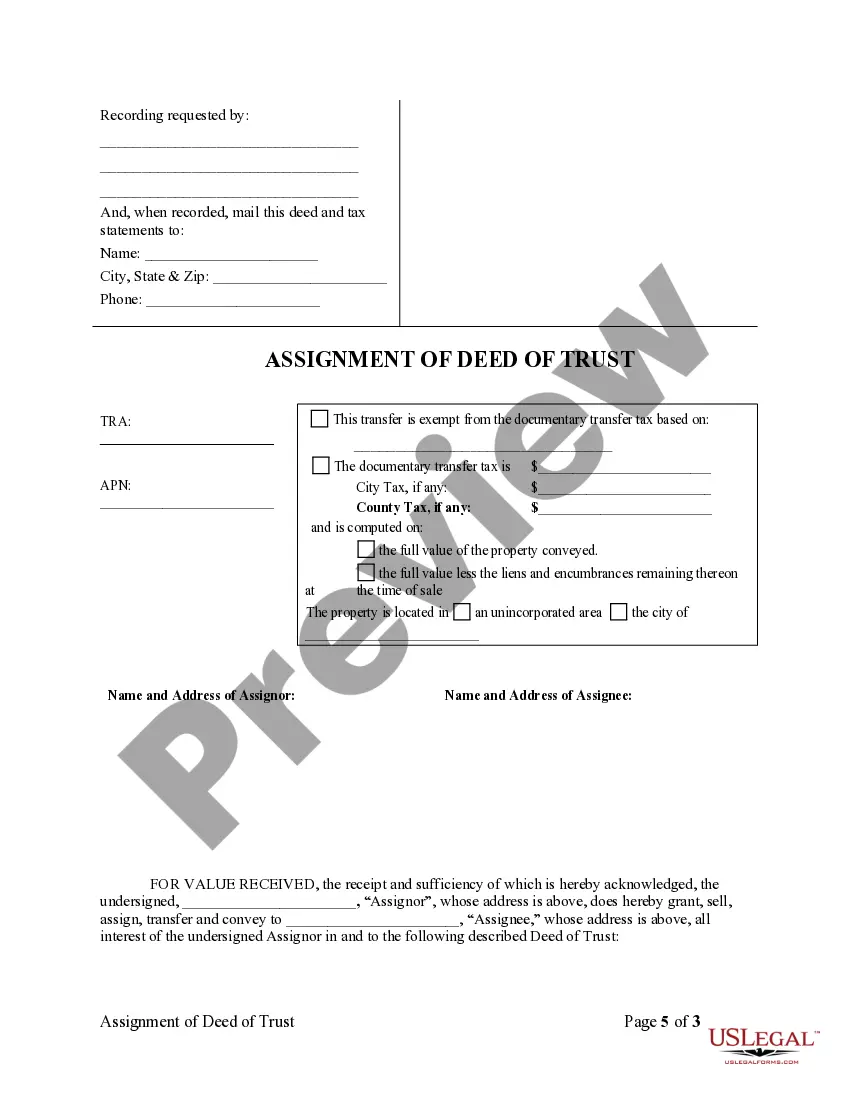

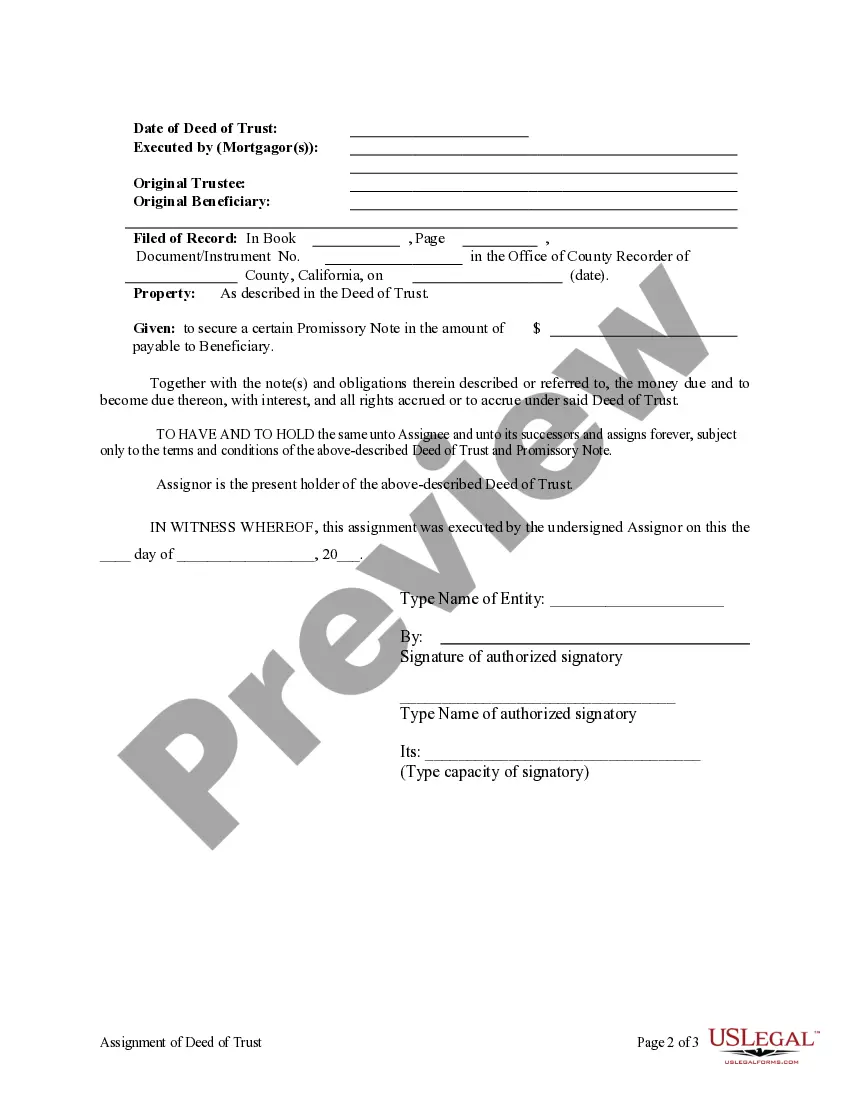

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

A Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of ownership of a property's Deed of Trust from a corporate mortgage holder to another party. This document outlines the terms and conditions of the assignment and solidifies the new party's rights and responsibilities as the new mortgage holder. The Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder is an essential process in the real estate industry. It allows companies and individuals to sell or transfer their mortgage interests while ensuring legal protection for all parties involved. This document is typically used in cases where a corporate mortgage holder wants to sell or transfer their mortgage to another entity. Keywords: Fullerton California, assignment of deed of trust, corporate mortgage holder, property ownership, transfer of ownership, legal protection, real estate industry, mortgage interests, sell or transfer mortgage, new mortgage holder. Types of Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Assignment of Deed of Trust — Sale: This type of assignment occurs when a corporate mortgage holder decides to sell their mortgage to another entity. The terms and conditions of the sale are documented in the assignment, including the transfer of ownership and any associated financial arrangements. 2. Assignment of Deed of Trust — Transfer: In this type of assignment, a corporate mortgage holder transfers their mortgage to another party without involving a sale. This could happen in cases of restructuring, consolidation, or internal transfers within a corporate organization. 3. Assignment of Deed of Trust — Substitution: This assignment type involves substituting the original corporate mortgage holder with a new entity or individual. It often occurs when a corporate mortgage holder undergoes a name change, merges with another company, or transfers their mortgage to a subsidiary or affiliate. 4. Assignment of Deed of Trust — Partial Assignment: Sometimes, a corporate mortgage holder may choose to transfer only a portion of their mortgage to another entity. This could be done for various reasons, such as risk mitigation, diversification of investment portfolios, or partnership agreements. The partial assignment outlines the specific terms and details of the transferred portion. 5. Assignment of Deed of Trust — Assignment of Beneficial Interest: This assignment occurs when a corporate mortgage holder transfers the beneficial interest in the mortgage to another party. The new party gains the right to receive payments and the benefits associated with the mortgage, while the original mortgage holder retains legal title to the mortgage. In conclusion, the Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that allows corporate mortgage holders to transfer their mortgage interests to other parties. This document plays a crucial role in ensuring a smooth transfer of ownership while safeguarding the rights and responsibilities of all parties involved in the transaction.A Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of ownership of a property's Deed of Trust from a corporate mortgage holder to another party. This document outlines the terms and conditions of the assignment and solidifies the new party's rights and responsibilities as the new mortgage holder. The Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder is an essential process in the real estate industry. It allows companies and individuals to sell or transfer their mortgage interests while ensuring legal protection for all parties involved. This document is typically used in cases where a corporate mortgage holder wants to sell or transfer their mortgage to another entity. Keywords: Fullerton California, assignment of deed of trust, corporate mortgage holder, property ownership, transfer of ownership, legal protection, real estate industry, mortgage interests, sell or transfer mortgage, new mortgage holder. Types of Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Assignment of Deed of Trust — Sale: This type of assignment occurs when a corporate mortgage holder decides to sell their mortgage to another entity. The terms and conditions of the sale are documented in the assignment, including the transfer of ownership and any associated financial arrangements. 2. Assignment of Deed of Trust — Transfer: In this type of assignment, a corporate mortgage holder transfers their mortgage to another party without involving a sale. This could happen in cases of restructuring, consolidation, or internal transfers within a corporate organization. 3. Assignment of Deed of Trust — Substitution: This assignment type involves substituting the original corporate mortgage holder with a new entity or individual. It often occurs when a corporate mortgage holder undergoes a name change, merges with another company, or transfers their mortgage to a subsidiary or affiliate. 4. Assignment of Deed of Trust — Partial Assignment: Sometimes, a corporate mortgage holder may choose to transfer only a portion of their mortgage to another entity. This could be done for various reasons, such as risk mitigation, diversification of investment portfolios, or partnership agreements. The partial assignment outlines the specific terms and details of the transferred portion. 5. Assignment of Deed of Trust — Assignment of Beneficial Interest: This assignment occurs when a corporate mortgage holder transfers the beneficial interest in the mortgage to another party. The new party gains the right to receive payments and the benefits associated with the mortgage, while the original mortgage holder retains legal title to the mortgage. In conclusion, the Fullerton California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that allows corporate mortgage holders to transfer their mortgage interests to other parties. This document plays a crucial role in ensuring a smooth transfer of ownership while safeguarding the rights and responsibilities of all parties involved in the transaction.