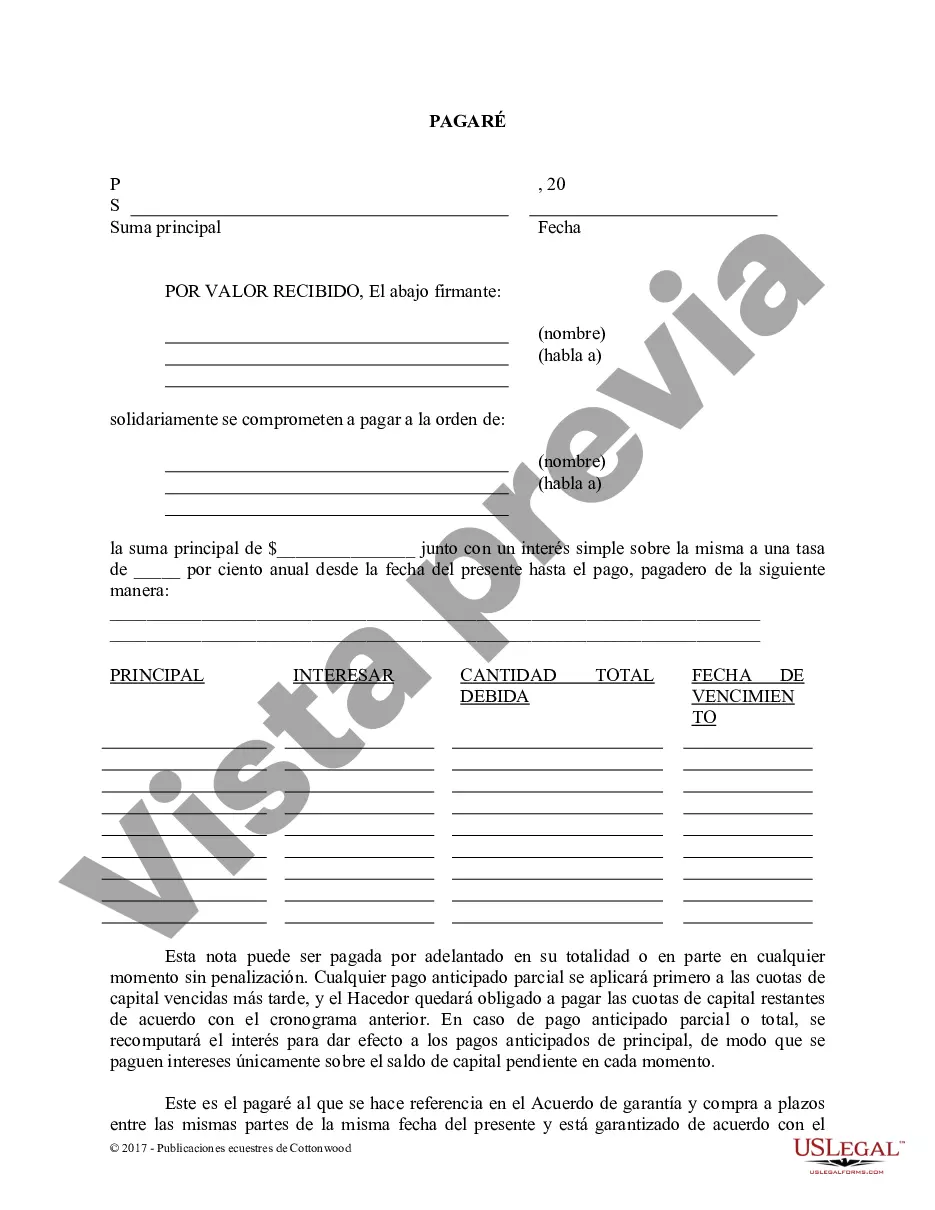

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Inglewood California Promissory Note — Horse Equine Forms are legal documents designed to outline the terms and conditions of a financial agreement between parties related to the buying or selling of horses in Inglewood, California. These promissory notes serve as written evidence of the borrower's promise to repay the lender a specific amount of money within a predefined period. The Inglewood California Promissory Note — Horse Equine Forms typically contain essential details such as the names and addresses of the borrower and lender, the principal loan amount, the interest rate or any applicable fees, the repayment schedule, and the consequences of defaulting on the loan. These forms are crucial for establishing a clear and legally binding agreement between both parties involved in the horse equine transaction. Different types of Inglewood California Promissory Note — Horse Equine Forms may include: 1. Simple Promissory Note: This form is used for straightforward horse purchases or sales, where the buyer borrows money from the seller and agrees to repay it within a specified period, along with an agreed-upon interest rate. 2. Installment Promissory Note: This type of form is commonly utilized when the buyer wishes to repay the loan in installments over a particular period. It outlines the agreed-upon repayment schedule and the interest calculated on the outstanding balance. 3. Secured Promissory Note: In some instances, a lender may require additional security for the loan, especially if it involves a significant amount of money. This form specifies the collateral offered by the borrower, such as the horse itself or other valuable assets, in case of default. 4. Balloon Promissory Note: A balloon payment often applies when the borrower agrees to make smaller monthly installments but is obliged to repay the remaining balance in a lump sum at the end of the loan term. This form clarifies the repayment plan, including the final balloon payment amount and due date. Regardless of the specific type, Inglewood California Promissory Note — Horse Equine Forms play a crucial role in protecting the interests and rights of both the borrower and lender involved in horse-related financial transactions. It is essential to carefully review and understand the terms outlined in the form before entering into any agreement, ensuring compliance with state laws and regulations.Inglewood California Promissory Note — Horse Equine Forms are legal documents designed to outline the terms and conditions of a financial agreement between parties related to the buying or selling of horses in Inglewood, California. These promissory notes serve as written evidence of the borrower's promise to repay the lender a specific amount of money within a predefined period. The Inglewood California Promissory Note — Horse Equine Forms typically contain essential details such as the names and addresses of the borrower and lender, the principal loan amount, the interest rate or any applicable fees, the repayment schedule, and the consequences of defaulting on the loan. These forms are crucial for establishing a clear and legally binding agreement between both parties involved in the horse equine transaction. Different types of Inglewood California Promissory Note — Horse Equine Forms may include: 1. Simple Promissory Note: This form is used for straightforward horse purchases or sales, where the buyer borrows money from the seller and agrees to repay it within a specified period, along with an agreed-upon interest rate. 2. Installment Promissory Note: This type of form is commonly utilized when the buyer wishes to repay the loan in installments over a particular period. It outlines the agreed-upon repayment schedule and the interest calculated on the outstanding balance. 3. Secured Promissory Note: In some instances, a lender may require additional security for the loan, especially if it involves a significant amount of money. This form specifies the collateral offered by the borrower, such as the horse itself or other valuable assets, in case of default. 4. Balloon Promissory Note: A balloon payment often applies when the borrower agrees to make smaller monthly installments but is obliged to repay the remaining balance in a lump sum at the end of the loan term. This form clarifies the repayment plan, including the final balloon payment amount and due date. Regardless of the specific type, Inglewood California Promissory Note — Horse Equine Forms play a crucial role in protecting the interests and rights of both the borrower and lender involved in horse-related financial transactions. It is essential to carefully review and understand the terms outlined in the form before entering into any agreement, ensuring compliance with state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.