The San Diego California Amendment to Living Trust allows individuals in the region to make changes or additions to their existing living trust. Living trusts are legal documents that dictate how an individual's assets should be managed and distributed during their lifetime and after their demise. This amendment is crucial for individuals who wish to modify their living trust due to changes in personal circumstances or estate planning goals. By utilizing the San Diego California Amendment to Living Trust, individuals can ensure their financial matters align with their evolving needs and preferences. Some common scenarios where an amendment to a living trust may be necessary to include marriage, divorce, the birth of a child, adoption, changes in financial situations, acquiring or selling assets, or relocating to or from San Diego, California, among others. The San Diego California Amendment to Living Trust contains specific legal provisions that facilitate the modification process in compliance with the state's laws. It ensures that the revised terms adhere to local regulations and effectively express the settler's intentions while minimizing potential conflicts or legal challenges. While there may not be different types per se, the San Diego California Amendment to Living Trust is designed to accommodate various modifications as required by the individual. This includes adding or removing beneficiaries, changing the appointed trustee or successor trustee, updating asset distribution percentages, revising trust provisions or terms, incorporating new assets, or making any other necessary adjustments. By properly executing the San Diego California Amendment to Living Trust, individuals can enjoy the benefits of retaining control over their estate planning decisions, gain flexibility to adapt to life changes, and ensure their wishes are upheld. In conclusion, the San Diego California Amendment to Living Trust provides individuals in San Diego, California, with a comprehensive legal mechanism to modify and update their living trust according to their specific needs and circumstances. It ensures compliance with state laws and enables individuals to safeguard their estate plans, protect their beneficiaries, and maintain control over their financial affairs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Enmienda al fideicomiso en vida - California Amendment to Living Trust

State:

California

County:

San Diego

Control #:

CA-E0178A

Format:

Word

Instant download

Description

Formulario para modificar un fideicomiso en vida.

The San Diego California Amendment to Living Trust allows individuals in the region to make changes or additions to their existing living trust. Living trusts are legal documents that dictate how an individual's assets should be managed and distributed during their lifetime and after their demise. This amendment is crucial for individuals who wish to modify their living trust due to changes in personal circumstances or estate planning goals. By utilizing the San Diego California Amendment to Living Trust, individuals can ensure their financial matters align with their evolving needs and preferences. Some common scenarios where an amendment to a living trust may be necessary to include marriage, divorce, the birth of a child, adoption, changes in financial situations, acquiring or selling assets, or relocating to or from San Diego, California, among others. The San Diego California Amendment to Living Trust contains specific legal provisions that facilitate the modification process in compliance with the state's laws. It ensures that the revised terms adhere to local regulations and effectively express the settler's intentions while minimizing potential conflicts or legal challenges. While there may not be different types per se, the San Diego California Amendment to Living Trust is designed to accommodate various modifications as required by the individual. This includes adding or removing beneficiaries, changing the appointed trustee or successor trustee, updating asset distribution percentages, revising trust provisions or terms, incorporating new assets, or making any other necessary adjustments. By properly executing the San Diego California Amendment to Living Trust, individuals can enjoy the benefits of retaining control over their estate planning decisions, gain flexibility to adapt to life changes, and ensure their wishes are upheld. In conclusion, the San Diego California Amendment to Living Trust provides individuals in San Diego, California, with a comprehensive legal mechanism to modify and update their living trust according to their specific needs and circumstances. It ensures compliance with state laws and enables individuals to safeguard their estate plans, protect their beneficiaries, and maintain control over their financial affairs.

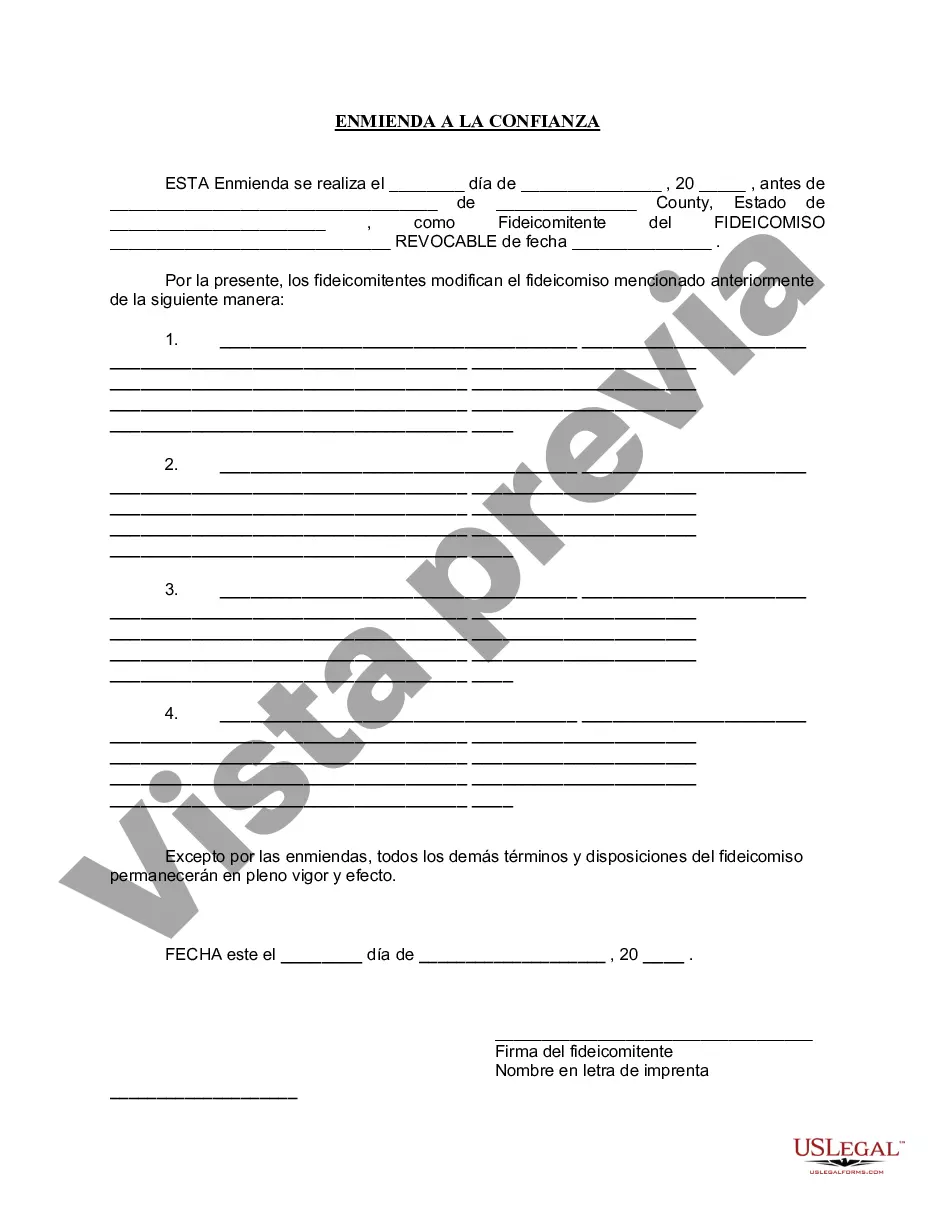

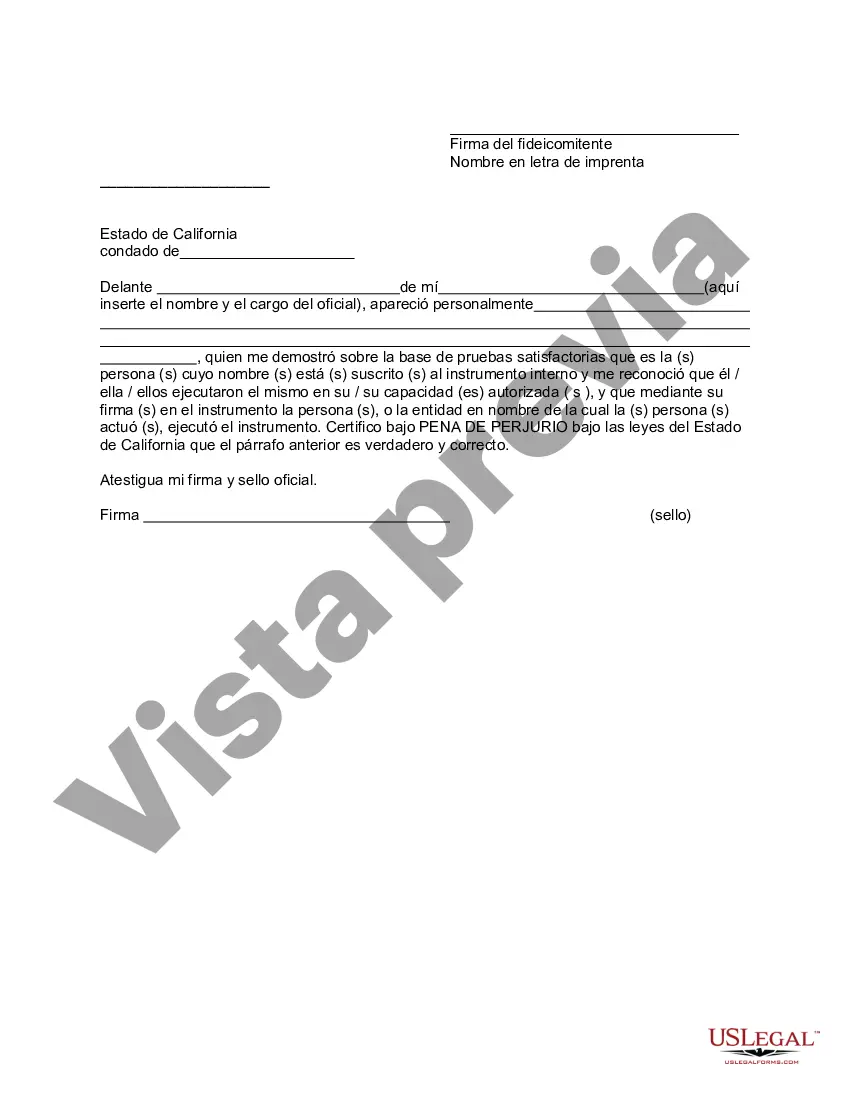

Free preview

How to fill out San Diego California Enmienda Al Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the San Diego California Amendment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your San Diego California Amendment to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!