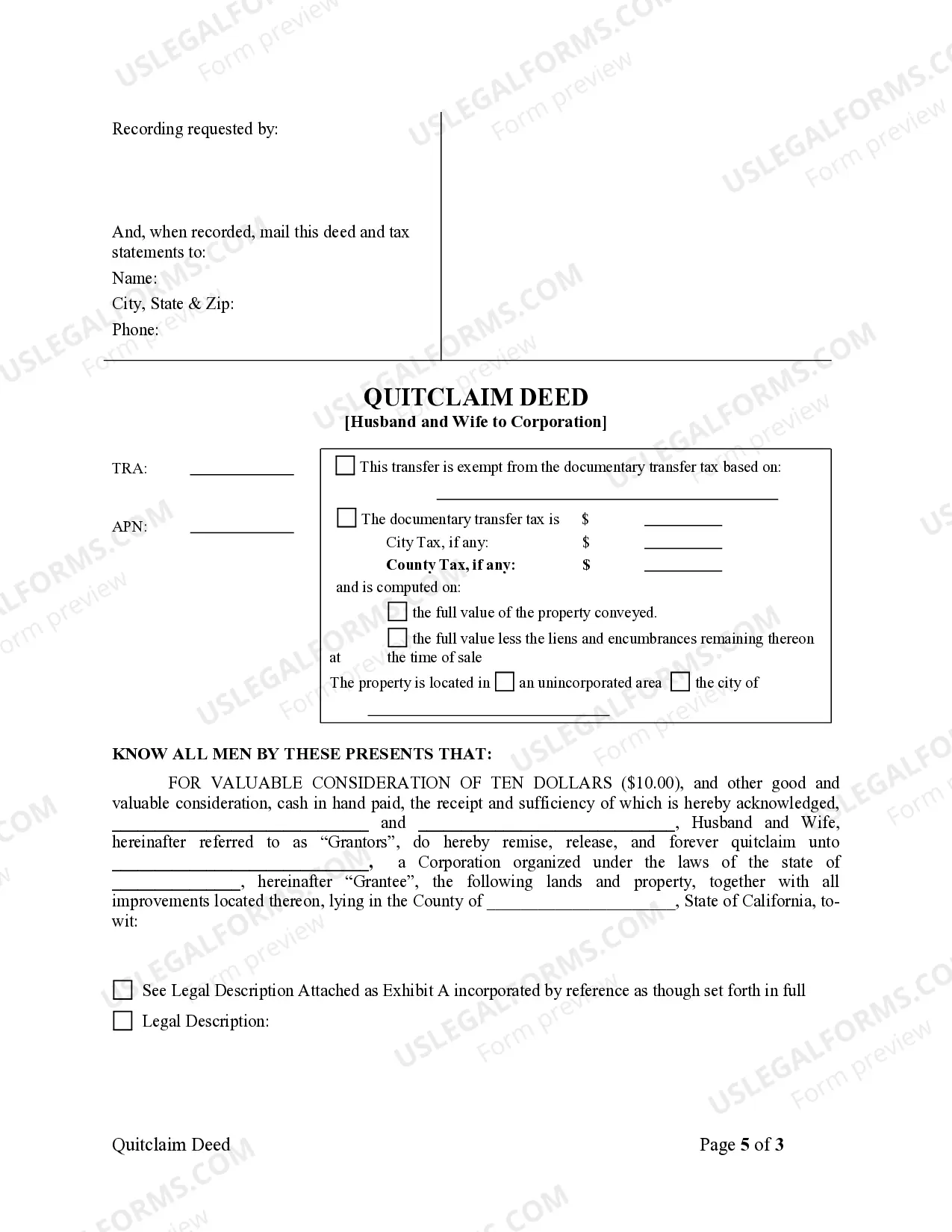

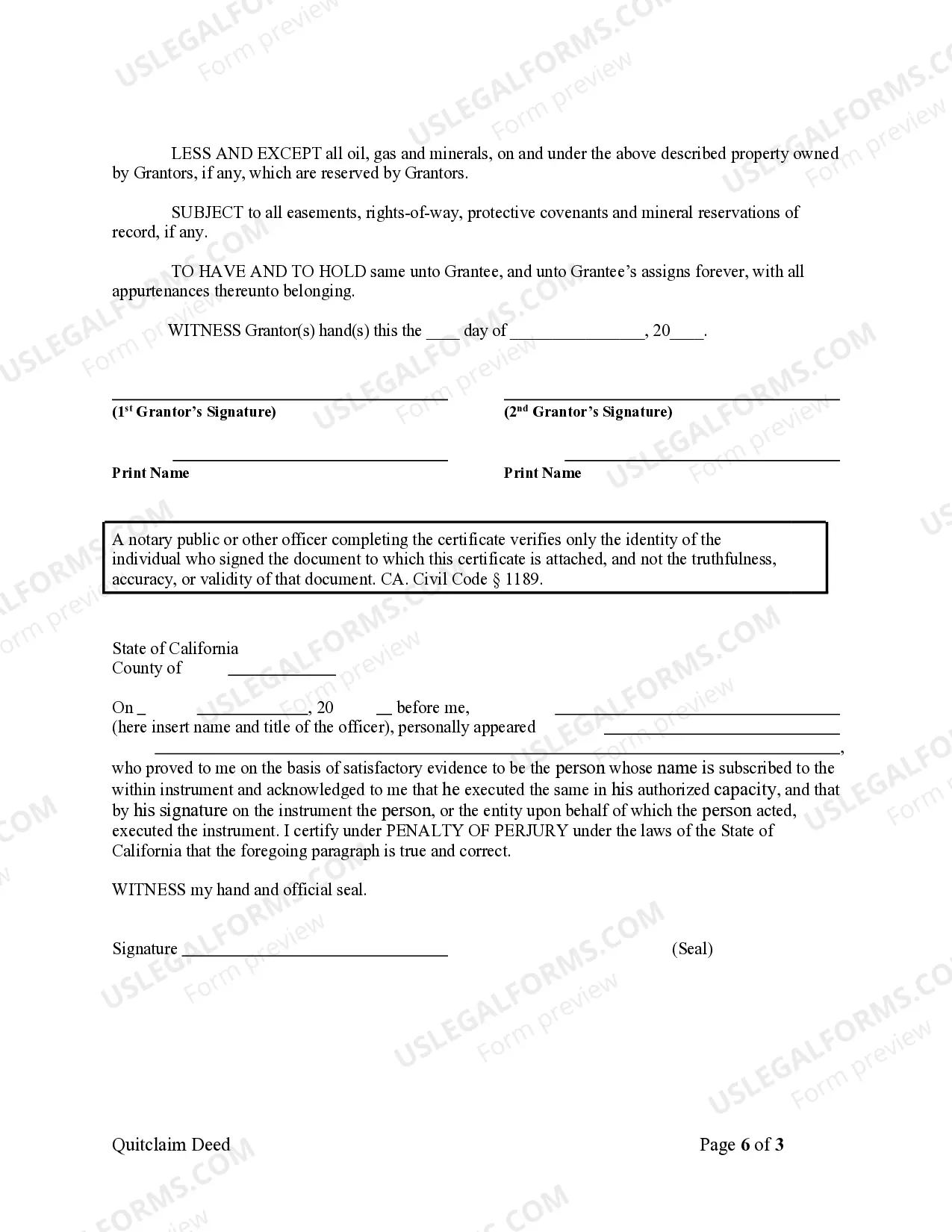

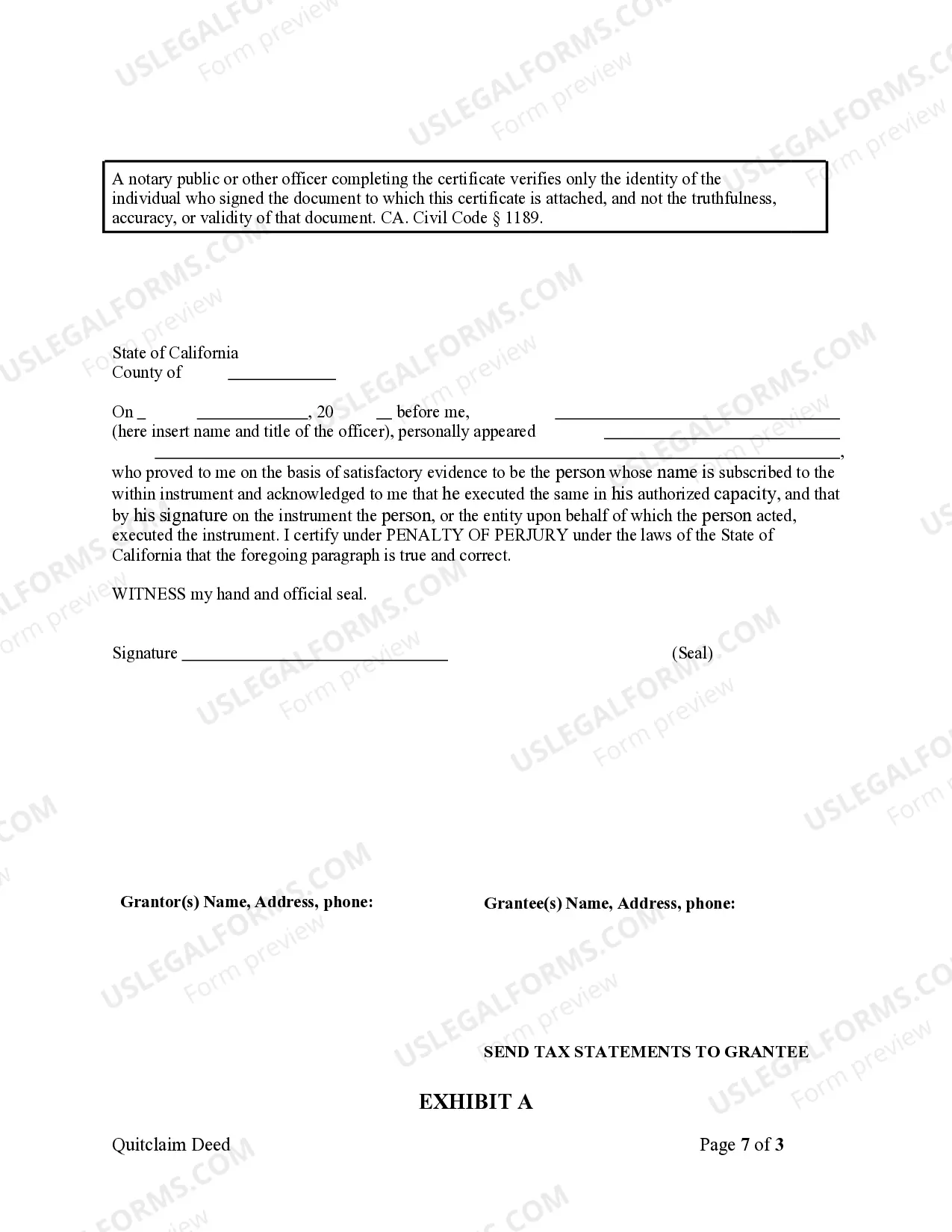

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Santa Maria California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation. This type of deed allows the couple, as granters, to relinquish any existing rights, titles, and claims they have over the property, while transferring those rights to the corporation, known as the grantee. This means that the husband and wife are effectively transferring full ownership of the property to the corporation, without any warranties or guarantees regarding the property's title. It's important to note that a quitclaim deed does not provide any assurance or guarantee that the property is free from liens or encumbrances, nor does it guarantee the granters' ownership rights. There are different variations of a Santa Maria California Quitclaim Deed from Husband and Wife to Corporation, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the couple transfers their entire interest in the property to the corporation, without specifying any limitations or conditions. 2. Limited or Partial Quitclaim Deed: In this case, the couple may choose to transfer only a portion or specific interest in the property to the corporation while retaining the remaining interest. 3. Quitclaim Deed with Reservation of Rights: In some instances, the husband and wife may decide to transfer the property to the corporation but retain certain rights, such as the right to live on the property for a specified period or any other agreed-upon terms. It is important to consult with a real estate attorney or legal professional to ensure that the correct type of quitclaim deed is selected based on the specific circumstances and objectives of the transfer. Additionally, it's advisable to conduct a thorough title search before proceeding with the transfer to uncover any potential issues or encumbrances that may affect the property's transferability. Keywords: Santa Maria California, quitclaim deed, husband and wife, corporation, property ownership, transfer, rights, titles, claims, warranties, guarantees, liens, encumbrances, ownership rights, general quitclaim deed, limited quitclaim deed, partial quitclaim deed, quitclaim deed with reservation of rights, real estate attorney, legal professional, title search, transferability.A Santa Maria California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation. This type of deed allows the couple, as granters, to relinquish any existing rights, titles, and claims they have over the property, while transferring those rights to the corporation, known as the grantee. This means that the husband and wife are effectively transferring full ownership of the property to the corporation, without any warranties or guarantees regarding the property's title. It's important to note that a quitclaim deed does not provide any assurance or guarantee that the property is free from liens or encumbrances, nor does it guarantee the granters' ownership rights. There are different variations of a Santa Maria California Quitclaim Deed from Husband and Wife to Corporation, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the couple transfers their entire interest in the property to the corporation, without specifying any limitations or conditions. 2. Limited or Partial Quitclaim Deed: In this case, the couple may choose to transfer only a portion or specific interest in the property to the corporation while retaining the remaining interest. 3. Quitclaim Deed with Reservation of Rights: In some instances, the husband and wife may decide to transfer the property to the corporation but retain certain rights, such as the right to live on the property for a specified period or any other agreed-upon terms. It is important to consult with a real estate attorney or legal professional to ensure that the correct type of quitclaim deed is selected based on the specific circumstances and objectives of the transfer. Additionally, it's advisable to conduct a thorough title search before proceeding with the transfer to uncover any potential issues or encumbrances that may affect the property's transferability. Keywords: Santa Maria California, quitclaim deed, husband and wife, corporation, property ownership, transfer, rights, titles, claims, warranties, guarantees, liens, encumbrances, ownership rights, general quitclaim deed, limited quitclaim deed, partial quitclaim deed, quitclaim deed with reservation of rights, real estate attorney, legal professional, title search, transferability.