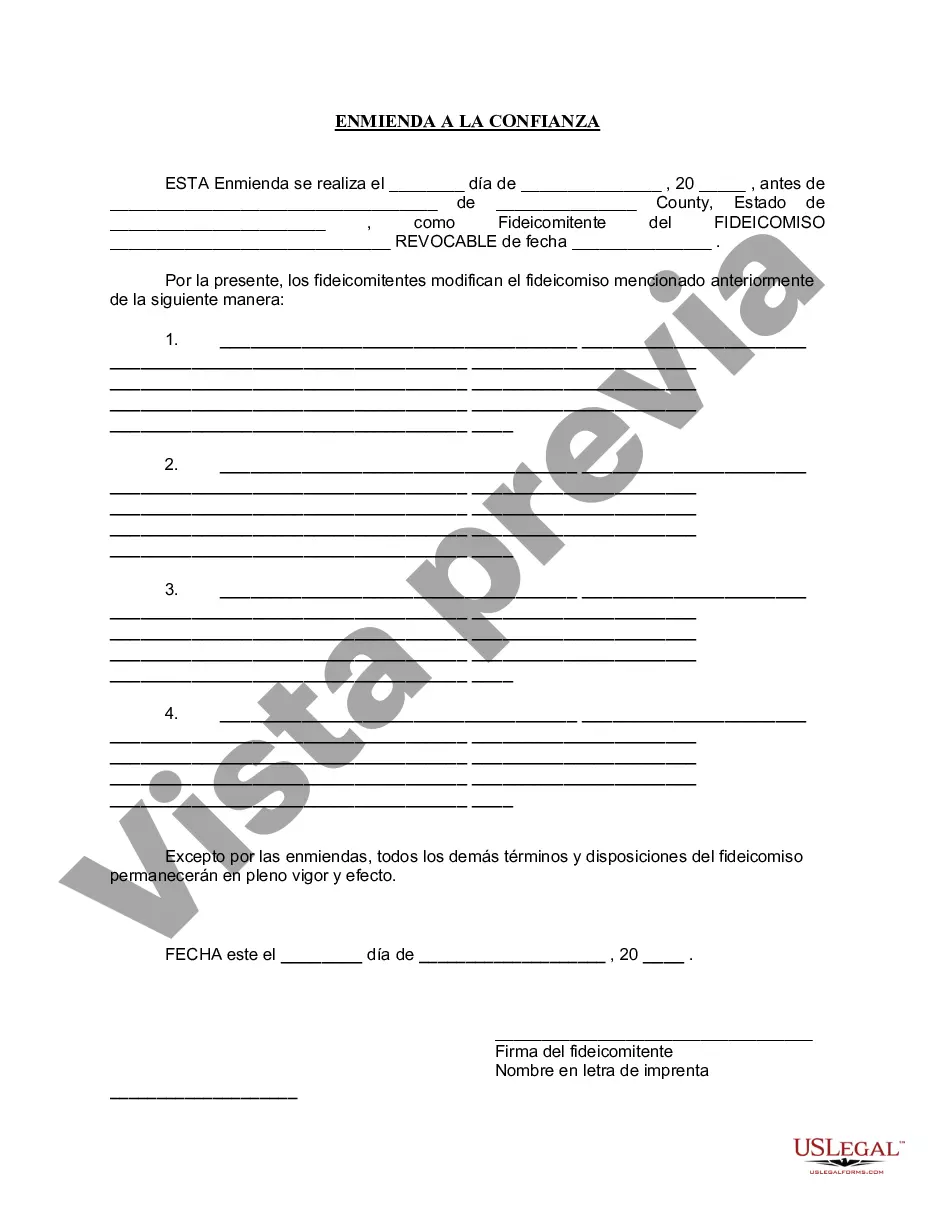

The Stockton California Amendment to Living Trust is a legal instrument utilized by individuals residing in Stockton, California, to modify and update the terms and provisions stated within their living trust documents. A living trust is an estate planning tool used to manage and distribute assets during an individual's lifetime and after their death. When circumstances change or an individual wishes to make alterations to their living trust, they may opt to create an amendment rather than drafting an entirely new trust. An amendment allows individuals to add, remove, or modify specific provisions, beneficiaries, or trustees without having to revoke the entire trust. There are several types of amendments that individuals in Stockton, California, may consider when making changes to their living trust: 1. General Amendment: This is the most common type of Stockton California Amendment to Living Trust. It allows individuals to make multiple changes to their trust, such as modifying beneficiaries, updating asset distribution percentages, or altering trustee designations. 2. Specific Amendment: A specific amendment is used when an individual wants to make a single, specific change to their living trust. It could involve adding or removing a beneficiary, incorporating new assets, or changing the terms of asset distribution. 3. Contingency Amendment: A contingency amendment is employed to address future circumstances that may affect the trust. For instance, individuals may include provisions on handling the trust if a beneficiary passes away before the trust or if the trust or becomes incapacitated. 4. Successor Trustee Amendment: This type of amendment focuses primarily on changing or updating the designated successor trustees of the living trust. It enables individuals to appoint new trustees, remove existing ones, or specify alternate trustees in case the initial choices are unable or unwilling to serve. 5. Trustee Powers Amendment: A trustee powers amendment allows individuals to modify or expand the authority of their chosen trustee(s). This type of amendment can cover matters such as investment powers, real estate transactions, or granting the trustee the power to establish and fund sub-trusts. It is important to consult with a qualified attorney experienced in estate planning and living trusts to ensure that any Stockton California Amendment to Living Trust complies with local laws and accurately reflects the trust or's wishes. By utilizing these various types of amendments, individuals can effectively adapt their living trust to accommodate changing circumstances and ensure their estate planning goals are met in Stockton, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Stockton California Enmienda al fideicomiso en vida - California Amendment to Living Trust

Description

How to fill out Stockton California Enmienda Al Fideicomiso En Vida?

If you are searching for a valid form template, it’s impossible to choose a more convenient place than the US Legal Forms website – probably the most comprehensive online libraries. Here you can get a large number of form samples for organization and individual purposes by categories and states, or keywords. With our advanced search feature, getting the most up-to-date Stockton California Amendment to Living Trust is as elementary as 1-2-3. In addition, the relevance of every record is confirmed by a team of professional attorneys that regularly review the templates on our platform and revise them in accordance with the latest state and county demands.

If you already know about our platform and have an account, all you should do to get the Stockton California Amendment to Living Trust is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you need. Read its information and use the Preview function to check its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the proper file.

- Affirm your selection. Click the Buy now option. Next, pick the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and download it on your device.

- Make changes. Fill out, revise, print, and sign the obtained Stockton California Amendment to Living Trust.

Every single template you add to your profile has no expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to get an extra copy for modifying or printing, you can come back and save it again at any time.

Take advantage of the US Legal Forms extensive catalogue to get access to the Stockton California Amendment to Living Trust you were looking for and a large number of other professional and state-specific templates on one platform!