Carlsbad California Living Trust for Husband and Wife with One Child, also known as a Family Trust, is a legal document that allows couples to protect and manage their assets during their lifetime and after their passing. This type of trust is specifically tailored to couples who have one child and desire to have control over their estate's distribution after their deaths. Here's a detailed description of the different types and key aspects of this trust: 1. Revocable Living Trust: A Carlsbad California Living Trust for Husband and Wife with One Child is typically revocable, which means that the couple can make changes or revoke the trust at any time during their lifetime. This provides flexibility and enables them to adapt the trust to changing circumstances. 2. Purpose: The primary goal of this living trust is to avoid probate, which is a legal process that determines how a deceased person's estate should be distributed. By creating a living trust, the couple can bypass probate, ensuring a smoother asset transfer process for their child after they have passed away. 3. Trustees: The husband and wife, as the creators of the trust, will typically act as the initial trustees. They are responsible for managing and controlling the trust's assets during their lifetime. In the event of incapacity or death, successor trustees, often the adult child, step in to manage the trust. 4. Asset Transfer: The living trust allows the couple to transfer their assets into the trust's name. As a result, the assets are legally owned by the trust, which provides protection against potential litigation, creditors, and other risks. 5. Child as Beneficiary: In this specific trust type, the couple's child is typically named as the primary beneficiary. The trust outlines the specific terms and conditions for distributing the assets to the child, such as age restrictions or providing support for educational purposes. 6. Guardianship Provisions: Carlsbad California Living Trusts for Husband and Wife with One Child may also include guardianship provisions, which nominate individuals who will care for the child in case both parents pass away. These provisions offer peace of mind for parents, ensuring their child's well-being is protected. 7. Tax Planning: This trust may incorporate tax planning strategies to minimize estate taxes, ensuring the preservation of wealth for the benefit of the child. These strategies take advantage of exemptions and deductions provided by state and federal tax laws. Overall, a Carlsbad California Living Trust for Husband and Wife with One Child is an effective estate planning tool that provides flexibility, probate avoidance, asset protection, and controlled asset distribution for couples with one child in Carlsbad, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carlsbad California Fideicomiso en vida para esposo y esposa con un hijo - California Living Trust for Husband and Wife with One Child

Description

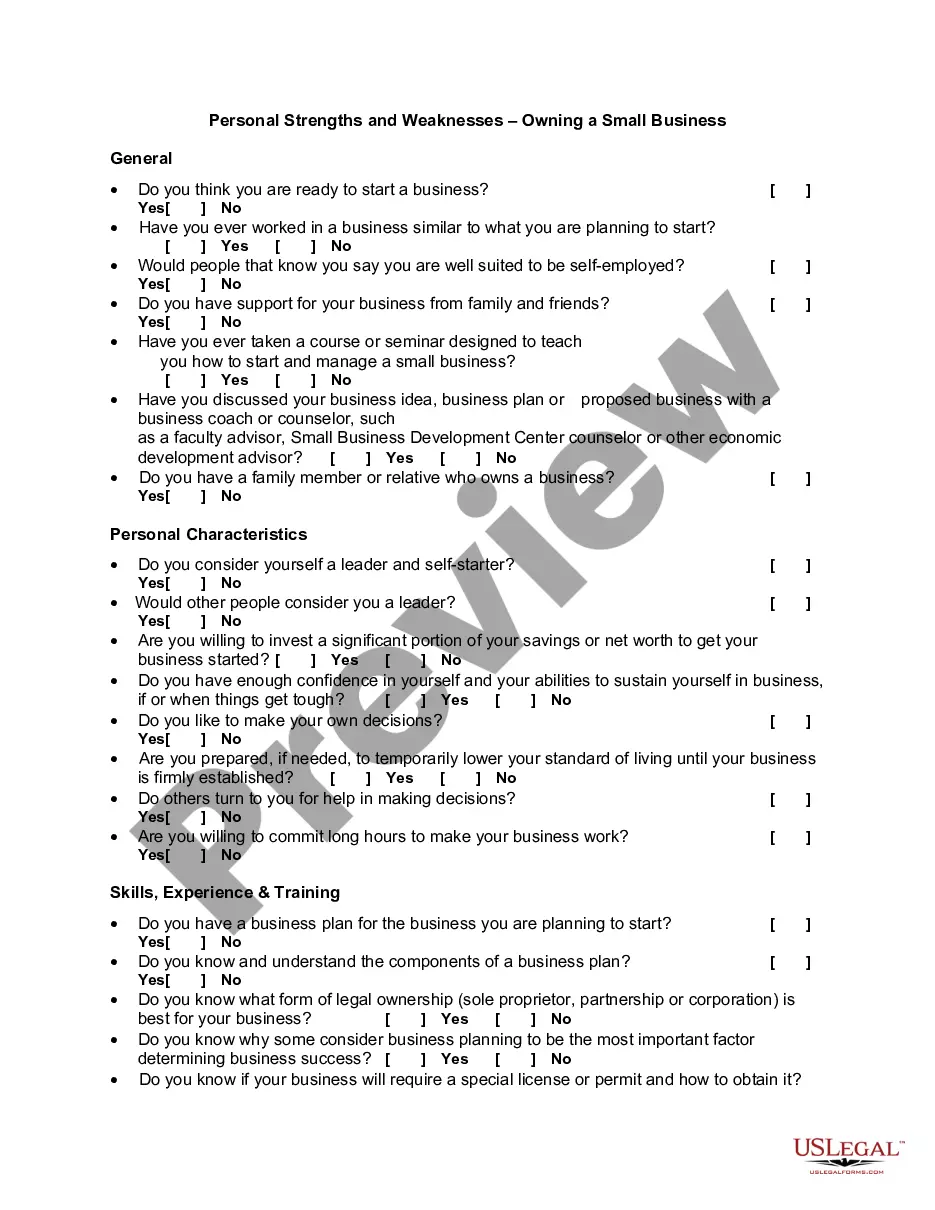

How to fill out Carlsbad California Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Carlsbad California Living Trust for Husband and Wife with One Child gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Carlsbad California Living Trust for Husband and Wife with One Child takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Carlsbad California Living Trust for Husband and Wife with One Child. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!