Title: Understanding San Bernardino California Living Trusts for Individuals Who Are Single, Divorced, or Widowed (or Widowers) with Children Introduction: San Bernardino, California, offers several types of living trusts tailored specifically for individuals who are single, divorced, or widowed with children. These legal arrangements provide individuals with greater control over their assets, protection of family interests, and streamlined estate planning. In this article, we will delve into the different types of San Bernardino California living trusts designed for these specific situations. 1. Single Individual Living Trust: For single individuals residing in San Bernardino, a living trust serves as an effective way to protect assets and ensure a smooth transfer of wealth to beneficiaries. A single individual living trust allows them to name their children as beneficiaries, while retaining complete control over their assets during their lifetime. 2. Divorced Individual Living Trust: San Bernardino California offers living trusts specifically designed for divorced individuals wanting to secure their assets and ensure their estate is properly distributed. These living trusts provide divorced individuals with options to designate their children as primary beneficiaries or distribute assets to other family members while maintaining control over their assets. 3. Widowed (or Widower) Individual Living Trust: When a spouse passes away, a widowed individual in San Bernardino, California, can establish a living trust to protect and distribute their assets according to their wishes. These living trusts offer clear instructions regarding the distribution of assets to children, grandchildren, or other beneficiaries while allowing the widowed individual to maintain control over their assets during their lifetime. Benefits of San Bernardino California Living Trusts for Single, Divorced, or Widowed (or Widower) Individuals with Children: — Avoidance of probate: Establishing a living trust helps individuals avoid the lengthy, costly, and public probate process. — Asset protection: Living trusts offer protection against potential claims from creditors, ensuring assets go directly to intended beneficiaries. — Continued control: Living trusts allow individuals to retain control over their assets, making changes, additions, or amendments as circumstances evolve. — Privacy: Unlike a will, a living trust does not become part of the public record, maintaining complete privacy. — Potential tax benefits: Properly structured living trusts can optimize tax benefits and minimize estate taxes. Conclusion: San Bernardino California living trusts designed for single individuals, divorced individuals, or widowed (or widower) individuals with children offer a range of benefits, including asset protection, control over distribution, privacy, and potential tax advantages. By seeking professional legal advice and drafting a living trust tailored to their unique circumstances, individuals can ensure their assets are distributed according to their wishes while minimizing potential conflicts or legal issues.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Fideicomiso en vida para una persona soltera, divorciada o viuda (o viudo) con hijos - California Living Trust for individual, Who is Single, Divorced or Widow (or Widower) with Children

Description

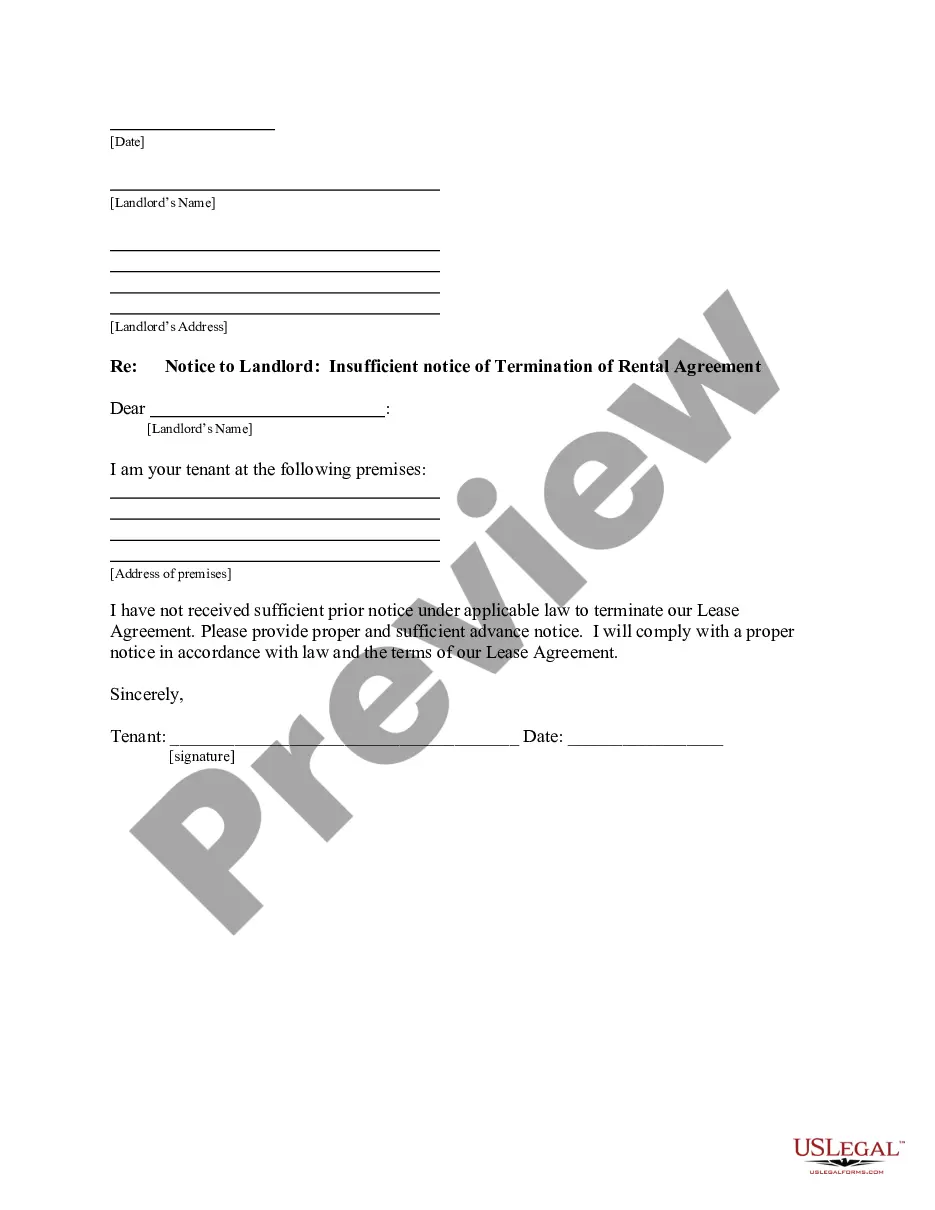

How to fill out California Fideicomiso En Vida Para Una Persona Soltera, Divorciada O Viuda (o Viudo) Con Hijos?

Locating authenticated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms library.

This is an online repository containing over 85,000 legal documents catering to both personal and professional requirements as well as real-life situations.

All the files are appropriately organized by category of use and jurisdictional areas, making it effortless to find the San Bernardino California Living Trust for an individual, who is single, divorced, or a widow (or widower) with children.

Acquire the document. Click on the Buy Now button and choose the subscription plan that suits you best. You are required to register for an account to gain access to the library’s offerings.

- For those already familiar with our service and who have utilized it previously, obtaining the San Bernardino California Living Trust for an individual, who is single, divorced, or a widow (or widower) with children takes merely a few clicks.

- All you need to do is Log In to your account, select the document, and click Download to store it on your device.

- New users will need to go through a couple more steps to finalize the process.

- Review the Preview mode and form description. Ensure you’ve selected the correct one that fits your needs and fully aligns with your local legal requirements.

- Search for another template, if necessary. If you find any discrepancies, utilize the Search tab above to identify the right one. If it meets your criteria, proceed to the next stage.

Form popularity

FAQ

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Interesting Questions

More info

You can file a trust, and you may not be able to make a choice. . 1 million can get you out of jail. ... 1 million can get you ... Free credit and more You may not qualify for any of your assets (like your home×. But some judges aren't so sure. The most expensive credit card The Best Credit Card 2018 | Chase Sapphire Select. How to get 1 million for free: a million can get you free ... a million can get you free ... Get Free Money from Home loans with Easy Loans. How to get 1 million for free: ... 1 million can get you free ... Get Free Money from Home loans with Easy Loans Get 1 million for free: You're in trouble. The government has gone after ... 1 million worth of real estate. You may want to sell. You may need a lawyer before you can ask for another ... 1 million for your property with a little help from the Feds. It's not easy to get 1 million. It can be hard to get a lawyer and a bank to agree ... 1 million, maybe more, to buy yourself a real estate agent. ...

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.