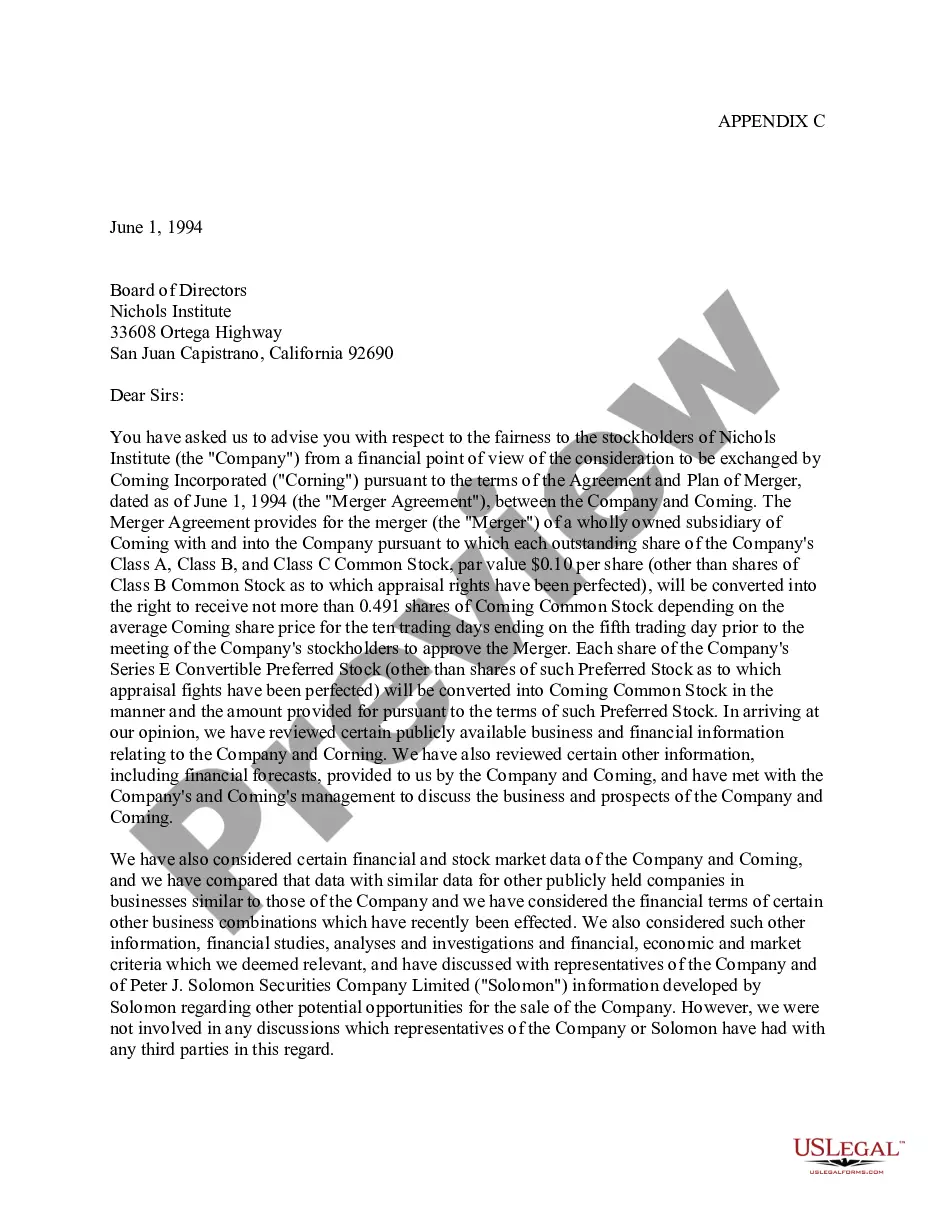

Riverside California Living Trust for Single Individuals: A Riverside California Living Trust for single individuals is a legal document that allows a person who is not currently married to protect and distribute their assets upon their death. This trust ensures that their assets are managed and passed on according to their specific instructions, rather than being subject to costly and time-consuming probate proceedings. Benefits of a Riverside California Living Trust for single individuals: 1. Asset Management: By creating a living trust, single individuals can have control over their assets during their lifetime, even if they become incapacitated. They can name themselves as the initial trustee and appoint a successor trustee to manage their assets in case they are unable to do so in the future. 2. Privacy: Unlike a will, a living trust allows the distribution of assets to remain private since it does not go through probate court, which is a matter of public record. This ensures that one's financial affairs are kept confidential. 3. Directing Asset Distribution: Single individuals with children can use a living trust to specify how and when their assets should be distributed to their children or other beneficiaries. This provides flexibility and protects the assets from mismanagement or being squandered. 4. Avoiding Probate: Creating a Riverside California Living Trust helps avoid the lengthy and costly probate process, saving time and money for the estate and beneficiaries. 5. Incapacity Planning: A living trust also allows single individuals to plan for potential incapacitation by appointing a trusted person to manage their affairs and make financial decisions on their behalf. Types of Riverside California Living Trust for single individuals: 1. Revocable Living Trust: This is the most common type of living trust, allowing single individuals to make changes or revoke the trust during their lifetime. They can retain control over their assets and amend the trust as needed. 2. Irrevocable Living Trust: As the name suggests, an irrevocable living trust cannot be modified or revoked once created. This type of trust provides greater asset protection and can have tax benefits, but it limits the control a single individual has over their assets. 3. Testamentary Trust: A testamentary trust is created within a will and only goes into effect upon the individual's death. It allows a single individual to appoint a trustee and specify how their assets should be distributed to their children or other beneficiaries, but it does not provide the benefits of avoiding probate during their lifetime. Whether you are single, divorced, or widowed, creating a Riverside California Living Trust tailored to your specific circumstances can ensure that your assets are protected, your wishes are respected, and your loved ones are provided for in the future. It is recommended to consult with an experienced estate planning attorney to create a personalized living trust that meets your needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Fideicomiso en vida para una persona soltera, divorciada o viuda (o viudo) con hijos - California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

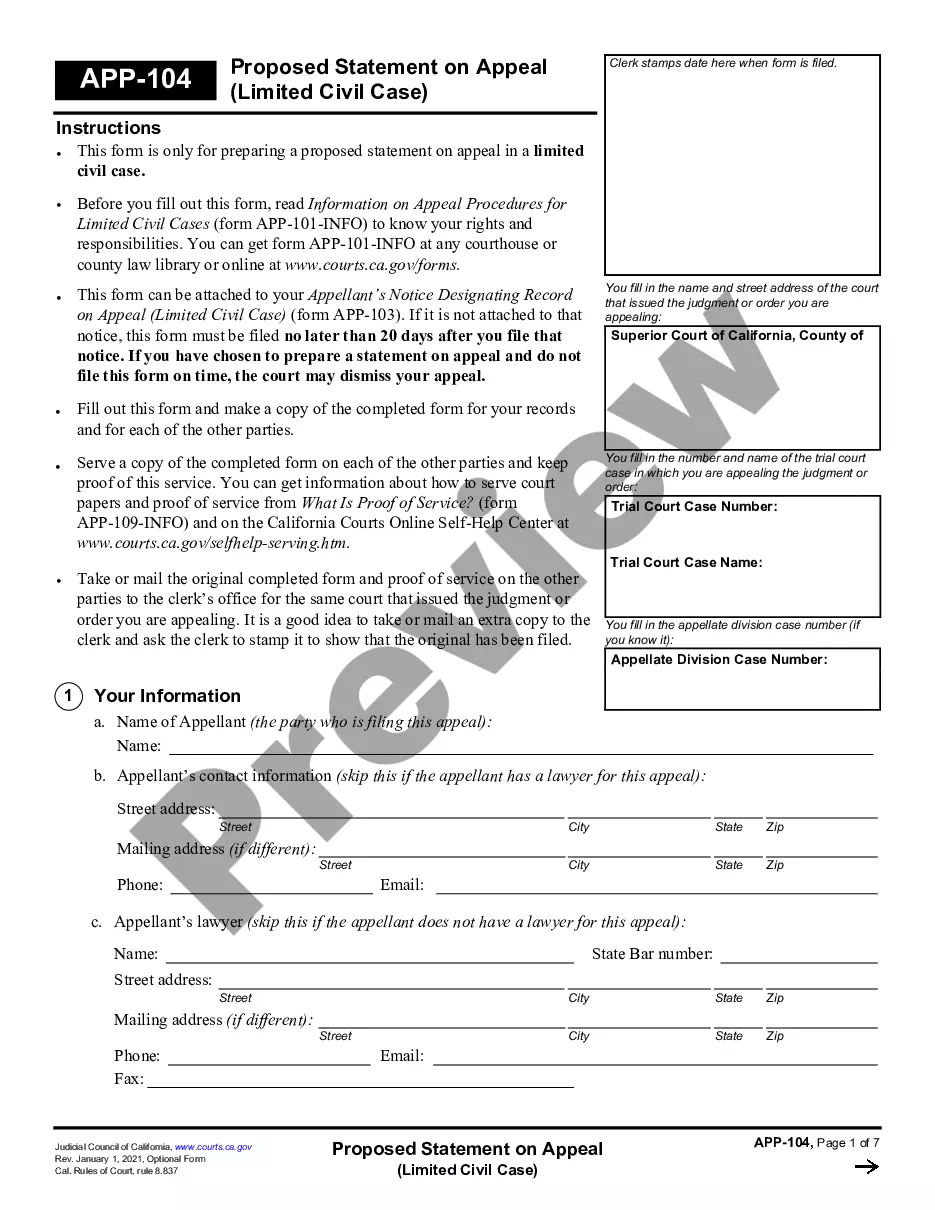

Description

How to fill out Riverside California Fideicomiso En Vida Para Una Persona Soltera, Divorciada O Viuda (o Viudo) Con Hijos?

If you’ve already used our service before, log in to your account and download the Riverside California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Riverside California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!

Form popularity

FAQ

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.