Costa Mesa California Notice of Dishonored Check Civilvi— - Only for Stopped Payment Introduction: In Costa Mesa, California, the legal consequences of issuing a bad or bounced check can be enforced through the Notice of Dishonored Check — Civil procedure. This notice aims to alert individuals who have issued a bad check, specifically in cases of stopped payment, about the civil consequences they may face. Please note that there might be variations in this notice based on different types of dishonored checks under civil law in Costa Mesa. Let's delve further into the specifics: Types of Dishonored Checks: 1. Bad Check: A bad check refers to a check that is not honored by the bank due to insufficient funds in the issuer's account. This could happen when the check amount exceeds the available balance, rendering it invalid for payment to the recipient. 2. Bounced Check: A bounced check is another term used to describe a check that has been returned unpaid by the bank. This can occur for various reasons, including insufficient funds, account closures, or suspected fraud. Notice of Dishonored Check — Civil (Only for Stopped Payment): In cases of stopped payment, the Notice of Dishonored Check — Civil serves as a legal mechanism to notify the check issuer of their defaulted payment and the potential legal consequences they may face. This notice is specifically applicable when a payment has been stopped by the issuer after giving the check to the recipient. Key Elements of the Notice: 1. Notification: The notice clearly informs the check issuer that their payment through the specific check has been dishonored due to stopped payment. It provides them with an official notification of the financial obligation they have failed to meet. 2. Non-Payment Consequences: The notice outlines the potential legal repercussions of issuing a bad or bounced check, highlighting the civil actions that can be taken against the issuer. This could include monetary penalties, legal fees, and potential damage to their credit rating. 3. Rectification Period: In some instances, the notice may offer the check issuer a specific period to rectify the dishonored payment. This allows them an opportunity to make the payment in full, including any additional fees accrued as a result of the dishonored check. 4. Legal Action: If the check issuer fails to respond or make the required payment within the given rectification period, the notice may specify that legal action will be pursued against them. This can involve court proceedings and further financial liabilities. Conclusion: The Costa Mesa California Notice of Dishonored Check Civilvi— - Only for Stopped Payment is a crucial tool in holding individuals accountable for issuing bad or bounced checks with stopped payments. It serves as a warning to check issuers about the legal consequences they may face if they fail to rectify the dishonored payment promptly. Respecting financial obligations, ensuring sufficient funds, and being aware of the legal implications associated with issuing checks are important for maintaining financial integrity and avoiding legal complications.

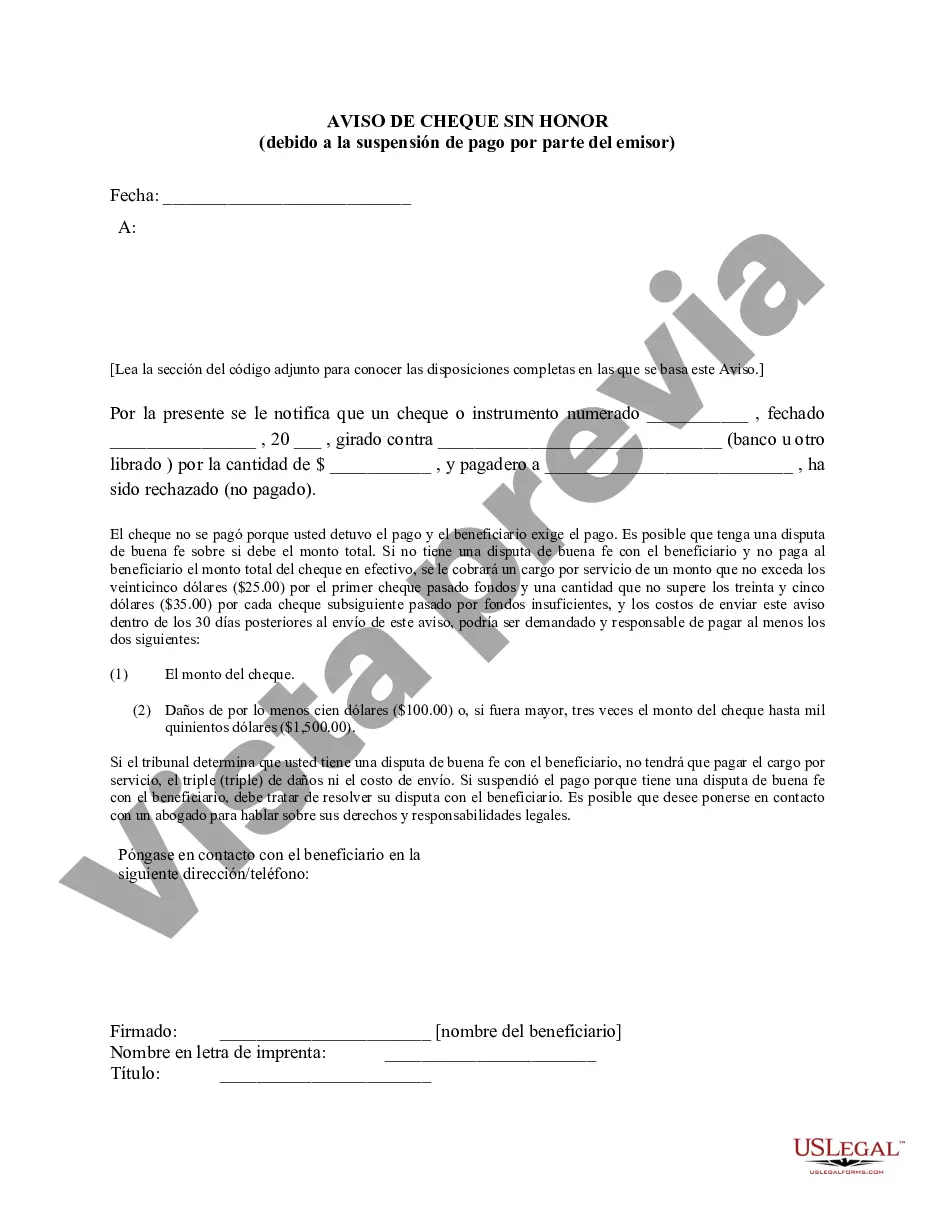

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Costa Mesa California Aviso de cheque sin fondos - Civil - Solo para suspensión de pago - Palabras clave: cheque sin fondos, cheque sin fondos - California Notice of Dishonored Check - Civil - Only for Stopped Payment - Keywords: bad check, bounced check

State:

California

City:

Costa Mesa

Control #:

CA-402N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

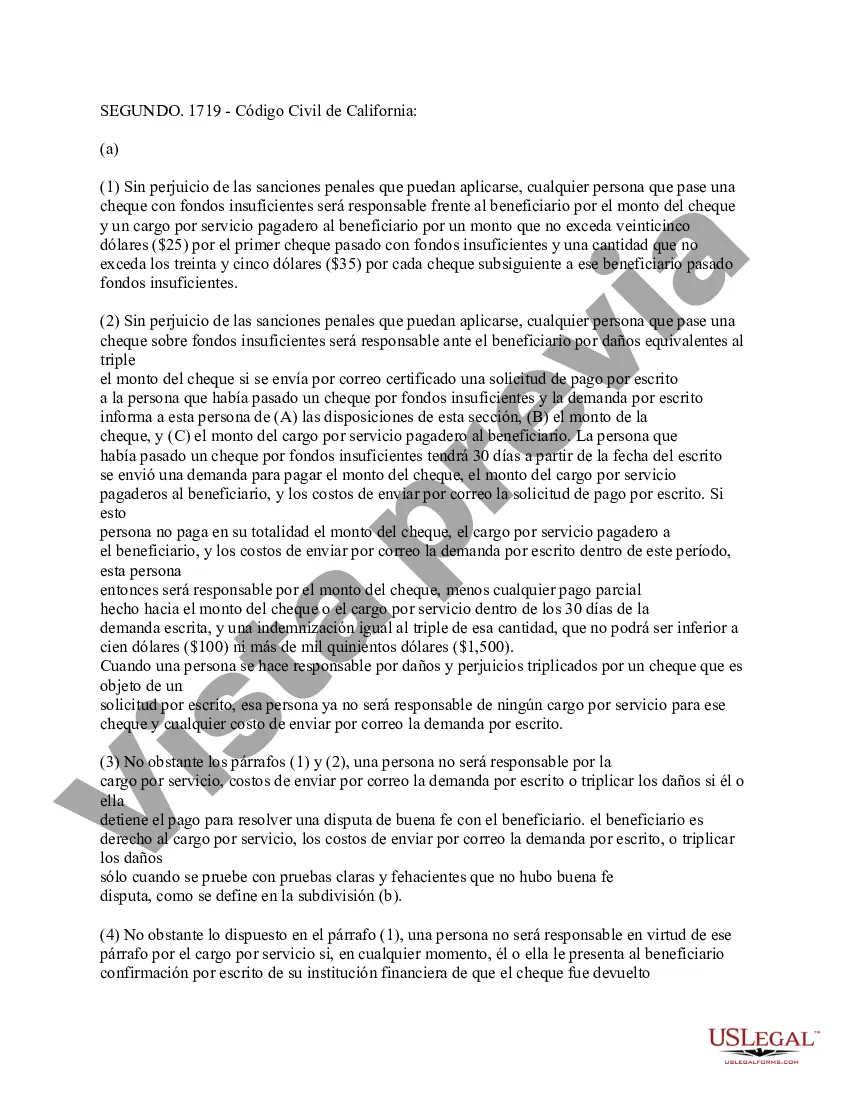

Costa Mesa California Notice of Dishonored Check Civilvi— - Only for Stopped Payment Introduction: In Costa Mesa, California, the legal consequences of issuing a bad or bounced check can be enforced through the Notice of Dishonored Check — Civil procedure. This notice aims to alert individuals who have issued a bad check, specifically in cases of stopped payment, about the civil consequences they may face. Please note that there might be variations in this notice based on different types of dishonored checks under civil law in Costa Mesa. Let's delve further into the specifics: Types of Dishonored Checks: 1. Bad Check: A bad check refers to a check that is not honored by the bank due to insufficient funds in the issuer's account. This could happen when the check amount exceeds the available balance, rendering it invalid for payment to the recipient. 2. Bounced Check: A bounced check is another term used to describe a check that has been returned unpaid by the bank. This can occur for various reasons, including insufficient funds, account closures, or suspected fraud. Notice of Dishonored Check — Civil (Only for Stopped Payment): In cases of stopped payment, the Notice of Dishonored Check — Civil serves as a legal mechanism to notify the check issuer of their defaulted payment and the potential legal consequences they may face. This notice is specifically applicable when a payment has been stopped by the issuer after giving the check to the recipient. Key Elements of the Notice: 1. Notification: The notice clearly informs the check issuer that their payment through the specific check has been dishonored due to stopped payment. It provides them with an official notification of the financial obligation they have failed to meet. 2. Non-Payment Consequences: The notice outlines the potential legal repercussions of issuing a bad or bounced check, highlighting the civil actions that can be taken against the issuer. This could include monetary penalties, legal fees, and potential damage to their credit rating. 3. Rectification Period: In some instances, the notice may offer the check issuer a specific period to rectify the dishonored payment. This allows them an opportunity to make the payment in full, including any additional fees accrued as a result of the dishonored check. 4. Legal Action: If the check issuer fails to respond or make the required payment within the given rectification period, the notice may specify that legal action will be pursued against them. This can involve court proceedings and further financial liabilities. Conclusion: The Costa Mesa California Notice of Dishonored Check Civilvi— - Only for Stopped Payment is a crucial tool in holding individuals accountable for issuing bad or bounced checks with stopped payments. It serves as a warning to check issuers about the legal consequences they may face if they fail to rectify the dishonored payment promptly. Respecting financial obligations, ensuring sufficient funds, and being aware of the legal implications associated with issuing checks are important for maintaining financial integrity and avoiding legal complications.

Free preview

How to fill out Costa Mesa California Aviso De Cheque Sin Fondos - Civil - Solo Para Suspensión De Pago - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already used our service before, log in to your account and save the Costa Mesa California Notice of Dishonored Check - Civil - Only for Stopped Payment - Keywords: bad check, bounced check on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Costa Mesa California Notice of Dishonored Check - Civil - Only for Stopped Payment - Keywords: bad check, bounced check. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!