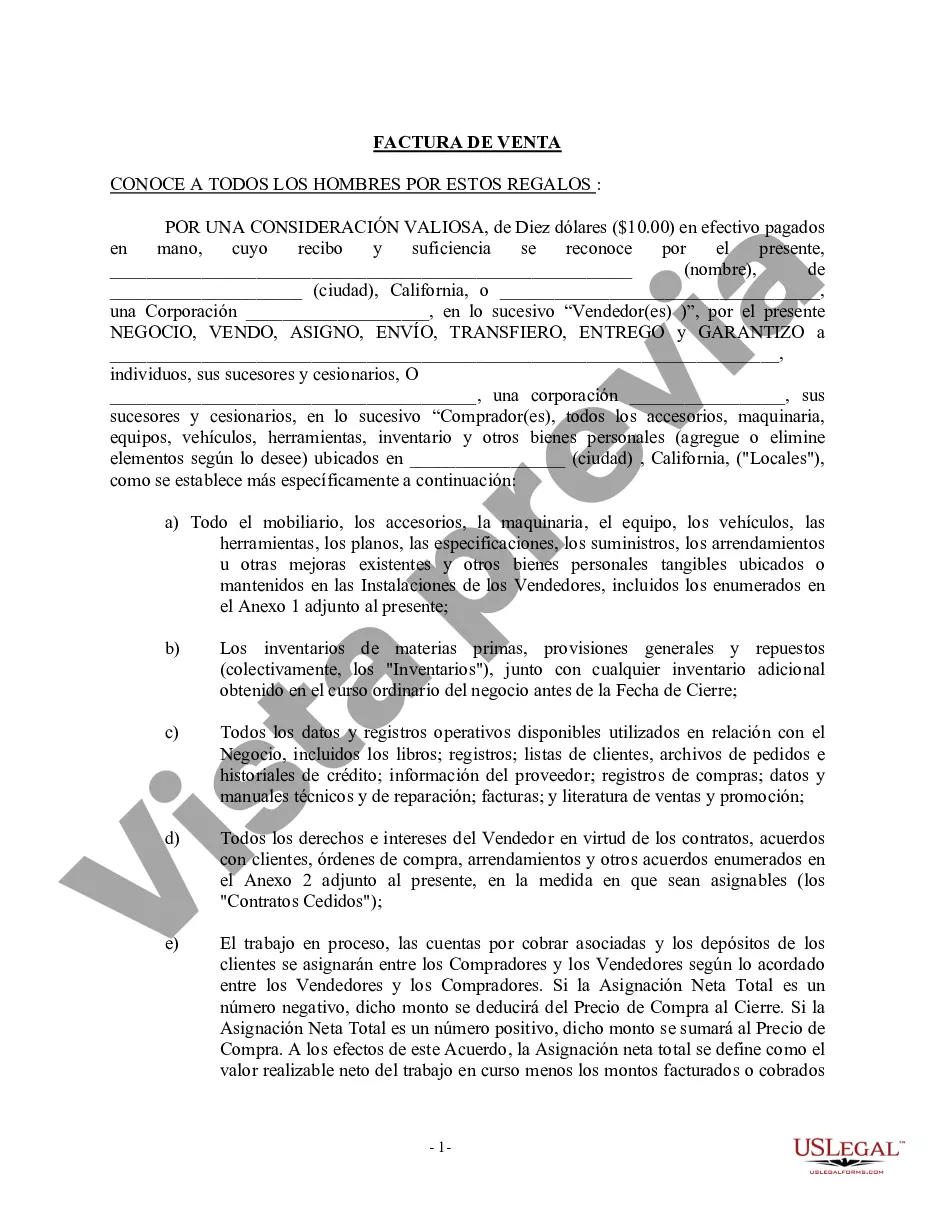

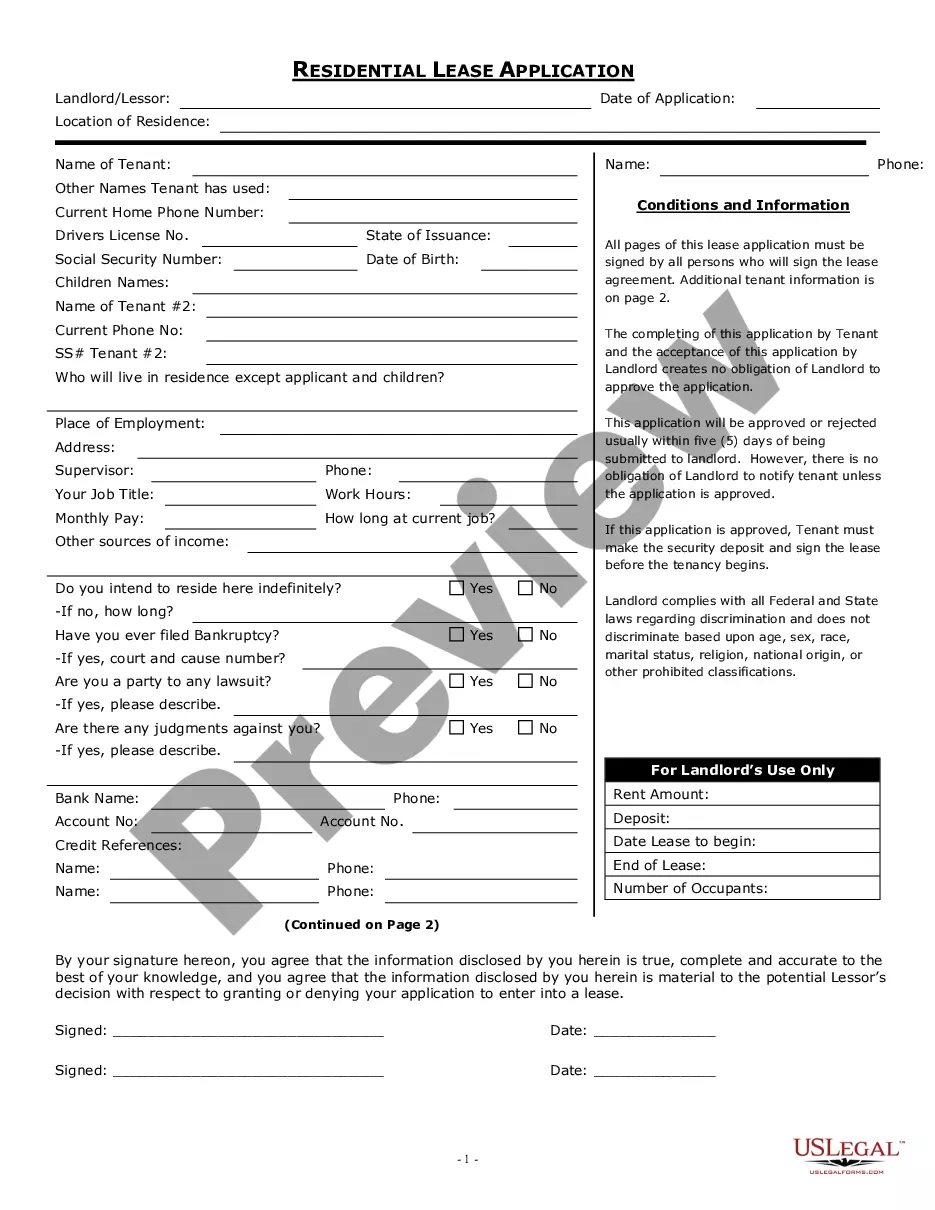

The Vallejo California Bill of Sale in Connection with the Sale of a Business by an Individual or Corporate Seller is a legal document that outlines the transfer of ownership rights from a seller to a buyer when selling a business in Vallejo, California. This bill of sale is crucial for both the seller and the buyer as it serves as an official record of the transaction and ensures the smooth transfer of assets, liabilities, and legal obligations. It also provides protection to both parties involved and helps avoid any future disputes by clearly defining the terms and conditions of the sale. The Vallejo California Bill of Sale in Connection with the Sale of a Business can vary depending on the type of seller. If an individual is selling the business, the bill of sale will include specific information regarding the seller's personal details, such as their full name, address, and contact information. On the other hand, if the business is being sold by a corporate seller, the bill of sale will require the seller's company information, including the legal entity's name, address, and other relevant details. Some key elements typically included in the Vallejo California Bill of Sale in Connection with the Sale of a Business are: 1. Details of the Parties Involved: The bill of sale will include the full legal names, addresses, and contact information of both the seller and the buyer. If the seller is a corporate entity, it will also require the company's information, including the business name, address, and contact details. 2. Business Description: A thorough description of the business being sold is essential to avoid any confusion or misinterpretation in the future. This includes the business name, type of business, assets included in the sale, inventory, supplies, equipment, and any other fixed or tangible assets. 3. Purchase Price and Payment Terms: The bill of sale must specify the total purchase price for the business, including any deposits or down payments made by the buyer. It should also outline the agreed payment terms, such as the payment method, installment plans, or any other agreed-upon terms. 4. Assets and Liabilities: Detailed information about the assets and liabilities of the business being sold is necessary to ensure a transparent transfer of ownership. This includes specifying any outstanding debts, contracts, pending legal matters, or any other liabilities that the buyer will assume after the sale. 5. Sales Tax and Other Fees: If applicable, the bill of sale should mention the federal, state, or local sales taxes involved in the transaction. Additionally, any other fees, permits, or licenses required for the transfer of ownership should be clearly stated. 6. Seller Representations and Warranties: This section outlines the seller's guarantees regarding the accuracy of the information provided about the business, assets, liabilities, and any other legal obligations. It ensures that the seller is providing accurate and complete details to the buyer. 7. Signatures and Notarization: To make the bill of sale legally binding, it requires the signatures of both the seller and the buyer. Depending on the specific legal requirements in Vallejo, California, the document may need to be notarized or witnessed. It's important to note that while this description provides a general overview of the Vallejo California Bill of Sale in Connection with the Sale of Business by Individual or Corporate Seller, the specific requirements and terminology may vary. It's advisable to consult with a legal professional proficient in California business laws and regulations to ensure compliance and accuracy in creating and executing the bill of sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vallejo California Factura de venta en relación con la venta del negocio por parte del vendedor individual o corporativo - California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Vallejo California Factura De Venta En Relación Con La Venta Del Negocio Por Parte Del Vendedor Individual O Corporativo?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no law background to create this sort of papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Vallejo California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Vallejo California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in minutes using our trusted platform. If you are already a subscriber, you can go on and log in to your account to download the needed form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Vallejo California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller:

- Be sure the template you have chosen is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a brief description (if available) of cases the paper can be used for.

- In case the one you selected doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Vallejo California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller as soon as the payment is completed.

You’re all set! Now you can go on and print out the form or fill it out online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.