated benefits allows residents to optimize their asset distribution, estate planning, and even contribute to charitable causes effectively. If you reside in Simi Valley, it is prudent to consult with legal and financial professionals who can offer guidance on the most suitable renunciation strategies for your specific needs and aspirations.Title: Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: Overview and Types Introduction: Simi Valley, California, offers residents a range of financial planning tools and options to manage their retirement savings effectively. One such tool is the Renunciation and Disclaimer of Individual Retirement Account (IRA), Annuity, or Bond. This comprehensive description will delve into the concept, benefits, and various types of Renunciation and Disclaimer in Simi Valley, California, providing essential information to empower residents seeking to optimize their financial future. What is Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond? The Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond in Simi Valley refers to a legal mechanism that allows an individual, typically the beneficiary, to relinquish their claim or interest in an IRA, annuity, or bond. This renunciation cancels the potential rights that the beneficiary may have had and allows the assets to pass to an alternative beneficiary or be redistributed as per the provisions outlined in the original financial instrument. Types of Simi Valley California Renunciation and Disclaimer: 1. IRA Renunciation: Simi Valley residents may choose to renounce their inherited IRA, which typically involves disclaiming their right to receive distributions from the IRA account. By doing so, the assets held within the IRA can be directed to alternate beneficiaries, such as other family members, charities, or trusts, thereby optimizing the estate planning process. 2. Annuity Renunciation: In cases where an individual has been named as a beneficiary of an annuity, they may choose to renounce their interest in it. By renouncing their rights, the annuity can then pass on to an alternative beneficiary, ensuring that the funds are managed in line with the original account holder's intentions. 3. Bond Renunciation: Renunciation of bonds occurs when an individual refuses their claim to receive future interest payments and principal amount associated with a bond instrument. This decision allows the bond to be reassigned to another designated beneficiary or managed by the executor as part of the estate planning process. Benefits of Simi Valley California Renunciation and Disclaimer: 1. Flexibility in Estate Planning: Renunciation provides individuals with the means to ensure their assets are distributed in a manner consistent with their needs and goals for their estate. 2. Tax Efficiency and Minimization: By renouncing a financial instrument, the renounced can potentially minimize tax implications on the proceeds or prevent unintended tax burdens resulting from distributions. 3. Preservation of Family Wealth: Renunciation allows assets to be redirected to specific beneficiaries, ensuring wealth preservation and alignment with the family's long-term financial objectives. 4. Charitable Contributions: The renunciation of an asset like an IRA or annuity can allow individuals to direct funds to charitable organizations, enabling them to support causes close to their hearts while potentially gaining tax benefits. Conclusion: Simi Valley California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond empower individuals to make informed decisions about their financial futures. Understanding the various types of renunciation and the associated benefits allows residents to optimize their asset distribution, estate planning, and even contribute to charitable causes effectively. If you reside in Simi Valley, it is prudent to consult with legal and financial professionals who can offer guidance on the most suitable renunciation strategies for your specific needs and aspirations.