Antioch California Living Trust for Individuals as Single, Divorced, or Widow/Widower with No Children: A Comprehensive Guide Introduction: In Antioch, California, individuals who are single, divorced, or widowed with no children have several options when it comes to establishing a living trust. A living trust is a legal document that allows you to manage and distribute your assets while you are alive and after your passing. It serves as an essential tool for planning your estate and ensuring that your wishes regarding property distribution, healthcare decisions, and financial matters are honored. 1. Single Individuals: For unmarried individuals in Antioch, California, creating a living trust can bring peace of mind and provide a clear plan for the management of their assets. A living trust allows single individuals to maintain control over their property while alive and designate beneficiaries or charitable organizations to inherit their assets after their passing. 2. Divorced Individuals: Divorce can significantly impact your estate planning needs, making a living trust a beneficial option for individuals who have gone through a divorce. A living trust can help divorced individuals maintain control over their assets, protect their property, and ensure that they pass on to their chosen beneficiaries according to their wishes. 3. Widows or Widowers: Widows or widowers in Antioch, California, can benefit greatly from establishing a living trust. Whether they have children or not, a living trust gives widows or widowers the ability to control their assets and outline specifics for asset distribution after their passing, ensuring their wishes are followed. It can also provide protection from potential future spouses, creditors, or unforeseen circumstances. Types of Antioch California Living Trust for Individuals: 1. Revocable Living Trust: A revocable living trust is the most common type and allows the individual to retain complete authority over their assets during their lifetime. They can modify, amend, or revoke the trust at any time, making it highly flexible and versatile. 2. Irrevocable Living Trust: An irrevocable living trust is unable to be altered once it is established, providing a higher level of asset protection. The individual transfers their assets into the trust, relinquishing ownership and control. This type of trust is commonly used for tax planning, protecting assets from creditors, or Medicaid planning. 3. Testamentary Trust: A testamentary trust is created through a will and takes effect after the individual's passing. This type of trust offers no control during the individual's lifetime but allows them to outline specific instructions for asset distribution to beneficiaries, including single, divorced, or widowed individuals with no children. Conclusion: Establishing a living trust in Antioch, California, as a single, divorced, or widowed individual with no children is a wise estate planning decision. With various options such as revocable living trusts, irrevocable living trusts, and testamentary trusts available, these individuals can secure their assets, protect their property, and ensure their wishes are carried out according to their specific circumstances. By consulting with a qualified attorney experienced in estate planning, individuals can create a tailored living trust that gives them control, peace of mind, and confidence in the future handling of their assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Antioch California Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos (o Viudos) sin Hijos - California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children

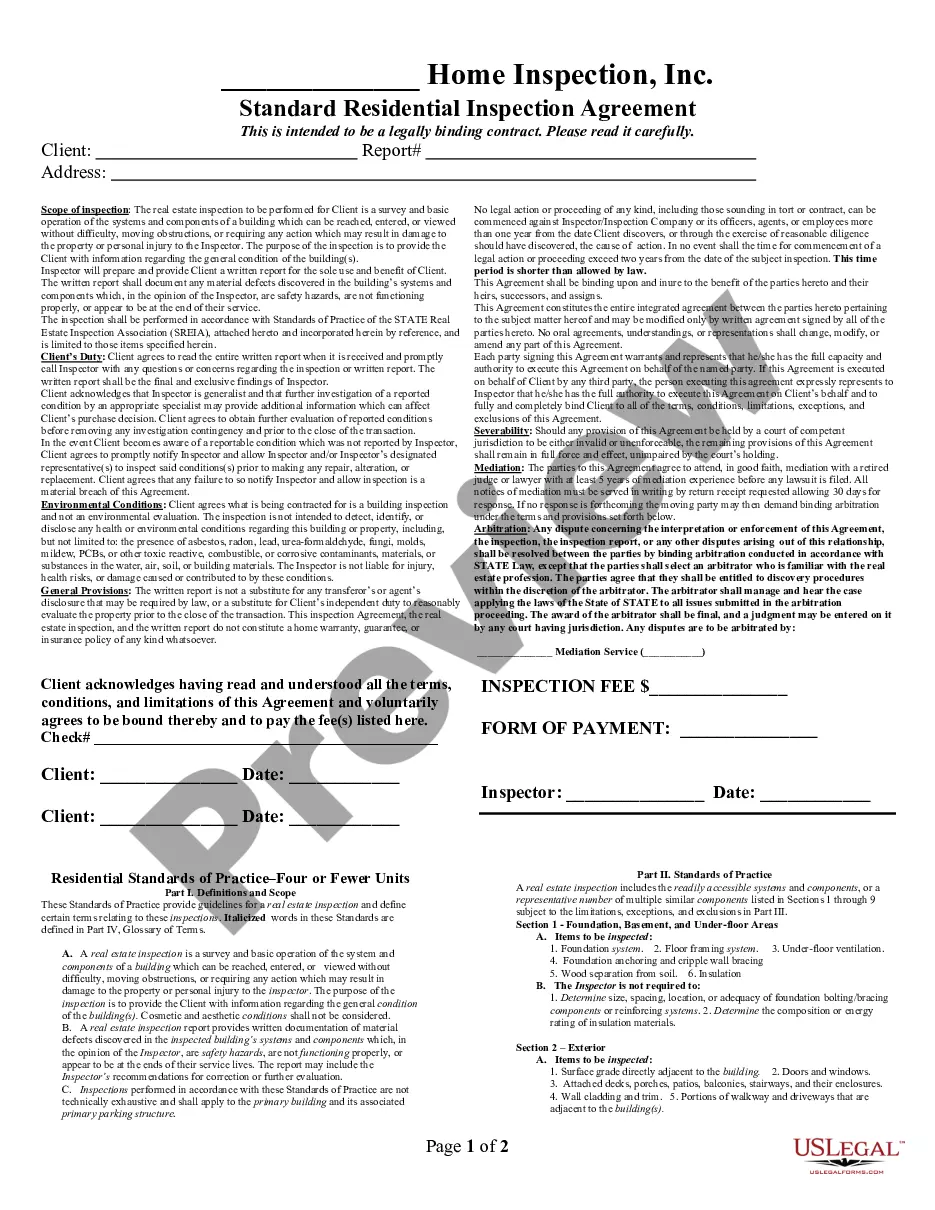

Description

How to fill out Antioch California Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos (o Viudos) Sin Hijos?

If you are looking for a relevant form, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can get thousands of form samples for company and individual purposes by types and states, or keywords. With the high-quality search feature, discovering the latest Antioch California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children is as elementary as 1-2-3. Furthermore, the relevance of every file is verified by a group of expert lawyers that regularly review the templates on our website and revise them in accordance with the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to get the Antioch California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you need. Check its explanation and make use of the Preview feature to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to get the appropriate document.

- Confirm your selection. Click the Buy now button. After that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Antioch California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children.

Each template you save in your account has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you want to have an extra version for enhancing or creating a hard copy, you can come back and save it again at any moment.

Make use of the US Legal Forms professional collection to gain access to the Antioch California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children you were seeking and thousands of other professional and state-specific templates on a single platform!