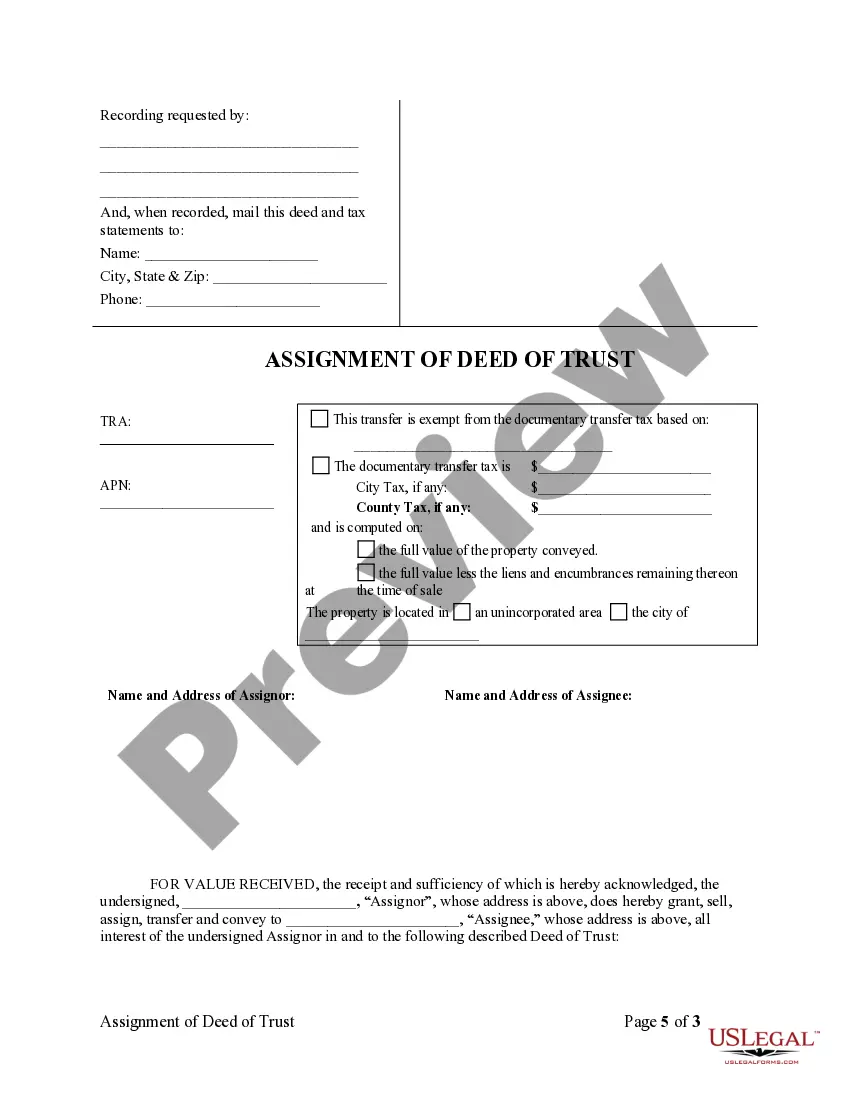

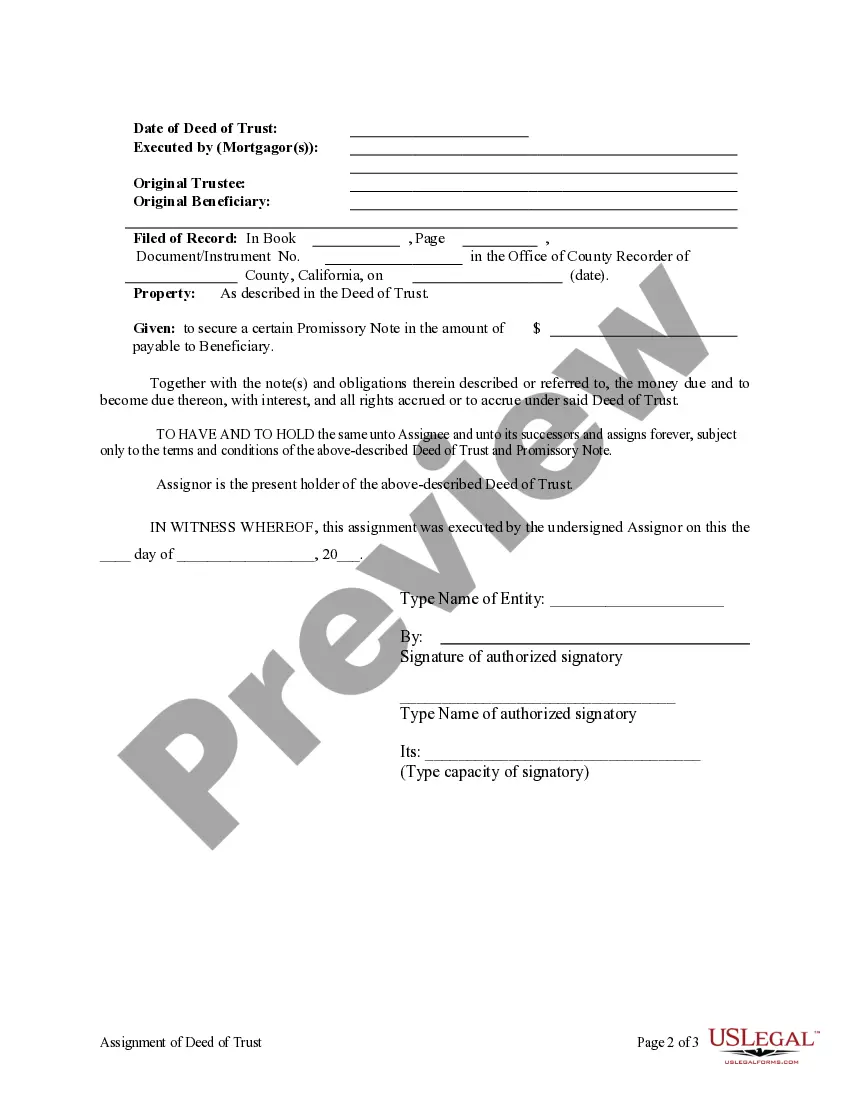

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

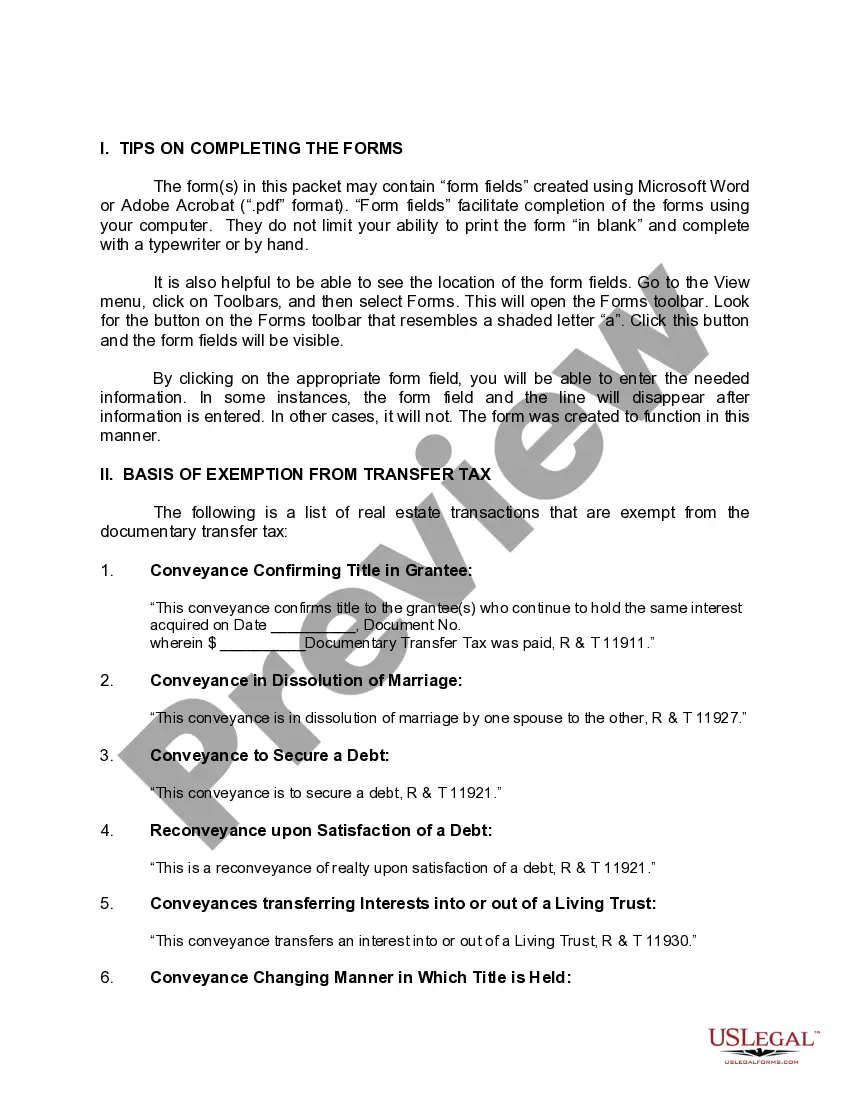

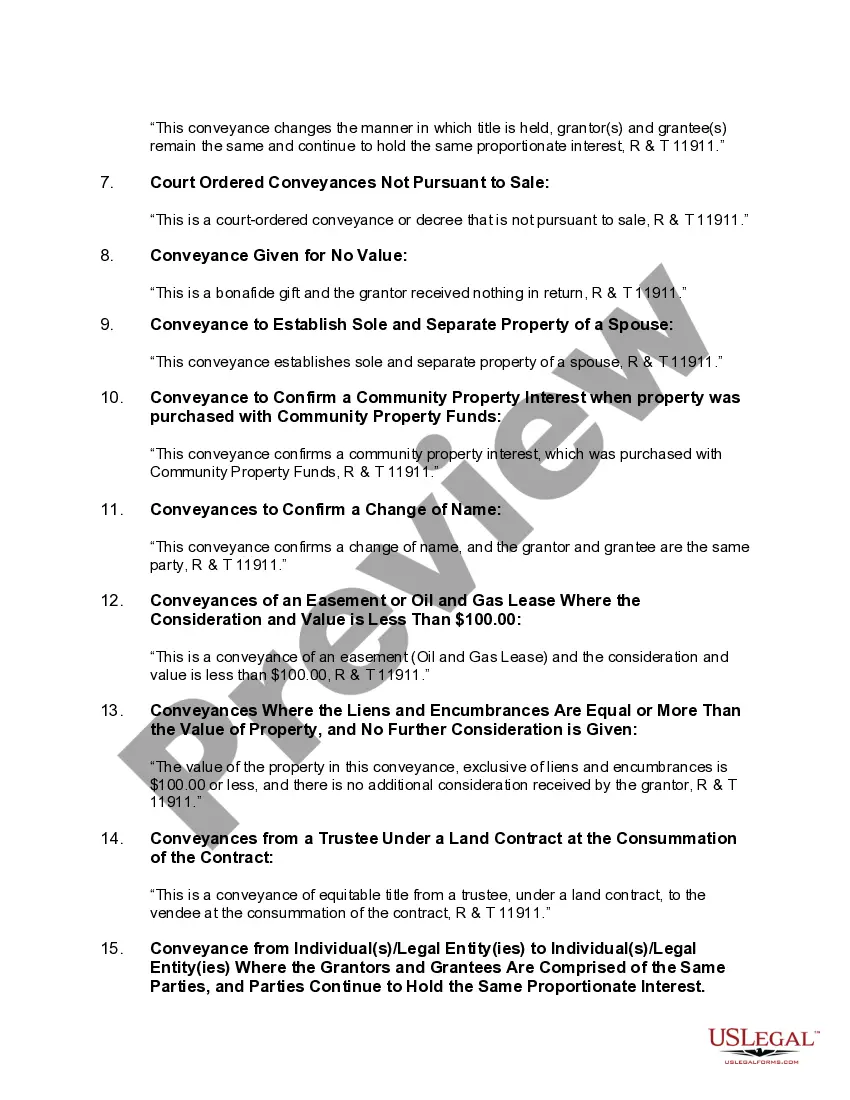

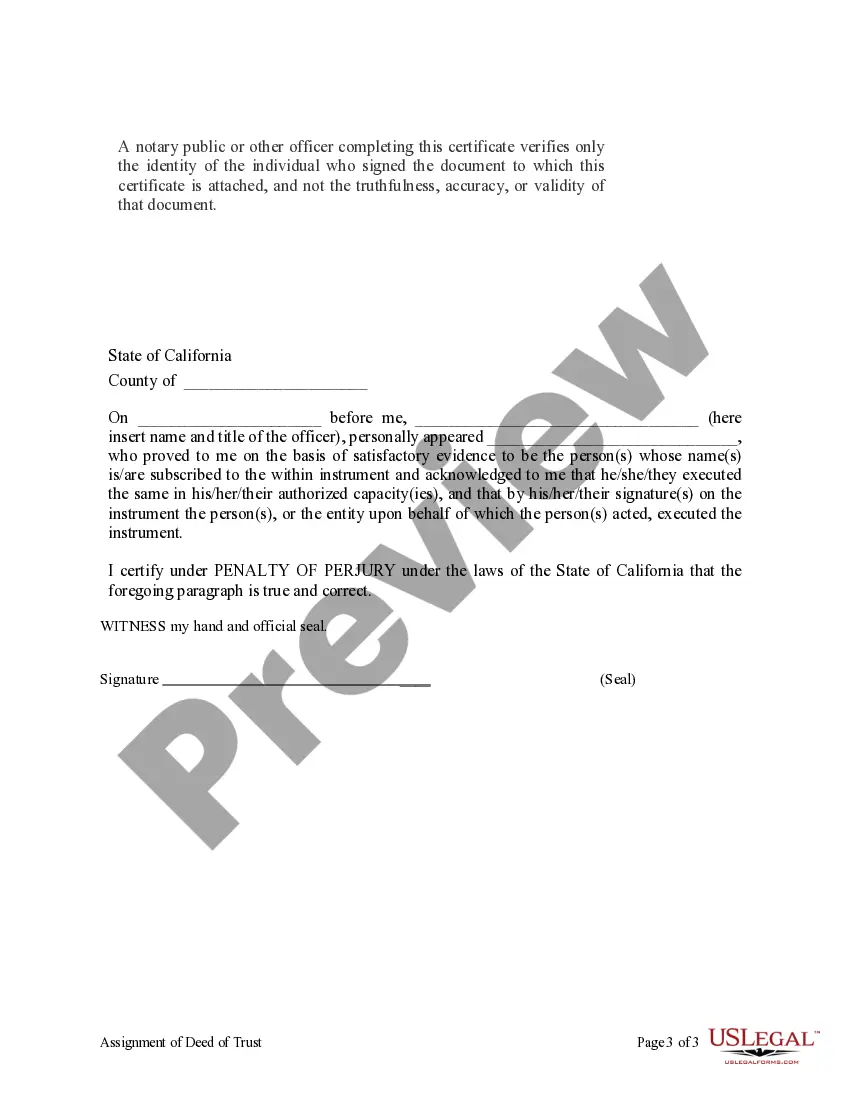

Santa Ana California Assignment of Deed of Trust by Corporate Mortgage Holder — A Comprehensive Overview In Santa Ana, California, a common legal process involves the Assignment of Deed of Trust by Corporate Mortgage Holder. This assignment refers to the transfer of ownership of a property's deed of trust from one corporate mortgage holder to another. This detailed description will provide valuable insights into this process, outlining its significance, key players, and various types. 1. Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust is a crucial step in the real estate and mortgage industry. It occurs when the original lender, typically a corporate entity, transfers the mortgage interest to another corporate mortgage holder. This transaction typically affects loans secured by real estate, enabling the new mortgage holder to assume the rights and responsibilities associated with the deed of trust. 2. Key Players Involved: a. Original Lender: This is the corporate mortgage holder who initially extends the loan to the borrower and secures it with a deed of trust. b. Assignor: The assignor is the original lender who transfers the deed of trust to a new corporate mortgage holder. c. Assignee: This represents the new corporate mortgage holder who receives ownership of the deed of trust through the assignment process. d. Borrower: The borrower or property owner is obligated to repay the loan or mortgage amount to the new mortgage holder. 3. Types of Assignment of Deed of Trust: While the assignment process is similar, specific types exist within Santa Ana, California. These may include: a. Full Assignment: In this type, the complete ownership and rights of the deed of trust are transferred by the original lender to the new corporate mortgage holder. The new holder assumes all rights, obligations, and interest in the loan. b. Partial Assignment: Sometimes, the original lender assigns only a part of their interest in the deed of trust to another corporate mortgage holder. This is common when the loan amount is large, and the original lender seeks to reduce its exposure. c. Assignment with Recourse: This type of assignment means that if the borrower defaults, the assignor (original lender) remains liable for the loss or damage suffered by the assignee (new mortgage holder). Essentially, the assignor guarantees the assignee against any financial loss. d. Assignment without Recourse: In this scenario, the original lender (assignor) relinquishes any liability or obligation for the loan or deed of trust once it is assigned to the new mortgage holder (assignee). The assignee bears all risks associated with loan default or financial losses. 4. Legal Requirements: To ensure legality and enforceability, the Assignment of Deed of Trust by Corporate Mortgage Holder in Santa Ana, California, must adhere to specific legal requirements. These may include: a. Written Document: The assignment must be in writing, signed, and notarized by both the assignor and the assignee. b. Public Recording: The assignment document should be recorded with the county recorder's office to provide public notice of the transfer. c. Proper Documentation: The assignment document should contain essential details, such as the names of parties involved, loan amount, property address, recording information of the original deed of trust, and legal description of the property. In conclusion, the Assignment of Deed of Trust by Corporate Mortgage Holder is a vital process in the Santa Ana, California real estate industry. This description provides a comprehensive understanding of its significance, the key players involved, different types, and legal requirements. Adhering to these legal procedures ensures transparency and protects the rights of all parties engaged in the assignment.Santa Ana California Assignment of Deed of Trust by Corporate Mortgage Holder — A Comprehensive Overview In Santa Ana, California, a common legal process involves the Assignment of Deed of Trust by Corporate Mortgage Holder. This assignment refers to the transfer of ownership of a property's deed of trust from one corporate mortgage holder to another. This detailed description will provide valuable insights into this process, outlining its significance, key players, and various types. 1. Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust is a crucial step in the real estate and mortgage industry. It occurs when the original lender, typically a corporate entity, transfers the mortgage interest to another corporate mortgage holder. This transaction typically affects loans secured by real estate, enabling the new mortgage holder to assume the rights and responsibilities associated with the deed of trust. 2. Key Players Involved: a. Original Lender: This is the corporate mortgage holder who initially extends the loan to the borrower and secures it with a deed of trust. b. Assignor: The assignor is the original lender who transfers the deed of trust to a new corporate mortgage holder. c. Assignee: This represents the new corporate mortgage holder who receives ownership of the deed of trust through the assignment process. d. Borrower: The borrower or property owner is obligated to repay the loan or mortgage amount to the new mortgage holder. 3. Types of Assignment of Deed of Trust: While the assignment process is similar, specific types exist within Santa Ana, California. These may include: a. Full Assignment: In this type, the complete ownership and rights of the deed of trust are transferred by the original lender to the new corporate mortgage holder. The new holder assumes all rights, obligations, and interest in the loan. b. Partial Assignment: Sometimes, the original lender assigns only a part of their interest in the deed of trust to another corporate mortgage holder. This is common when the loan amount is large, and the original lender seeks to reduce its exposure. c. Assignment with Recourse: This type of assignment means that if the borrower defaults, the assignor (original lender) remains liable for the loss or damage suffered by the assignee (new mortgage holder). Essentially, the assignor guarantees the assignee against any financial loss. d. Assignment without Recourse: In this scenario, the original lender (assignor) relinquishes any liability or obligation for the loan or deed of trust once it is assigned to the new mortgage holder (assignee). The assignee bears all risks associated with loan default or financial losses. 4. Legal Requirements: To ensure legality and enforceability, the Assignment of Deed of Trust by Corporate Mortgage Holder in Santa Ana, California, must adhere to specific legal requirements. These may include: a. Written Document: The assignment must be in writing, signed, and notarized by both the assignor and the assignee. b. Public Recording: The assignment document should be recorded with the county recorder's office to provide public notice of the transfer. c. Proper Documentation: The assignment document should contain essential details, such as the names of parties involved, loan amount, property address, recording information of the original deed of trust, and legal description of the property. In conclusion, the Assignment of Deed of Trust by Corporate Mortgage Holder is a vital process in the Santa Ana, California real estate industry. This description provides a comprehensive understanding of its significance, the key players involved, different types, and legal requirements. Adhering to these legal procedures ensures transparency and protects the rights of all parties engaged in the assignment.