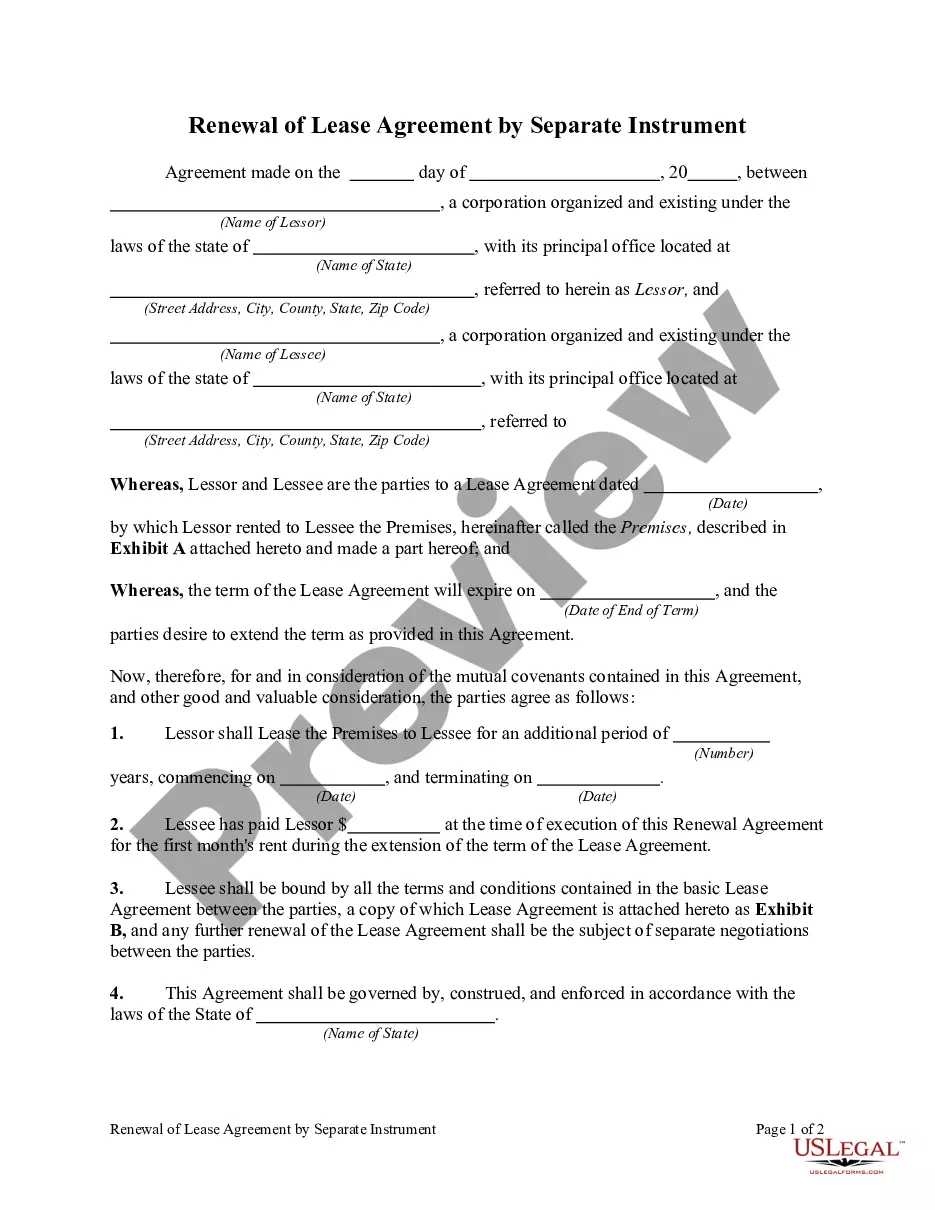

Title: San Diego California Living Trust for Husband and Wife with No Children: A Comprehensive Guide Introduction: In San Diego, California, a living trust is a valuable estate planning tool that offers a range of benefits to couples without children. A living trust ensures the proper distribution of assets, protects privacy, avoids probate, and allows for easier management of assets during incapacity or death. This article explores the concept of a San Diego California Living Trust for Husband and Wife with No Children, shedding light on its benefits, types, and considerations. 1. Benefits of a Living Trust for Husband and Wife in San Diego: — Avoidance of probate: Establishing a living trust helps bypass the probate process, saving time, costs, and providing a more efficient transfer of property to beneficiaries. — Privacy protection: Unlike a will, a living trust is not made public, preserving the confidentiality of the asset distribution. — Incapacity planning: A living trust allows for seamless management of assets if one spouse becomes incapacitated, ensuring financial stability and peace of mind. — Flexibility and control: Couples can customize the terms of the trust, including the ability to amend or revoke it during their lifetime. 2. Types of San Diego California Living Trusts for Husband and Wife with No Children: While the basic structure of a living trust remains the same, couples in San Diego may consider the following variations: — Revocable Living Trust: A revocable living trust allows couples to maintain full control over their assets while alive. They can make changes, add, or remove assets from the trust at their discretion. This type of trust enables easy management during incapacity and a seamless transition of assets upon death. — Testamentary Trust: A testamentary trust is not created during the couple's lifetime, rather it is established through a will after the death of one or both spouses. It allows for more specific instructions regarding asset distribution, charitable giving, or creating ongoing trusts for beneficiaries. — Irrevocable Living Trust: This type of trust, once established, cannot be easily modified or revoked. Irrevocable living trusts provide potential tax benefits, asset protection, and can serve specific purposes such as Medicaid planning or preserving assets for future generations. 3. Considerations for Establishing a Living Trust in San Diego: — Property Ownership: Determine how assets are held jointly or individually, and whether they should be transferred into the trust to maximize its benefits. — Successor Trustees and Beneficiaries: Choosing responsible individuals to manage the trust and naming beneficiaries who will inherit the assets upon the death of both spouses. — Estate Tax Planning: Consult with an estate planning attorney to assess the potential tax implications of a living trust and explore strategies to minimize taxes. — Professional Guidance: Seek assistance from an experienced estate planning attorney specialized in living trusts to ensure the trust is created correctly, complying with state laws and regulations. In conclusion, a San Diego California Living Trust for Husband and Wife with No Children offers numerous advantages, including probate avoidance, privacy protection, and flexibility. By considering the different types of living trusts available, couples can tailor their estate plan to meet their specific needs and goals. Proper planning and professional advice are essential to create a comprehensive living trust that effectively protects assets and ensures a smooth transfer of wealth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Fideicomiso en vida para esposo y esposa sin hijos - California Living Trust for Husband and Wife with No Children

Description

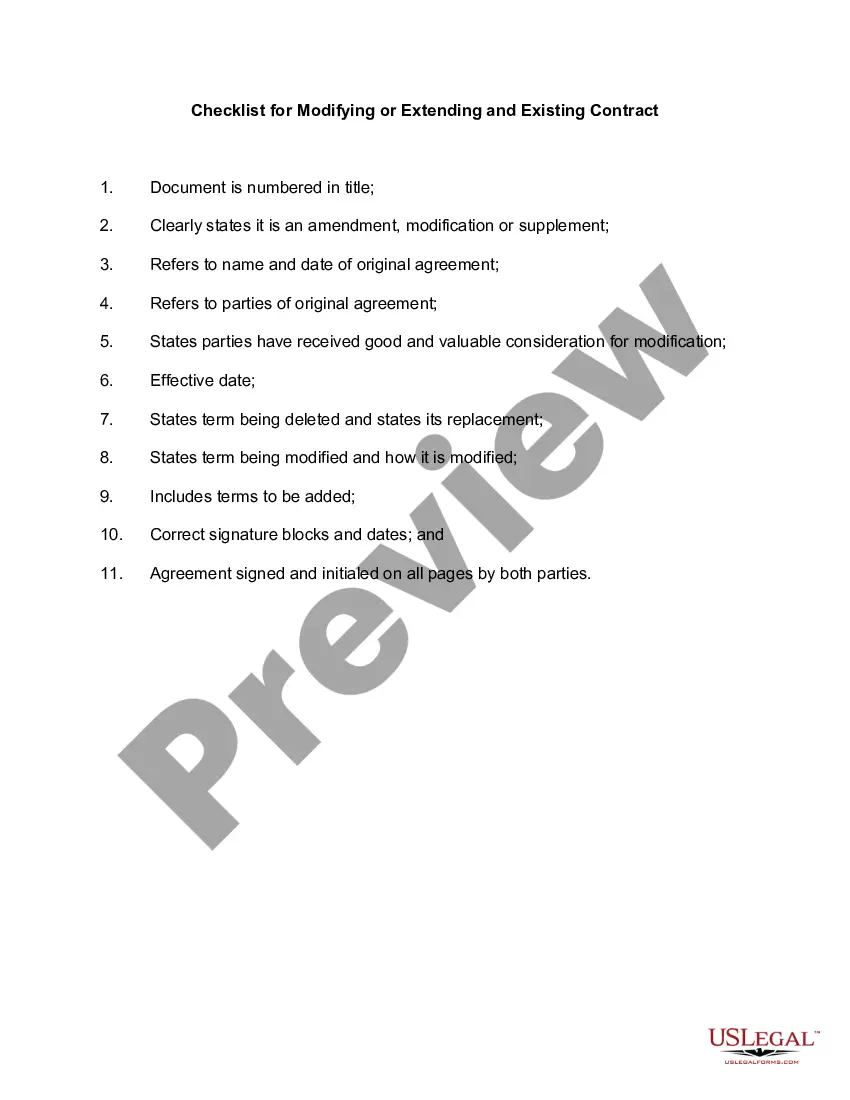

How to fill out San Diego California Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

Are you looking for a trustworthy and affordable legal forms supplier to buy the San Diego California Living Trust for Husband and Wife with No Children? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the San Diego California Living Trust for Husband and Wife with No Children conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Restart the search if the template isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the San Diego California Living Trust for Husband and Wife with No Children in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.