Fontana California Fideicomiso en vida para una persona soltera, divorciada o viuda (o viudo) con hijos - California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

Description

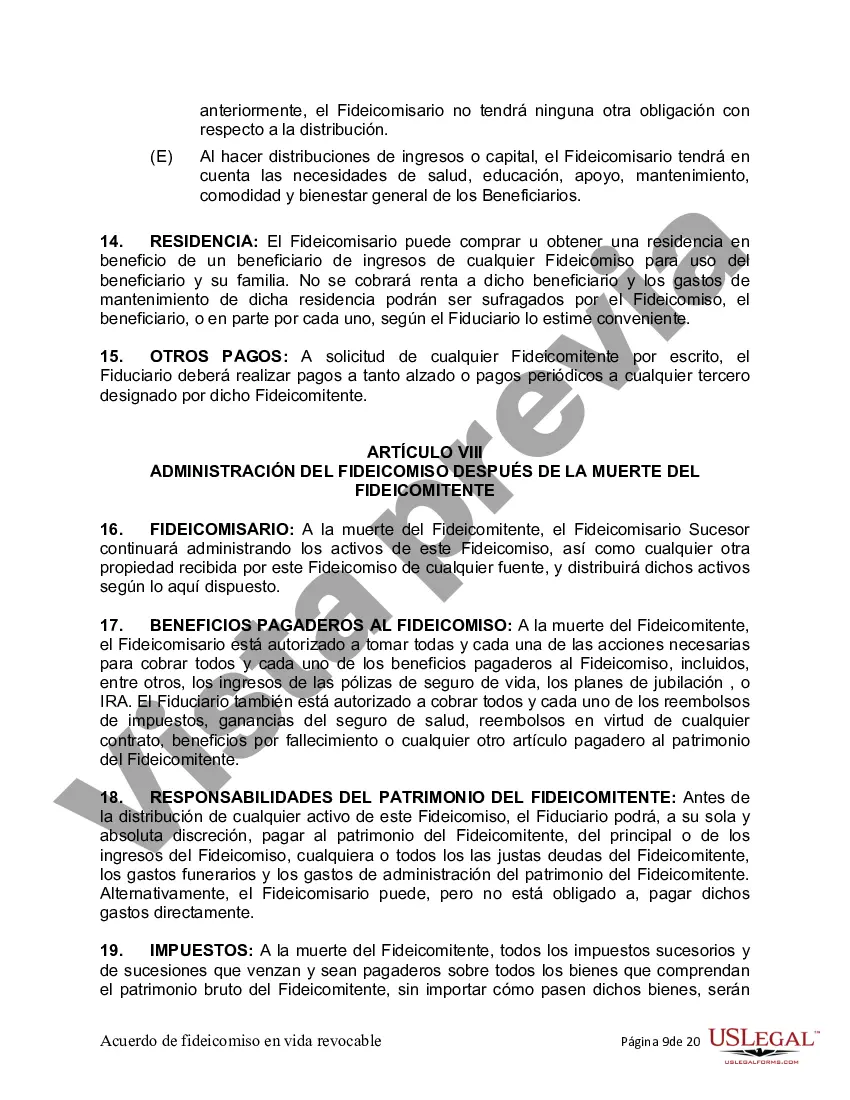

How to fill out Fontana California Fideicomiso En Vida Para Una Persona Soltera, Divorciada O Viuda (o Viudo) Con Hijos?

If you are in search of a legitimate form, it’s challenging to discover a superior service than the US Legal Forms website – likely the largest online repositories.

Here you can locate a vast array of templates for corporate and personal uses categorized by types and regions, or keywords.

With the refined search feature, locating the most current Fontana California Living Trust for individuals who are Single, Divorced, or Widowed (or Widower) with Children is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Specify the file format and download it onto your device. Make alterations. Fill out, modify, print, and sign the retrieved Fontana California Living Trust for individuals who are Single, Divorced, or Widowed (or Widower) with Children.

- Moreover, the validity of each document is confirmed by a team of experienced attorneys who regularly review the templates on our site and update them according to the latest state and county laws.

- If you are already aware of our platform and possess a registered account, all you need to obtain the Fontana California Living Trust for individuals who are Single, Divorced, or Widowed (or Widower) with Children is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have found the form you require. Review its details and use the Preview feature to examine its content. If it does not satisfy your needs, employ the Search field at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. After that, choose your preferred subscription plan and provide details to create an account.

Form popularity

FAQ

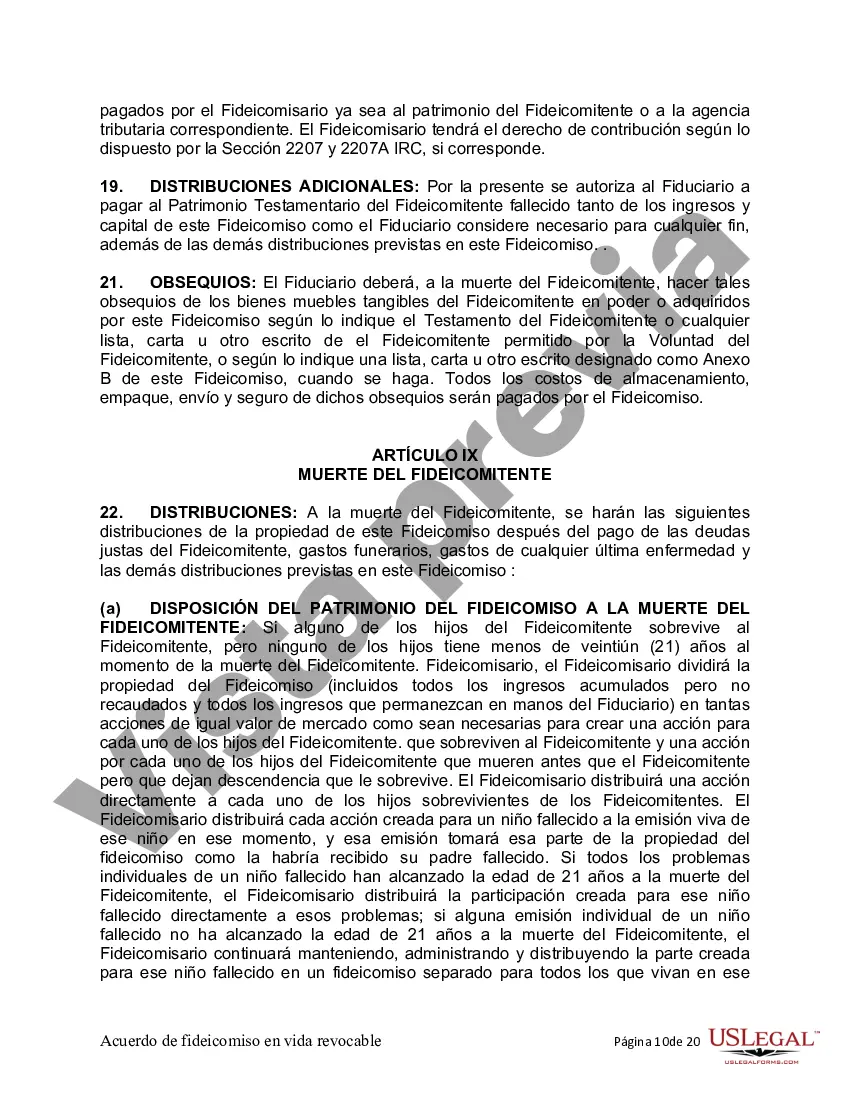

A trust does become irrevocable when one spouse passes away, assuming it was a joint trust. This means that the trust's terms cannot be changed without the agreement of the beneficiaries. For those setting up a Fontana California Living Trust tailored for individuals who are single, divorced, or widowed with children, it is vital to understand this aspect to make informed decisions about your estate.

In California, when one spouse dies, the living trust may remain active unless specified otherwise. The surviving spouse can often continue managing the trust, and the trust assets will generally pass to the beneficiaries as defined in the trust. If you have a Fontana California Living Trust and are single, divorced, or widowed with children, having clear instructions in your trust can ease decision-making during such transitions.

When one person in a trust dies, the trust typically continues to operate according to its terms. The surviving trustee will manage the trust’s assets and distributions to beneficiaries as outlined in the trust document. If you're considering a Fontana California Living Trust for individuals who are single, divorced, or widowed with children, understanding the continuity of your trust can provide peace of mind during difficult times.

In California, a surviving spouse has the ability to change a living trust, but it depends on the trust's terms and any applicable laws. If the trust is revocable, the surviving spouse can typically make modifications. For those interested in Fontana California Living Trusts for individuals, who are single, divorced, or widowed with children, it’s advisable to consult legal resources or platforms like uslegalforms for guidance in navigating these changes.

In California, a trust does not need to be filed with the court unless it becomes part of a probate case. For individuals living in Fontana, California, creating a living trust can be a private way to manage your assets, especially if you are single, divorced, or a widow or widower with children. By establishing a Fontana California Living Trust for individuals like you, you can avoid court intervention and maintain control over your estate. If you have concerns, consider consulting uslegalforms for guidance on setting up your living trust.

One disadvantage of a living trust in California is that establishing it can require significant time and legal assistance, which can add expenses. Additionally, while a Fontana California Living Trust helps avoid probate, it does not protect assets from creditors or lawsuits. It’s important to weigh these factors when considering whether a living trust is right for you.

During a divorce in California, a living trust may need to be reviewed to determine which assets are subject to division. If assets in the Fontana California Living Trust are deemed marital property, they may be divided, but the trust itself remains intact unless specifically altered. This highlights the importance of understanding how living trusts operate in conjunction with marital property laws.

Several factors can invalidate a trust in California, including lack of capacity of the person creating the trust, undue influence, or failure to follow legal formalities during its establishment. For those creating a Fontana California Living Trust, ensuring that the trust is properly documented and executed is crucial to avoid pitfalls. Consulting a legal expert can help prevent any issues that may render your trust invalid.

If you get divorced, the fate of your trust depends on how it was set up and the specific circumstances of the divorce. In many cases, a Fontana California Living Trust can remain intact, but some assets may need to be divided as part of the divorce settlement. It's important to review your trust documents and possibly update them to reflect your new circumstances.

Individuals in California who have significant assets, want to ensure their children's financial security, or seek to avoid probate should consider establishing a living trust. This is especially important for those who are single, divorced, or widowed with children, as it provides clarity and direction for asset distribution. A Fontana California Living Trust can make the process easier, ensuring your wishes are carried out smoothly.