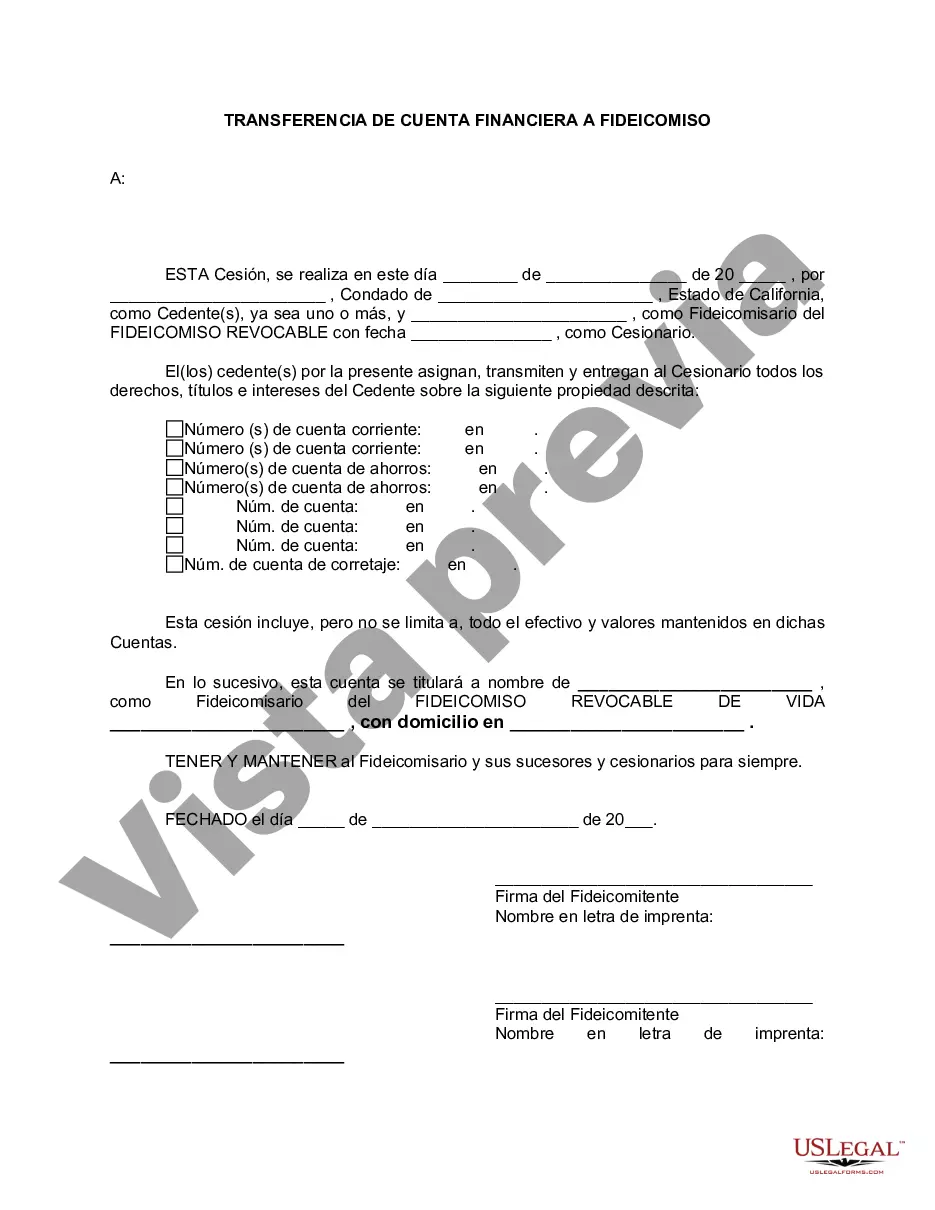

If you reside in Alameda, California, and are considering a financial account transfer to a living trust, it's important to understand the process and implications involved. A living trust allows you to place assets, including financial accounts, into a trust during your lifetime, and then those assets are managed and distributed according to your instructions upon your passing. This legal arrangement can help streamline the transfer of assets, avoid probate, and provide privacy for your loved ones. There are several types of financial accounts that can be transferred to a living trust in Alameda, California: 1. Checking and Savings Accounts: These accounts hold your liquid assets and can be easily transferred to your living trust. By transferring them, you ensure that your designated beneficiaries will have immediate access to funds after your passing, without encountering the delays of the probate process. 2. Investment Accounts: If you have brokerage accounts, stocks, bonds, or mutual funds, they can also be transferred to your living trust. This ensures that these investment assets are managed and distributed as per your instructions, while avoiding probate. 3. Retirement Accounts: While it is generally not advisable to transfer retirement accounts such as IRAs or 401(k)s directly into a living trust, you can name the trust as the primary or contingent beneficiary of these accounts. This allows for the continued tax-deferred growth of these assets during your lifetime, while ensuring a seamless transfer to your beneficiaries upon your passing. 4. Real Estate: While not a financial account, real estate can also be transferred to a living trust. Transferring properties avoids the need for probate and grants your chosen trustee the authority to manage or sell the property according to your wishes. 5. Business Accounts: If you own a business in Alameda, California, the financial accounts associated with it can be transferred to your living trust. This ensures the continuation of business operations and provides clear instructions on how the business assets should be managed and distributed upon your passing. During the process of transferring financial accounts to a living trust in Alameda, California, it is crucial to consult with an experienced estate planning attorney. They can guide you through the legal requirements, ensure that all necessary paperwork is completed accurately, and help tailor the living trust to your specific needs and wishes. By proactively transferring your financial accounts to a living trust, you can provide financial security for your loved ones, avoid probate, and maintain control over the distribution of your assets in Alameda, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Alameda California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are looking for a valid form, it’s impossible to choose a more convenient service than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can find thousands of form samples for company and personal purposes by categories and states, or key phrases. Using our advanced search feature, finding the most up-to-date Alameda California Financial Account Transfer to Living Trust is as elementary as 1-2-3. Furthermore, the relevance of each and every record is verified by a team of professional attorneys that on a regular basis check the templates on our platform and revise them according to the latest state and county demands.

If you already know about our platform and have an account, all you should do to get the Alameda California Financial Account Transfer to Living Trust is to log in to your account and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the form you want. Read its information and utilize the Preview option to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to discover the appropriate record.

- Confirm your choice. Click the Buy now option. After that, pick the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Alameda California Financial Account Transfer to Living Trust.

Each and every template you save in your account does not have an expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to get an extra copy for editing or printing, you may come back and export it again at any time.

Take advantage of the US Legal Forms professional catalogue to gain access to the Alameda California Financial Account Transfer to Living Trust you were seeking and thousands of other professional and state-specific templates on a single platform!

Form popularity

FAQ

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

Es un contrato basado principalmente en la confianza, en el cual una persona transfiere bienes o derechos a favor de un patrimonio autonomo, el cual es administrado por Interbank y dirigido a cumplir determinados objetivos.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

More info

See Form W-9 for a complete form including fee. Click to Enlarge All wait lists are closed at this time. Living Trust for the Deceased A trust is a legal means by which an individual or family, in trust for the other, sets aside and manages property for a future use. It may be beneficial for a person to set up a trust for financial beneficiaries who receive a large amount of money in the future before their demise. A deceased person who dies a wealthy person can leave all of his or her wealth to his or her family, so the people in the family may better care for their loved one. A living trust works similarly. It helps family members invest money or assets they need to take care of their loved one. A living trust may not be beneficial if your loved one has a substantial income or investments. A living trust is generally only used as a trust by deceased persons before their death. Living trusts are set up in a legal way.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.