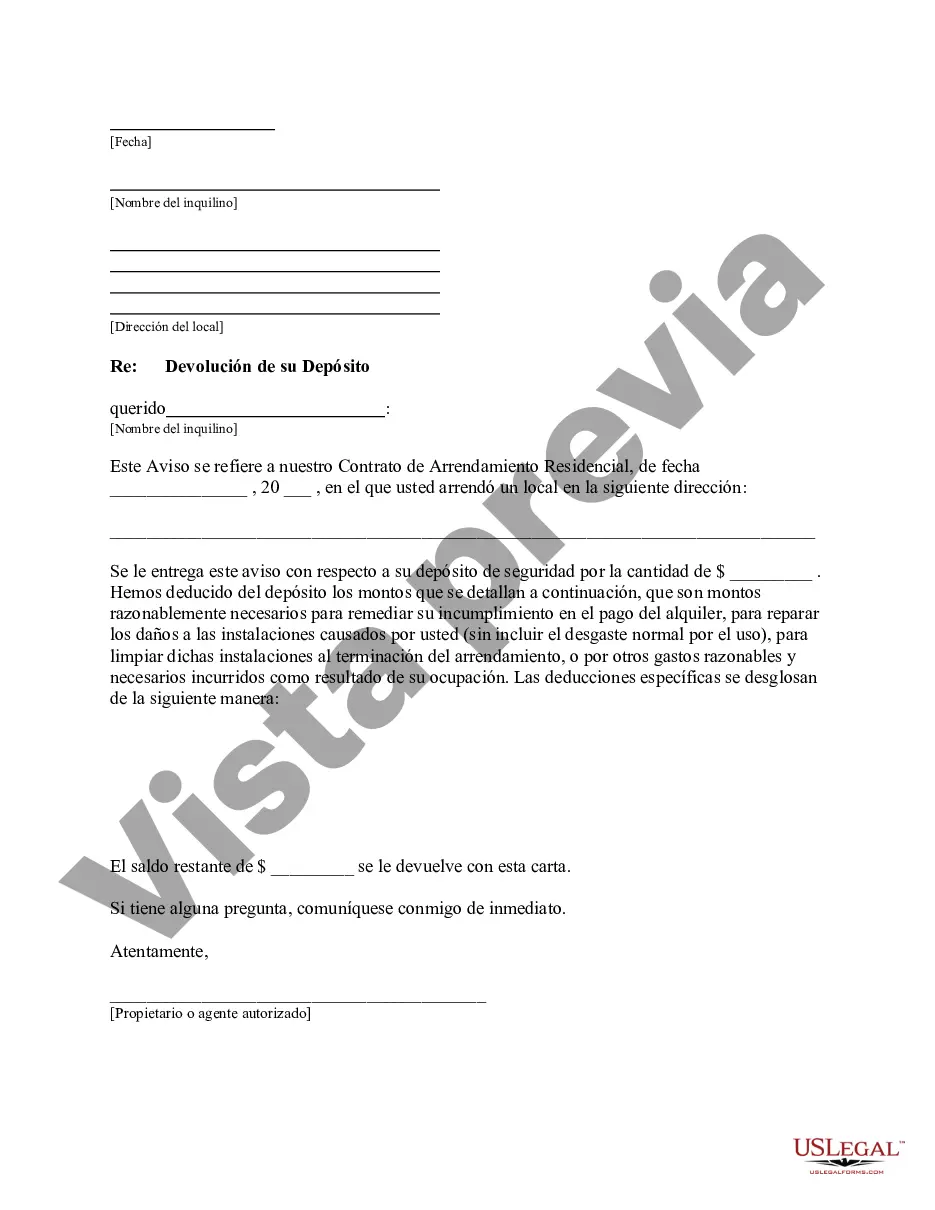

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Writing a San Diego California Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In the state of California, San Diego landlords are required to follow specific guidelines when returning a tenant's security deposit. This detailed description will guide you through writing a professional and legally compliant letter from the landlord to the tenant while deducting appropriate charges. Key Guidelines: 1. Clear Identification: Begin the letter by properly identifying both the landlord and tenant involved, including their full names, contact details, and the rental property address. 2. Deductible Expenses: Outline the legitimate deductions made from the security deposit. These deductions may include unpaid rent, utility bills, repair costs for damages beyond normal wear and tear, and cleaning expenses exceeding regular maintenance. 3. Supporting Documentation: Include itemized invoices, receipts, and relevant photographs substantiating the expenses deducted from the security deposit. Attach copies of invoices from professionals or contractors hired to perform repairs or cleaning services. 4. Security Deposit Amount: Mention the initial security deposit amount and state the final sum being returned to the tenant after deducting the legitimate charges. Specify the method of payment, such as a check or electronic transfer, and provide any necessary instructions or forms required for the tenant to access the funds. 5. Timeframe for Return: Clearly state the date when the tenant should expect to receive the returned security deposit. According to California law, landlords have 21 days from the tenant's move-out date to return the deposit. The letter should also indicate any delays or extensions in returning the funds, if applicable. 6. Required Statements: Include California-specific legal statements regarding the tenant's rights, such as references to the "California Civil Code Section 1950.5" and the tenant's right to request an itemized statement of deductions if desired. 7. Contact Information: Provide your contact information, including a phone number and email address, allowing the tenant to reach out with questions or concerns regarding the deductions or the return of the security deposit. Types of San Diego California Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Standard Security Deposit Return Letter: Used for returning a security deposit to a tenant after subtracting only legitimate deductions, such as unpaid rent or utility bills. — Itemized Security Deposit Return Letter: Provided when deducting additional expenses for repairs, cleaning, or any other charges beyond normal wear and tear. This letter includes itemized invoices and related documents as evidence. Conclusion: By following these guidelines and including all relevant information, San Diego landlords can create a comprehensive and legally compliant letter when returning a tenant's security deposit less deductions. Always ensure you adhere to California-specific laws and regulations while maintaining open communication with your tenant throughout the entire process.Title: Writing a San Diego California Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In the state of California, San Diego landlords are required to follow specific guidelines when returning a tenant's security deposit. This detailed description will guide you through writing a professional and legally compliant letter from the landlord to the tenant while deducting appropriate charges. Key Guidelines: 1. Clear Identification: Begin the letter by properly identifying both the landlord and tenant involved, including their full names, contact details, and the rental property address. 2. Deductible Expenses: Outline the legitimate deductions made from the security deposit. These deductions may include unpaid rent, utility bills, repair costs for damages beyond normal wear and tear, and cleaning expenses exceeding regular maintenance. 3. Supporting Documentation: Include itemized invoices, receipts, and relevant photographs substantiating the expenses deducted from the security deposit. Attach copies of invoices from professionals or contractors hired to perform repairs or cleaning services. 4. Security Deposit Amount: Mention the initial security deposit amount and state the final sum being returned to the tenant after deducting the legitimate charges. Specify the method of payment, such as a check or electronic transfer, and provide any necessary instructions or forms required for the tenant to access the funds. 5. Timeframe for Return: Clearly state the date when the tenant should expect to receive the returned security deposit. According to California law, landlords have 21 days from the tenant's move-out date to return the deposit. The letter should also indicate any delays or extensions in returning the funds, if applicable. 6. Required Statements: Include California-specific legal statements regarding the tenant's rights, such as references to the "California Civil Code Section 1950.5" and the tenant's right to request an itemized statement of deductions if desired. 7. Contact Information: Provide your contact information, including a phone number and email address, allowing the tenant to reach out with questions or concerns regarding the deductions or the return of the security deposit. Types of San Diego California Letters from Landlord to Tenant Returning Security Deposit Less Deductions: — Standard Security Deposit Return Letter: Used for returning a security deposit to a tenant after subtracting only legitimate deductions, such as unpaid rent or utility bills. — Itemized Security Deposit Return Letter: Provided when deducting additional expenses for repairs, cleaning, or any other charges beyond normal wear and tear. This letter includes itemized invoices and related documents as evidence. Conclusion: By following these guidelines and including all relevant information, San Diego landlords can create a comprehensive and legally compliant letter when returning a tenant's security deposit less deductions. Always ensure you adhere to California-specific laws and regulations while maintaining open communication with your tenant throughout the entire process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.