A Santa Clara California Living Trust for Husband and Wife with One Child is a legal document that allows a couple to protect and distribute their assets during their lifetime and after their death, while also ensuring the care and financial stability of their child. This type of living trust is a common estate planning tool used by many families in Santa Clara, California, as it offers several benefits such as avoiding probate, minimizing estate taxes, and maintaining privacy. A Santa Clara California Living Trust for Husband and Wife with One Child typically includes the following key elements: 1. Granters: The husband and wife, referred to as the granters, are the creators of the trust. They transfer their assets into the trust and retain control over them during their lifetime. 2. Trustee: The granters initially act as the trustees of their living trust, managing and controlling the assets within the trust. They also have the flexibility to appoint successor trustees who will take over the responsibilities after their death or incapacity. 3. Beneficiaries: The primary beneficiary of the living trust is usually the child of the husband and wife. The trust aims to ensure that the child receives the assets and financial support for their education, healthcare, and general well-being. 4. Asset Protection: The living trust safeguards the couple's assets from potential creditors, lawsuits, and other legal claims. It helps hold the assets separate from personal ownership, offering a layer of protection for the family's financial security. 5. Avoidance of Probate: One of the significant advantages of a living trust is the ability to bypass the often lengthy and costly probate process. By properly funding the trust and transferring ownership of assets to it, the assets can be distributed to the beneficiaries without court supervision. 6. Estate Tax Planning: A well-crafted living trust can help minimize estate taxes for the couple and their child. It utilizes various tax-saving strategies, such as the use of exemptions and deductions, to reduce the overall tax burden on the estate. 7. Special Instructions: The living trust can accommodate special instructions and conditions that the couple may desire. This may include specific healthcare directives, charitable contributions, or guidelines for the child's education. Some variations or additional options of Santa Clara California Living Trusts for Husband and Wife with One Child may include: 1. Revocable Living Trust: This type of living trust allows the granters to make changes or revoke the trust during their lifetime. It provides flexibility in managing assets and allows adjustments as the family's circumstances change. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of all parties involved. It offers greater asset protection and may be utilized for specific estate tax planning purposes. 3. Special Needs Trust: If a couple has a child with special needs, they may consider creating a special needs trust within their living trust. This trust ensures that the child receives financial support without jeopardizing their eligibility for government benefits. In conclusion, a Santa Clara California Living Trust for Husband and Wife with One Child is a comprehensive estate planning tool that allows couples to protect their assets, plan for the financial well-being of their child, and streamline the transfer of assets upon their passing. Consultation with an experienced attorney is crucial to ensure that the living trust is tailored to the specific needs and goals of the family.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Fideicomiso en vida para esposo y esposa con un hijo - California Living Trust for Husband and Wife with One Child

Description

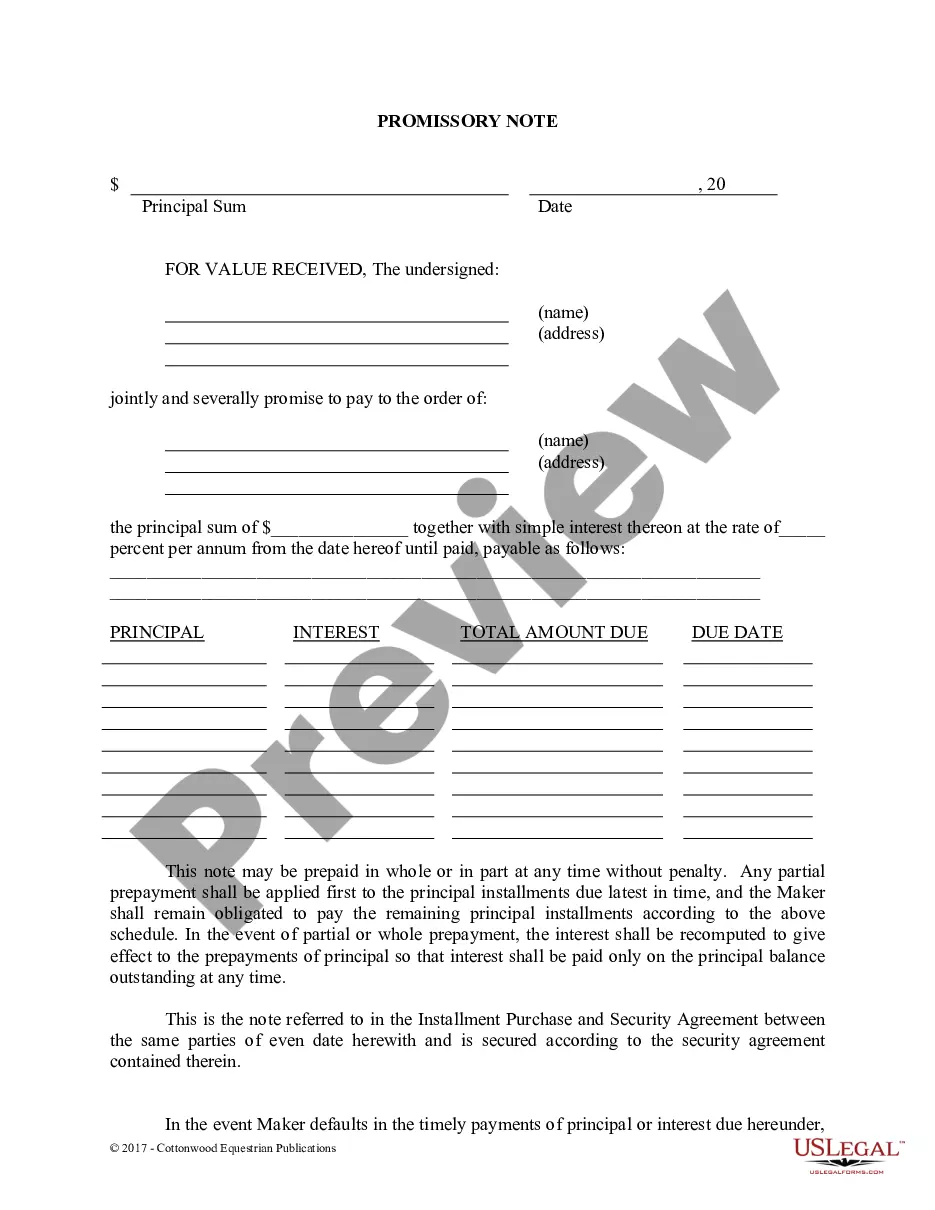

How to fill out Santa Clara California Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

Benefit from the US Legal Forms and have immediate access to any form template you need. Our beneficial website with thousands of document templates makes it simple to find and get virtually any document sample you want. You can download, complete, and sign the Santa Clara California Living Trust for Husband and Wife with One Child in just a couple of minutes instead of browsing the web for hours seeking a proper template.

Using our collection is a wonderful strategy to increase the safety of your document submissions. Our experienced legal professionals on a regular basis review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and polices.

How can you obtain the Santa Clara California Living Trust for Husband and Wife with One Child? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. In addition, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instructions below:

- Open the page with the template you require. Make certain that it is the form you were seeking: verify its headline and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Select the format to get the Santa Clara California Living Trust for Husband and Wife with One Child and change and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the web. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Santa Clara California Living Trust for Husband and Wife with One Child.

Feel free to benefit from our platform and make your document experience as efficient as possible!