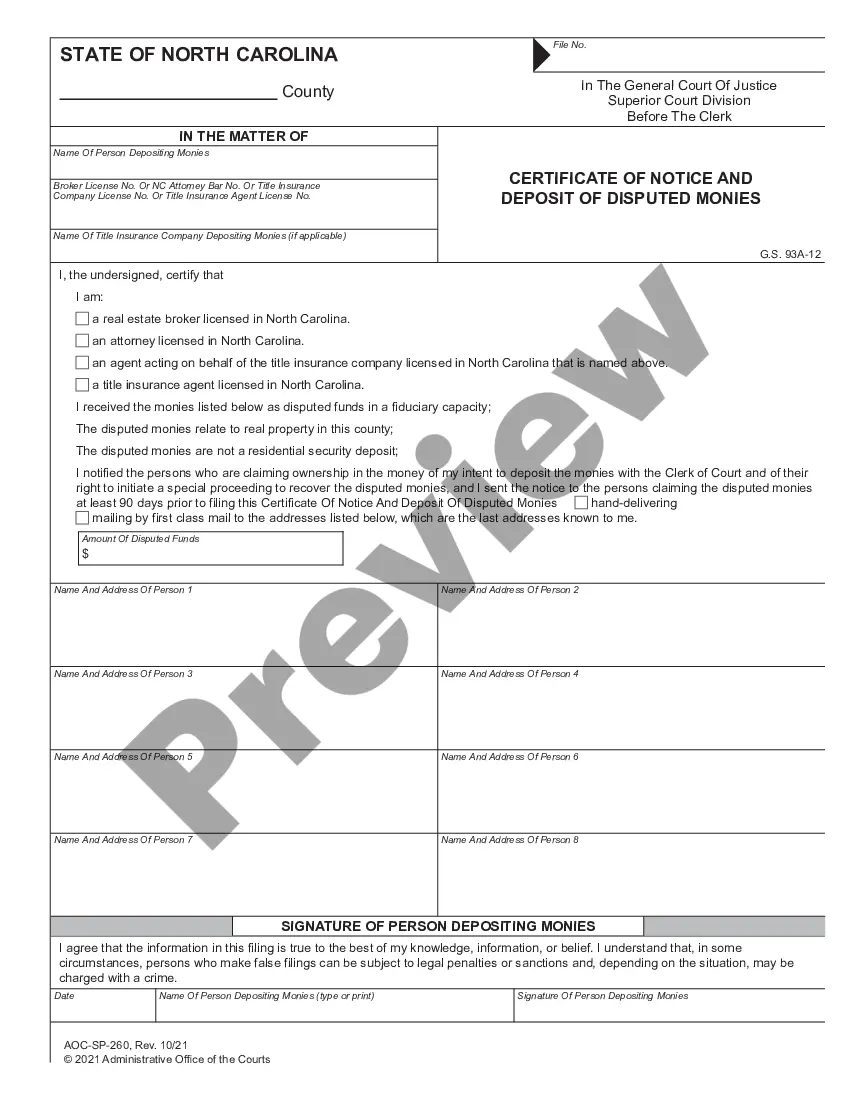

A Garden Grove California Living Trust for Husband and Wife with One Child is a legally binding document designed to preserve and distribute assets owned by a married couple to their child upon their death. Also known as a joint living trust or family trust, it allows spouses to jointly manage their properties and investments during their lifetime, ensuring a smooth transfer of assets and avoiding the probate process. This type of living trust provides several key benefits for couples with one child residing in Garden Grove, California. Firstly, it allows the couple to retain full control over their assets while alive and enables them to specify their wishes regarding the distribution of those assets after their passing. The living trust also provides privacy as it avoids the probate process, which is a matter of public record. By setting up a living trust, couples can keep their financial affairs confidential. In Garden Grove, California, there are variations of living trusts that can be tailored to the specific needs of each couple. For instance, a revocable living trust allows the couple to make changes or amendments to the trust throughout their lifetime. On the other hand, an irrevocable living trust provides less flexibility in modifying the terms but offers additional protection for the assets from creditors and certain estate taxes. Moreover, there can be specific provisions within a living trust created for a husband and wife with one child in Garden Grove, California. For instance, the trust can outline the management of real estate properties owned by the couple, including their primary residence, vacation homes, or rental properties. It can also address the allocation of financial accounts, such as bank accounts, investment portfolios, and retirement funds, ensuring the child receives an equitable share. Additionally, the living trust can include provisions for the care, education, and support of the child until they reach a specific age or milestone, allowing the parents to dictate how their child's needs should be met. This provision provides peace of mind for parents, knowing that their child's well-being is secured even in their absence. By establishing a Garden Grove California Living Trust for Husband and Wife with One Child, spouses can take proactive steps to protect their assets, eliminate the lengthy probate process, maintain financial privacy, and ensure an efficient transfer of wealth to their child. It is recommended to consult with an estate planning attorney to determine the specific type of living trust that best fits their unique circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Garden Grove California Fideicomiso en vida para esposo y esposa con un hijo - California Living Trust for Husband and Wife with One Child

Description

How to fill out Garden Grove California Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to draft such papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Garden Grove California Living Trust for Husband and Wife with One Child or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Garden Grove California Living Trust for Husband and Wife with One Child quickly employing our trustworthy platform. If you are presently a subscriber, you can go on and log in to your account to get the needed form.

However, in case you are new to our platform, ensure that you follow these steps before obtaining the Garden Grove California Living Trust for Husband and Wife with One Child:

- Be sure the template you have found is good for your area because the regulations of one state or area do not work for another state or area.

- Preview the document and go through a quick outline (if available) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Choose the payment method and proceed to download the Garden Grove California Living Trust for Husband and Wife with One Child once the payment is completed.

You’re all set! Now you can go on and print the document or complete it online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.