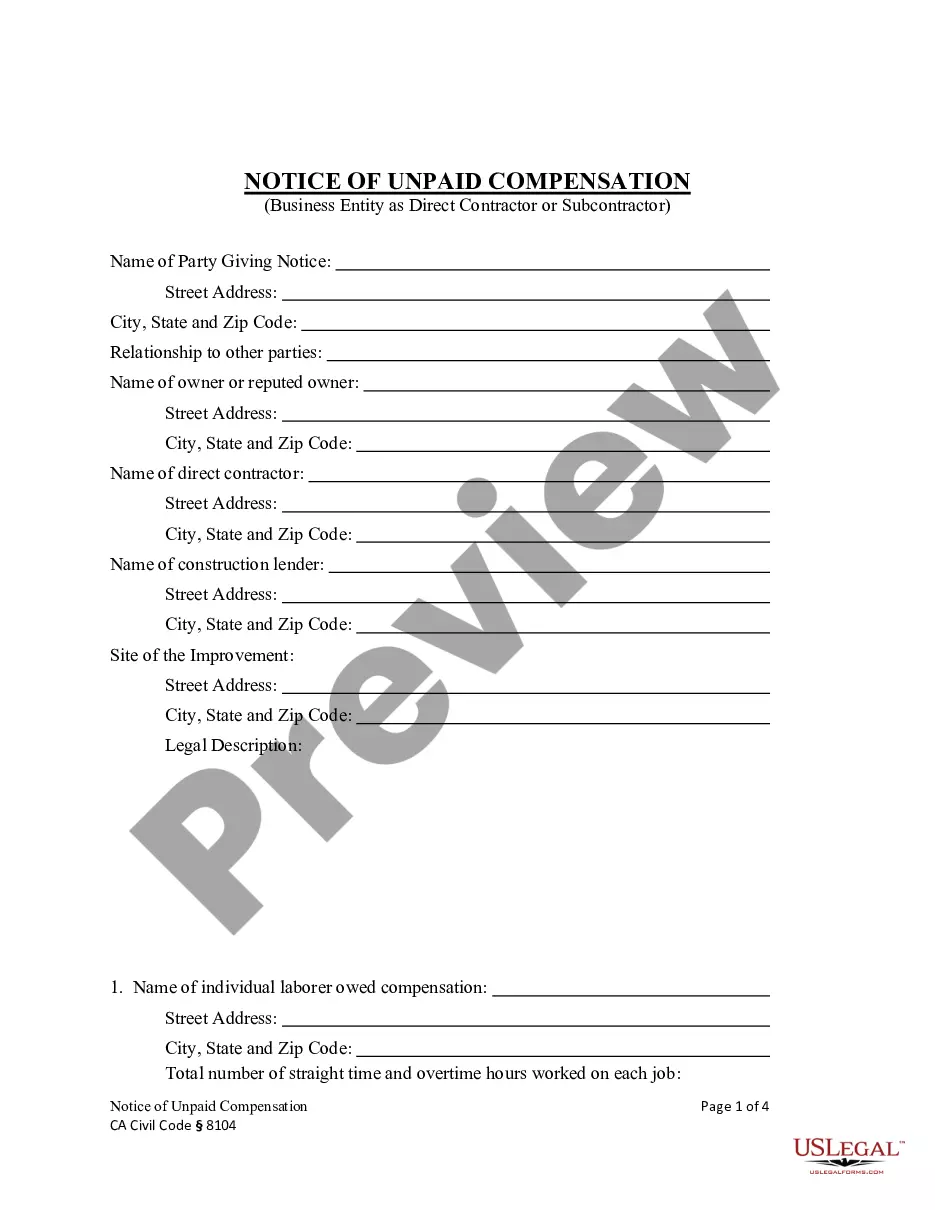

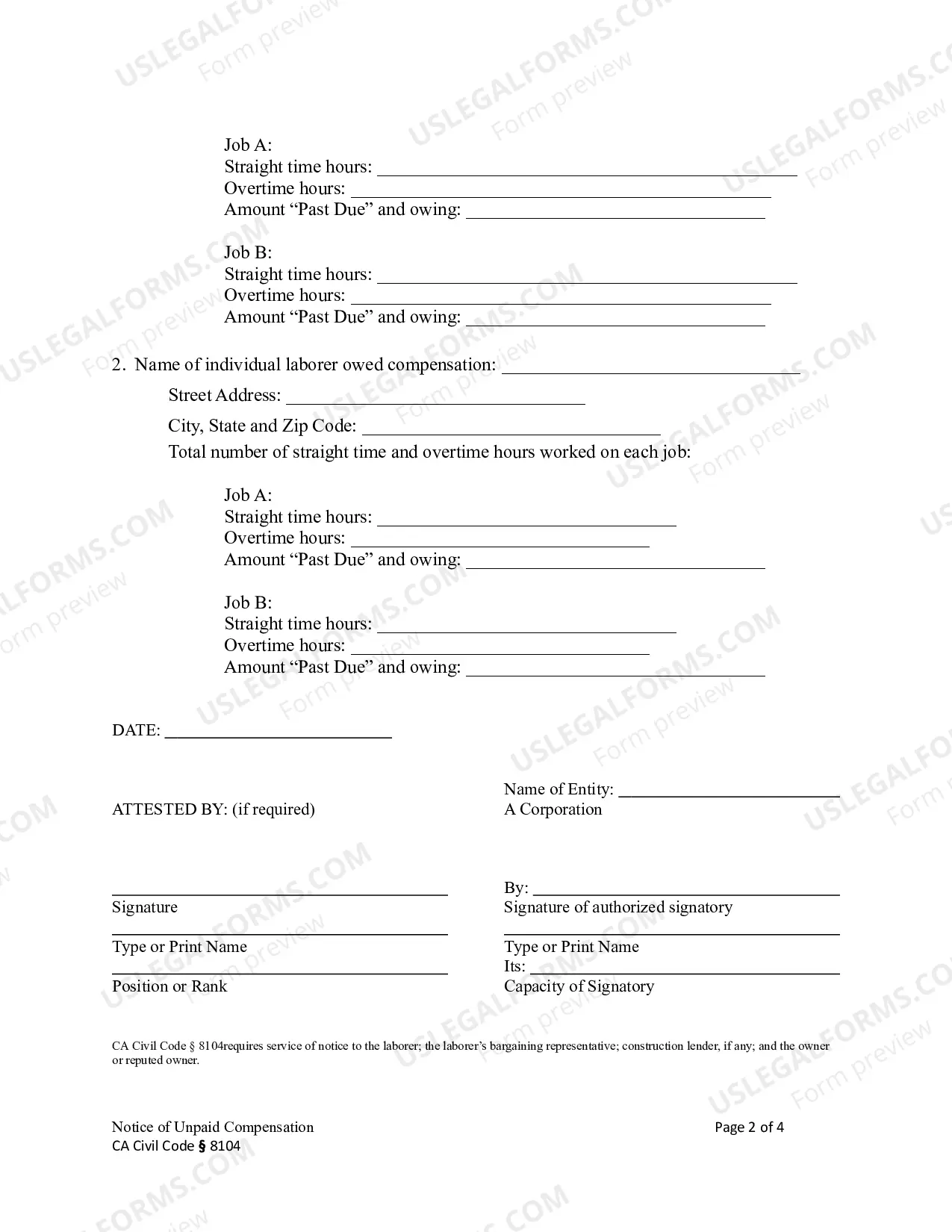

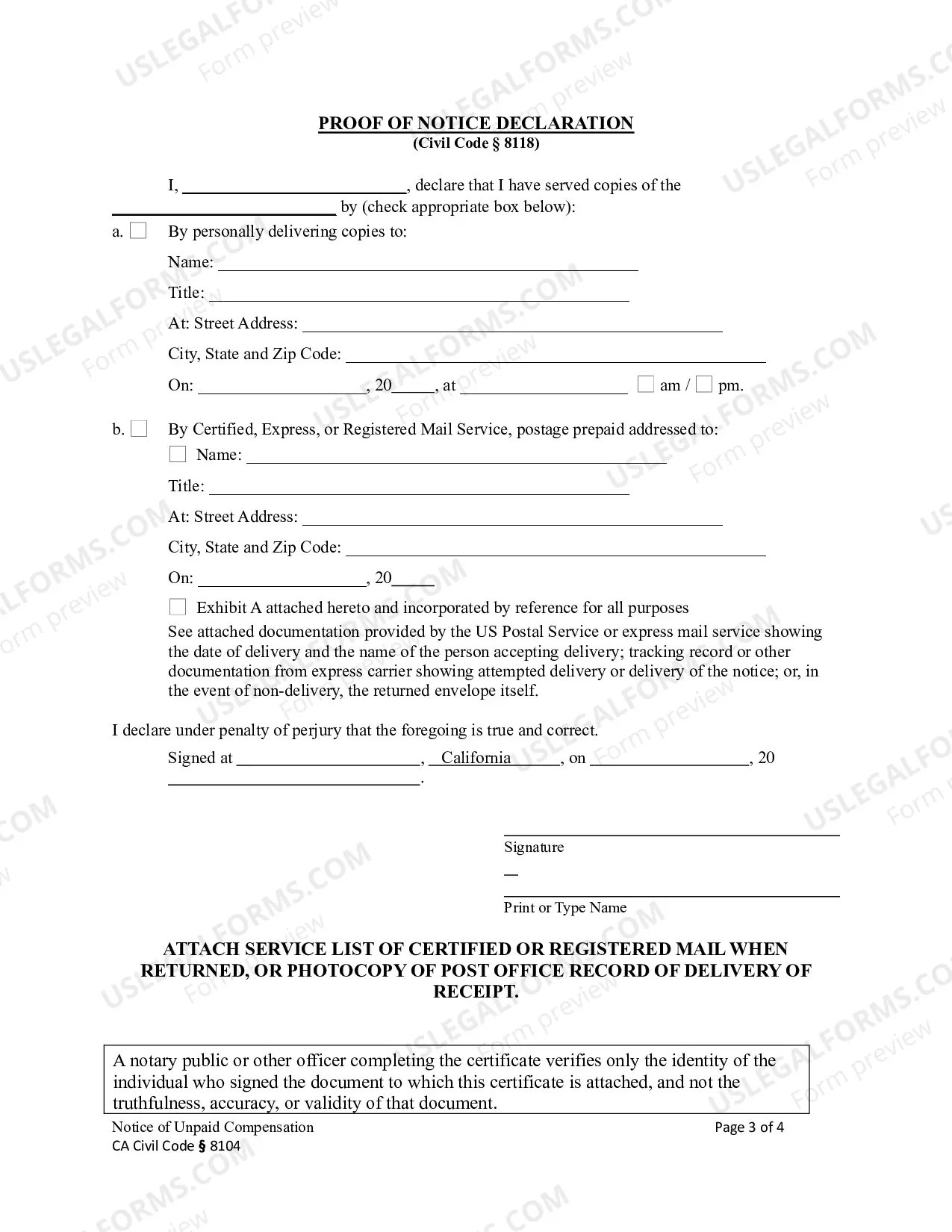

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

Contra Costa California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a means for contractors or subcontractors to assert their right to unpaid compensation for work performed on construction projects. Under Civil Code Section 8104, contractors or subcontractors can file a Notice of Unpaid Compensation against a business entity such as a corporation or limited liability company (LLC) in Contra Costa County, California. This notice aims to protect the rightful claimants and assert their right to payment for their services. Keywords: Contra Costa California, Notice of Unpaid Compensation, Construction Liens, Business Entity, Corporation, LLC, Civil Code Section 8104. There are different types of Contra Costa California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104, depending on the specific circumstances of the situation: 1. Preliminary Notice: Contractors or subcontractors must initially provide a Preliminary Notice to the business entity they have contracted with, notifying them of their intent to file a construction lien in the event of unpaid compensation. This notice typically needs to be sent within a specific timeframe after commencing work or providing materials for the project. 2. Notice of Intent to File Lien: If the contractor or subcontractor is not paid for their work, they can file a Notice of Intent to File Lien, which formally declares their intention to file a construction lien against the property if payment is not received within a specific period. This notice serves as a final warning to the business entity. 3. Construction Lien: If payment is still not received after serving the Notice of Intent to File Lien, the contractor or subcontractor can proceed with filing a Construction Lien. This lien attaches to the property and can have serious legal implications for the business entity, potentially leading to foreclosure if the debt remains unpaid. It is important for contractors or subcontractors in Contra Costa County, California, to familiarize themselves with the relevant laws and requirements under Civil Code Section 8104 to protect their right to receive compensation for their construction services. By understanding and following the proper legal procedures, contractors can help ensure their unpaid compensation claims are handled effectively and lawfully.Contra Costa California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a means for contractors or subcontractors to assert their right to unpaid compensation for work performed on construction projects. Under Civil Code Section 8104, contractors or subcontractors can file a Notice of Unpaid Compensation against a business entity such as a corporation or limited liability company (LLC) in Contra Costa County, California. This notice aims to protect the rightful claimants and assert their right to payment for their services. Keywords: Contra Costa California, Notice of Unpaid Compensation, Construction Liens, Business Entity, Corporation, LLC, Civil Code Section 8104. There are different types of Contra Costa California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104, depending on the specific circumstances of the situation: 1. Preliminary Notice: Contractors or subcontractors must initially provide a Preliminary Notice to the business entity they have contracted with, notifying them of their intent to file a construction lien in the event of unpaid compensation. This notice typically needs to be sent within a specific timeframe after commencing work or providing materials for the project. 2. Notice of Intent to File Lien: If the contractor or subcontractor is not paid for their work, they can file a Notice of Intent to File Lien, which formally declares their intention to file a construction lien against the property if payment is not received within a specific period. This notice serves as a final warning to the business entity. 3. Construction Lien: If payment is still not received after serving the Notice of Intent to File Lien, the contractor or subcontractor can proceed with filing a Construction Lien. This lien attaches to the property and can have serious legal implications for the business entity, potentially leading to foreclosure if the debt remains unpaid. It is important for contractors or subcontractors in Contra Costa County, California, to familiarize themselves with the relevant laws and requirements under Civil Code Section 8104 to protect their right to receive compensation for their construction services. By understanding and following the proper legal procedures, contractors can help ensure their unpaid compensation claims are handled effectively and lawfully.