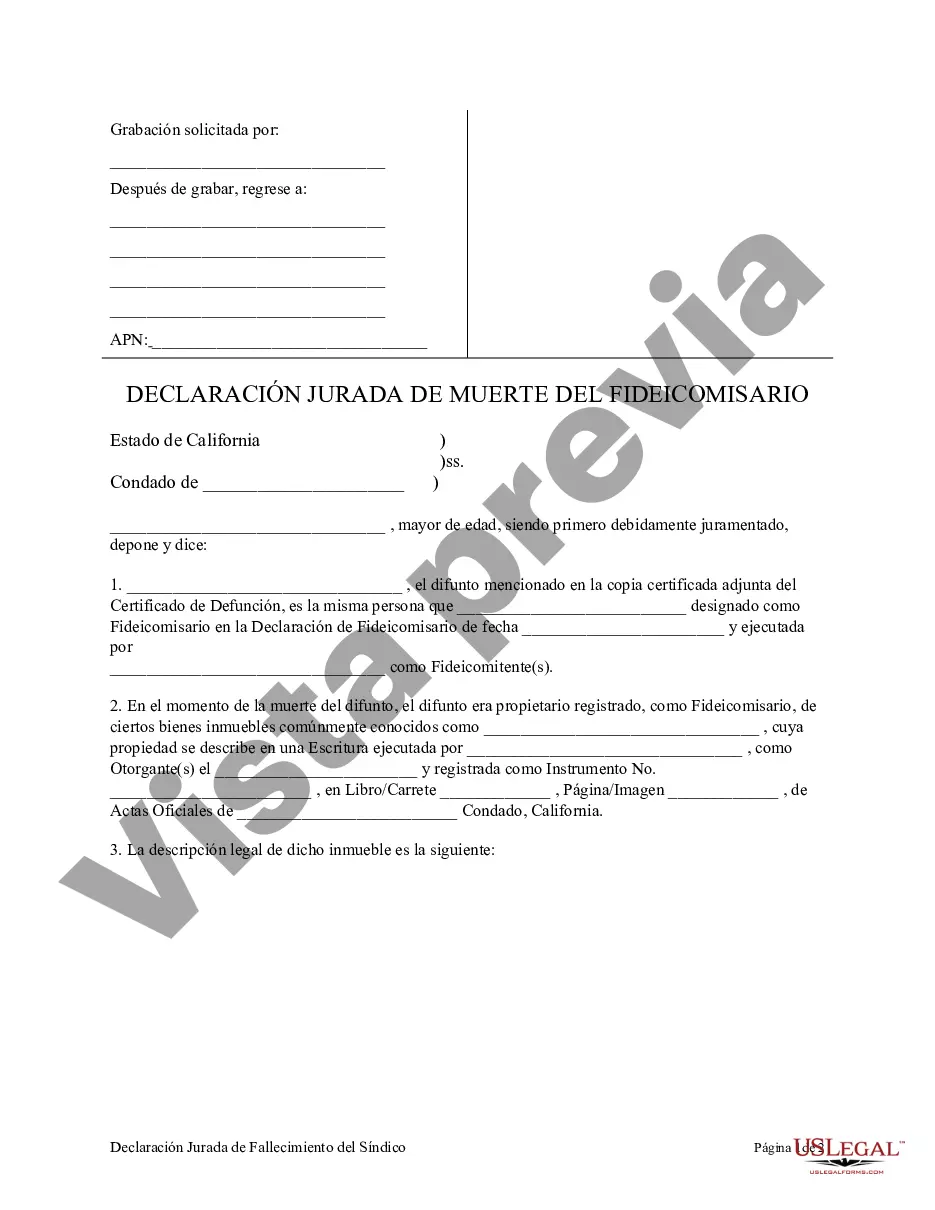

The Norwalk California Affidavit of Death of Trustee is a legal document that serves as proof of the trustee's death in a trust agreement. This affidavit is important to ensure the smooth continuation of the trust's administration and the transfer of the trustee's assets to the beneficiaries or successor trustee. In Norwalk, California, there are various types of Affidavit of Death of Trustee: 1. Individual Trustee: This type of affidavit is applicable when the trustee was an individual and has passed away. It outlines the essential details regarding the deceased individual, such as their full name, date of death, social security number, and the trust's name and date of creation. 2. Corporate Trustee: In case the trustee was a corporation, the Norwalk California Affidavit of Death of Trustee comes into play. This affidavit requires information about the corporation, including its legal name, date of incorporation, and the registered agent's contact details. 3. Successor Trustee: When a successor trustee needs to replace the deceased trustee, a specific Affidavit of Death of Trustee is used. It mandates details about the successor trustee's identity, including their full name, contact information, and their acceptance of the responsibilities associated with the role. 4. Notarization: It is important to note that all types of Norwalk California Affidavit of Death of Trustee must be notarized. The affidavit should be signed in the presence of a notary public, who verifies the identity of the person signing the document and ensures its authenticity. By completing the appropriate Norwalk California Affidavit of Death of Trustee, the legal process can proceed smoothly. This document acts as proof of the trustee's passing and ensures the proper transfer of assets and the continued administration of the trust per the deceased trustee's intentions. Addressing the necessary legal steps promptly with the correct affidavit safeguards the interests of both the beneficiaries and the trust itself, avoiding potential complications or disputes. If you require further information or assistance, it is advisable to consult with a qualified attorney specialized in estate planning or trust administration to navigate the process accurately and efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Norwalk California Declaración Jurada de Fallecimiento del Síndico - California Affidavit of Death of Trustee

Description

How to fill out Norwalk California Declaración Jurada De Fallecimiento Del Síndico?

Are you looking for a reliable and affordable legal forms provider to buy the Norwalk California Affidavit of Death of Trustee? US Legal Forms is your go-to choice.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Norwalk California Affidavit of Death of Trustee conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Norwalk California Affidavit of Death of Trustee in any provided format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.