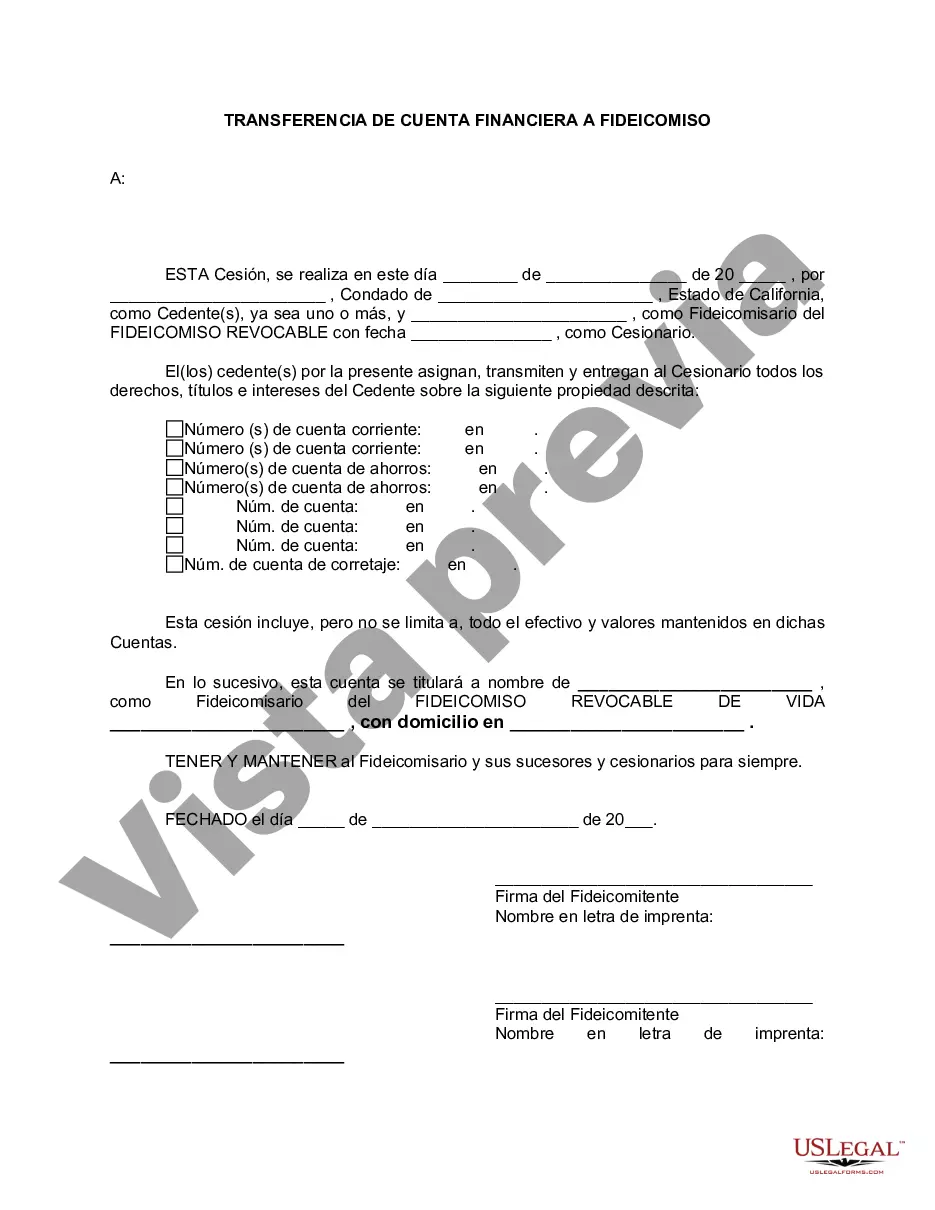

Antioch California Financial Account Transfer to Living Trust: A Comprehensive Guide When it comes to estate planning in Antioch, California, one crucial aspect is the transfer of financial accounts to a living trust. This process ensures that your assets are protected and can seamlessly pass on to your designated beneficiaries upon your death, avoiding probate and potential complications. In this detailed description, we will explore the various types of Antioch California financial account transfers to a living trust and provide you with relevant keywords associated with each. 1. Checking and Savings Accounts: Transfer your existing checking and savings accounts in Antioch, California, to your living trust to guarantee a smooth transition of these funds to your chosen beneficiaries. Keywords: Antioch California checking account transfer, Antioch California savings account transfer, living trust financial account transfer. 2. Investment Accounts: If you have investment accounts, such as stocks, bonds, mutual funds, or brokerage accounts, it is prudent to transfer them to a living trust in Antioch, California. This ensures that the gains from these investments can be efficiently managed and distributed to your chosen beneficiaries. Keywords: Antioch California investment account transfer, living trust investment transfer, Antioch California brokerage account transfer. 3. Retirement Accounts: To safeguard your retirement savings in Antioch, California, it is vital to transfer your 401(k), IRA, or other retirement accounts to your living trust. By doing so, you can control how these assets are distributed to your beneficiaries while potentially providing them with tax advantages. Keywords: Antioch California retirement account transfer, living trust retirement account transfer, Antioch California 401(k) transfer. 4. Real Estate and Property: The transfer of real estate and property to a living trust is essential to preserve the value of these assets and avoid probate proceedings in Antioch, California. This includes residential homes, commercial properties, vacant land, and any other real estate holdings you may possess. Keywords: Antioch California real estate transfer, living trust property transfer, Antioch California commercial property transfer. 5. Business Accounts: If you own a small business or have ownership in a partnership or corporation in Antioch, California, it is vital to transfer business accounts to your living trust. This ensures your interests are protected and allows for a smooth transition of these assets to your chosen beneficiaries. Keywords: Antioch California business account transfer, living trust business asset transfer, Antioch California partnership account transfer. Remember, before initiating any financial account transfer to a living trust, it is imperative to consult with an experienced estate planning attorney in Antioch, California. They can guide you through the process, ensuring compliance with local laws and regulations while helping you safeguard your assets for your loved ones' future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Antioch California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Antioch California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney solutions that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Antioch California Financial Account Transfer to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can create your account within minutes.

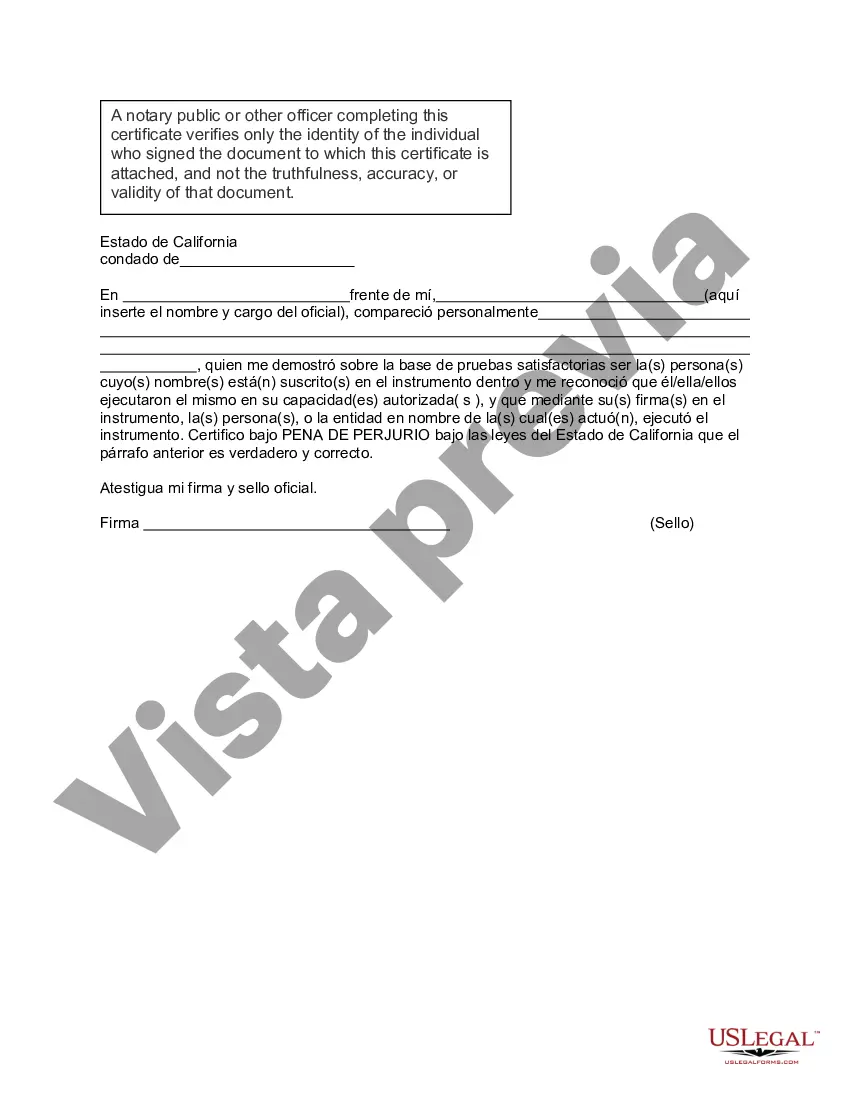

- Make sure to check if the Antioch California Financial Account Transfer to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Antioch California Financial Account Transfer to Living Trust is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!