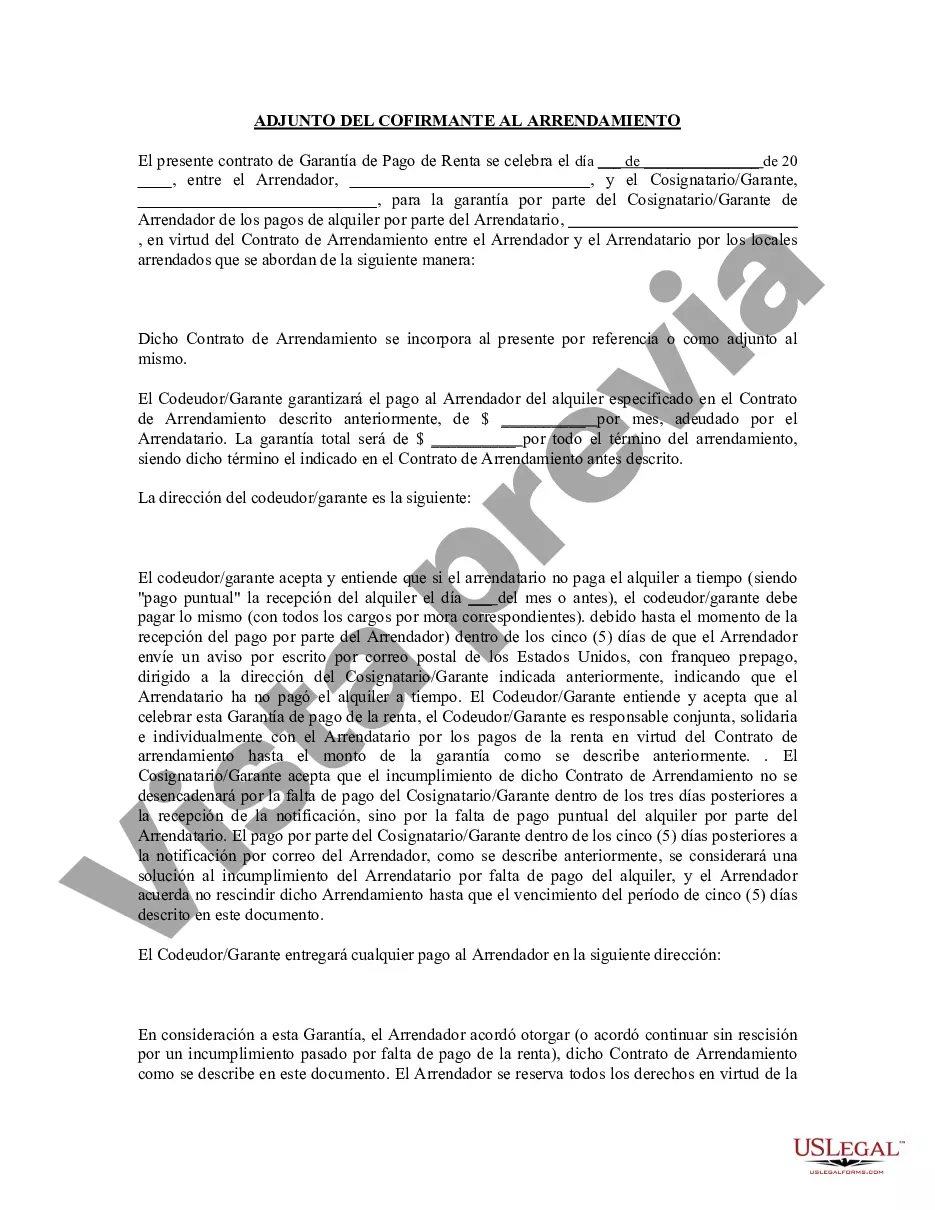

This Guaranty Attachment to Lease for Guarantor or Cosigner is a document in which a third party "co-signs" a lease. This third party agrees to guaranty the payment of rent under the lease and obligates that third party to pay any unpaid rent for tenant.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

A Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that is typically used in the real estate industry, specifically for rental agreements. This attachment serves as an additional layer of protection for landlords or property owners, ensuring that the financial obligations outlined in the lease agreement are fulfilled by the guarantor or cosigner if the primary tenant fails to meet these obligations. The purpose of a Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner is to establish a legally binding agreement between the guarantor or cosigner and the landlord, ensuring that both parties understand their responsibilities and obligations in the event of default by the primary tenant. It provides an added level of security for property owners, allowing them to mitigate risks associated with potential tenant default and financial loss. Some relevant keywords to consider when discussing a Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner are: 1. Lease guarantor: The individual who assumes financial responsibility for the leased property in the event the tenant fails to meet their obligations. 2. Lease cosigner: An individual who signs the lease agreement alongside the tenant and shares equal financial responsibility for the property. 3. Financial obligations: Refers to the monetary responsibilities outlined in the lease agreement, such as rent payments, property maintenance costs, and other fees. 4. Default: The failure of the tenant to fulfill their obligations stated in the lease agreement, such as non-payment of rent. 5. Legal document: A written agreement that is legally enforceable and establishes the rights and obligations of the involved parties. 6. Rental agreement: The contract between the landlord and tenant that outlines the terms and conditions of the lease, including the financial responsibilities of the tenant. 7. Risk mitigation: The process of reducing or eliminating potential threats or losses associated with tenant defaults or breaches of lease agreements. 8. Financial loss: The negative impact on the landlord's income or potential damages incurred due to tenant defaults or breaches. 9. Real estate industry: The sector consisting of property owners, tenants, real estate agents, and related professionals involved in the buying, selling, and renting of properties. 10. Pomona, California: The city where this particular Guaranty Attachment to Lease is used, located in Los Angeles County, California. Different types or variations of Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner may exist based on specific clauses, terms, or conditions included in the agreement. Some examples may include: 1. Limited Guaranty Attachment: A variation of the attachment that outlines limited liability for the guarantor or cosigner, restricting their responsibility to specific aspects or a certain timeframe. 2. Joint and Several Guaranty Attachment: This type of attachment holds both the tenant and the guarantor or cosigner jointly and severally liable for the financial obligations, implying that the landlord can pursue either party for full payment. 3. Conditional Guaranty Attachment: This variation of the attachment incorporates specific conditions or requirements that must be met by the primary tenant or guarantor for the attachment to be valid or enforceable. It is important to consult with legal experts or professionals well-versed in California real estate laws to ensure the Guaranty Attachment to Lease meets all legal requirements and adequately protects the interests of the involved parties.A Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that is typically used in the real estate industry, specifically for rental agreements. This attachment serves as an additional layer of protection for landlords or property owners, ensuring that the financial obligations outlined in the lease agreement are fulfilled by the guarantor or cosigner if the primary tenant fails to meet these obligations. The purpose of a Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner is to establish a legally binding agreement between the guarantor or cosigner and the landlord, ensuring that both parties understand their responsibilities and obligations in the event of default by the primary tenant. It provides an added level of security for property owners, allowing them to mitigate risks associated with potential tenant default and financial loss. Some relevant keywords to consider when discussing a Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner are: 1. Lease guarantor: The individual who assumes financial responsibility for the leased property in the event the tenant fails to meet their obligations. 2. Lease cosigner: An individual who signs the lease agreement alongside the tenant and shares equal financial responsibility for the property. 3. Financial obligations: Refers to the monetary responsibilities outlined in the lease agreement, such as rent payments, property maintenance costs, and other fees. 4. Default: The failure of the tenant to fulfill their obligations stated in the lease agreement, such as non-payment of rent. 5. Legal document: A written agreement that is legally enforceable and establishes the rights and obligations of the involved parties. 6. Rental agreement: The contract between the landlord and tenant that outlines the terms and conditions of the lease, including the financial responsibilities of the tenant. 7. Risk mitigation: The process of reducing or eliminating potential threats or losses associated with tenant defaults or breaches of lease agreements. 8. Financial loss: The negative impact on the landlord's income or potential damages incurred due to tenant defaults or breaches. 9. Real estate industry: The sector consisting of property owners, tenants, real estate agents, and related professionals involved in the buying, selling, and renting of properties. 10. Pomona, California: The city where this particular Guaranty Attachment to Lease is used, located in Los Angeles County, California. Different types or variations of Pomona California Guaranty Attachment to Lease for Guarantor or Cosigner may exist based on specific clauses, terms, or conditions included in the agreement. Some examples may include: 1. Limited Guaranty Attachment: A variation of the attachment that outlines limited liability for the guarantor or cosigner, restricting their responsibility to specific aspects or a certain timeframe. 2. Joint and Several Guaranty Attachment: This type of attachment holds both the tenant and the guarantor or cosigner jointly and severally liable for the financial obligations, implying that the landlord can pursue either party for full payment. 3. Conditional Guaranty Attachment: This variation of the attachment incorporates specific conditions or requirements that must be met by the primary tenant or guarantor for the attachment to be valid or enforceable. It is important to consult with legal experts or professionals well-versed in California real estate laws to ensure the Guaranty Attachment to Lease meets all legal requirements and adequately protects the interests of the involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.