This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

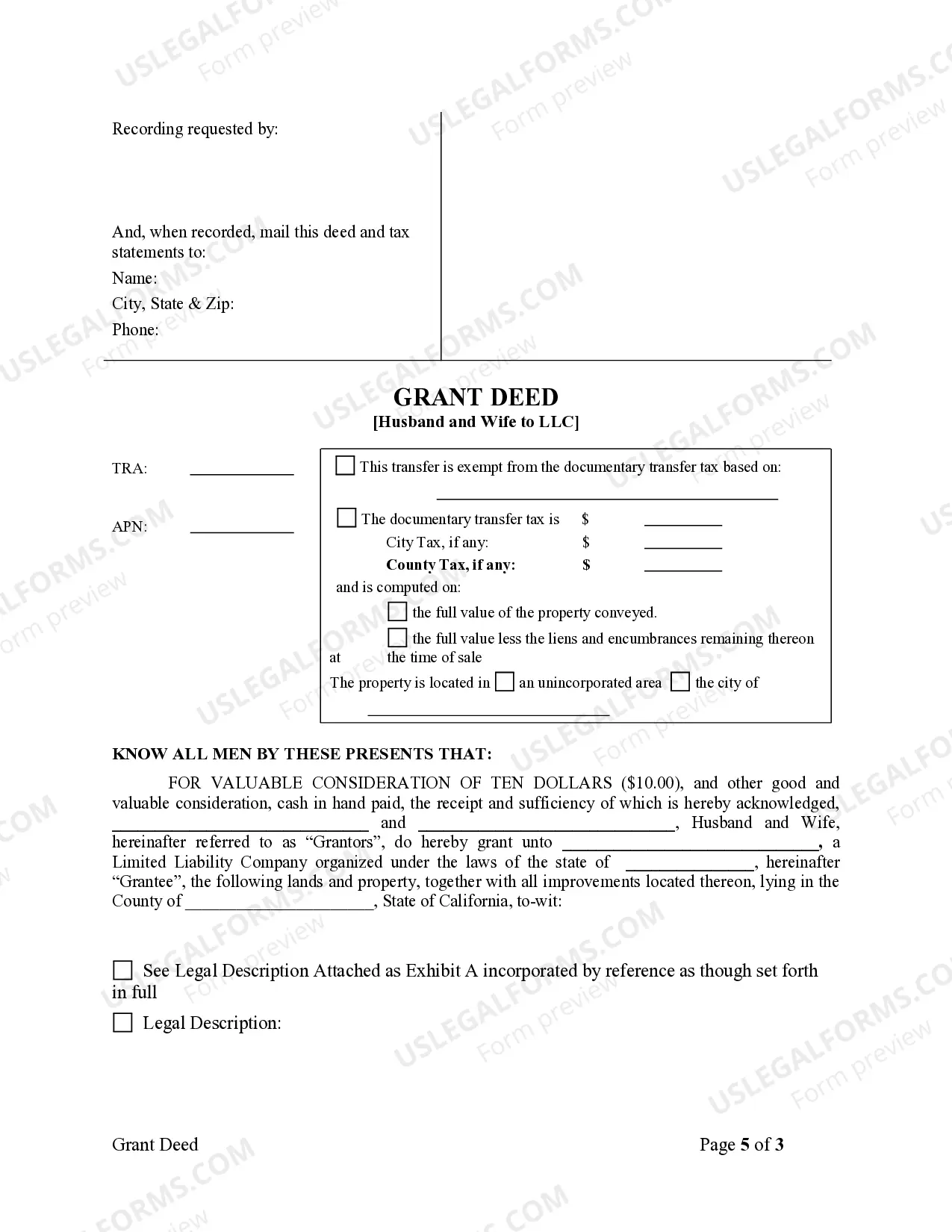

A Temecula California Grant Deed from Husband and Wife to LLC is a legal document used to transfer real property ownership from a married couple to a Limited Liability Company (LLC) in the city of Temecula, California. This type of transaction is typically used to protect the property and business interests of the couple by transferring ownership to a separate legal entity, the LLC, which provides liability protection and potential tax benefits. The Temecula California Grant Deed from Husband and Wife to LLC involves the transfer of ownership rights and interests held by the husband and wife as individual owners to the LLC. This deed clearly outlines the details of the transfer, such as the date of transfer, the legal description and address of the property, the names and addresses of the husband and wife as granters, and the name and address of the LLC as grantee. There are different types of Temecula California Grant Deeds from Husband and Wife to LLC that can be used, depending on the specific circumstances of the transaction. These include: 1. Traditional Grant Deed: This is the most common type of grant deed used to transfer ownership from individuals to an LLC. It includes provisions stating that the granters (husband and wife) grant, sell, and convey the property to the LLC, with the grantee assuming all ownership rights and responsibilities. 2. Trust Grant Deed: In some cases, the property may be held in a trust by the husband and wife. In such situations, a Trust Grant Deed is used to transfer the property from the trust to the LLC. This deed ensures that the property remains within the control of the trust and is then transferred to the LLC, maintaining the asset protection benefits of the trust structure. 3. Quitclaim Deed: Although less commonly used, a Quitclaim Deed can also be utilized to transfer property from husband and wife to an LLC. This type of deed transfers any ownership rights the granters may have, without providing any warranties or guarantees of title. It is typically used in situations where the granters are confident in their ownership of the property and do not require the additional assurances provided by a traditional grant deed. In conclusion, a Temecula California Grant Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property from a married couple to an LLC in Temecula, California. This deed ensures that the property is protected and owned by the LLC, providing liability protection and potential tax benefits for the couple. The different types of deeds that can be used include Traditional Grant Deeds, Trust Grant Deeds, and Quitclaim Deeds, each serving specific purposes based on the circumstances of the transaction.A Temecula California Grant Deed from Husband and Wife to LLC is a legal document used to transfer real property ownership from a married couple to a Limited Liability Company (LLC) in the city of Temecula, California. This type of transaction is typically used to protect the property and business interests of the couple by transferring ownership to a separate legal entity, the LLC, which provides liability protection and potential tax benefits. The Temecula California Grant Deed from Husband and Wife to LLC involves the transfer of ownership rights and interests held by the husband and wife as individual owners to the LLC. This deed clearly outlines the details of the transfer, such as the date of transfer, the legal description and address of the property, the names and addresses of the husband and wife as granters, and the name and address of the LLC as grantee. There are different types of Temecula California Grant Deeds from Husband and Wife to LLC that can be used, depending on the specific circumstances of the transaction. These include: 1. Traditional Grant Deed: This is the most common type of grant deed used to transfer ownership from individuals to an LLC. It includes provisions stating that the granters (husband and wife) grant, sell, and convey the property to the LLC, with the grantee assuming all ownership rights and responsibilities. 2. Trust Grant Deed: In some cases, the property may be held in a trust by the husband and wife. In such situations, a Trust Grant Deed is used to transfer the property from the trust to the LLC. This deed ensures that the property remains within the control of the trust and is then transferred to the LLC, maintaining the asset protection benefits of the trust structure. 3. Quitclaim Deed: Although less commonly used, a Quitclaim Deed can also be utilized to transfer property from husband and wife to an LLC. This type of deed transfers any ownership rights the granters may have, without providing any warranties or guarantees of title. It is typically used in situations where the granters are confident in their ownership of the property and do not require the additional assurances provided by a traditional grant deed. In conclusion, a Temecula California Grant Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property from a married couple to an LLC in Temecula, California. This deed ensures that the property is protected and owned by the LLC, providing liability protection and potential tax benefits for the couple. The different types of deeds that can be used include Traditional Grant Deeds, Trust Grant Deeds, and Quitclaim Deeds, each serving specific purposes based on the circumstances of the transaction.