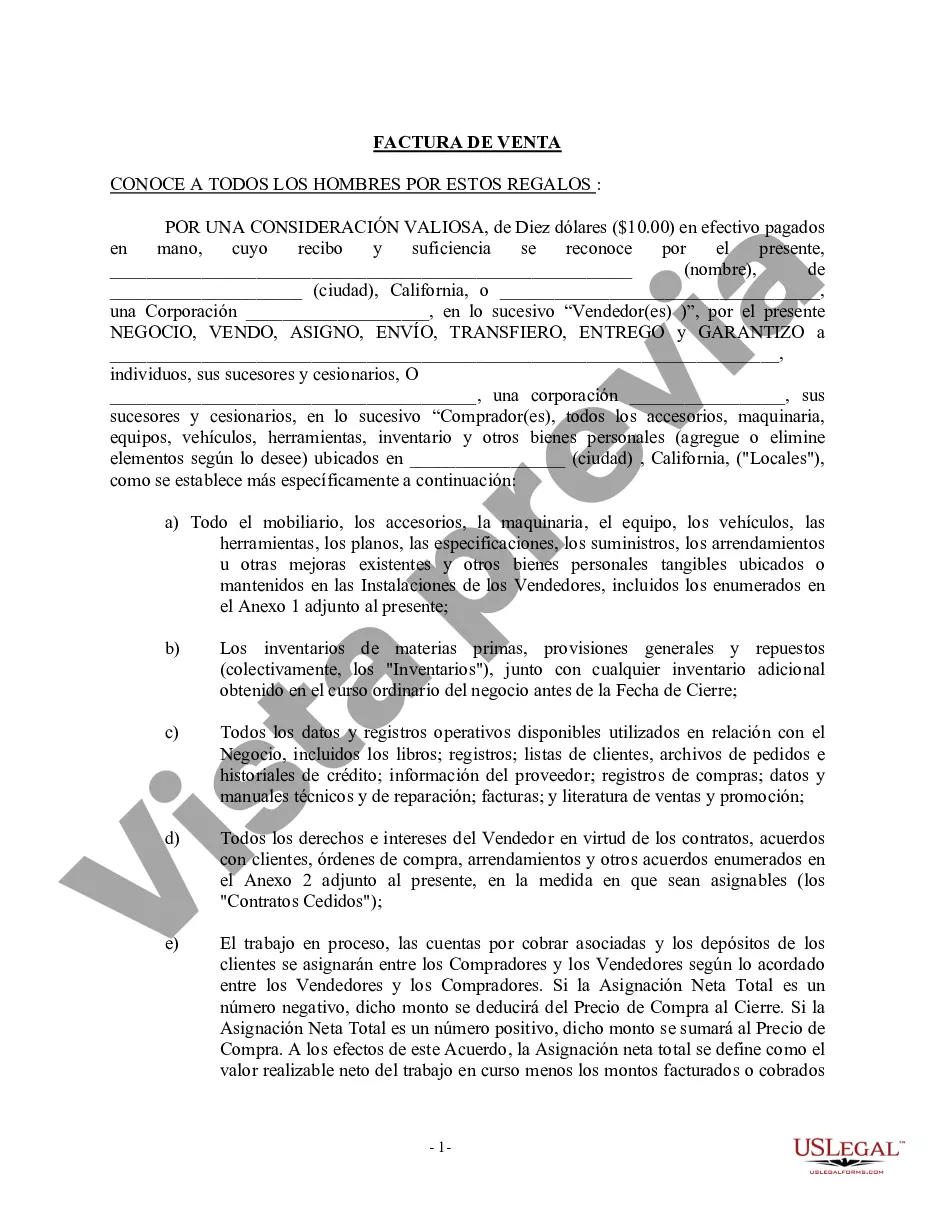

The San Jose California Bill of Sale in Connection with the Sale of Business by Individual or Corporate Seller is a legal document that outlines the transfer of ownership of a business from one party to another. It serves as proof of the transaction and provides specific details regarding the assets, liabilities, and terms and conditions of the sale. This bill of sale is applicable in San Jose, California, and is used when an individual or a corporation is selling their business to another individual, corporation, or entity. It ensures a smooth and legally binding transfer of ownership, protecting the interests of both the buyer and the seller. The San Jose California Bill of Sale includes various sections that are crucial to the sale of a business. These sections may include: 1. Parties involved: This section identifies the seller, buyer, and any third parties involved in the transaction. It includes their legal names, addresses, contact information, and corporate identification numbers, if applicable. 2. Business description: This section provides a detailed description of the business being sold. It may include information such as the name of the business, its legal structure (sole proprietorship, partnership, corporation), and its business address. 3. Assets and liabilities: In this section, the bill of sale lists all the assets and liabilities included in the sale. Assets may include tangible property like equipment, inventory, vehicles, real estate, intellectual property, and goodwill. Liabilities may include outstanding debts, loans, leases, or contractual obligations. 4. Purchase price and payment terms: This section outlines the agreed-upon purchase price of the business and the payment terms. It may include details on the down payment, financing arrangements, installment payments, or any other considerations. 5. Representations and warranties: Both the seller and the buyer may make certain representations and warranties regarding the business. These statements affirm the accuracy of information provided and the condition and legality of the business being sold. 6. Closing conditions: This section details the conditions necessary for the completion of the sale. It may include requirements such as obtaining necessary permits, licenses, or consents, or the completion of due diligence by the buyer. 7. Indemnification: This section addresses the indemnification obligations of both parties, protecting each party from any losses, claims, damages, or liabilities that may arise from the sale. Different types of San Jose California Bills of Sale in connection with the sale of a business may be categorized based on the nature of the business being sold, such as retail, manufacturing, professional services, or franchises. However, the core elements of the bill of sale remain consistent, with variations specific to the nature of the business or the preferences of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Factura de venta en relación con la venta del negocio por parte del vendedor individual o corporativo - California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out San Jose California Factura De Venta En Relación Con La Venta Del Negocio Por Parte Del Vendedor Individual O Corporativo?

We consistently seek to reduce or evade legal complications when handling subtle law-related or financial issues.

To achieve this, we enlist attorney services that are generally quite costly.

Nevertheless, not every legal challenge is as intricate; many can be managed by ourselves.

US Legal Forms is an online resource featuring a current compilation of do-it-yourself legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In/">Log In to your account and click the Get button next to it. If you lose the form, you can always re-download it in the My documents tab. The procedure is just as simple if you are new to the website! You can set up your account in just a few minutes. Ensure that the San Jose California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller complies with the laws and regulations of your state and locality. Additionally, it is vital to review the form's description (if available), and if you find any inconsistencies with your initial requirements, search for another form. Once you've verified that the San Jose California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller meets your needs, you can choose a subscription plan and proceed to payment. Thereafter, you can download the form in any preferred file format. Having been in the market for over 24 years, we have assisted millions of individuals by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

- Our platform empowers you to manage your affairs independently without relying on an attorney's services.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Utilize US Legal Forms whenever you need to quickly and securely locate and download the San Jose California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller or any other document.