Riverside California Fideicomiso en vida para esposo y esposa con un hijo - California Living Trust for Husband and Wife with One Child

Category:

State:

California

County:

Riverside

Control #:

CA-E0177

Format:

Word

Instant download

Description

Este archivo contiene el formulario de fideicomiso en vida preparado para su estado.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés.

For your convenience, the complete English version of this form is attached below the Spanish version.

Free preview

How to fill out California Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

We consistently attempt to reduce or avert legal harm when addressing intricate legal or financial matters.

To achieve this, we seek legal remedies that are typically very expensive.

Nevertheless, not all legal challenges are equally complicated.

The majority of them can be managed independently.

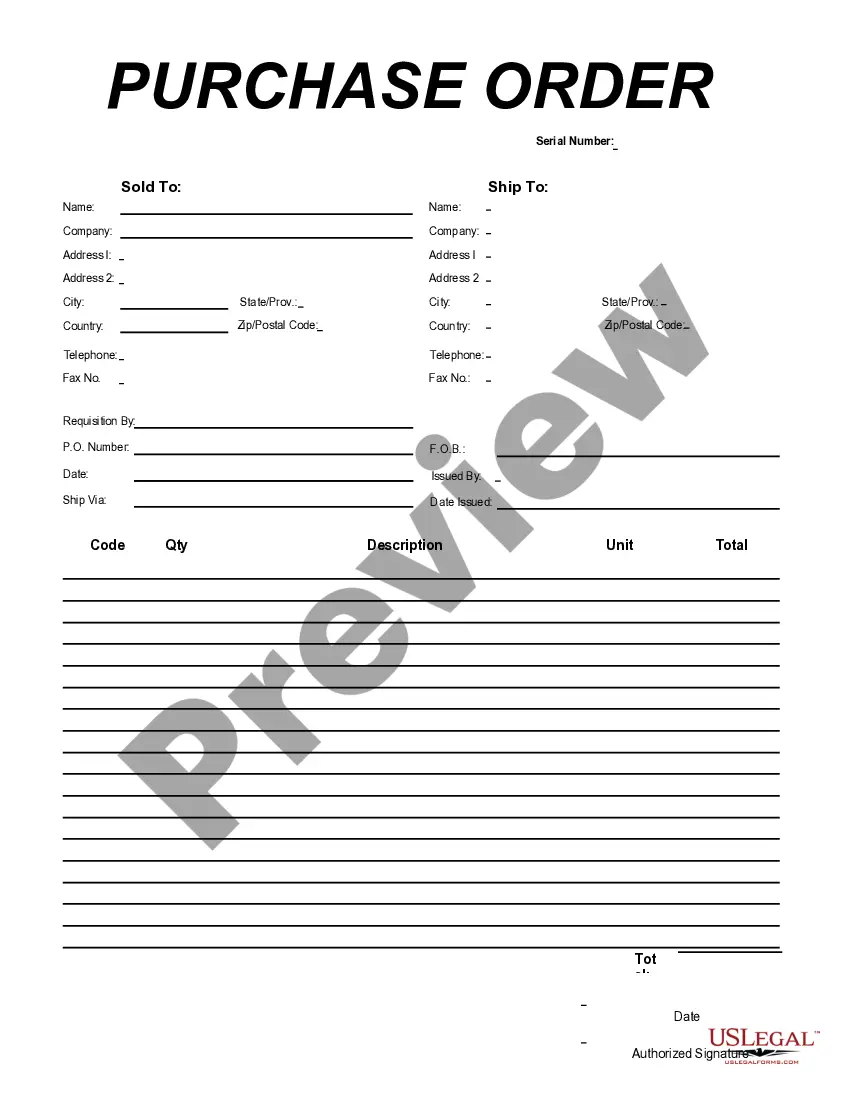

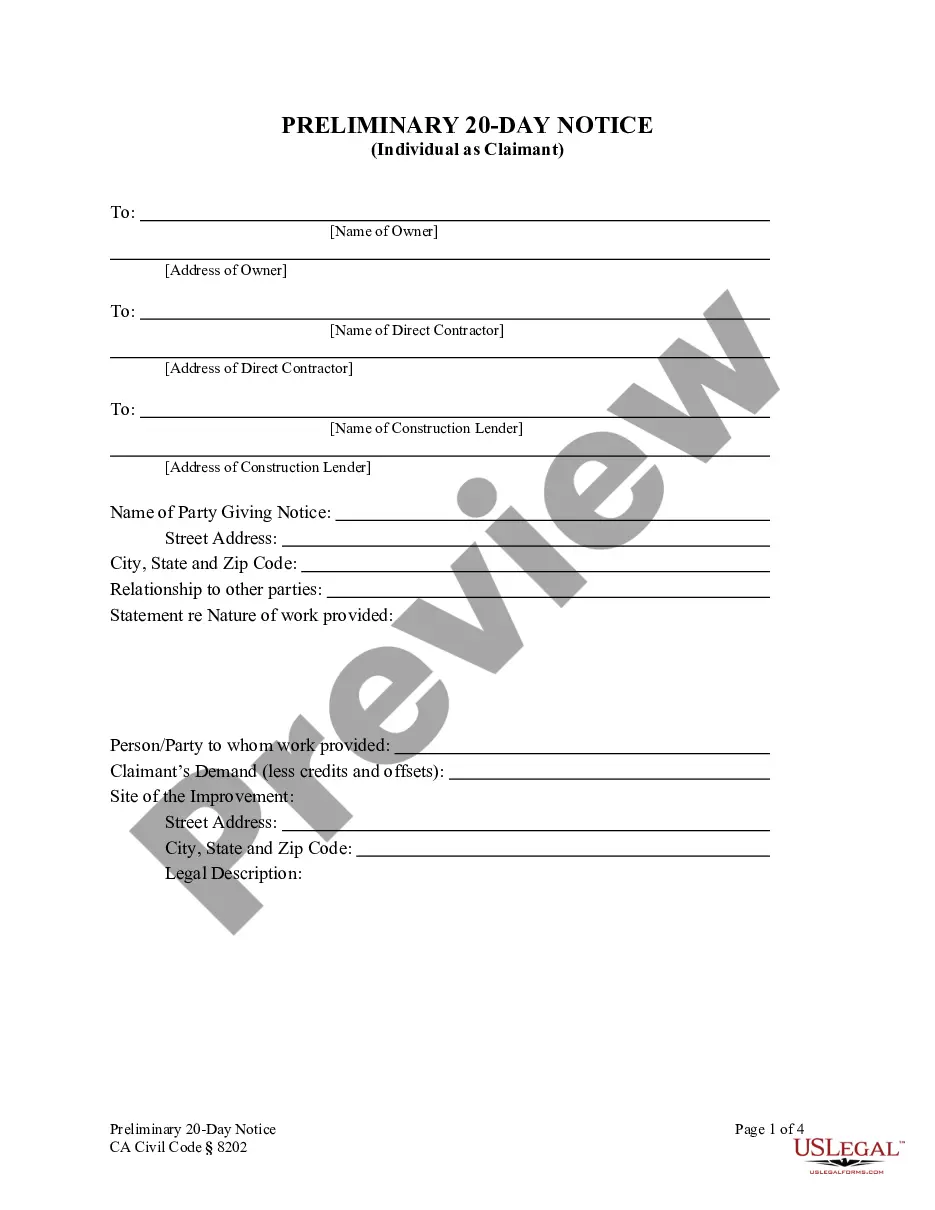

Take advantage of US Legal Forms whenever you need to locate and download the Riverside California Living Trust for Husband and Wife with One Child or any other document effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection enables you to handle your affairs independently without the need for a lawyer's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.