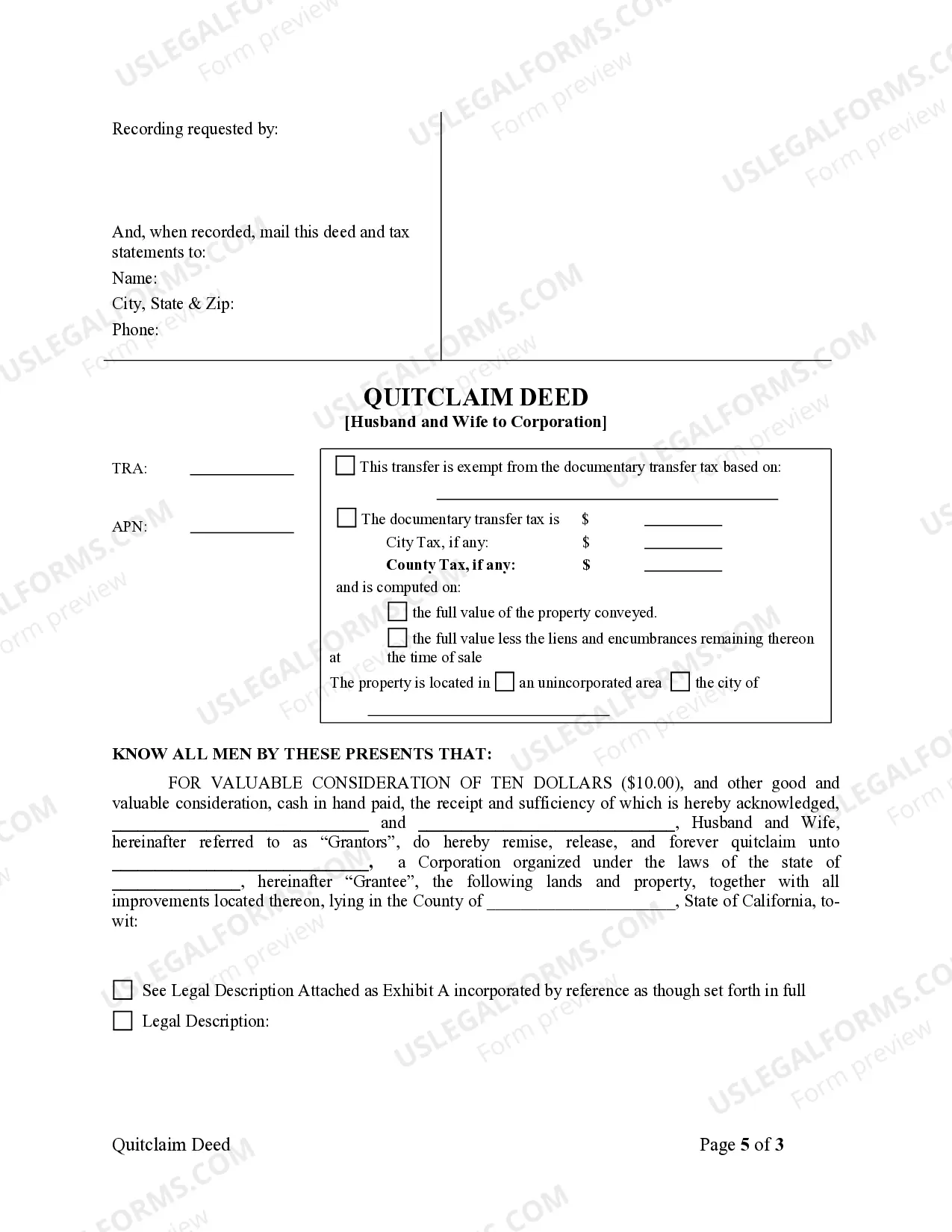

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

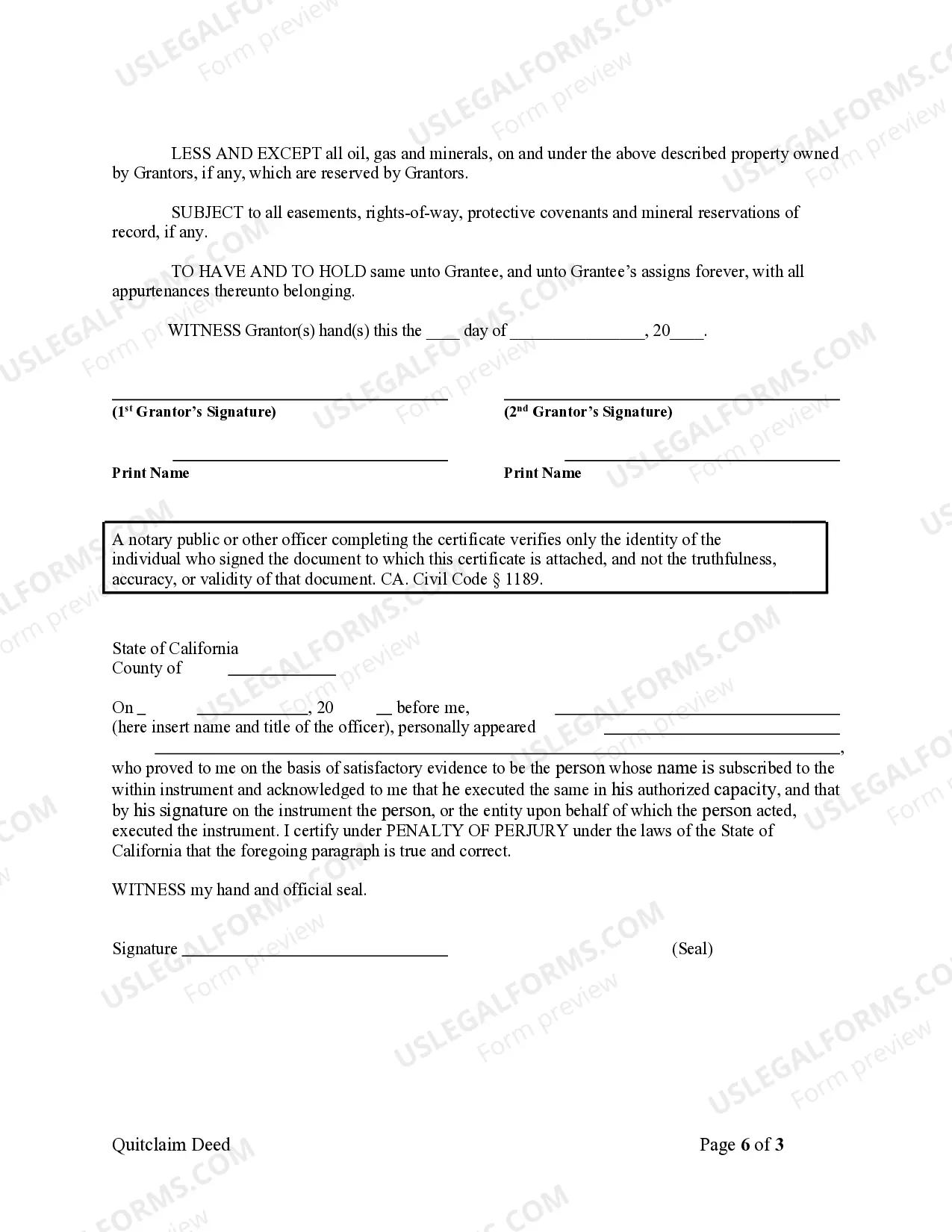

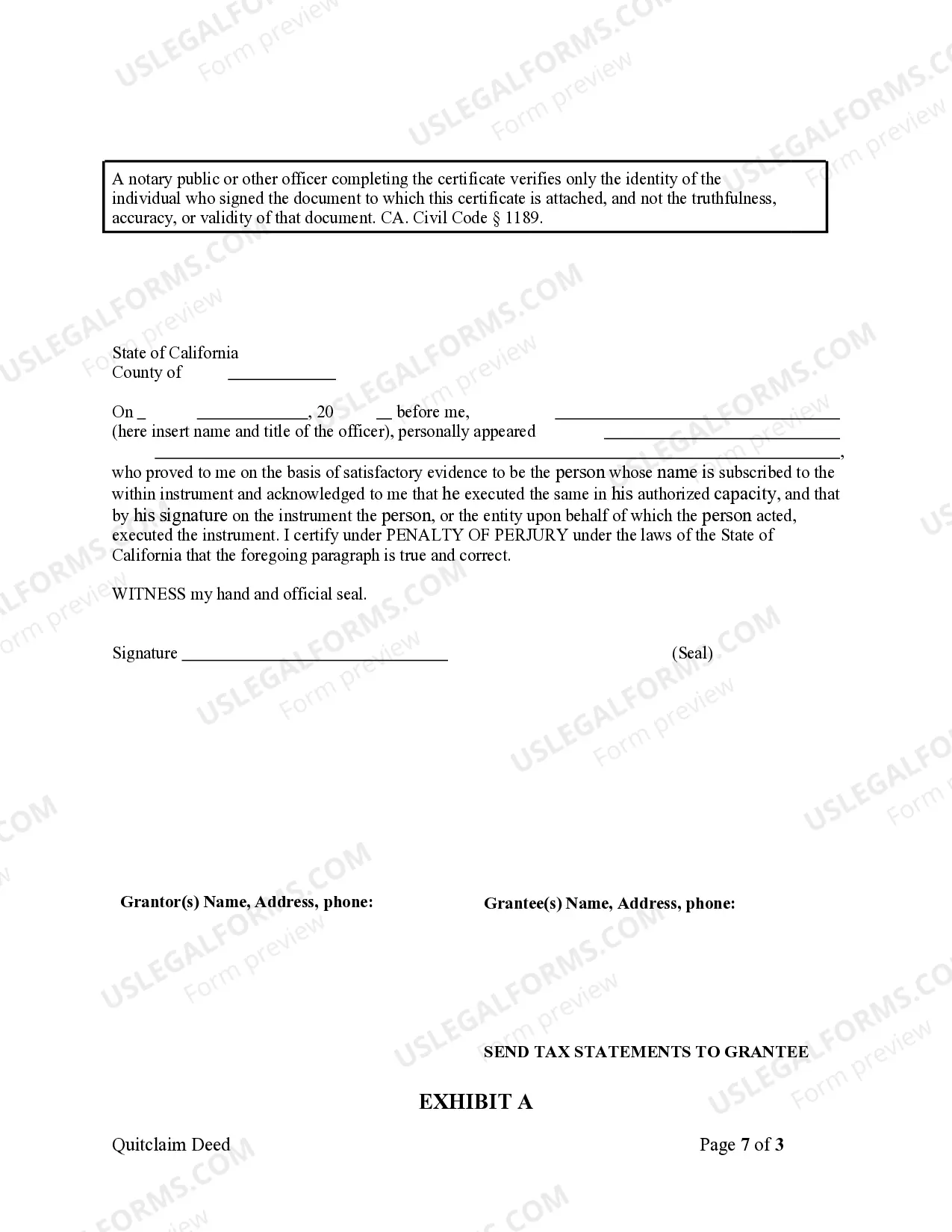

A Santa Clara California Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that transfers ownership of a property from a married couple to a corporation. This type of deed is commonly used when a couple wishes to transfer property they jointly own to a corporation they have established or are affiliated with. The quitclaim deed is a popular choice for this type of transfer as it allows for a simple and efficient transfer of ownership without warranties or guarantees of the property's title. There are different variations of the Santa Clara California Quitclaim Deed from Husband and Wife to Corporation, each catering to specific circumstances. Some of these variations include: 1. Voluntary Transfer: This quitclaim deed is executed willingly by the husband and wife to the corporation. It may occur when they decide to transfer property for business purposes or to protect assets under the corporation's ownership. 2. Divorce Settlement: In cases of divorce, where a couple owned property jointly during the course of their marriage, a quitclaim deed may be used to transfer the property to a corporation as part of the divorce settlement agreement. This deed ensures a clean transfer of ownership, minimizing future disputes. 3. Business Restructuring: When a couple jointly owns property and decides to restructure their business operations, they may choose to transfer the property to a corporation they have established. This allows for better management and separation of personal and business assets. 4. Estate Planning: A Santa Clara California Quitclaim Deed from Husband and Wife to Corporation can be utilized as a part of estate planning. By transferring jointly owned property to a corporation, the couple can ensure that the property is managed and distributed according to their wishes after their demise. To execute a Santa Clara California Quitclaim Deed from Husband and Wife to Corporation, certain components must be included. These keywords can enhance the understanding of the process: — Property description: This includes details such as the legal description of the property and its address. Granteror and grantee: The grantor refers to the husband and wife jointly transferring ownership, while the grantee is the corporation that will assume ownership. — Consideration: The consideration refers to the value received by the granter in exchange for transferring the property to the corporation. This can be monetary or other forms of compensation. — Signatures: The deed must be signed and notarized by the husband, wife, and a notary public. — Legal language: The quitclaim deed should include specific legal language indicating the intention to transfer the property and a clear statement that the transfer is made without warranties or guarantees of the property's title. — Recording: It is important to record the quitclaim deed with the Santa Clara County Recorder's Office to establish a public record of the ownership transfer. Executing a Santa Clara California Quitclaim Deed from Husband and Wife to Corporation involves adherence to specific legal requirements and attention to detail. Seeking legal advice from a qualified attorney familiar with California real estate law is recommended to ensure accurate completion of the deed and avoid any future complications.A Santa Clara California Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that transfers ownership of a property from a married couple to a corporation. This type of deed is commonly used when a couple wishes to transfer property they jointly own to a corporation they have established or are affiliated with. The quitclaim deed is a popular choice for this type of transfer as it allows for a simple and efficient transfer of ownership without warranties or guarantees of the property's title. There are different variations of the Santa Clara California Quitclaim Deed from Husband and Wife to Corporation, each catering to specific circumstances. Some of these variations include: 1. Voluntary Transfer: This quitclaim deed is executed willingly by the husband and wife to the corporation. It may occur when they decide to transfer property for business purposes or to protect assets under the corporation's ownership. 2. Divorce Settlement: In cases of divorce, where a couple owned property jointly during the course of their marriage, a quitclaim deed may be used to transfer the property to a corporation as part of the divorce settlement agreement. This deed ensures a clean transfer of ownership, minimizing future disputes. 3. Business Restructuring: When a couple jointly owns property and decides to restructure their business operations, they may choose to transfer the property to a corporation they have established. This allows for better management and separation of personal and business assets. 4. Estate Planning: A Santa Clara California Quitclaim Deed from Husband and Wife to Corporation can be utilized as a part of estate planning. By transferring jointly owned property to a corporation, the couple can ensure that the property is managed and distributed according to their wishes after their demise. To execute a Santa Clara California Quitclaim Deed from Husband and Wife to Corporation, certain components must be included. These keywords can enhance the understanding of the process: — Property description: This includes details such as the legal description of the property and its address. Granteror and grantee: The grantor refers to the husband and wife jointly transferring ownership, while the grantee is the corporation that will assume ownership. — Consideration: The consideration refers to the value received by the granter in exchange for transferring the property to the corporation. This can be monetary or other forms of compensation. — Signatures: The deed must be signed and notarized by the husband, wife, and a notary public. — Legal language: The quitclaim deed should include specific legal language indicating the intention to transfer the property and a clear statement that the transfer is made without warranties or guarantees of the property's title. — Recording: It is important to record the quitclaim deed with the Santa Clara County Recorder's Office to establish a public record of the ownership transfer. Executing a Santa Clara California Quitclaim Deed from Husband and Wife to Corporation involves adherence to specific legal requirements and attention to detail. Seeking legal advice from a qualified attorney familiar with California real estate law is recommended to ensure accurate completion of the deed and avoid any future complications.